This is a viewpoint editorial by Bitcoin Graffiti, a software application designer and graffiti artist.

“Those things which I am saying now may be obscure, yet they will be made clearer in their proper place.”

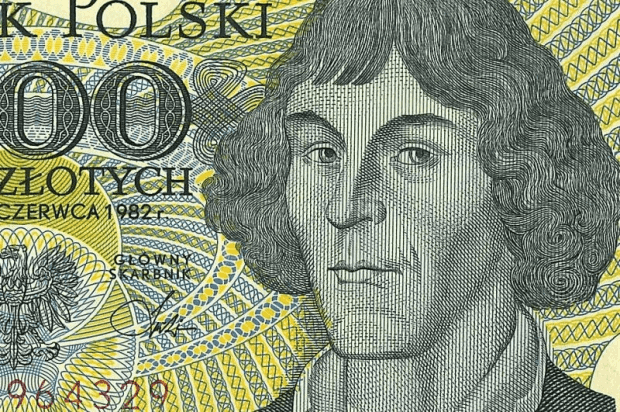

–Nicolaus Copernicus

In the record of history, Nicholas Copernicus is commemorated as the groundbreaking astronomer who fell the geocentric view and revealed the heliocentric design, positioning the sun at the center of our planetary system. However, there is a lesser-known aspect of Copernicus’ genius that stays shrouded in obscurity: his extensive contributions to financial idea.

While his huge accomplishments have actually mesmerized generations, his insights into the nature of money and its impacts on economies have actually mostly been ignored.

As the middle ages period waned, marked by transformative innovations like the Gutenberg printing press and the disruptive force of gunpowder, Copernicus’s groundbreaking work challenged not just the dominating huge beliefs however also the accepted ideas of money.

The introduction of the printing press introduced an age of unmatched understanding dissemination, slowly deteriorating the info monopoly of the Catholic Church. Concurrently, the prevalent adoption of gunpowder rendered knights and their armor helpless, symbolizing the decrease of the feudal system. Amid this background of modification, Copernicus became a visionary, his mathematical computations ultimately showing that the Earth was not the center of deep space.

While we might reflect on our geocentric forefathers and admire their expected lack of knowledge, we should acknowledge that the majority of us are rather incapable of showing the heliocentrism ourselves. We normally accept the present belief. If that holds true, should not there be apparent things we could be missing out on today? What if our presumptions about money, the lifeline of economies, are flawed too and the research study of economics is still in its infantile phase? Perhaps, simply as Copernicus shattered the dominating huge story, we are on the cusp of an intellectual transformation that will expose the imperfections of modern financial belief.

It is here, in the middle of these extensive reflections, that Copernicus’ concealed knowledge in financial matters resurfaces. Unbeknownst to numerous, this visionary mind not just changed our understanding of the paradises however also made enduring contributions to the field of financial idea.

Copernicus the Monetary Scientist

Born in 1473, Copernicus was a person of Prussia (now part of modern-day Poland) and lived the majority of his life in Frombork, where the polymath was utilized in the royal court as an accounting professional and consultant on financial reform after King Sigismund I requested him to take a look at the country’s diminishing currency.

His very first financial contribution was to reinforce a theory we now referred to as Gresham’s law. The law explains that when there are 2 currencies in blood circulation, and the federal government decrees a set currency exchange rate, the bad money eliminates the dearer. In such a situation, it pays to exchange the debased coin and hoard the more difficult one. In 1526, his findings were bundled into a pamphlet entitled “Monetae Cudendae Ratio” — the “Monetary Minting Ratio.” Copernicus opened his writing in Hayekian design, highlighting the surreptitious nature of financial deterioration:

”Although there are innumerable plagues by which kingdoms, principalities, and republics tend to decline, yet these four (in my judgment) are the most powerful: discord, mortality, the barrenness of the land, and cheapness of money. The first three are so evident that no one knows that it is so, but the fourth, as regards money, is considered by a few and only by the most earnest, because it did not happen all at once, but gradually, in a kind of secret way. It overthrew republics by reason… Therefore, money is like a measure of some common estimation. It is necessary, however, that what should be a measure should always be firm and maintain a state of order. Otherwise, it is necessary to confuse the organization of the republic, and to defraud the buyers and sellers in many ways, as if the cubit does not hold a certain weight.”

In a pushing tone, he argued for a repair work of currency, to damage the old and bring full-weighted silver coins back into blood circulation. Prussia had actually simply suffered a war and subsequent currency debasement. The quantity of copper in the coin increased at the expenditure of the rare-earth element and lastly lowered the cash to useless puce cents. Since a set currency exchange rate was in force, it ended up being more rewarding to melt down the coin and extract the silver.

In completion, Prussia’s currency ended up being useless, leaving the occupants not able to trade abroad considering that no one would accept the twisted money. The excellent money was gone. Hoarded, melted and exported — a Gresham’s law by example. Though this mechanic was formerly understood to other civilizations, Copernicus was the very first European to effectively pen it down. Unfortunately for Prussia, the king didn’t follow his recommendations.

The Quantity Theory Of Money

Murray Rothbard, the American financial expert of the Austrian school, even declared that the Polish polymath thought an early variation of the quantity theory of money (QTM). Rothbard summed up Copernicus’ ideas in “Economic Thought Before Adam Smith Vol. 1”:

“The causal chain began with debasement, which raised the quantity of the money supply, which in turn raised prices. The supply of money is the major determinant of prices. We in our sluggishness do not realize that the dearness of everything is the result of the cheapness of money. For prices increase and decrease according to the condition of the money.”

While modern guy is still monetarily illiterate, Copernius, half a millennium back, currently elegantly thought a direct relationship in between the supply of money and market value. Somehow we take our system of account to be repaired in supply, and never ever conclude that greater rates are the outcome of currency devaluation. Like the geocentric paradigm, it’s tough to remove from this immersive and inclined perspective.

Today, QTM is quantitatively specified in Fisher’s formula. Here, the cash supply (M) times the typical speed (V), equates to the amount of all deals in the economy (q) times their particular rate (p). Given that costs habits stays steady (V) and items and services production stays level, we conclude that a boost in the money supply differs straight with all rates in the economy.

Subsequently, let’s emphasize that rate (p) is a vector of all rates which separately react in a different way to inflation, however typically boost linearly with the cash supply. For example, a digital service may decrease throughout financial growth through technological deflation, while limited realty values. This is a point not lost on Michael Saylor, CEO of MicroStrategy and the biggest business holder of bitcoin, as revealed when he responded in a tweet to Keynesian Paul Krugman in May 2021 on financial growth:

“Inflation is a vector. A scalar index can be prejudiced by selecting particular products. Your index presumes humans do not require food, energy, or own a home, nor desire properties such as home, equity, bonds, or products. It’s apparent much of the inflation has actually remained in properties.”

End Of An Age

Copernicus generally completed “De Revolutionibus Orbium Coelestium” in 1532, but only published his heliocentric thesis on his deathbed in 1543 fearing the church’s scorn. The seed had been sown, but the theory took flight a century later following the arrival of the spyglass. Galileo Galilei was an early telescope adopter who produced the first anomalous celestial observations that could only be explained by embracing Copernicus’ paradigm.

Rejection is easy in the absence of appliances that falsify the current model. Heliocentrism remained merely an abstract idea prior to telescopy. But then, what about Copernicus’ monetary findings? Did we simply lack the tools to turn this view into reality?

With Bitcoin still in its early days, it appears that Copernicus is still way ahead of Keynesian economists and could be considered a Bitcoiner avant la lettre. Bitcoin, with its fixed supply of 21 million coins, is a digital telescope for anyone willing to peer deeply into the economic machine. We may now all observe what the polymaths of yesteryear had been saying all along — that a sound economy revolves around sound money. And though it may be designed by humans, Bitcoin shines bright as the natural center we’ve all been searching for. For this time might be that proper place, where simple monetary laws will refuse to remain obscure anymore.

“At rest, however, in the middle of everything is the sun.”

–Copernicus, “De Revolutionibus Orbium Coelestium”

This is a visitor post by Bitcoin Graffiti. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.