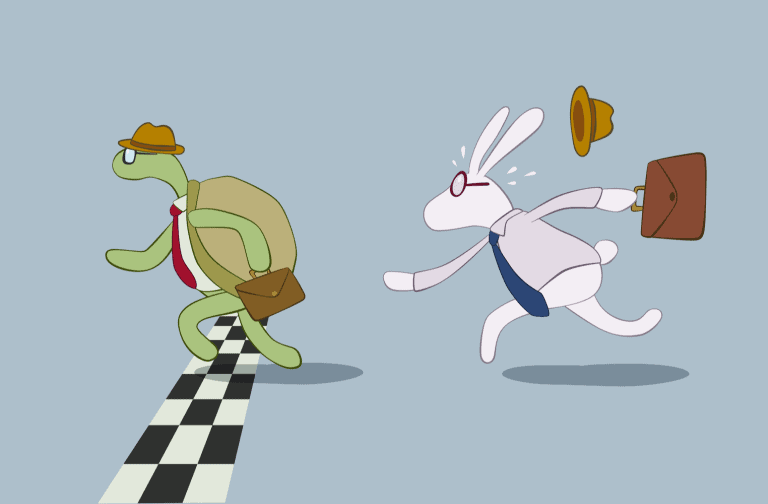

Dollar Cost Averaging (DCA) as a crypto investment approach might not be the most awesome method to hypothesize on the bitcoin rate, however it is among the most level-headed, according to advocates. Using a basic online DCA calculator, one can select a prepare for purchasing percentages of bitcoin at routine periods. While the strategy might result in losing out on some real bottoms, it also prevents compulsive FOMO purchasing throughout peaks, and rests on the olden saying that “sluggish and consistent wins the race.”

How DCA Works

“Dollar expense averaging, not the most attractive thing … however it could be the most effective thing you read IF you use it,” states user ManLikeAJ in his current read.money post on the subject, entitled: Dollar Cost Averaging – The Most Underrated Approach to Investing.

The fundamental concept of DCA is to rein in the biologically hardwired desire to get abundant immediately, and take a more measured method. There’s no lack of folks in the area who have actually seen markets increase, purchased in compulsively, and after that needed to reverse and offer the majority of their crypto cost savings not long after, when things remedied. Instead, investing little, achievable quantities over the long term tends to ravel the bumps. And in numerous cases, it puts the “tortoise financiers” far ahead of their more erratic equivalents.

Dcabtc.com offers a good little resource for determining (according to historical rate information) just how much one could have acquired if leveraging DCA in BTC investment. For example, the image above programs that somebody who began investing $10 a week 3 years back, and continued to do this each week for those 3 years, would have more than doubled their investment by the end, with a 119.49% gain. This suggests that in 2.5 years somebody could have seen $1,500 develop into $3,000, based upon the marketplace rates from this period.

Granted this may not be as thrilling as the mad BTC gains made from cocaine-fueled charge card purchases in 2017, however the financier most likely won’t requirement to offer their last sats to pay the light expense when more difficult times come, either.

Slow and Steady vs. Random Guessing Games

As ManLikeAJ states: “I overextended myself in the past, lost my task and after that needed to offer my BCH to make it through. I do not wish to EVER experience that once again therefore I am attempting to stay disciplined with a percentage that I understand I won’t miss out on and will get rid of rate swing feelings from.”

Dcabtc.com sets out a situation where 2 characters, John and Alice, choose to invest utilizing non-DCA and DCA techniques, respectively. John purchases up $5,000 of BTC on Jan. 1, 2018, all in one go. The rate at the time for one coin was $13,800, so he winds up owning 0.362 BTC. Alice, “rather of investing the whole quantity today, she chooses to buy $500 each month, for 10 months. 10 months later on, Alice owns 0.61 BTC. That’s practically two times as much as John, despite the fact that both invested the very same quantity.”

There are benefits and drawbacks to DCA, however the primary aspect worried by supporters is that no matter how wise somebody is, there’s eventually no other way to naturally and regularly time the marketplaces, which go through all sort of variables. Though some good bottoms may be missed out on, so will some circumstances of purchasing in expensive and taking a loss.

When BTC is taken a look at from an adequate range, the typical pattern is extremely favorable, which routine, determined investment can make the most of. DCA doesn’t dismiss leveraging technical analysis, either, as dcabtc.com explains:

“If you have some experience trading, you’ll rapidly understand that you can enhance the efficiency of your dollar expense balancing method by using some basic tools. When going this path, you would buy Bitcoin whenever a set of basic technical analysis tools offer you a signal, rather of a set time period.”

DCA for Other Coins and Assets

Dcabtc.com provides a good alternative of comparing DCA gains in bitcoin to other possessions from a chosen amount of time and investment method. The image above programs that in the period picked BTC was the very best carrying out investment, with an approximately 119% ROI. Gold yielded about a 25% gain, and USD about 18%.

Even for cryptos that put on’t yet have the historic ROI of bitcoin core, DCA can work to a financier’s benefit. For example, numerous see worth in the Bitcoin Cash network due to the low costs, active advancement and strong neighborhood which intends to adhere to the initial bitcoin values of financial flexibility for the person. Should the BCH haters be right, and see the entire thing tank to no one day, dollar expense averaging would nevertheless stand to alleviate high buys along the method for BCH advocates. Conversely, needs to the “simply hodl put on’t invest” story of core maximalists not wind up producing a reliable shop of worth, DCA integrated with wise withdrawals could put a pillow in front of the brick wall.

Because investing constantly includes threat (federal government fiat money consisted of), it’s not that DCA is a magic bullet, however an usually level-headed method to a danger a financier has actually currently considered beneficial and chose to take. So for the bettors out there, fear not — you still could lose or acquire all of it, simply a bit more gradually.

What do you consider the DCA approach for investing in bitcoin? Let us understand your ideas in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.