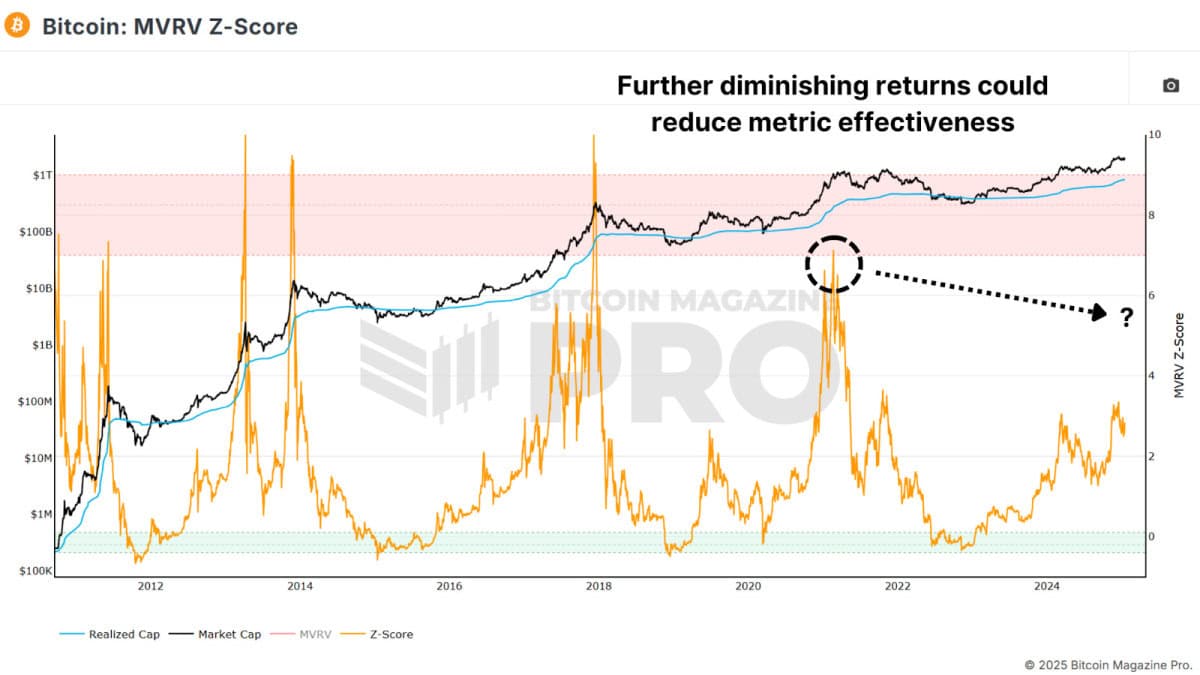

The Bitcoin MVRV Z-Score has actually long been acknowledged as an extremely reliable metric for determining market cycle tops and bottoms within the Bitcoin environment. Recent improvements to this tool have actually raised its abilities, providing much deeper insights that are especially appropriate in today’s quickly altering market landscape.

What Is the Bitcoin MVRV Z-Score?

The MVRV Z-Score is computed by analyzing the ratio in between Bitcoin’s understood market capitalization—the typical acquisition expense of all Bitcoin presently in flow—and its market capitalization, which shows the existing appraisal of the network. By standardizing this ratio with Bitcoin’s price volatility, as determined by basic discrepancy, the Z-Score efficiently signals durations of overvaluation or undervaluation when compared to historic requirements.

View Live Chart 🔍

When peaks are observed in the red zone, this typically shows overvaluation, recommending possible profit-taking chances. Conversely, troughs in the green zone signal undervaluation, frequently representing robust build-up chances. Historically, this metric has actually shown a high degree of precision in determining considerable extremes within market cycles.

Despite its strengths, the standard MVRV Z-Score is not without constraints. In previous cycles, the Z-Score reached worths in between 9 and 10 throughout market peaks. By contrast, in the current cycle, the score peaked near 7. This disparity might be credited to the rounded double-peak cycle skilled, instead of the sharp blow-off tops observed in earlier cycles. It is important to incorporate the progressing characteristics of the market, consisting of the increasing participation of institutional financiers and shifts in financier habits.

The Enhanced MVRV Z-Score

The traditional MVRV Z-Score makes use of Bitcoin’s total price history, consisting of the significant volatility present throughout its early years. As Bitcoin has actually grown, the impact of these early information points has actually minimized, possibly skewing significance to existing market conditions. In action, the MVRV Z-Score 2-Year Rolling has actually been produced. This customized variation evaluates volatility based entirely on the preceding 2 years of information.

View Live Chart 🔍

This technique permits a more precise reflection of Bitcoin’s progressing market capitalization and moving characteristics, guaranteeing the metric remains appropriate in modern analyses. Notably, throughout the last market cycle, this changed variation recorded a greater peak worth compared to the standard Z-Score, lining up more carefully with the price motions observed in 2017. Importantly, it continues to determine considerable build-up zones with significant accuracy.

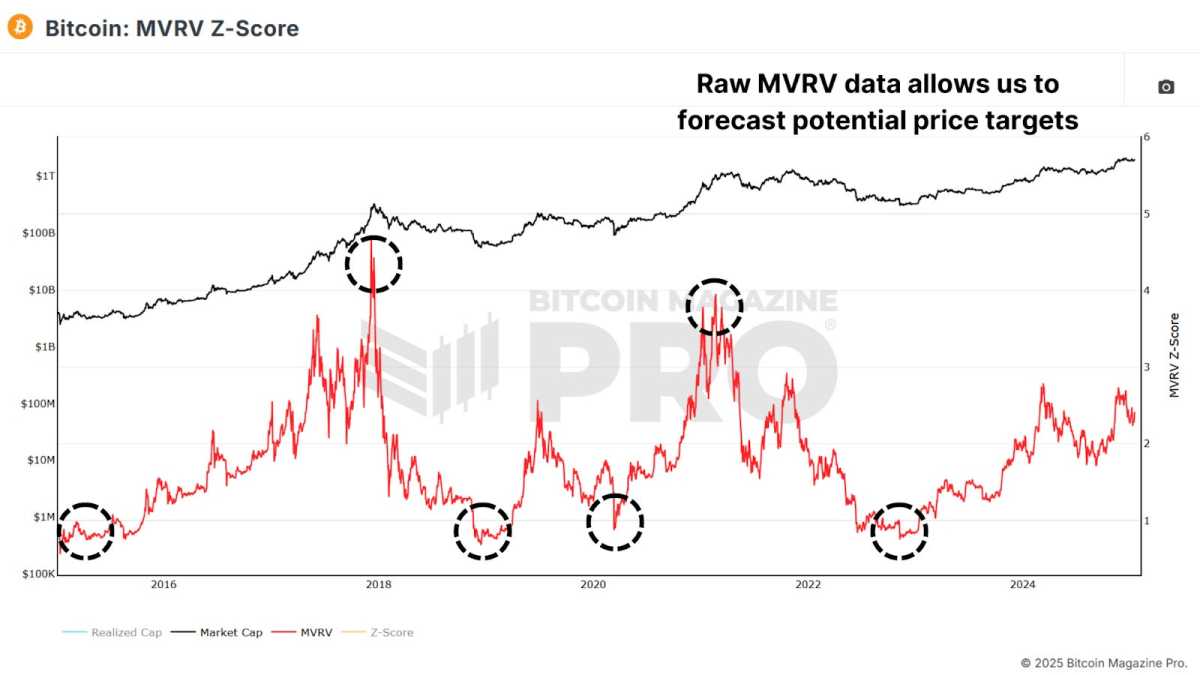

Raw MVRV Ratio

An extra analytical point of view includes analyzing the MVRV ratio without volatility standardization. This analysis exposes that the previous cycle’s MVRV ratio peaked at 3.96, rather than 4.72 in the previous cycle. Such worths suggest less market discrepancy, possibly developing a more steady structure for forecasting future price levels.

View Live Chart 🔍

Assuming a recognized price of $60,000—taking into consideration the forecasted development over the upcoming 6 months—and an MVRV ratio of 3.96, possible peak rates might approach $240,000. Should decreasing returns change the ratio to 3.0, a peak price may still reach around $180,000.

Conclusion

While the MVRV Z-Score stays among the premier tools for examining market cycle extremes, one need to get ready for the possibility that this metric might not reach the raised highs observed in previous cycles. By refining this information to integrate existing market characteristics, financiers can much better represent decreased volatility as Bitcoin develops.

For a more detailed evaluation of this topic, audiences are motivated to view a current YouTube video entitled: Improving The Bitcoin MVRV Z-Score.

For more comprehensive Bitcoin analysis and to gain access to advanced functions such as live charts, individualized sign signals, and extensive market reports, please see Bitcoin Magazine Pro.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.