Markets Weekly is a weekly column analyzing value actions within the international blockchain token markets. This version appears on the week from 10th by way of 16th December.

Ether traditional (ETC) made a strident comeback this week.

As the nascent digital currency surged in worth, its hashrate additionally rose and its supporting group introduced a brand new financial coverage proposal.

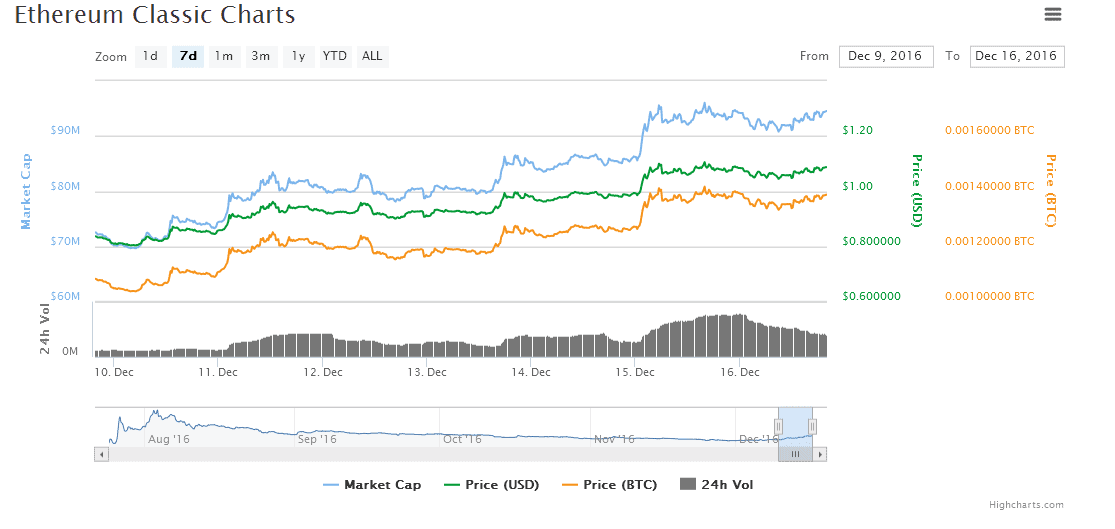

Zooming in on the figures, ETC costs rose as a lot as 37% throughout the week, climbing to a excessive of $1.11 from their opening value of $zero.81, CoinMarketCap figures reveal.

Market observers noticed the week as a constructive one for the venture, which splintered off within the wake of the collapse of The DAO.

“ETC is being embraced by the community as a superior and decentralized alternative to ETH,” mentioned Petar Zivkovski, COO of leveraged bitcoin buying and selling platform Whaleclub.

He asserted that whereas “ETC and ETH are battling for a piece of the same pie,” some market observers are predicting that ETC’s market cap will surpass that of ETH’s in both 2017 or 2018.

Discontent in China?

Arthur Hayes, co-founder and CEO of leveraged bitcoin buying and selling platform BitMEX, offered the same forecast, telling CoinDesk that “I expect ETC to make a move for parity with ETH in 1Q2017.” He additional elaborated on ETC’s tailwinds, stating that:

“The Chinese community is not happy with the direction that Vitalik has taken Ethereum. This is mostly due to DAO bail-out. Pumping ETC is their retribution.”

For now, ethereum’s loss could also be ethereum traditional’s achieve.

In addition to the surging value, one other signal of ETC’s rising adoption is its sharp enhance in hashrate, a measure that surged 68% from 534 gigahashes/second (GH/s) at 12:00 UTC on 10th December to a excessive of 899.47 GH/s at 06:00 UTC on 16th December, in response to GasTracker.io information.

Kong Gao, abroad advertising supervisor for bitcoin dealer RichFund, speculated on the assorted elements that could possibly be pushing ETC’s hashrate larger, singling out Zcash’s “continued price decline” and ethereum’s upcoming implementation of proof-of-stake.

All hypothesis apart, a better hashrate makes the ethereum traditional community much less susceptible to 51% assaults, which is extra excellent news for the cryptocurrency.

Classic nonetheless faces hurdles

Even although ethereum traditional has made some nice strides ahead recently, the platform will seemingly want to beat vital hurdles if it needs to both equal or surpass ethereum. For starters, ethereum and its token ETH profit from a powerful community impact.

“There are still strong network effects that will tend to make the more widely used coin (currently ETH) more and more dominant with time,” mentioned algorithmic dealer Jacob Eliosoff. However, he added that “the ETC crew have been doing well to resist that effect, in particular solidifying their strategy as to how to differentiate ETC from ETH.”

Ethereum traditional might want to receive higher adoption, a key requirement in response to Zivkovski. He emphasised that to stay viable long run, ETC might want to “grow out its community and succeed in attracting developers to build on its platform,” one thing he described as “not an easy feat”.

Should ETC achieve surpassing ETH’s market cap, the previous currency would expertise some pretty sturdy good points. Currently, ETC’s market cap stands at roughly $94m, lower than 15% of ETH’s, which stands at greater than $680m, CoinMarketCap information reveals.

Bitcoin’s relative calm

Bitcoin had a far much less thrilling week than ethereum traditional, rising to a 34-month excessive however in any other case having a comparatively quiet week. Prices reached as a lot as $788.49 on 13th December, a brand new 2016 annual excessive and essentially the most elevated worth since February 2014, in response to the CoinDesk Bitcoin Price Index (BPI).

However, even this 34-month excessive represented an solely 2.three% enhance from bitcoin’s opening value of $770.41 in the beginning of the week.

The BitMEX 30-day Historical Volatility Index (.BVOL Index), a measure of annualized rolling 30-day volatility, averaged 25.15% throughout the seven-day interval from 10th–17th December.

Hayes instructed CoinDesk that volatility pushed decrease as merchants waited for the itemizing of the March 2017 futures contracts. These contracts had been listed at 08:00 UTC on 16th December, he famous.

Bitcoin costs had traded at elevated ranges all week, fluctuating fluctuating inside 1% of the earlier 2016 excessive of $781.31 for many of the interval.

The digital currency skilled these value actions amid sustained bullish sentiment, because the market was a mean of 90% lengthy throughout the six days between 10th–16th December, going by Whaleclub information.

“Price is still quite bullish,” famous Zivkovski. However, he emphasised that many market members are taking a breather to see what the market will do subsequent.

He added:

“Price will need to continue rising over the next few days or weeks to give new money enough confidence to keep investing and sway current long position holders into delaying their profit-taking. Volume is lower than usual as traders sit on the sidelines of this 34-month high, uncertain, anticipating what will happen next.”

This article just isn’t meant to supply, and shouldn’t be taken as, funding recommendation.

Image by way of Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.