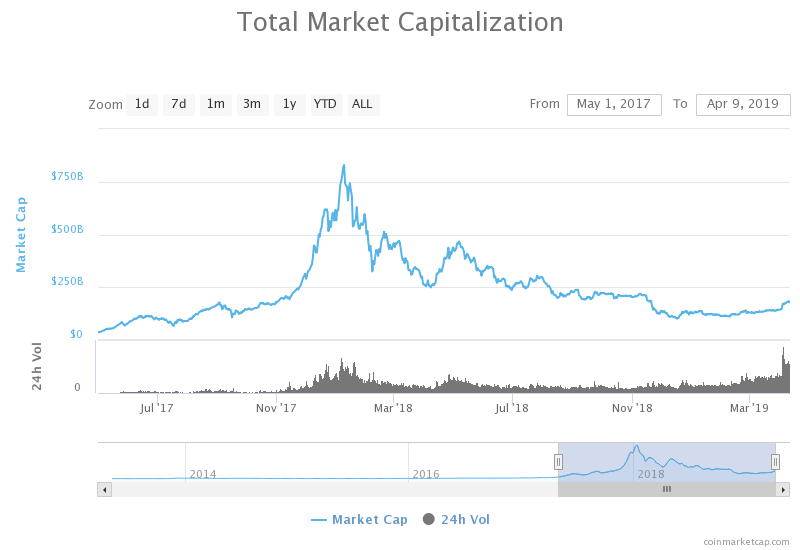

Volume has actually been increase throughout the cryptocurrency markets, with April seeing a brand-new all-time high published for everyday worldwide cryptocurrency volume. The month has also seen Chicago Mercantile Exchange (CME) report record trade volume for its BTC futures agreements, in addition to Cumberland’s trade desk reporting an increase of 1,000 BTC purchase orders, indicating strength throughout many aspects of the virtual currency community.

Also Read: How 5 Asian Countries Regulate Cryptocurrency

New All-Time High Posted for Global Cryptocurrency Trade

According to Coinmarketcap, brand-new records for everyday worldwide cryptocurrency trade were published on April 4 and 5 consecutively, with $77.07 billion and $79.99 billion worth of crypto altering hands on every day. The brand-new records vanquish the previous all-time high of almost $70 billion that was published on Jan 5, 2018, by more than 10%.

The rally appears to have actually been driven by a substantial spike in USDT trade, with USDT volume beating BTC on both April 3 and April 4. Currently, April 4 makes up the greatest day on record for both USDT and BTC, with $25.3 billion worth of tether and $21.7 billion worth of bitcoin core altering hands.

As of this writing, BTC and USDT volume is almost similar, with practically $15.81 billion worth of BTC and $15.74 billion worth of USDT having actually been traded over the past 24 hours.

CME Reports Record Volume

April fourth also saw CME report record volume for its BTC futures agreements with more than 22,500 agreements or the equivalent of 112,700 BTC traded, vanquishing the previous record of 18,300 agreements that was set since February 19.

On April 1, Cumberland reported that a big increase of 1,000 BTC purchase orders had actually been performed within the period of a single hour on its trading desk, more evidencing a remarkable spike in need throughout the cryptocurrency markets.

Speaking to CNBC, the president of Binance, CZ, reported that the platform has actually seen a record variety of orders performed in current days, mentioning: “The number of transactions … is at an all-time high, we are actually seeing more orders than January 2018.”

News.Bitscoins.internet also connected to a non-prescription (OTC) BTC broker, who kept in mind that “demand is picking up” in the OTC markets.

Do you believe that the boost in trade volume is an indicator of a shift in the cryptocurrency meta-trend? Share your ideas in the comments area below!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.