A brand-new yield farming project is all the rage today, as the Yam Finance project saw over $460 million dollars locked into the platform in 17 hours on Tuesday. On social networks and crypto-focused online forums, individuals have actually been really doubtful of the Yam Finance project as the code has actually not been investigated. On Wednesday afternoon Yam Finance designers exposed a bug in the clever contract and after the statement, the project’s token toppled in worth.

At the time of publication, lots of digital currency supporters are speaking about a brand-new decentralized finance (defi) project called Yam Finance. The procedure integrates a variety of defi applications like a flexible supply influenced by Ampleforth, reasonable circulation comparable to Yearn Finance, and onchain governance that’s similar to Compound Finance.

Yam is an “speculative procedure mashing up a few of the most interesting developments in programmable cash and governance,” discusses the project’s blog site post released on Tuesday.

“The future will be totally managed by the neighborhood of YAM holders. Again, YAM holds absolutely no fundamental worth; any worth which may accumulate would be a completely emerging residential or commercial property of the neighborhood that takes control,” discusses the Yam group. “This neighborhood of YAM holders will figure out and upgrade the performance of the Yam procedure, consisting of oracle use, rebase performance, inflation, reward style, the Yam treasury, and more.”

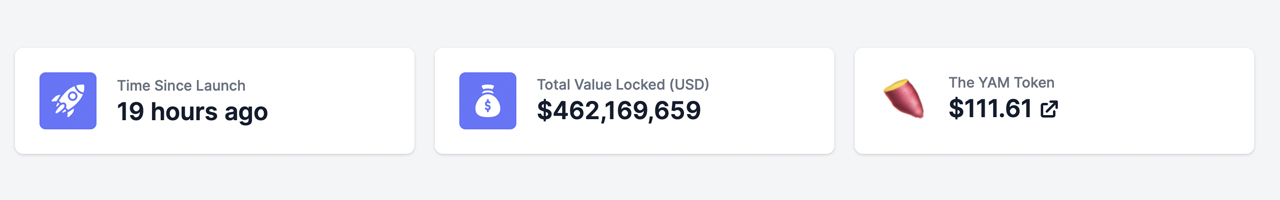

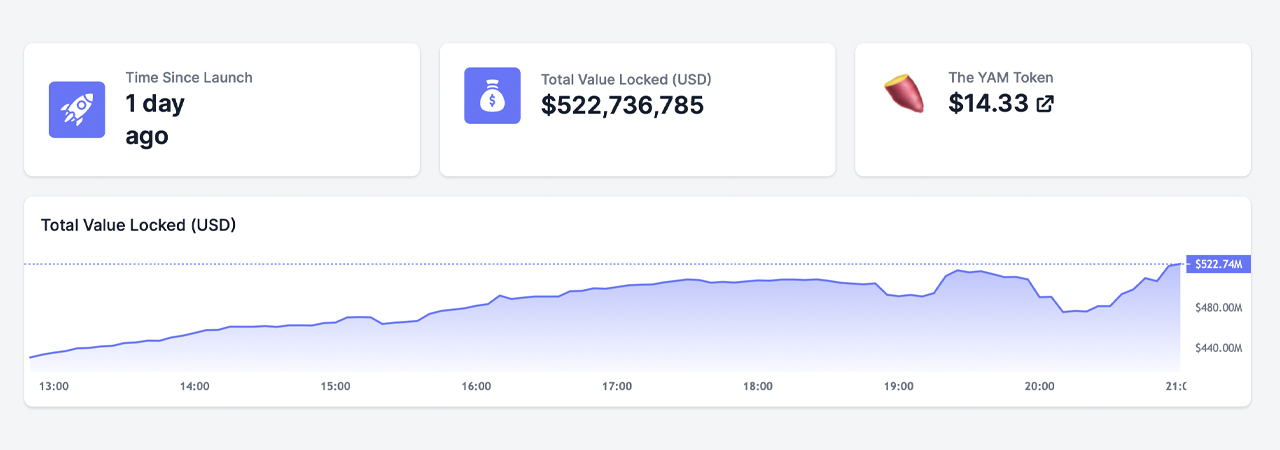

So far, the Yam Finance project has actually seen a great deal of need, and swarms of financiers have actually hurried towards the project. In the very first 6 hours the total-value-locked (TVL) into the Yam Finance system was around $170 million.

17 hours later on, the analytics site yam.zippo.io had actually revealed Yam Finance had more than $460 million TVL. The web website states the swimming pools “just collected 106,207 YAM out of the 2,000,000 YAM assigned for Wave 1.” After the project saw all that cash circulation into it, the project was the talk of the town on crypto Twitter.

Bitmex creator Arthur Hayes appeared delighted when he tweeted: “I’m a farmer now. Long live the defi booming market.” Other crypto observers have actually not been impressed by the Yam Finance project, as lots of doubters have actually grumbled that the codebase was not investigated.

One individual’s popular tweet said: “For the sake of the market, I believe we ought to instantly crowdfund an audit on YAM today.” Shapeshift creator Erik Voorhees stated the Yam Finance project looked like a “rip-off.”

“Yam appears like a rip-off… or to be more charitable, relatively transparent pump and discard rubbish,” Voorhees tweeted. “Projects like this are not going to benefit defi… What am I missing out on? Are the purchasers prepared individuals in a ridiculous video game, or are individuals declaring real worth?”

Of course, Voorhees’s viewpoint wasn’t valued by all the Yam Finance fans out there, as one individual called his tweet a “bad take” and asked the Shapeshift creator if he attempted it. “Bad take? I’m asking to be informed here,” Voorhees reacted. “Not gonna attempt it till I comprehend it. What are you seeing that I’m not?”

However, the private never ever reacted back and another individual chose to respond to the Shapeshift creator’s concern.

“Since nobody will really respond to…YFI…YAM…and other YFI forks are basically automating yield farming which itself is basically arbitrage of rates and yields based upon obtain and providing rates,” Allen Hena said to Voorhees.

“These are market inadequacies that will get flattened out in time. Taking it an action even more, this automation will develop to target other market inadequacies in the future to return yield to holders of stated coins and/or deal governance/voting input on the next actions for each dapp (e.g. YFI vaults, YAM deposits, etc),” Hena included.

Many individuals believed the quantity of funds that were locked into Yam Finance was “overwhelming” although it didn’t have an audit. “Some tasks have an audit and exit rip-off. It’s the wild wild west in here,” explained the Chocolate Maker.

Another individual composed: “This has actually been by far the most strange day in all of defi. Yam Finance has actually gone from $0 to $170M TVL in 6 hours, sustained by degens who transferred into a procedure without any security audit that was constructed in simply 10 days,” the individual stressed on Twitter. “Yes I am farming the hell out of it,” he included.

Meanwhile, a touch after 2 p.m. ET, the Yam finance Twitter deal with announced a bug in the clever contract that impacted the rebasing contract. “All funds in the staking contract are safe, as this is an unassociated part of the procedure,” the group tweeted. “User YAM balances are also untouched.” While this quandary took place, the token worth of YAM plummeted significantly in value and a couple of crypto advocates ridiculed the group. Still, according to onchain analytics, the project has a massive $522 million in TVL at the time of publication.

What do you consider the Yam Finance project raising $460 million in 17 hours? Let us understand what you consider this story in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.