This is a viewpoint editorial by Bitcoms, a Bitcoin-focused author and licensed accounting professional.

With traditional monetary management titans such as BlackRock, Fidelity and Vanguard all legitimizing BTC as a monetary property through their interest in using associated items to customers, the “big money” worldwide might well be poised to increase its direct exposure to bitcoin. These considerable financiers might not yet see the liberating, world-improving, hard-money elements of the innovation that I see, however they are most likely to have an effect on bitcoin as a shop of worth all the exact same.

And, if anything, I think the likely price impact of considerable quantities of capital being brought in to bitcoin is ignored by the majority of Bitcoiners. It’s now typical to explain bitcoin’s prospective worth ceiling as “everything divided by 21 million” — a referral to all saved worth divided by the overall possible supply of bitcoin. But, in my view, an affordable heuristic for forecasting bitcoin’s price is “everything divided by 7 million” (where “everything” is the overall reallocated of capital to bitcoin, nevertheless high that might be). This suggests, for instance, that bitcoin might strike $1 million with only one-third of the rerouted capital typically believed to be required.

To reveal why this is a more practical yardstick, I’ll broaden on some existing methods of approximating newly-allocated capital’s impact on bitcoin’s price, changing the outcomes for what I view as 3 important however ignored aspects.

Existing Tools For Predicting Bitcoin’s Price

For a preliminary bitcoin price forecast, we’ll utilize 2 existing tools, both born of deep research study and comprehensive analysis: a structure proposed by Onramp COO Jesse Myers (also known as Croesus) and a design produced by Swan CIO Alpha Zeta.

For our example circumstance, we’ll presume $20 trillion of financial investment capital draining of conventional possessions and into bitcoin (the particular quantity isn’t too essential, as we’ll bend the numbers up and down later on). For the sake of simpleness and comparability, our example circumstance is timeframe agnostic (so, all figures remain in today’s dollars).

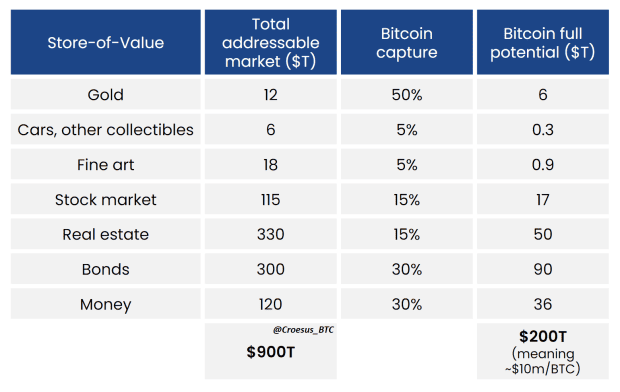

Myers’ structure, released previously this year, presumes an optimal capacity bitcoin market capitalization of $200 trillion, approximated by catching that quantity from his own $900 trillion price quote of the overall of existing store-of-value possessions and presuming bitcoin will record some portion of each classification.

As suggested in the bottom right of the above table, the structure recommends an optimal capacity bitcoin capture of $200 trillion, resulting in an approximate bitcoin price of $10 million ($200 trillion divided by about 20 million equates to about $10 million per BTC.)

In his commentary, Myers recommends that (*7*) So, if we scale everything down by an order of magnitude for our more modest bitcoin capture of $20 trillion (approximately 2.2% of Myers’ $900 trillion “total addressable market”), the exact same math provides us an anticipated price of about $1 million per BTC.

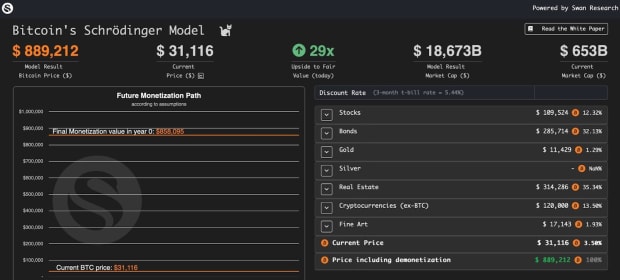

Meanwhile, Alpha Zeta’s design is an advanced, interactive tool with a configurable set of input criteria, which (with apologies to its author) I crudely controlled to approximate the worths we utilized with Myers’ structure. Because the tool permits just for round portions, I designed Bitcoin’s property capture at just 2% (not the approximately 2.2% utilized with Myers’ design) of $900 trillion. This leads to precisely what I would have anticipated: a comparable, however a little lower, BTC price forecast of around $900,000 per coin.

For the sake of handling round numbers, let’s state that in catching about $20 trillion in international financial investment capital, both tools would recommend an anticipated bitcoin dollar price of about $1 million. These tools are not just sensible, however also constant with each other. So, what might they miss out on?

Overlooked Factor One: Lost Bitcoin

Both tools appear to base their price forecasts on a reallocated dollar worth divided by a rough overall variety of bitcoin in problem (about 20 million). However, this overlooks the truth that some released bitcoins are not available.

First, think about lost coins. The variety of bitcoin that have actually been lost is difficult to measure with accuracy, however it has actually been approximated at almost 4 million in a 2020 report by Chainalysis. Cane Island Digital’s 2020 report “There Will Never Be More Than 14 Million Bitcoins” recommends a greater variety of about 5.4 million lost coins. I looked for a 3rd viewpoint from leading on-chain expert Checkmate for this short article, who kindly shared a preliminary price quote of “around 3.942 million BTC.”

Using approximately these 3 information points, we can justifiably presume that, of the 19.4 million bitcoin released to date, around 4.4 million are lost, leaving 15 million available by their owners. This is considerably less than the approximately 20 million normally utilized in bitcoin prices designs.

Overlooked Factor Two: Hardcore HODLers

Second, consider what percentage of this available 15 million bitcoin may never ever be cost fiat. The evident presence of “hardcore HODLers” — real followers who are unwilling to sell at any price — suggests that the basic aphorism that “everyone has their price” might not always use to Bitcoin.

Potentially-beneficial research study on this neglected element is a Glassnode report from 2020, which concluded that “14.5 million BTC can be classified as being illiquid.” This was built on by Rational Root in his 2023 “HODL Model,” which assumes that by “2024, the illiquid supply… will be… 14.3 million bitcoin.” Subtracting our earlier price quote of 4.4 million lost coins from this overall illiquid supply figure (that includes lost bitcoin), these sources recommend that about 10 countless the approximately 15 million available bitcoin remain in this “illiquid” classification, i.e., their HODLers hesitate to offer.

But measuring the number of of those 10 million illiquid coins will be “hardcore HODL’d” by the diamond handed in the face of extraordinary bitcoin worth gratitude is truly beyond the limitations of analysis and securely in the worlds of opinion. It appears completely logical to me to anticipate lots of existing HODLers to part with a minimum of a part of their stack if the fiat price increases to brand-new all-time highs. Recognizing that any “guesstimate” is more practical than disregarding this phenomenon entirely, I’m going to expect simply half of those 10 million illiquid bitcoin will be “hardcore HODL’d” as the price increases.

The Price Effect Of Unavailable Coins

So, as soon as we’ve enabled 4.4 million lost and 5 million “hardcore HODL’d” bitcoin, that leaves around 10 million coins offered for the $20 trillion of caught worth in our example circumstance. $20 trillion divided by 10 million provides us a $2 million mean price paid per BTC.

That mean of $2 million is double the assessment tools’ unadjusted price quote of $1 million. So, for me, at this moment an affordable heuristic for assessing the mean bitcoin price is: “everything divided by 10 million” (where “everything” is the overall fiat recently assigned to bitcoin, nevertheless much that might be).

Overlooked Factor Three: Volatility

But $2 million is the mean price in our example circumstance, and the price at any provided time throughout bitcoin’s absorption of the $20 trillion might be considerably greater or lower. So, we also require to forecast the variety within which the price may move.

Using history as a guide, we see that the dollar-BTC price has actually ended up being less unpredictable as bitcoin has actually matured from young child to a teen, with the ratio of the major USD price tops to subsequent bottoms diminishing as follows:

Presuming that this pattern towards lower volatility continues, over the next couple of years we may plausibly anticipate a high-to-low ratio of around 3. Against our example circumstance’s longer-term moving typical price of $2 million, that may equate to short-term lows of about $1 million and brief highs of about $3 million.

That high of $3 million is triple the assessment tools’ unadjusted price quote of $1 million. So, for me, an affordable existing heuristic for assessing the optimum price is: “everything divided by 7 million” (where “everything” is the overall fiat recently assigned to bitcoin, nevertheless much that might be).

Scaling The Example Scenario

Next, we’ll change the quantity of brand-new capital being reallocated to bitcoin to produce alternative situations, as follows:

Based on this, for bitcoin’s price to strike $1 million, instead of needing the approximately $20 trillion reallocation of international financial investment capital recommended by the raw tools, just around one third of that quantity would be required.

Although modest-sounding in the context of international wealth, such a reallocation would nevertheless include considerable involvement by big, slow-moving and conservative swimming pools of capital. In my view, while this is possible over the medium- or long term, this appears unlikely within the next couple of years without seismic interruption in monetary markets (such as a significant sovereign financial obligation crisis, banking system collapse or constantly dizzy inflation) speeding up the essential paradigm move far from “fiat thinking.”

In the lack of such an occasion within that time, I see something like the very first and most modest circumstance in the table as more likely, with short-term highs in the low numerous countless dollars as “big capital” gradually reallocates to bitcoin.

You might naturally have your own opinion on a suitable heuristic. But, having actually thought about the function of volatility and represented not available bitcoin (both lost and “hardcore HODL’d”), I believe “everything divided by 7 million” is an affordable gauge for the most likely peak price effect of capital rerouted to bitcoin. While “everything” here is the overall of that capital — which might in theory be as much as all the saved worth worldwide — any reputable guess at a future price requirements to be based upon a practical level of reallocation to bitcoin.

This is a visitor post by Bitcoms. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.