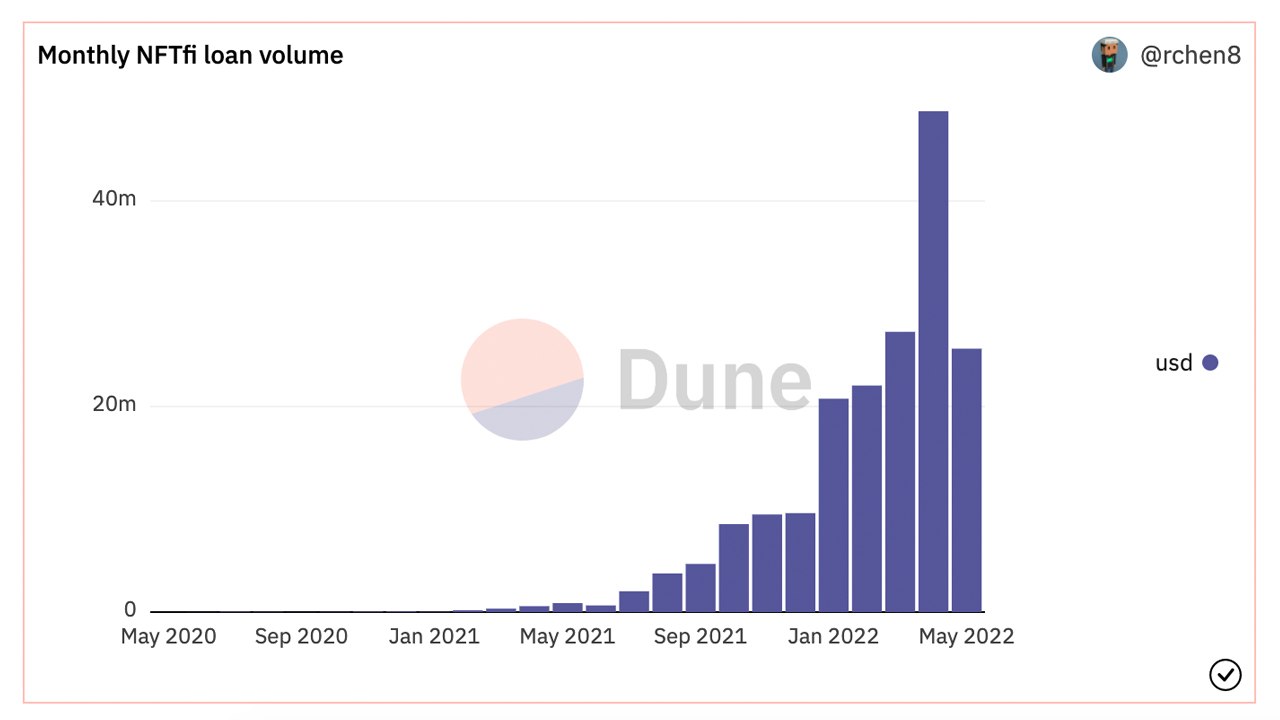

While non-fungible token (NFT) antiques have actually ended up being a hot product over the last 12 months, a variety of NFT owners are taking loans out versus their NFTs. This month, a job called Nftfi has actually assisted in $25.6 million in NFT loans up until now, and last month the financing market tape-recorded almost $50 million in NFT loans.

NFT Lending and Borrowing Continues to Grow

NFTs have actually ended up being a billion-dollar market throughout the in 2015 and a popular blockchain innovation usage case. Even though sales have actually moved in current times in the middle of the crypto market slump, NFTs are still costing numerous thousands and even countless dollars per digital collectible. In addition to the NFT sales and auctions, NFT owners are also lending their digital antiques for gain access to to liquidity. For circumstances, a decentralized financing (defi) platform called Nftfi has actually seen $185.4 million in cumulative loan volume given that the marketplace’s beginning.

In the recently, the peer-to-peer market for NFT collateralized loans tape-recorded 4 loans for more than $100K or more each. On May 16, Bored Ape Yacht Club (BAYC) 7,813 was utilized for a $100K loan, and Autoglyph 231 was leveraged for a $200K loan on May 12. BAYC 6,276 was utilized for a $150K loan on May 10, and the BAYC 371 owner was able to acquire a $115K loan for the NFT the day in the past. So far this month, Nftfi has actually assisted in $25.6 million in NFT loans, according to data from Dune Analytics. Nftfi is also partners with the blockchain companies Flow and Animoca Brands.

NFT Lending Competition

Nftfi is not the only NFT financing platform on the block, as there are others like Arcade, Nexo.io, and Drops. Statistics reveal the Drops loan market has actually assisted in $6,746,515 in financing. Arcade has actually raised $17.8 million from financiers like Pantera Capital, Franklin Templeton Investments, Castle Island Ventures, and Protofund. Another rival is the peer-to-peer NFT financing market Flowty, which is constructed on the Flow blockchain network. Flowty raised $4.5 million in the business’s very first financial investment round from 2 lead financiers and 23 overall.

Nftfi has a large choice of NFTs and a variety from a variety of blue-chip digital collectible collections as well. For circumstances, there are ENS names, Unstoppable Domains, Axies, Doodles, Sanbox land, Otherdeeds, Hashmasks, Bored Ape Yacht Club, and Mutant Ape Yacht Club (MAYC). Just just recently the platform phased out its old clever agreement (Nftfi V1) on April 4, 2022, and released a brand-new clever agreement called Nftfi V2. According to the web website, Chainsecurity and Halborn investigated the platform’s V2 clever agreement.

What do you think of individuals providing out their NFTs for collateral to obtain a loan? Let us understand what you think of this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.