Discreet Log Contracts are an old idea in this area at this moment, proposed by Thaddeus Dryja (co-creator of the Lightning Network procedure) in 2017. DLCs are a wise agreement structure created to attend to 3 problems with agreement plans prior to the proposition: to start with the scalability of the wise agreement itself, which needed bigger on-chain footprints for a bigger set of prospective results; second of all, the concern of getting information external to the blockchain “into the blockchain” for agreement settlement; and last but not least, the personal privacy of users of the wise agreement.

The standard plan is extremely easy, 2 celebrations develop a multisig address made up of the 2 of them, and select an oracle. After doing so, they develop a set of Contract Execution Transactions that communicate with the oracle. Say the oracle is revealing the rate of bitcoin, and the individuals are banking on the rate of bitcoin, what the oracle does is release a set of dedications to the messages it will check in order to “announce” the rate of Bitcoin at a specific time. The CETs are built so that the signature on each CET one individual offers to the other is secured utilizing adapter signatures. Each signature for the settlement of the agreement at any provided rate can just be decrypted with info from the signed oracle message vouching for that provided rate. The oracle merely releases their dedications to messages for whatever information they are functioning as the oracle for, and any individual can non-interactively utilize this info to make a DLC. The last piece is a timelocked refund deal, if the oracle never ever transmits the needed info to settle the DLC, after a timelock duration extended beyond the agreement life time has actually expired both celebrations are merely reimbursed their cash.

This fixes the 3 significant problems Tadge (Thaddeus) marked in the initial DLC whitepaper: it is scalable, requiring just a single deal to money the agreement and a single deal to settle it; it permits a method for external information to be “brought into” the blockchain; and it fixes the personal privacy concern, because the method oracles simply blindly transmitted information to the general public they acquire no insight into who is utilizing them as an oracle in an agreement. You can even utilize a federation of several oracles, where if the worth they vouch for is close sufficient to each other the agreement settles properly. One last crucial thing to keep in mind with DLCs, is the oracles lying to settle agreements improperly is a really various design than with a conventional escrow multisig. In the escrow design, an oracle can select to selectively damage a single user by signing for an inappropriate settlement. There is the capacity for alleviating the reputational damage there, however in the DLC design an oracle cannot do this. When they sign a message it is utilized to settle every DLC linked to that settlement message and time, there is no chance to selectively act destructive towards a single celebration since they do not understand who is utilizing them.

The just genuine imperfection of this plan, aside from the inevitable rely on an oracle, is the coordination concern. Depending on the nature of the agreement, state a bet on the rate of Bitcoin versus a bet on a sports video game (group X wins or group Y wins), there might either be a handful of CETs or a huge set of CETs to cover all prospective results. This opens 2 issues: one, if the set of deals is big enough this develops the capacity for network problems and DoS attacks losing individuals’ time by not finishing the agreement established; second of all, the capacity for a complimentary choice issue that would require an on-chain deal to handle. A complimentary choice concern would be if the agreement is established and completed, however the celebration who end up with the total financing signature didn’t relay it. This would permit them to just money the DLC on-chain if it remained in there prefer and not otherwise, and the only method for the other celebration to leave this circumstance would be to double invest their financing output on chain.

DLC Markets

LN Markets just recently released a short article explaining a brand-new DLC requirements they have actually created to customize a DLC system towards institutional stars. The existing suite of tasks developing on DLCs have actually been customized more towards retail customers, which left space for adjustment to the style to attend to the needs of bigger institutional stars.

Some problems for institutional clients are: the complimentary alternatives issue, which is not appropriate because kind of environment; the 2nd is an absence of margin calls, i.e. a position either being closed if one celebration does not have sufficient margin capital to cover their side of the trade at existing rate, or that celebration including the extra necessary margin to keep it open; last but not least the capability to utilize capital in a more effective method instead of having capital in one position secured from the start to surface of the agreement.

To address all of these problems LN Markets have actually presented the idea of a DLC organizer. Rather than peers in an agreement straight collaborating in between each other to deal with the financing and settlement of the agreement, the organizer can being in the middle and assist facilitate this. This fixes the complimentary alternatives issue rather elegantly, by having the organizer help with agreement settlements. Rather than each peer straight connecting with each other to sign the agreement execution and financing deals, they send their signatures for all of these to the organizer. At no point will either individual ever have access to the signatures required to money the agreement, getting rid of the capability for one to have a complimentary choice. The organizer is the only one who will ever have both signatures, and to attend to the issue of them conspiring with an individual or being destructive and not sending the financing deal for some other factor, the financing deal consists of a charge payment to them for working as an organizer. This provides a direct reward to send the financing deal after the DLC has actually been worked out and signed.

Another huge performance remains in the coordination procedure of building the DLC in the very first location. Without the organizer included, individuals would need to interact with each other, exchange address and UTXO info, and after that coordinate establishing the DLC. With the organizer, users can merely sign up an xpub and some UTXOs with the organizer, along with their deals for agreement terms. When somebody accepts an existing deal, the organizer has all the info needed to build the CETs, after which they can merely supply them to the individual accepting the deal to validate and sign, then transfer signatures to the organizer. The initial offerer will then get the CETs to validate and sign and return as quickly as they come online and choose to accept the counterparty, sending them back to the organizer who can then integrate signatures and send the financing deal.

Liquidations

Having the organizer included also provides a trustworthy interaction point for including the last missing out on piece for DLCs used in an expert environment: liquidations and managing including extra margin.

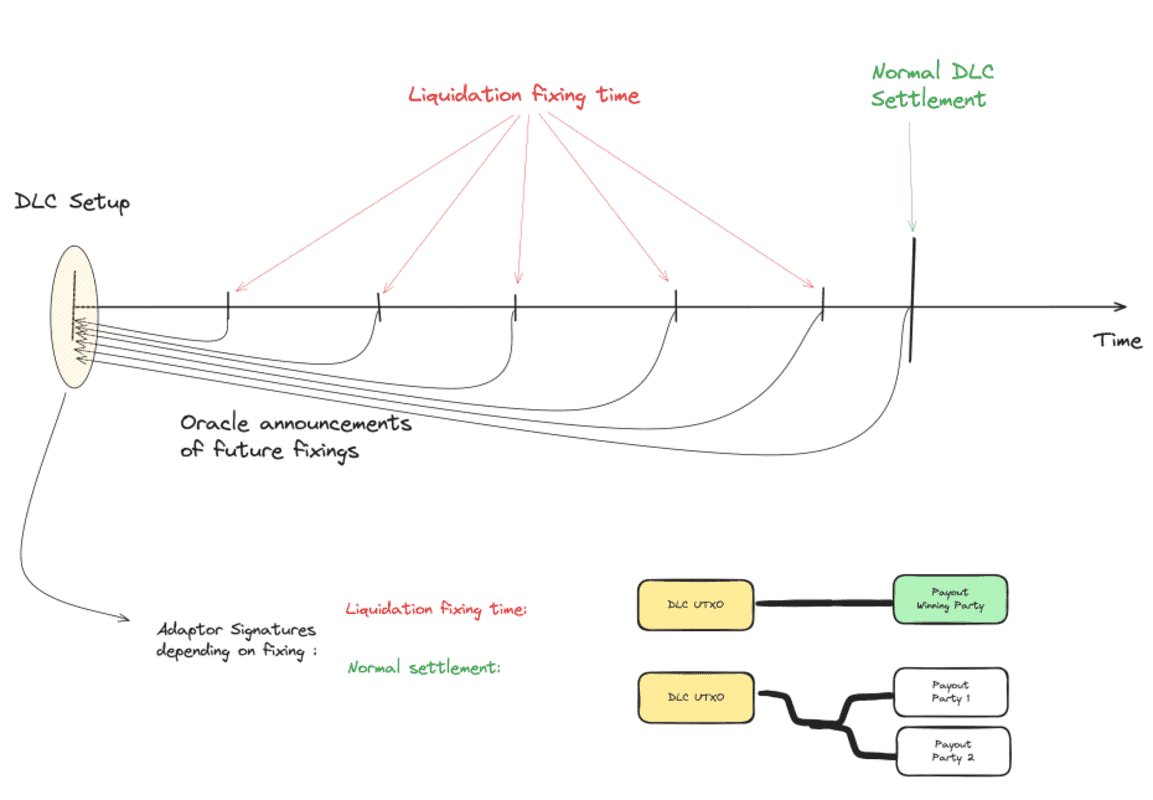

There was a great infographic from the whitepaper consisted of in the post LN Markets composed revealing the proposition, however I seem like this one is a lot more instinctive to comprehend. In addition to all the CETs connected to oracle messages for rate statements that might happen at the agreement expiration, there are also unique settlement deals for durations before the real agreement expiration – the period of which can be chosen by the individuals in line with the frequency the oracle releases rate messages at. Each celebration has one unique CET for each of these “liquidation times”, where if the rate is beyond the agreement variety (i.e. all of the funds are owed to a single side) at any of those liquidation points they can merely send this deal and settle the agreement previously.

If at any point approaching a liquidation time one celebration is at a liquidation point, they can utilize the organizer to collaborate including margin to the agreement, and enabling the other celebration to understand a few of their gains by withdrawing funds from the agreement. This would include both celebrations collaboratively investing from the financing multisig into a brand-new DLC that would get more funds from the under-collateralized celebration and let the “winning” celebration withdraw some funds. The brand-new DLC would be otherwise set to the exact same expiration time and with the exact same liquidation points set leading up to that.

This vibrant brings the abilities a lot more in line with what institutional financiers anticipate; the capability to handle liquidity better, to have an agreement end early if one celebration is under-collateralized based upon the existing market value, and the capability to include more security in action to a coming liquidation occasion.

What’s the huge offer?

To some this may appear like a series of extremely little and eventually unimportant modifications to the initial DLC requirements, however these little modifications take something that since of its existing drawbacks didn’t have much prospective beyond retail customer usage and put it in the league of possibly having the ability to meet the needs of much bigger financial stars and swimming pools of capital. If the Lightning Network was a big dive forward for transactional usage of Bitcoin, I believe this has the prospective to be a comparable dive forward for capital and monetary markets’ usage of Bitcoin.

Every utilize case of Bitcoin isn’t going to be a use case everybody else likes or has requirement of, and some might even have externalities they develop for other usage cases, however as an open system that is the truth of how Bitcoin works. Anyone can construct on it. This proposition may not be a main usage case for many individuals reading this, however that shouldn’t cause you disregarding the reality that it might grow to be a huge one.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.