A variety of Wall Street veterans like Bear Traps Report author, Larry McDonald, believe that markets may see some “devastating and inconceivable” effects in the future. Another experienced expert, Larry Williams, thinks the S&P 500 will shiver after July 28. Despite the pending doom edging towards conventional stock and equities markets, bullish crypto scientists think the digital currency bitcoin will see the opposite pattern moving forward.

Wall Street Vets Predict Disastrous Market Outlook

It’s safe to state that a great deal of individuals are worried about the international economy and the monetary systems leveraged in the nation they live in. This is because of the reality that federal governments around the world reacted to the Covid-19 break out by closing down a big part of the economy.

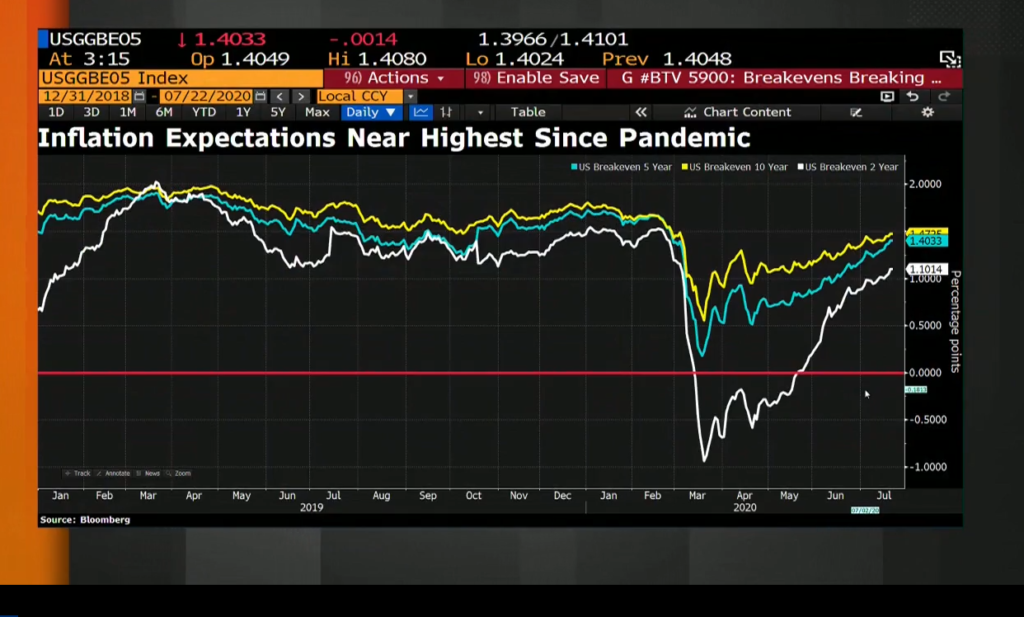

Despite the financial slump, reserve banks like the U.S. Federal Reserve has actually been on a cash production spree. This has actually boosted conventional stock and equities markets, however veteran financial experts believe that this present run can just last so long.

At press time, the 3 leading U.S. composite indexes; Nasdaq, Dow Jones, and NYSE, are all down on Friday, together with huge tech stocks too like Apple. People believe that stock exchange are still not reflective of truth right now, and a variety of experts think a difficult financial recession is looming in the background. Wall Street veteran Larry McDonald just recently discussed that federal government intervention worsens the economy and he called financial interventions a “cobra impact.”

“Basic financial presumptions, or structures, will end up being far more fluid than policymakers can expect. Therefore the outcomes will be devastating and inconceivable,” McDonald worried.

The “cobra impact” McDonald is discussing describes a time in India when there were a lot of poisonous cobras in the streets. So at that time, the Indian federal government paid individuals per cobra if they turned the snakes in to regional authorities. However, Indian policymakers lastly found out that people began reproducing cobras for additional earnings.

“We think we are at the early phase of the greatest cobra impact in the history of economics,” the author of the Bear Traps Report composed on July 21. “As the enormous financial and enormous financial stimuli (over $15T worldwide) adjoin to conserve the economy from a deflationary anxiety, they will trigger rather a hyperinflationary financial collapse.”

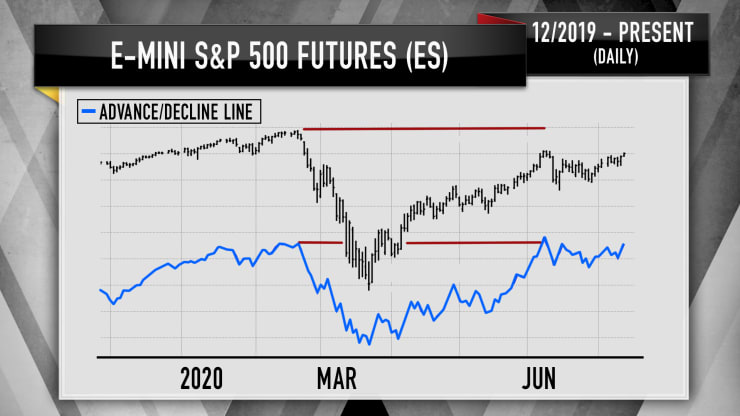

McDonald is not the only Wall Street veteran who thinks monetary markets are headed for disaster. Renowned trading specialist Larry Williams has in fact anticipated a specific date. Williams just recently informed CNBC’s Jim Cramer that the S&P 500 will top in July however at the end of the month, particularly on July 28, the S&P 500 remains in for some volatility.

Cramer discussed the current analysis Williams offered and stated he believes the well recognized trader may be onto something.

“The charts, as analyzed by the famous Larry Williams, recommend the S&P might climb up another 4% or 5% over the next 2 weeks, however come July 28, he anticipates the marketplace to begin rolling over,” Cramer stated on the broadcast “Mad Money.” “Given that the broadened joblessness insurance coverage gain from Washington end at the end of the month, well, I wouldn’t marvel” if he’s right,” Cramer included.

Bitcoin Analysts Believe ‘It’s Hard Not to be Bullish Here’

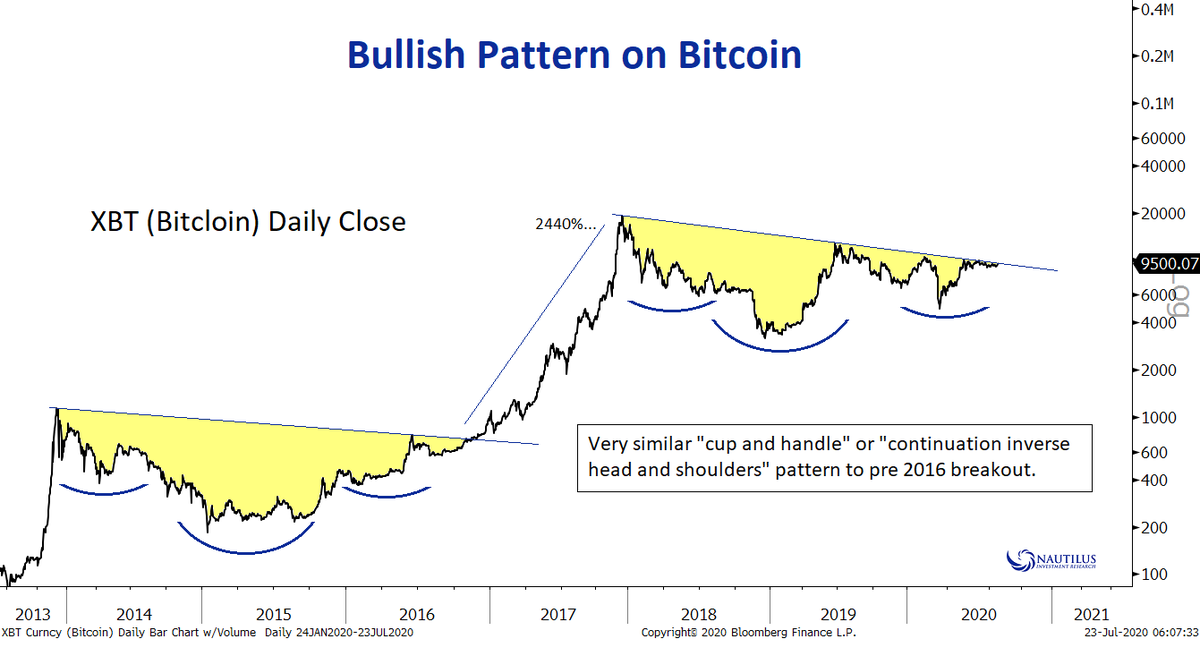

Even though market experts observing conventional stocks and equities anticipate an inbound dump, digital currency supporters anticipate crypto markets to move northbound. An “independent research study store” that offers institutional financiers with insight for today’s markets, Nautilus Research, believes bitcoin (BTC) looks bullish today.

On July 23, Nautilus Research tweeted a BTC/USD chart that shows a possible “bullish pattern.”

The exact same day, the popular Twitter account @thecryptocactus discussed to his 14,000 fans that today it’s hard to not be bullish.

“Hard not to be bullish here, as long as purchasers safeguard this $9,500 level for the remainder of the week ahead, I believe we will be seeing a retest towards the regional highs,” Cactus tweeted. No possible method to see this as bearish today,” the person included.

A variety of other bitcoin supporters are extremely bullish about bitcoin’s (BTC) cost moving northbound in the future. Investment strategist Lyn Alden just recently released a research study analysis of bitcoin, in order to discuss why she is “presently bullish from a macro/generalist financier viewpoint, as part of a portfolio.”

Although, not everybody is so positive and some individuals think we may be seeing a bull trap or fakeout. Bitcoin21.org expert Eran Gadot discussed on July 24, that BTC might see some difficulty ahead.

“Bitcoin broke out of a bullish pennant, however a substantial supply barrier ahead of it might provide difficulty for its uptrend,” Gadot composed on Friday.

What do you think of the bullish optimism bitcoiners have today as conventional markets may see disaster? Let us understand what you think of this topic in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.