The mainstream has actually captured a whiff of the gains cryptocurrencies like bitcoin and ethereum have actually seen, however many individuals are not familiar with the passive earnings crypto users are getting also. While monetary incumbents are providing individuals with savings accounts a meager 0.35% to 0.60%, digital currencies can offer individuals 1-17% or perhaps more by leveraging particular strategies.

Crypto Returns That Outpace the Savings Account

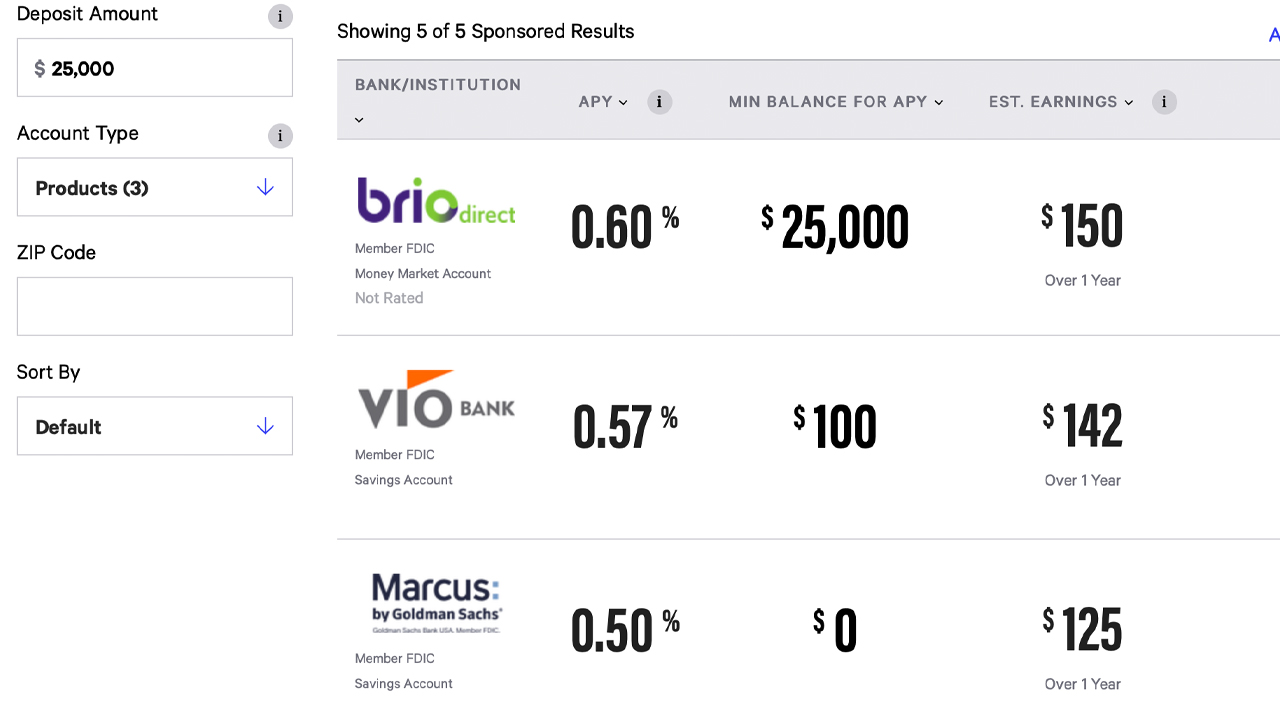

You might have heard the term “make your cash work for you” in the past, and that’s what savings accounts do if they make a portion of interest in time. Certainly, an individual can be a bit riskier and buy stocks and such however with a savings account, the cash merely sits there and accumulates a return over an amount of time. The more cash held, the more interest an account will get however nowadays banks wear’t like providing interest. We can see that a few of the leading banks on the planet will just offer 0.35% to 0.60% returns according to the very best savings account rates on bankrate.com.

Now you can do the very same thing with cryptocurrencies and get a far better yearly portion yield (APY). A great deal of central exchanges use anywhere in between 1-12% in interest for staking or holding a digital possession on the trading platform for an amount of time. For circumstances, on the trading platform Coinbase you can make 1.25% APY for holding USDC. Coinbase aso uses earning benefits for staking algorand (ALGO), universe (ATOM), and tezos (XTZ). These 3 coins see payment rates either everyday (ALGO), every 3 days (XTZ), and when a week (ATOM).

People can also utilize the exchange Crypto.com, which offers clients up to 2% to 6.5% per year (PA) for a myriad of cryptocurrencies and up to 12% for holding particular stablecoins. Crypto.com users can select a rate of interest by choosing a term which can either be versatile, one month long, and 3 months long.

Flexible suggests you can withdraw and utilize the cryptocurrencies at any time and you can get 2% for supported crypto assets and 8% for stablecoins. A 30-day term with Crypto.com gets the individual 4.5% for the typical crypto possession, while stablecoins will get up to 10%. 90-day terms accumulate 6.5% for coins like ETH and BTC, and stablecoins like USDC can get up to 12%.

Coinbase and Crypto.com are not the only exchanges or custodial services that use interest bearing accounts. Other interest-bearing items are provided by Blockfi, Linus, Outlet Finance, Gemini, Kraken, Youhodler, Coinloan, Nexo, and the Celsius Network. Each and everybody has various terms and rates of interest depending upon the crypto possession being held.

Most of these platforms use greater portion rates for stablecoins, as fiat-backed crypto assets can get savers bigger returns. Of course, custodial services are coins accepted a third-party, and individuals choosing to collect interest in this style need to comprehend there’s a higher threat. A custodial platform might phony reserves, get hacked, or perhaps run business into the ground by making bad organization choices. As the old expression goes “not your secrets, not your coins,” so holding funds on an exchange suggests you are trusting them.

Leveraging Proof-of-Stake Tokens, Ethereum 2.0 Staking

Individuals who desire to make passive earnings can also do so by leveraging noncustodial platforms and staking principles. Staking includes utilizing a proof-of-stake (PoS) crypto possession and the individual requires a staking wallet to perform this function (confirming deals) in order to acquire stake. Similar to a savings account, staking merely suggests holding the possession and being rewarded coins for the quantity the user holds. The more tokens held while staking, the more interest the user will acquire.

Currently, some individuals are staking ethereum (ETH) utilizing the brand-new ETH 2.0 staking function. However, in order to make ETH in this manner in a noncustodial style, the user requires an overall of 32 ETH to get involved. Although, the individual can make anywhere in between 5% to 17% PA. People can also stake ETH in a custodial way by means of exchanges like Kraken and Coinbase. The San Francisco exchange Coinbase offers “in between 3-7.5% benefit on any ETH that you stake.”

Defi Apps Built on Ethereum, Bitcoin Cash, Polkadot, and Tron

Additionally, besides staking, individuals who desire to get yield-bearing returns on their crypto assets can do so by leveraging a decentralized financing (defi) application. There are many defi apps like Compound, Aave, Nuo Network, Ddex, and Dydx that can use an individual a return merely by offering liquidity or financing. An excellent part of these noncustodial defi apps also offer greater yields nowadays for stablecoins.

Using these kinds of apps, individuals can make returns based upon an amount of time with many ERC20 tokens like TUSD, LINK, DAI, ETH, WBTC, and USDC. Moreover, there are other blockchains that are approaching producing defi communities also consisting of networks like Tron, Bitcoin Cash, EOS, and Polkadot.

One example on the BCH network is the Anyhedge procedure established by the General Protocols group, an idea that permits individuals to utilize BCH with the noncustodial application Detoken.

“The very first item readily available on Detoken is the Anyhedge BCH-USD futures agreement,” the group detailed when the app very first introduced. “This is a clever agreement which permits users to Hedge or Long their BCH while earning financing premium. Users also maintain control of their own cash throughout the whole procedure.”

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

Make Your Money Work for You

All of the previously mentioned platforms and tools use individuals a possibility to make their cash work for them. Individuals can make a return by doing something they most likely were doing prior to they understood they might make interest – merely holding. This decentralized kind of liquidity will continue to grow, as long as the need for crypto assets stays strong.

If mass adoption continues to boost, liquidity and possible incomes can just improve in time. Once the mainstream captures on to these enormously bigger rates of interest than the banks’ petty 0.35% to 0.60% rates, it won’t be long prior to they will desire to move their funds into something that collects genuine interest in time.

What do you think of all the platforms and services that permit individuals to make passive earnings simply by keeping their crypto assets? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.