Cryptocurrencies have actually been trending upwards in cost over the last couple of weeks, however in specific countries worldwide digital properties have actually ended up being much more important. For circumstances, in Argentina, the country’s sovereign currency has actually lost significant worth and cryptocurrencies like BTC are seeing all-time cost highs. The rise in worth is not simply occurring in Argentina as a couple of other countries struggling with devaluation are seeing significant demand too.

Lots of Crypto Demand Stems from Countries Experiencing High Inflation and Currency Devaluation

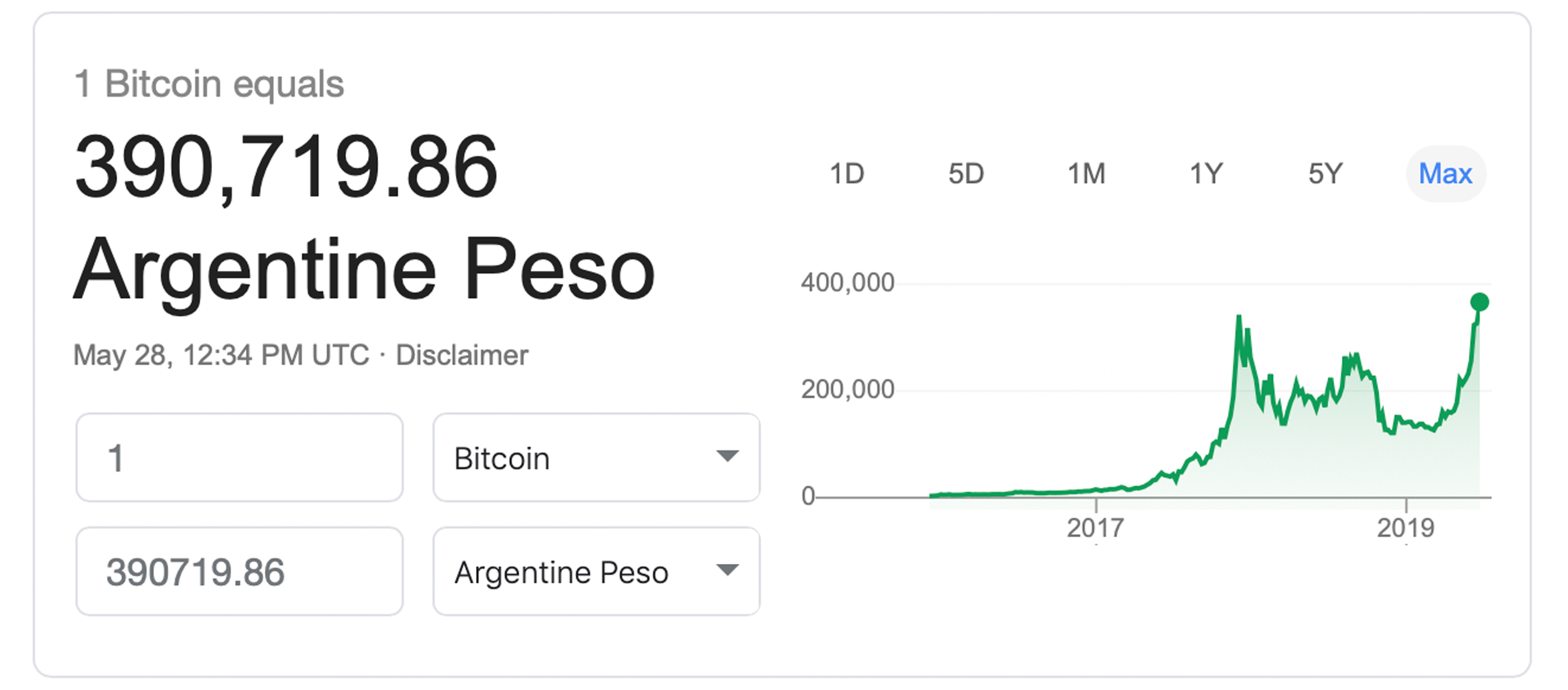

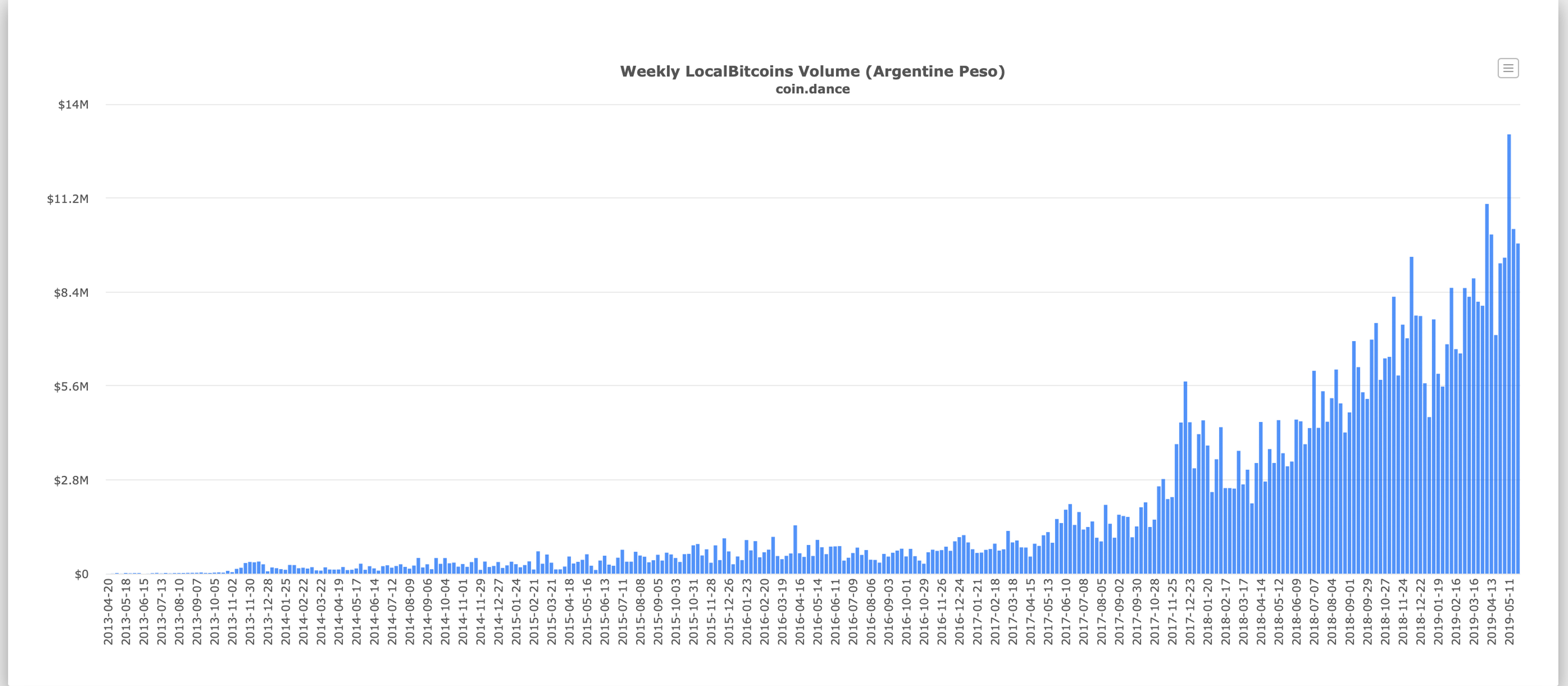

Over the recently, digital currency fans have actually observed that the cost of bitcoin core (BTC) and a couple of other popular properties have actually been seeing greater cost gains in some markets compared to the remainder of the world. The pattern has actually been seen in countries suffering from financial distress and devaluation, a sped up variation of conventional inflation. Essentially the state’s currency starts to wear down incredibly quick and the rates of items like food and medical products increase. Due to this aspect, the area’s residents generally change to more steady foreign currencies in order to hedge versus rapid inflation. Crypto fans have actually been observing this occur with digital properties and just recently individuals have actually observed the high cost of BTC in Argentina. Against the Argentine peso, bitcoin core’s worth has actually increased significantly and is even going beyond the all-time high in 2017.

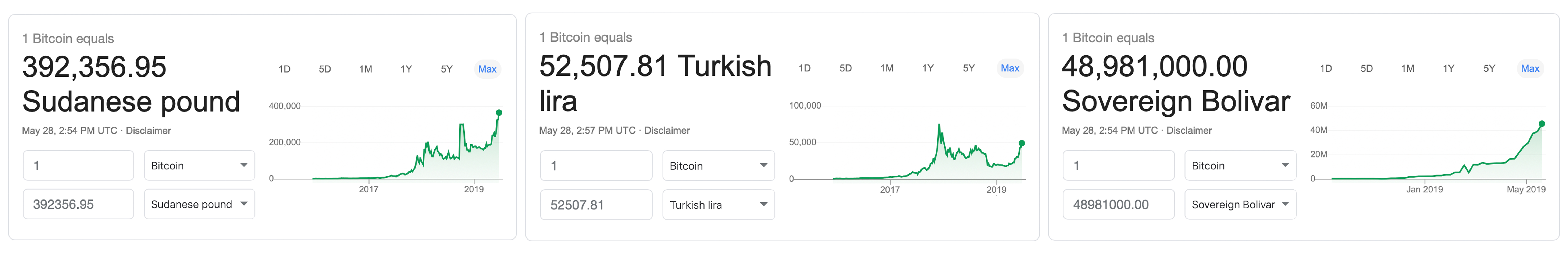

Currently, the cost per BTC is 390,719 pesos in Argentina and Localbitcoins trade volumes have also touched an all-time high. During the very first week of May, Argentinian Localbitcoins volumes reached $13 million and trading has actually continued non-stop. The Argentine peso has actually seen an enormous decrease versus the U.S. dollar and the financial unpredictabilities originate from the nation’s upcoming modification in management. However, the very same pattern is accompanying a couple of other stopping working currencies too like the Venezuelan bolivar, Sudanese pound, and Turkish lira. And there are other countries like Colombia, Chile, and Russia that are seeing increased crypto volumes and more demand than typical. Further, locations like Argentina and Venezuela are also seeing demand for bitcoin money (BCH) over the last 30 days.

On Localbitcoins, the Turkish lira has actually seen consistent volumes growing on the exchange and rates show that the worth of BTC is nearing 2017 highs too. At press time 1 BTC is around 52,577 Turkish lira and there’s been 500,000 to 750,000 in Localbitcoins volumes over the last couple of weeks. Throughout 2018 and 2019 the Turkish economy has actually seen rapid inflation and the lira has actually seen a decrease in worth versus other currencies. In addition to the lira, the Sudanese pound verses BTC has also been climbing up drastically.

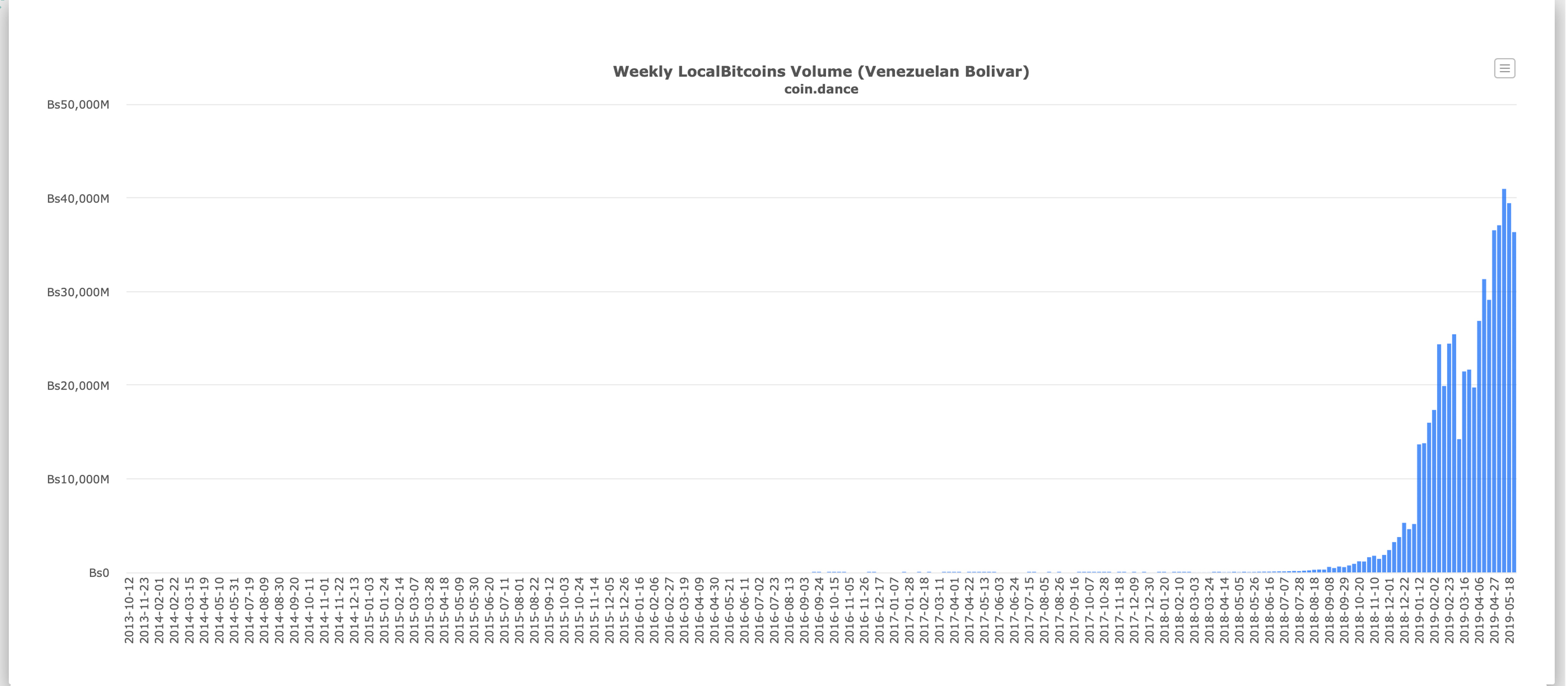

At the time of publication, a single BTC is 393,650 Sudanese pounds and liquidity is incredibly low in the area. Venezuela is also in the very same scenarios as the nation’s inflation rate of 1.30 million percent since April 2019 has actually ruined the sovereign bolivar. Over the previous couple of weeks of Localbitcoins volume information, the nation continues to smash all-time records. According to present currency exchange rate at press time, 1 BTC is 49,117,302 bolivars. There’s been a great deal of concentrate on Venezuela since the nation has the greatest inflation rate internationally however there are a couple of other countries that are following comparable courses. Alongside BTC, crypto supporters have actually been promoting BCH greatly in these areas too, with great deals of attention concentrated on Venezuela’s challenges.

Local.Bitscoins.internet Launch and the Bitcoin Cash Venezuela Merchant Initiative

Bitcoin Cash fans have actually remained in Venezuela promoting making use of the decentralized currency routinely. At Bitscoins.internet we acknowledge the requirement for individuals to trade fiat currencies for permissionless cryptocurrencies which’s why we developed Local.Bitscoins.internet. People from all around the world can trade bitcoin money (BCH) with each other in a peer-to-peer style when our noncustodial exchange Local BCH launches on June 4, 2019.

Bitcoin money offers any international person the flexibility to leave the irregular habits of central fiat currencies. And the low deal costs that are below one cent emphasize how BCH transcends for remittances. In addition to the non-prescription exchange following week, Bitscoins.internet has also been pressing merchant adoption with our Bitcoin Cash Venezuela effort. Our merchant adoption effort in the nation intends to assist sellers accept a brand-new ways of digital exchange and at the very same time, leave the bolivar’s decline.

The demand for cryptocurrencies has actually grown rather substantial over the last years, however in the last couple of years interest coming from areas struggling with serious financial challenges has actually increased significantly. There is a terrific requirement for permissionless digital properties like BCH in countries where the state-issued currencies are ending up being useless, capital controls are enforced, and sanctions from overbearing leaders make financial involvement harder. It’s likely at any time international residents who truly require a trustworthy circulating medium will flock to digital properties that can offer the ways to satisfy their ends. Individuals require alternative types of loan and specifically a one that works. Interest in a cryptocurrency that can offer permissionless exchange, together with dependability will definitely exceed the speculative lot of financiers pleading for institutional types to leap aboard. It appears that residents from Argentina, Turkey, Venezuela, and other countries are revealing strong demand for permissionless properties and this will just continue to grow.

What do you consider the demand for cryptos in areas where rapid inflation is dominant? Let us understand in the comments area below.

Image credits: Shutterstock, Google currency rates, Local.Bitscoins.internet, Venezuela.Bitscoins.internet, Coin Dance Cash.

Did you understand you can also buy Bitcoin Cash online with us? Download your totally free Bitcoin wallet and head to our Purchase Bitcoin page where you can purchase BCH and BTC safely.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.