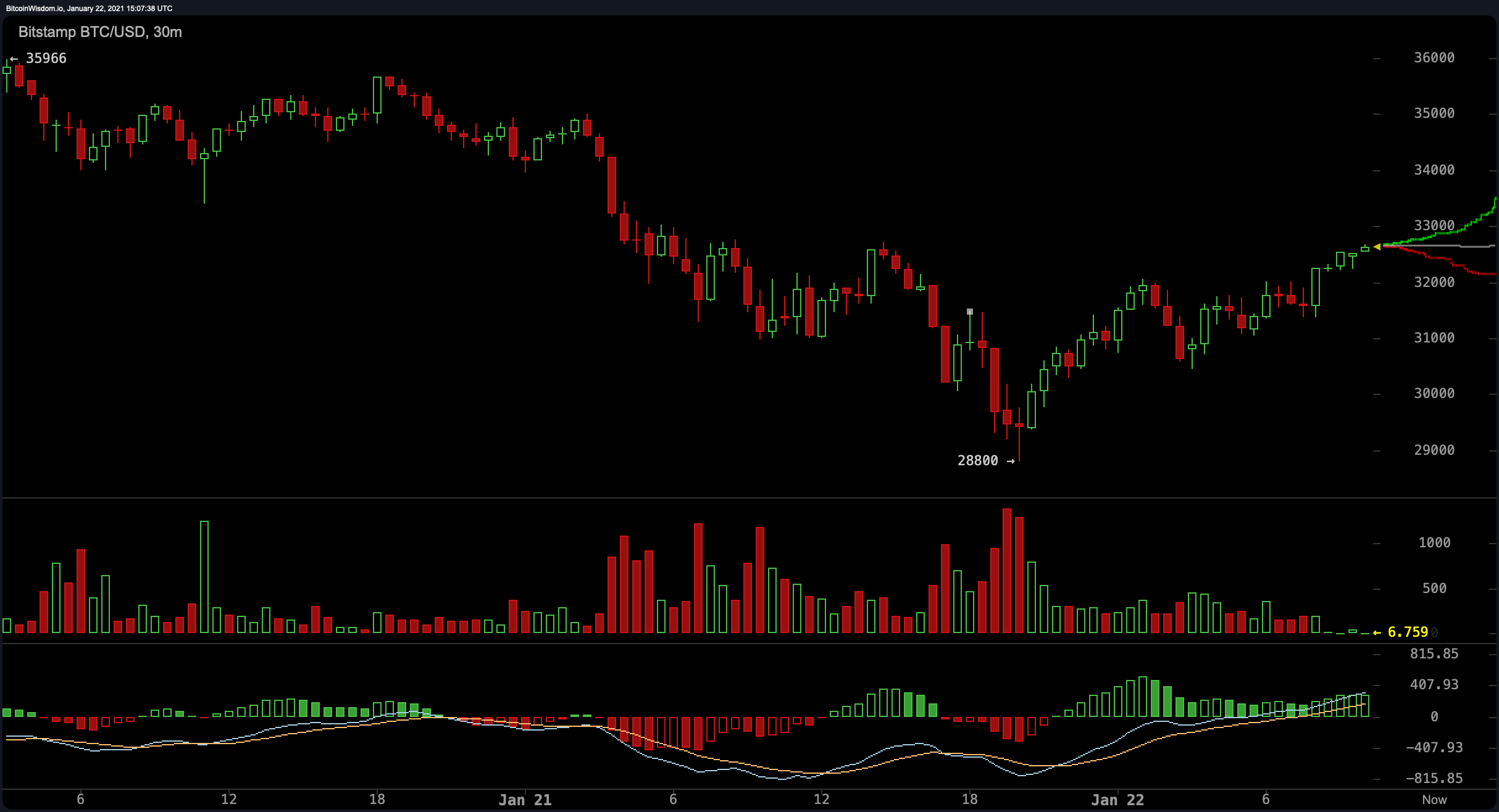

Digital currency markets have actually dropped in worth throughout the last 2 days as more than $100 billion was slashed off the whole crypto market evaluation. Bitcoin moved to the most affordable point of the year at $28,800 per system on Thursday afternoon, and a variety of other crypto-assets saw substantial losses also. Currently, as digital currency trading sessions head into the weekend, the crypto economy has actually restored a few of the losses suffered throughout the last couple of days.

Crypto Markets Attempt to Heal

During the last 2 days, the leading cryptocurrency in regards to market evaluation has moved significantly in worth. For circumstances, 2 days ago the rate of bitcoin (BTC) was exchanging hands for $35,900 per coin and on Thursday afternoon (EST), the rate dropped to $28,800 per system. That’s an overall loss of -19.77%, however BTC markets have actually rebounded ever since and handled to climb up right back over the $30k deal with.

At the time of publication, bitcoin (BTC) is switching at costs in between $32,200 to $32,800 per coin and has a touch over a $600 billion market evaluation.

On Friday there’s over $28 billion in worldwide BTC trade volume, with tether (USDT) catching 52% of all bitcoin trades today. BTC shed over 13% throughout the week, however is still up 35% for the last 1 month. Over the 90-day period, BTC has actually acquired 140% and 275% versus the USD for 12 months. Following BTC’s lead is ethereum (ETH), as each ether is trading for $1,240 per system. ETH’s market cap is presently hovering at around $140 billion throughout Friday early morning’s (EST) trading sessions.

Behind tether’s (USDT) market evaluation is polkadot (DOT) which is switching for $17.36 per DOT. On January 22, XRP is presently trading for $0.27 per token and holds a $12 billion market capitalization. XRP is followed by cardano (ADA $0.34), litecoin (LTC $140.81), chainlink (LINK $21.37), bitcoin money (BCH $448.74), and binance coin (BNB $40.57).

Bitcoin money has a market evaluation of around $8.1 billion and is down 12% throughout the last 7 days. During the course of the month, BCH is up 56% and 56% for the 90-day period also. Against the U.S. dollar throughout the last 12 months, bitcoin money (BCH) is up 32%.

Institutional Appetite for Bitcoin

In a note to financiers, Etoro crypto expert Simon Peters discussed bitcoin’s (BTC) current rate motions and volatility. Peters stated that lower costs might be “on the cards” however the expert does not “think it would last for long, [as] the feline runs out the bag with bitcoin.”

“This rate motion is a completely natural correction, one which occurs in all possessions once the marketplace has actually viewed them to be a little overbought,” Peters composed. “And although the rate is dropping, sitting at simply over $31,000 at the time of composing, the need for bitcoin is not.”

The Etoro crypto expert included:

Appetite amongst institutional financiers is still growing with the similarity financial investment trust Grayscale purchasing $600m of the crypto asset in a single day today and Blackrock, the world’s biggest asset supervisor, revealed 2 of its funds will sell bitcoin derivatives in the future.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

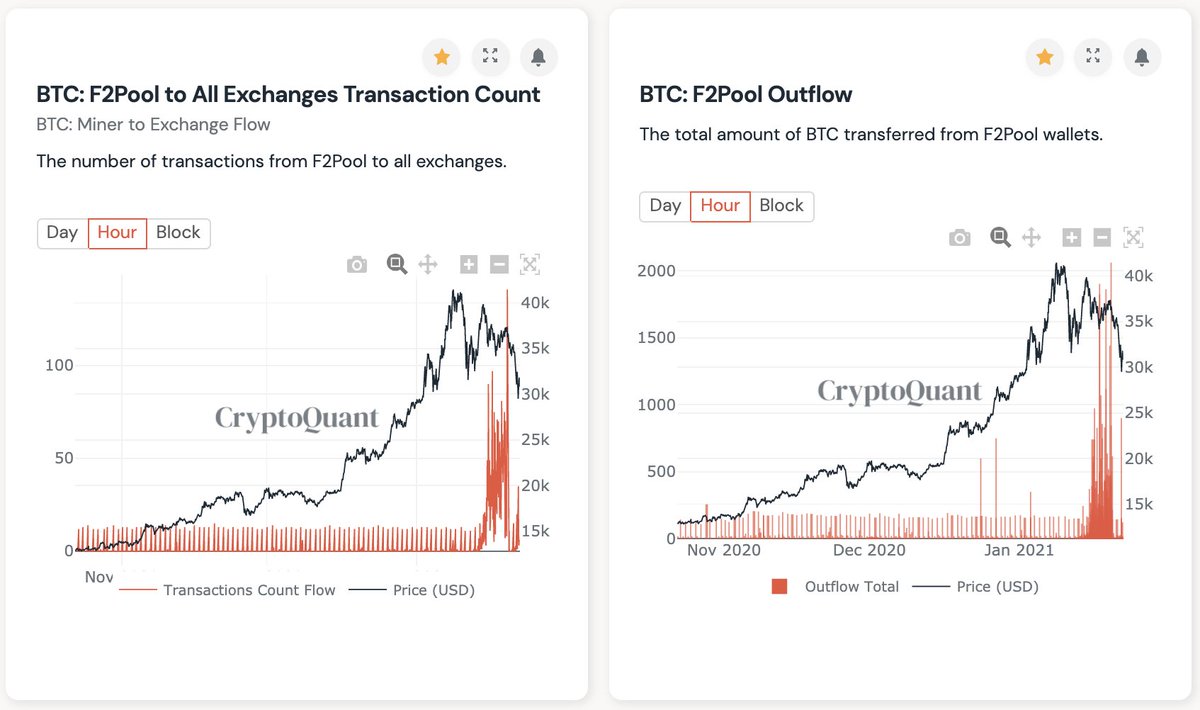

Onchain Analyst Says Bitcoin Miners May Have Dumped

On Friday, the CEO of Cryptoquant, Ki-Young Ju detailed the current sell-off might have been stimulated by some mining swimming pools offering. “This dump may have begun with BTC miners in F2pool,” the Cryptoquant executive tweeted.

The onchain scientist also shared charts of the action which revealed the Miners’ Position Index and miner to exchange inflows. “I got these bearish signals the other day,” Ki-Young Ju even more included. “Miners’ Position Index exceeded 2.5, 569 individuals transferred BTC in a single block (10 minutes), [and] 78 miners transferred BTC in a single block (10 minutes).”

Growing FUD

No one really understands what will occur from here in the land of crypto possessions and the growing economy. During the last couple of weeks, great deals of worry, unpredictability, and doubt (FUD) has actually been flowing extremely while crypto-assets like bitcoin (BTC) have actually been bullish.

So in 1 month we had:

✅ Mnuchin regulative scare

✅ tether fud

✅ journal hack

✅ Mt.Gox fud

✅ Yellen, Lagarde, Dragi scare

✅ Faketoshi rubbish

✅ rip-off & spam attacks

✅ bitcoin software application bug bullshitSome would state that is a bit excessive coincidence. Just stating.

— PlanB (@100trillionUSD) January 22, 2021

There’s been substantial regulative scares, unpredictability surrounding the Biden administration, unfavorable comments from Janet Yellen and Christine Lagarde, Mt Gox conversations, ecological disputes over proof-of-work, tether (USDT) debate, and the current Ledger client information hack. Despite all the FUD, cryptocurrency supporters still appear extremely positive about the future of crypto possessions in 2021.

Want to have a look at all the crypto market action with costs in real-time? Check out our crypto market aggregator at markets.Bitscoins.web.

What do you think of the current crypto rate action? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.