As the decentralized financing juggernaut rolls inexorably forward, the exploitation of defi job Bzx – in which $350K, or around 2% of overall possessions was taken – has actually called the decentralization of the market into doubt. The attack required an admin essential reset to redeem lost funds and stimulated a rise in defi insurance coverage, with significant gamers quickly securing cover to vaccinate themselves from monetary loss. Exactly how decentralized is decentralized financing, critics are questioning.

DEX Volume Swells 71% in a Week

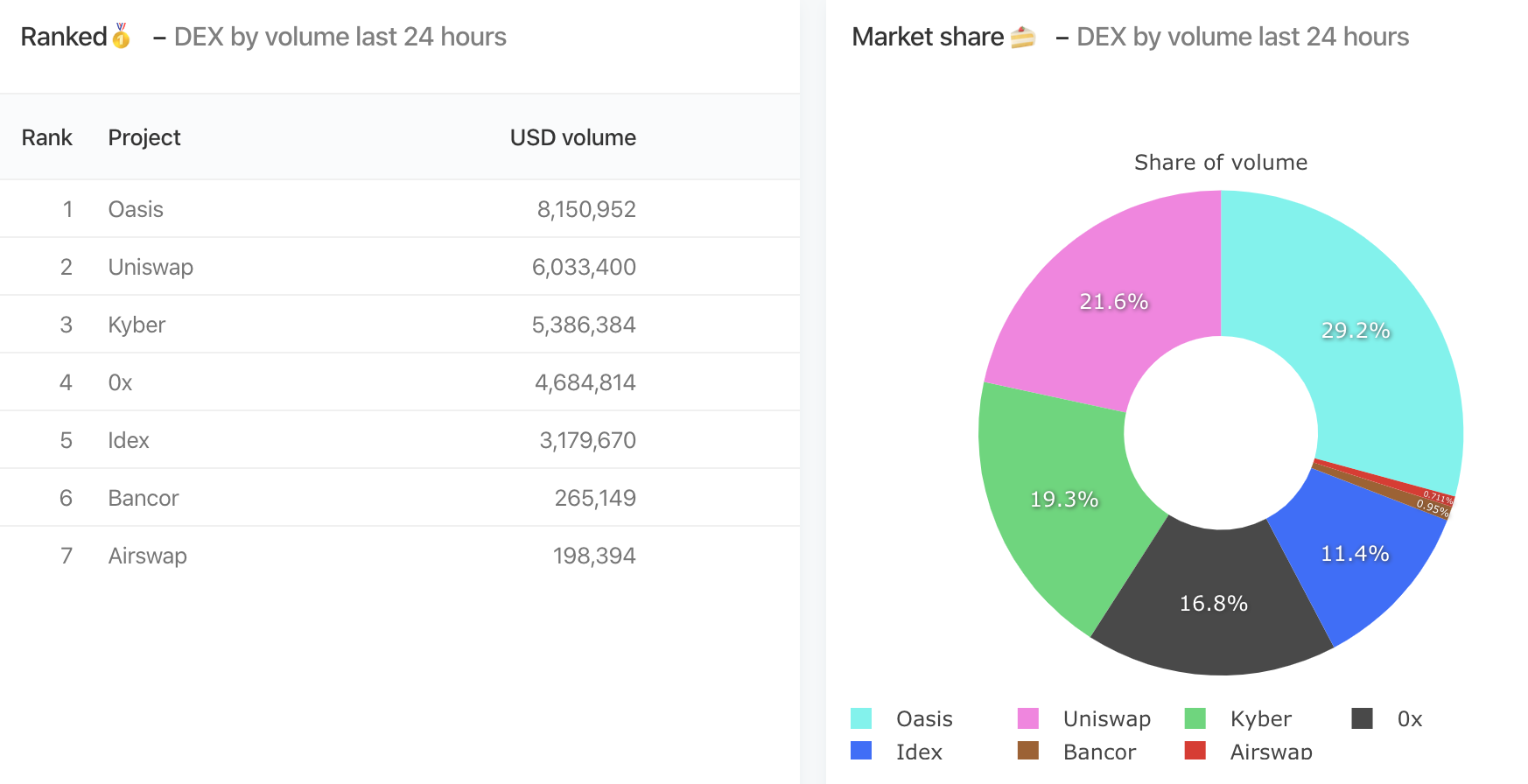

Decentralized exchanges, around which the defi motion revolves, are going strong. More than $2.3B was traded on Ethereum-based DEXs in 2015, and 2020 is on course to conveniently go beyond that. $119M was sold the last 7 days, according to Dune Analytics, marking a 71% boost. Meanwhile, brand-new DEXs are emerging routinely to fulfill growing need. The newest, Dexive, will run as a double Ethereum and Neo decentralized exchange, with incorporated trading functions such as property information, news website, conversation online forum and microblog. There are strategies to eventually incorporate other blockchains such as Eos and Zilliqa to produce a universal DEX.

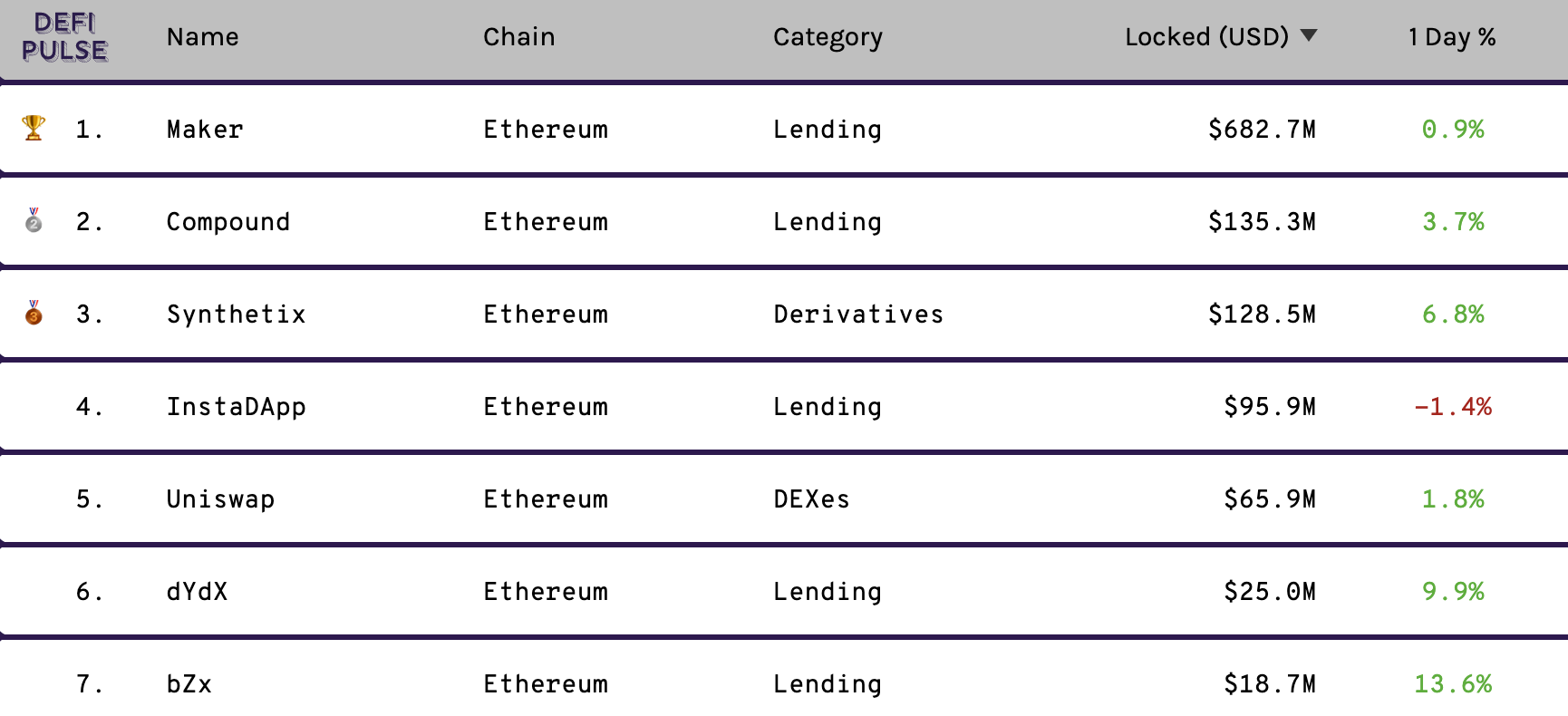

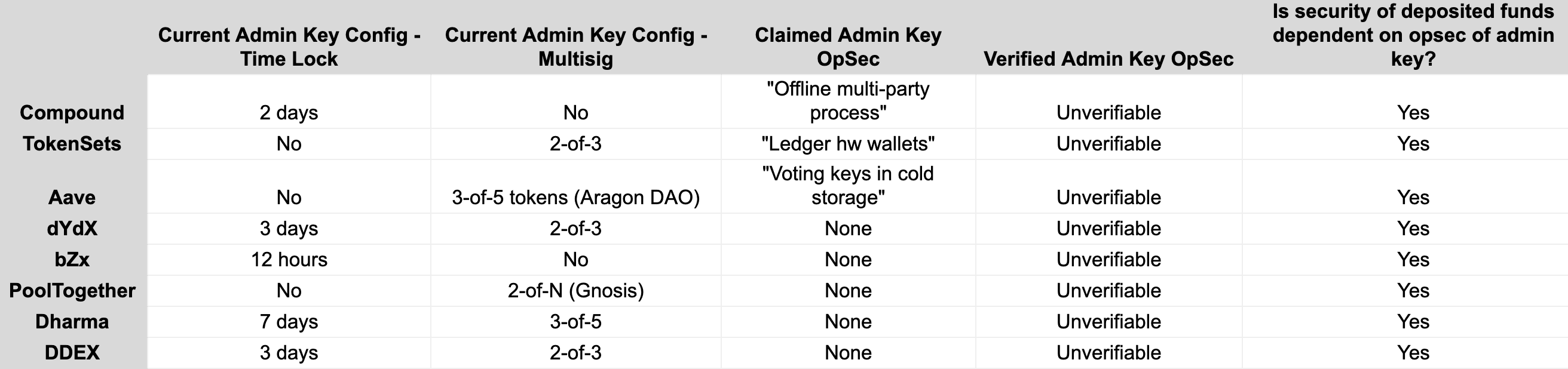

While need for decentralized token trading, and the defi primitives it supports, increases, the market has actually looked unsteady of late. The Bzx exploit that took place on February 15 has actually stimulated extreme argument regarding whether decentralized trading procedures are really decentralized, or whether the existence of a “eliminate switch” nullifies all such claims. Bzx is the seventh biggest defi procedure, with over $18 million worth of funds locked.

A Complex Transaction

The exploitation of Bzx took place on February 15, with job co-founder Kyle Kistner offering information through the platform’s authorities Telegram channel and briefly stopping briefly all trading on the exchange. “Exploit” is most likely the most suitable term, although arbitraging, assaulting, hacking, and thieving have actually all been freely utilized. The net outcome is the exact same: Bzx’s balance ended up $350K worth of ETH lighter, though the damage was far even worse offered the ensuing loss of equity. So, how did it take place?

Essentially an exploit was performed versus an agreement on the job’s Fulcrum trading platform. The criminal secured a 10,000 ETH flash loan from non-custodial exchange Dydx prior to dispatching 5,000 ETH to Compound and loaning 112 covered bitcoins (WBTC).

Thereafter, the aggressor sent out 5,000 ETH to Bzx, opening a 5x brief position for WBTC. After the exchange had actually transformed 5,637 ETH to 51 WBTC through Uniswap, the aggressor then transformed the 112 WBTC to 6,871 ETH on Uniswap prior to paying Dydx their initial 10,000 ETH. The overall deal expense sustained by the multi-part clever agreement was $8. Confused? You’re not alone; the elegance of the exploit has actually had commenters praising and head-scratching in equivalent procedure.

Tweets like “DeFi apps are no different than centralized exchanges because all the contracts have admin keys” is the inexpensive, uninteresting fast-track to “CT wokeness” nowadays, requiring me to take the devil’s supporter and mention why that’s often incorrect. Warranted retort:

— Eric Wall IS RIGHT (@ercwl) February 17, 2020

An Oracle Problem

In completion, the criminal made use of a Bzx defect that allowed them to trade an excessive quantity on Uniswap at an inflated cost of 3x. In other words, it wasn’t an oracle bug per se, but a basic vulnerability in the style of the defi stack that facilitated its execution. Opening such a substantial position triggered a drain of funds from Bzx to Uniswap, improving the rogue star to the tune of $350K and leading to a $620,000 loss of equity for Bzx. Market control at its finest.

Our very first claims evaluation has actually settled with the 30,000 DAI claim on @bzxHQ being decreased.

7 out of 8 members voted No, with over 76,000 NXM being staked at the same time (over $300,000 worth of stake).

The plaintiff can resubmit a claim one more time if they want. https://t.co/ffAvyKZlt0

— Nexus Mutual 🐢 (@NexusMutual) February 16, 2020

As well as briefly taking Fulcrum down for upkeep, Bzx deployed a contract upgrade they stated would make their system more robust versus comparable attacks and stated that they would cover the aggressor’s loan payment by streaming “interest and exit liquidity to existing iETH holders” from the 600k of WBTC left. Amid the post-mortem of the attack, insurance coverage for DeFi financing has actually experienced a major uptick, with numerous countless dollars’ worth of cover secured throughout procedures such as Maker, Compound, Dydx and Bzx.

How Decentralized Is Decentralized?

Perhaps the most pertinent concern to emerge from this mess was postured by Twitter user @SupraBo_ in response to Bzx’s upgrade on the deal: “Decentralized financing is so effectively decentralized that it can be stopped briefly.”

The bZx attack happens routinely in standard markets in the kind of acquired control, which tends to lead to severe regulative penalties.

The genuine quandary with DeFi is not flash loans or oracles, but that “attackers” simply play a permissionless video game by the guidelines.

— Qiao Wang (@QWQiao) February 16, 2020

Another tweet recommended the attack exposed the larger risk postured to the Ethereum network of fast-growing financing efforts: “DeFi = how to increase systemic danger on Ethereum.” Litecoin developer Charlie Lee, on the other hand, sounded off by calling defi “the worst of both worlds,” keeping in mind that it “can be closed down by a central celebration, so it’s simply decentralization theatre. And yet nobody can reverse a hack or exploit unless we include more centralization. So how is this much better than what we have now?” Research by Chris Blec, who costs himself as “defi’s friend and hardest critic,” has actually revealed that a lot of defi procedures have an admin secret that can bypass the system in emergency situations.

While it is simple to see why faith in defi has actually been knocked by this innovative break-in of sorts, another point of view is that the occasion represents a bump in the roadway for the motion, which stays at an early, speculative phase regardless of over $1 billion worth of worth being secured, mainly in providing services. The direct exposure of vulnerabilities, and ensuing intensifying of treatments, is required for maturation of a market in which development continues to play out.

What are your ideas on the Bzx exploit? Do you believe defi procedures are really decentralized? Let us understand in the comments area below.

Did you understand you can confirm any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, see our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.