The below is an excerpt from a current edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be amongst the very first to get these insights and other on-chain bitcoin market analysis directly to your inbox, subscribe now.

Bitcoin miners have actually not been running under regular scenarios for the previous numerous months. Bitcoin’s blockchain has actually seen an especially extreme degree of need over the previous numerous months, and it appears like BRC-20s, and to a lower level, image engravings, all enabled by the Ordinals procedure, bear a lot of duty. Essentially, this procedure allows users to engrave distinct information on the most minute denominations of bitcoin, permitting them to produce brand-new “tokens” straight on Bitcoin’s blockchain. This suggests that amounts of bitcoin worth cents in regards to their fiat worth might however be purchased and offered several times, with each of these deals requiring to be processed through the very same blockchain, not to point out the high need seen while at first minting.

This is where the Bitcoin miners been available in. The energy-utilizing calculations carried out by specialized mining hardware are not just suggested to produce brand-new bitcoin, however they also can be utilized to validate the blockchain’s deals and keep the digital economy streaming efficiently. With network use about as high as it’s ever been, miners have ample chances to make earnings simply by processing these deals, and the real production of newly-issued Bitcoin can take something of a rear seat. As of February 2024, these conditions have actually produced a scenario where mining trouble is greater than ever before in Bitcoin’s history, yet the industry is generating large earnings. However, among the most dependable patterns in the Bitcoin market has actually been the large turmoil that sees charges spike and after that plunge. So, what will occur to miners after these conditions alter?

It’s this community that ended up being rather interrupted on January 31 when federal regulators stated a brand-new required: the EIA, a subsidiary of the United States Department of Energy (DOE), was going to start a survey of electrical power usage from all miners running in the United States. Identified miners will be needed to share information on their energy use and other data, and EIA administrator Joe DeCarolis declared that this research study will “specifically focus on how the energy demand for cryptocurrency mining is evolving, identify geographic areas of high growth, and quantify the sources of electricity used to meet cryptocurrency mining demand.” These objectives appear uncomplicated enough initially look, however numerous elements have actually offered Bitcoiners time out. For something, Forbes declared that this instruction originated from the White House, which described this action as an “emergency collection of data request.” This survey is clearly produced with the objective of taking a look at the capacity for “public harm” from the mining industry, and even consisted of an aside that this “emergency” collection may result in a more regular collection gotten out of every miner in the future.

Obviously, language like this has actually left lots of in the neighborhood very anxious, and numerous leading miners have actually currently made declarations condemning the effort. The tone originating from regulators appears to be of a frustrating story that these services are a possible risk, whether by increasing carbon emissions, taxing electrical facilities, or being a public problem. Some of the most outright claims are quickly exposed, however it doesn’t alter the truth that a couple of hostile federal government actions might significantly distress this community. Furthermore, the world of mining currently has a significant upset on the horizon, in the type of the upcoming Bitcoin halving. This routine procedure baked into Bitcoin’s blockchain is set to immediately cut mining benefits in half at some point in April, at block 840,000, and currently some pessimists are declaring that this upset will suffice to put almost the whole industry out of organization. What are the real worst case circumstances here? What are the most likely ones?

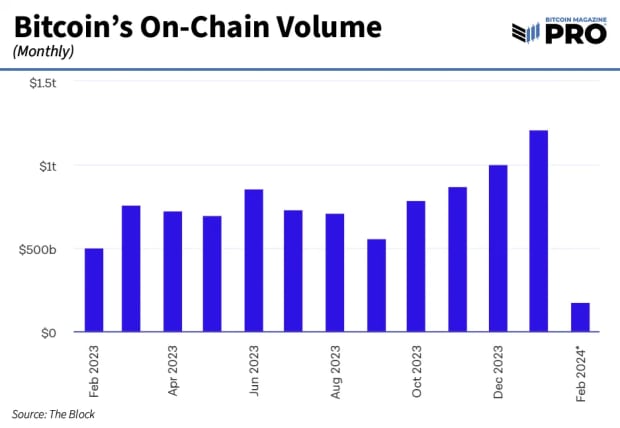

First, it’s important to take a look at a few of the elements intrinsic to Bitcoin that are most likely to effect miners, no matter federal government pressure. The miners remain in a strange market circumstance since deal charges can produce earnings on the very same level as real mining, however the circumstance might be supporting. New information reveals that Ordinals sales dropped by 61% in January 2024, revealing that their influence on blockspace need is most likely to lessen. So, if specific miners are depending upon these tokens to keep earnings, that earnings stream is not looking especially trustworthy. However, despite the fact that network use from these microtransactions is most likely to plunge, routine deals are really looking terrific. The trading volume of bitcoin is greater than it has actually been considering that late 2022, and it reveals no indications of stopping. Surely, then, there will be lots of need for the minting of brand-new bitcoin.

Bitcoin traffic has actually been increasing for numerous months as the possibility of a legalized Bitcoin ETF ended up being a growing number of genuine, and now that this fight is over, the trading volume has actually increased at a higher rate. While the halving can provide chances and obstacles for miners, none can declare that it’s an unanticipated occasion. Firms have actually been getting ready for it as a matter of course, with around $1B of this increased trading volume originating from miners themselves. Reserves of bitcoin held by miners are at their floor considering that before the spike in 2021, and miners are utilizing the capital from these sales to update devices and all set themselves.

In other words, independent of any federal government action, it appears that the marketplace conditions are most likely to move due to these elements. The bottom might fall out for a few of the smaller sized companies that run on slim margins, however the general development in Bitcoin trading volume suggests that there will constantly be chances to make earnings. Since it’s the most well-capitalized companies that can make the most substantial preparations for the halving, it might effectively happened that a few of the more ineffective mining business will not have the ability to make it through. From a regulative perspective, possibly that is a desired result.

The federal government appears mainly worried about perpetuating the concept that the mining industry is a tax on society as an entire, consuming enormous quantities of electrical power for an uncertain advantage. However, just the most effective operations will be ensured to make it through the halving and its financial fallout. As the less effective ones close their doors, the survivors will be entrusted to a much bigger piece of a smaller sized general pie. Besides, if the open letters from numerous leading companies are anything to pass, these business are totally prepared to make a singing battle versus any tried crackdown on the industry. Considering that the survey itself is still in its very first week of information collection, it’s tough to state what conclusions it will draw, or how the EIA will be empowered to act later on. The essential thing to think about, then, is that these brand-new patterns are accompanying or without the EIA’s impact.

The survey is only simply starting, and the halving is just months away. There are lots of factors to be worried about the EIA’s influence on the mining industry, however it’s not like this is the only aspect. From where we’re sitting, it looks like the entire community might be significantly altered by the time regulators are all set for any action, even if the action is severe. The individuals delegated face them will be solidified themselves, survivors and innovators from a disorderly market. Bitcoin’s terrific strength has actually been its capability to alter quickly, permitting brand-new lovers the possibility to benefit from one set of guidelines, and after that increase or fall as the guidelines alter. It’s this spirit that moved Bitcoin to its worldwide heights over more than a years of development. Compared to that, what possibility do its challengers have?

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.