Peer-to-peer cryptocurrency trading information reveals digital properties like bitcoin are growing incredibly popular in Russia, despite the State Duma’s viewpoints and policies targeted at crypto properties. On Monday, the Russian federal government released a draft variation of lawsuits requireds called “On Digital Financial Assets,” and legislators are searching for popular opinion. Despite the rigorous proposition prepared by the Russian administration, trade volumes on specific exchanges have actually seen considerable need from the nation’s residents.

Russia’s Cryptocurrency Laws Remain in the Gray Zone

Just just recently Russia’s State Duma launched a draft of proposed lawsuits towards cryptocurrencies and business that handle the innovation. The draft called “On Digital Financial Assets,” is an upgraded variation on how legislators may control the crypto market in the future. The files do not dig much into individual holdings, trading, and cross-border remittances, unless it is used to start-ups and seasoned business that take advantage of cryptocurrencies. People can own bitcoin or other digital properties, however the brand-new proposition does forbid the extensive blood circulation and even ministration when it concerns digital currencies versus the Russian ruble.

“Сryptocurrencies go entirely into the gray zone in Russia,” discusses Waves Enterprise agent Artem Kalikhov. “People who own a couple of bitcoins are not at danger. But all cryptocurrency exchanges and wallets hosted on Russian websites with a .ru at the end are now at danger.”

Demand for Cryptos Like Bitcoin and Bitcoin Cash Has Been Thriving in Russia

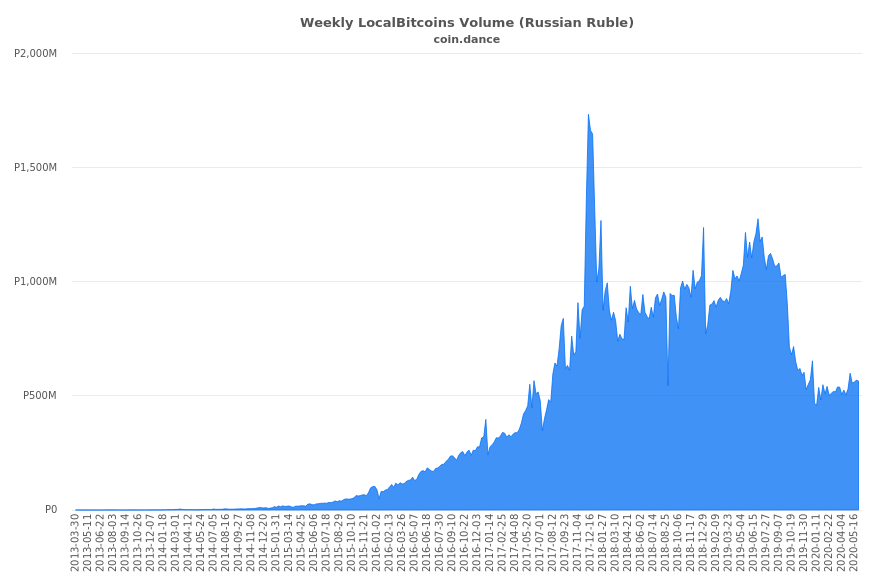

Despite the freshly upgraded proposition, Russian trade volume for bitcoin (BTC) on the peer-to-peer trading platform Localbitcoins (LBC) has actually been rising. For 2 months directly Russia has actually exceeded a variety of other nations who have also been seeing considerable trade volumes originate from the Russian individuals. Coin Dance stats suggest that Russia has actually represented 20% of May’s LBC trade volume. Even though regulative clearness has actually kept Russians in the dark, LBC’s information reveals that residents from the area are requiring more bitcoin than they have in years.

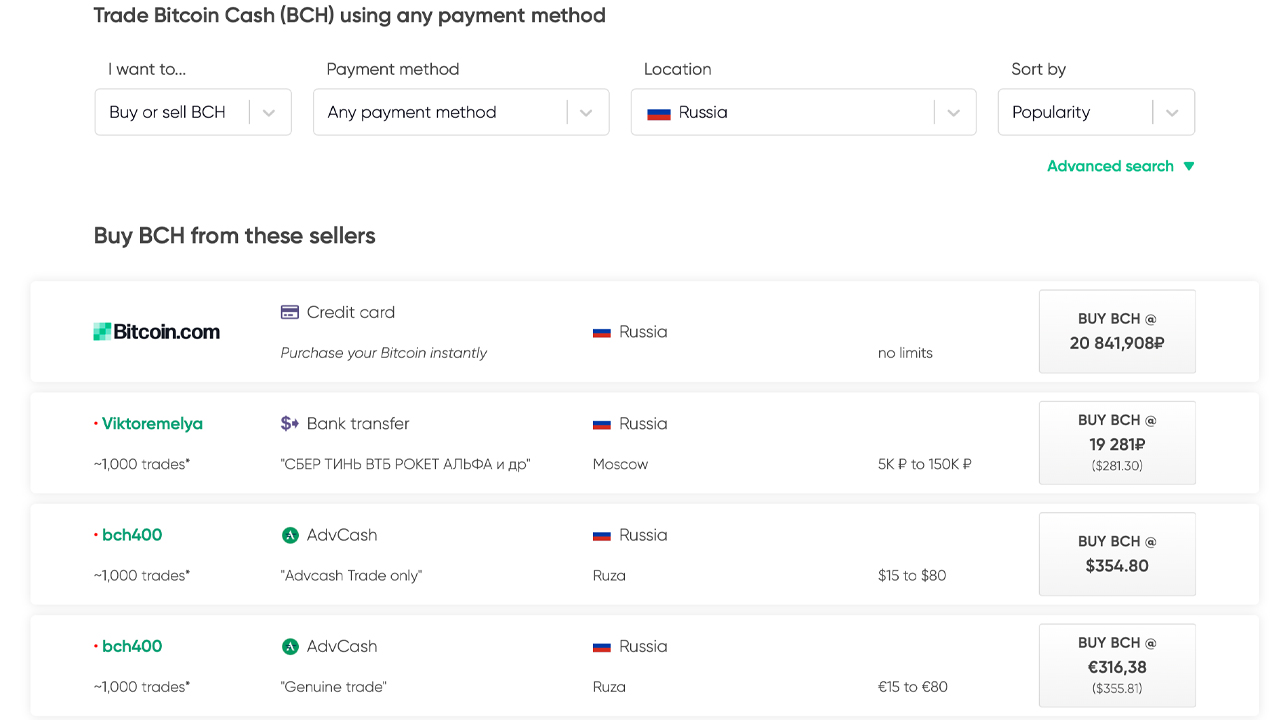

Data from Bitscoins.net’s regional bitcoin money (BCH) market, Local.Bitscoins.web, suggests that Russians are trading a great deal of BCH also. In popular areas like Venezuela and Colombia, there are individuals who have actually traded 50 to over 100 times utilizing Local.Bitscoins.web. In Russia, nevertheless, traders have actually settled over a thousand buys and offers in the regional area. People accept charge card, Advcash, Qiwi, and bank transfers. One trader from Russia reveals that he/she has actually settled over 15,000 sell the nation acquiring bitcoin money.

Russia was just recently included in an Onfo research study report, which had actually revealed the nation saw a much faster network impact than the similarity the U.S. and Germany. The pattern of adoption continues despite Russian legislators proposing a law that will apparently criminalize purchasing bitcoin with money.

News.Bitscoins.net’s Jeff Gogo reported on how transgressors from Russia might deal with 7 years in prison if the law is enacted. While the Russian federal government looks like it will punish bitcoin, there have actually been reports of the nation prohibiting digital properties for over 7 years now. Even however, Russian citizens are still in the “gray zone,” like Artem Kalikhov worried, the need for cryptocurrencies continues to flourish.

What do you consider the peer-to-peer exchange volumes originating from Russia? Let us understand in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.