The intro of Bitcoin ETFs in January 2024 was acknowledged as a special occasion in the monetary market. Analysts prepared for that these financial investment automobiles would assist in a rise in institutional capital, substantially raising Bitcoin costs. However, one year later on, the important concern occurs: have Bitcoin ETFs satisfied their pledge?

For a detailed evaluation of this topic, a current YouTube video entitled “Have Bitcoin ETFs Lived Up to Expectations?” is readily available for seeing.

A Strong Start

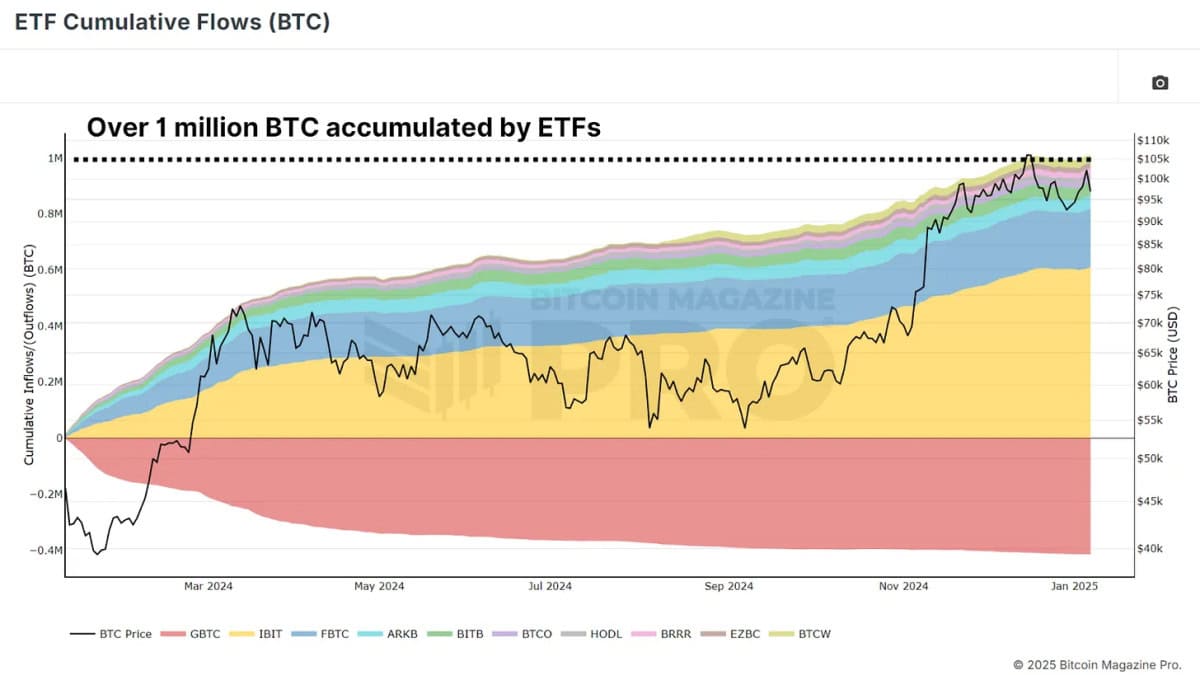

Since their beginning, Bitcoin ETFs have actually effectively collected over 1 million BTC, equating to roughly $40 billion in properties under management. Even after representing withdrawals from completing items such as the Grayscale Bitcoin Trust (GBTC), which experienced outflows going beyond 400,000 BTC, the net inflows are still significant at roughly 540,000 BTC.

View Live Chart 🔍

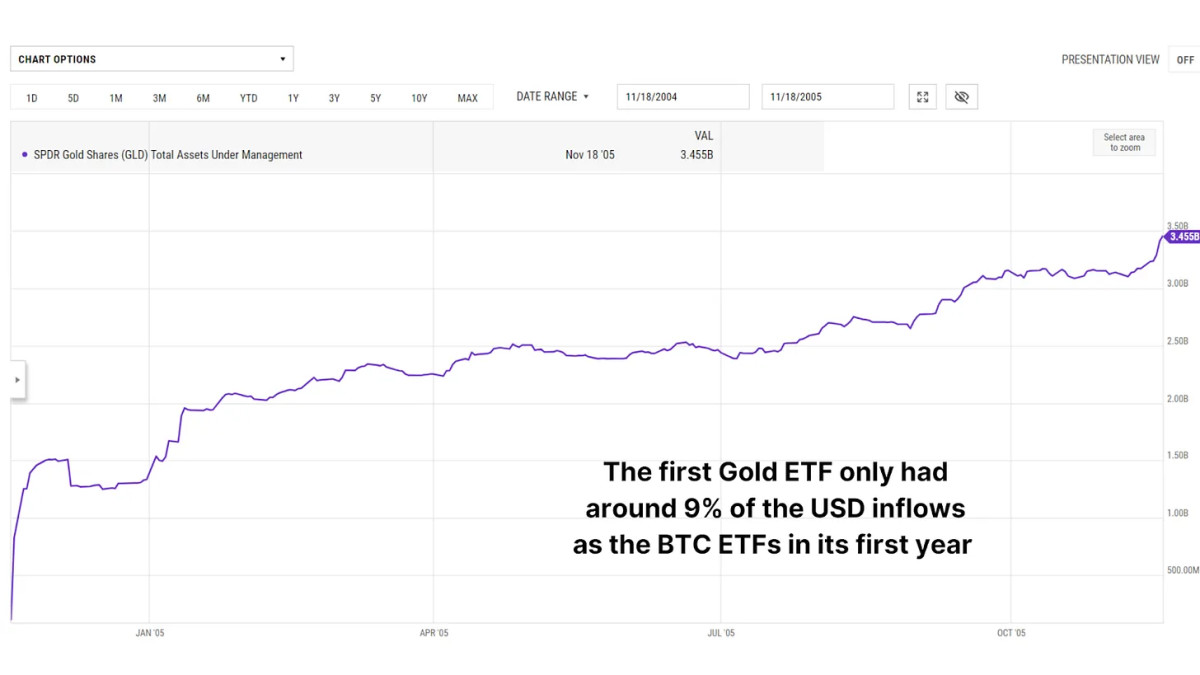

To contextualize this information, the level of inflows into Bitcoin ETFs considerably exceeds that of the inaugural gold ETFs introduced in 2004, which drew in $3.45 billion in their very first year. In plain contrast, Bitcoin ETFs gathered $37.5 billion in inflows within the exact same timeframe, showcasing the increased institutional interest in Bitcoin as a genuine monetary property.

Bitcoin’s Year of Growth

Although the early rate responses following the launch of Bitcoin ETFs were rather frustrating—with Bitcoin taping a short decrease of almost 20% in a “buy the rumor, sell the news” phenomenon—this bearish pattern was short-term. Over the previous year, Bitcoin’s worth has actually increased by roughly 120%, accomplishing brand-new record levels. In contrast, the very first year after the intro of gold ETFs saw a modest rate gratitude of just 9% for gold.

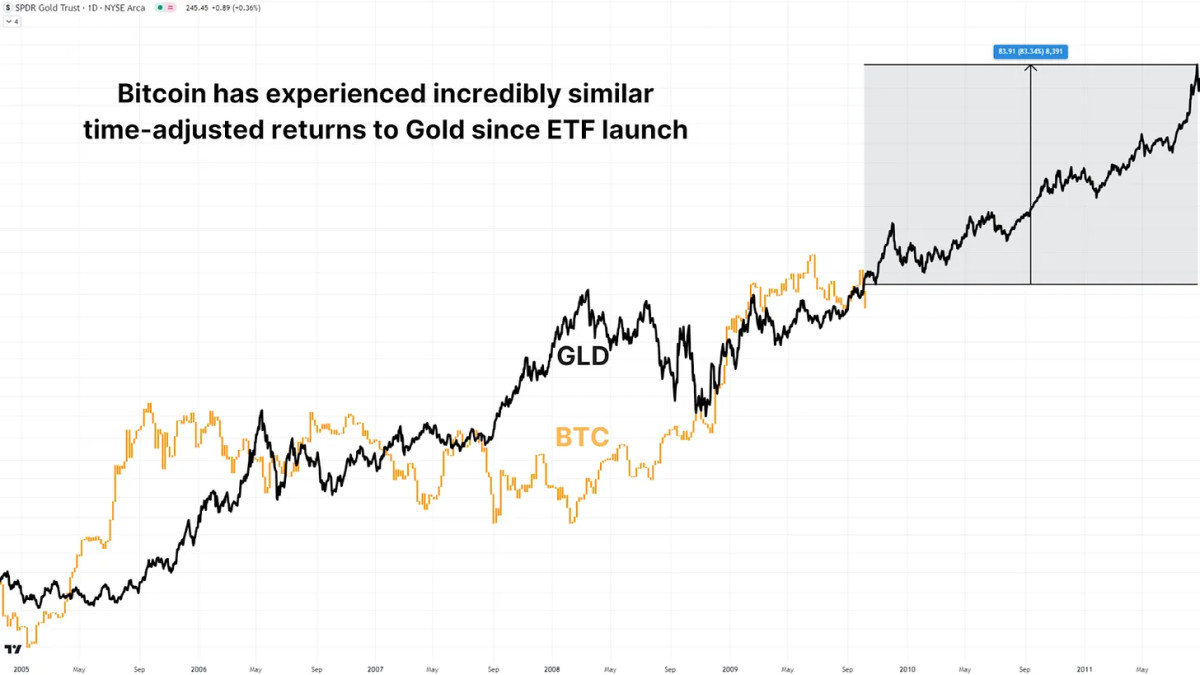

Following the Gold Fractal

When thinking about Bitcoin’s distinct 24/7 trading ability—leading to roughly 5.3 times more yearly trading hours compared to gold—an exceptional connection appears. By overlaying Bitcoin’s preliminary year of ETF rate motions with historic information from gold (changed for trading hours), a striking resemblance in portion returns can be observed. Should Bitcoin continue to imitate gold’s trajectory, it might possibly experience an extra 83% rate boost by mid-2025, which would place Bitcoin around $188,000.

Institutional Strategy

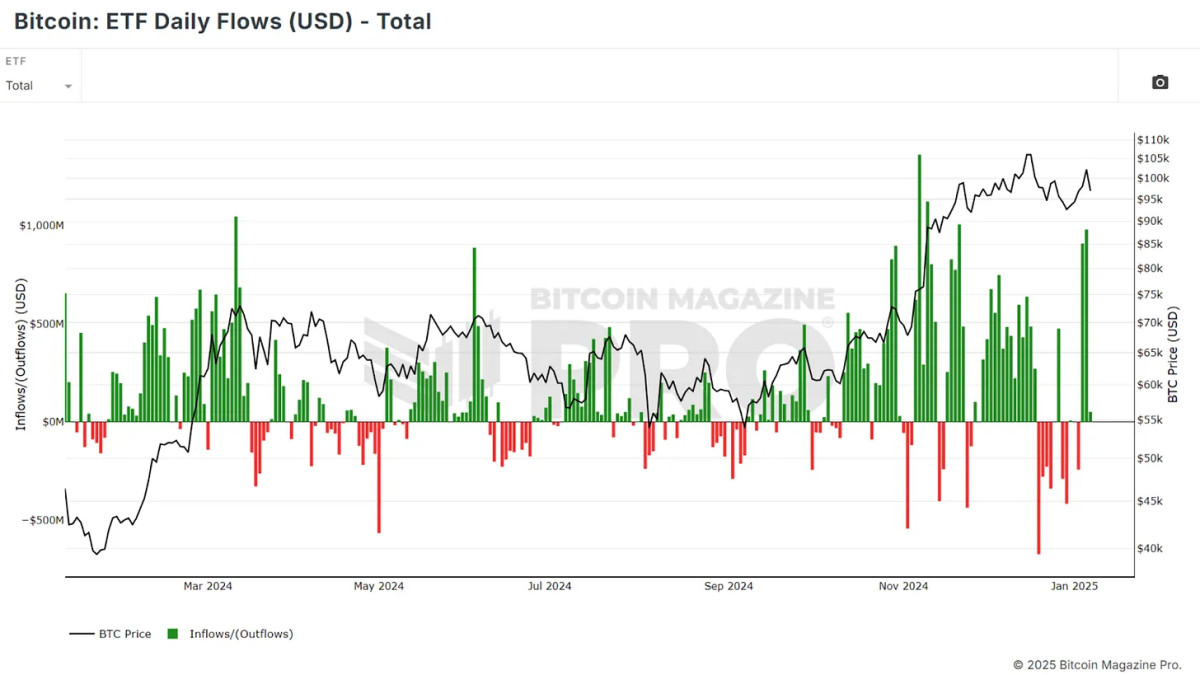

One notable observation originating from the intro of Bitcoin ETFs has actually been the connection in between fund inflows and rate variations. An straightforward method of acquiring Bitcoin on days with favorable ETF inflows, and liquidating on days with outflows, has actually regularly exceeded conventional buy-and-hold financial investments. From January 2024 to today, this method has actually yielded a return of 130%, compared to an approximate 100% for a buy-and-hold financier, highlighting an almost 10% edge.

View Live Chart 🔍

For more insights concerning this institutional inflow method, the following video is advised:

“Using ETF Data to Outperform Bitcoin [Must Watch].”

Supply and Demand Dynamics

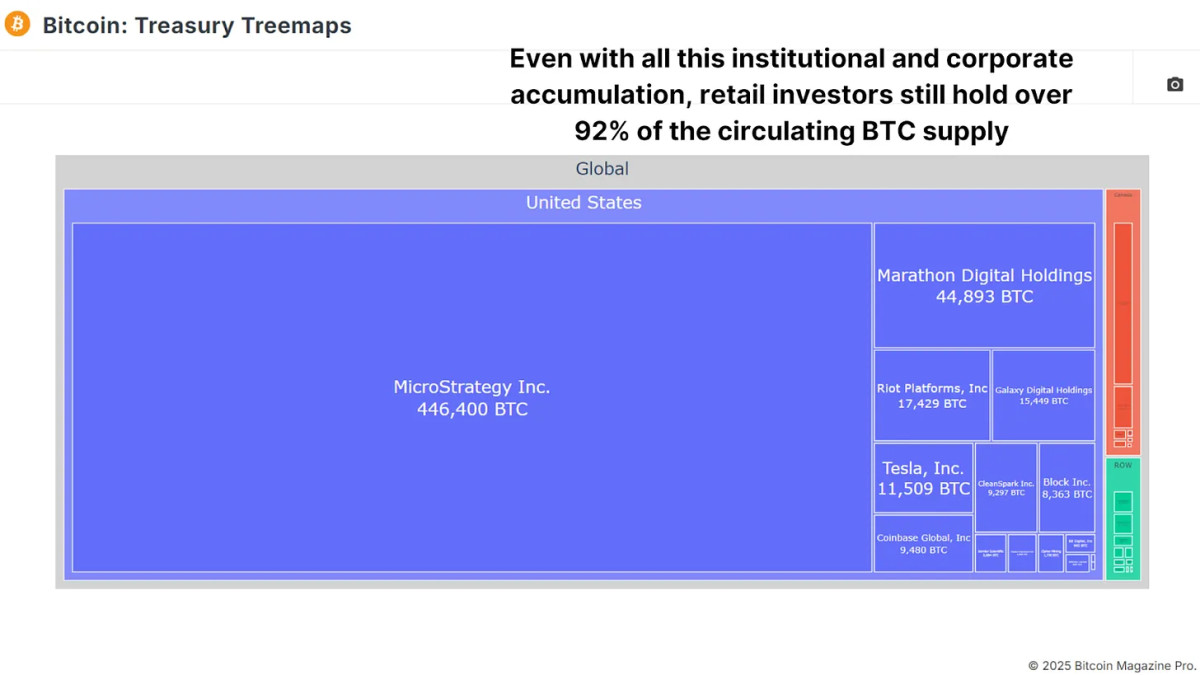

While Bitcoin ETFs have actually collected over 1 million BTC, this figure makes up just a small part of Bitcoin’s overall distributing supply of 19.8 million BTC. Notable corporations such as MicroStrategy have actually enhanced the reason for institutional adoption, jointly holding significant quantities of BTC. Nevertheless, most of Bitcoin stays amongst private financiers, making sure that market characteristics continue to be affected by decentralized supply and need systems.

View Live Chart 🔍

Conclusion

After one year, Bitcoin ETFs have actually exceeded preliminary expectations. With billions in inflows, a significant result on rate gratitude, and increased institutional adoption, they have actually securely developed themselves as an important part of Bitcoin’s market story. Although some early critics revealed dissatisfaction over the lack of instant considerable rate rises, the long-lasting outlook stays robustly positive.

The parallels drawn to gold ETFs supply an engaging structure for Bitcoin’s potential trajectory. Should the gold fractal show precise, the marketplace might be poised for another significant rally. Coupled with beneficial macroeconomic elements and increasing institutional interest, Bitcoin’s future potential customers appear extremely appealing.

For live information, charts, signs, and substantial research study to stay educated about Bitcoin’s rate motions, check out Bitcoin Magazine Pro.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.