Recent updates present that with the cryptocurrency markets performing removed from how they did a yr in the past, some exchanges have failed to adapt to the present state of affairs. For instance, one U.Ok. agency is reportedly set to fireplace most of its staff. Yet different exchanges are nonetheless going robust, breaking into new territories and including new buying and selling devices.

Also Read: The Daily: Crypto Funds Team up With New Startup Hub, FX Broker Adds BCH/BTC

Weak Quarterly Trading Volumes

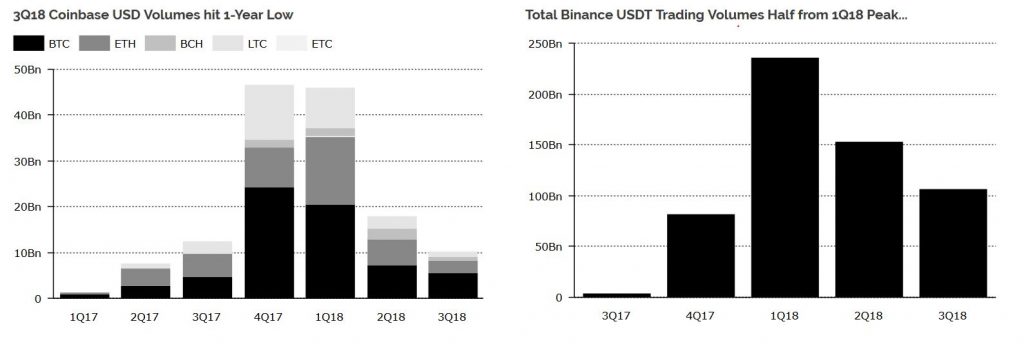

Diar, an evaluation service for the worldwide digital currency business, has issued a report highlighting the extraordinarily weak efficiency of fashionable crypto exchanges in the course of the third quarter of the yr. For instance, complete USD buying and selling volumes on Coinbase reached their lowest level in a yr and complete USDT buying and selling volumes on Binance fell from $235 billion within the first quarter to simply $106 billion.

As the report exhibits, a method the exchanges are wanting to safe development for the longer term is by transferring towards tokenized securities.

“Having made bank on the trading bonanza in the past year, cryptocurrency exchanges are also acutely aware that, for the most part, the tokens they list don’t currently satisfy a utility purpose,” Diar explained. “Diving into deep pockets, exchanges are diversifying their portfolio by investing in various parts of the ecosystem to support the long-term growth of an industry stuck in development. But most notably, exchanges have amped up their investment interest for the possible issuing and trading of tokenized securities.”

Coinfloor to Fire Over Half its Employees

Coinfloor is within the strategy of firing most of its employees, in accordance to a report by the Financial News, citing two folks aware of the matter. Founded in 2013 with backing from Transfer Wise founder Taavet Hinrikus, enterprise capital agency Passion Capital and Adam Knight, Coinfloor was estimated to make use of about 40 folks earlier than the newly deliberate cuts.

Coinfloor is within the strategy of firing most of its employees, in accordance to a report by the Financial News, citing two folks aware of the matter. Founded in 2013 with backing from Transfer Wise founder Taavet Hinrikus, enterprise capital agency Passion Capital and Adam Knight, Coinfloor was estimated to make use of about 40 folks earlier than the newly deliberate cuts.

Coinfloor CEO Obi Nwosu instructed the London-based newspaper that the corporate has “seen significant change in trade volume across the market.” He also acknowledged that: “Coinfloor is currently undergoing a business restructure to focus on our competitive advantages in the marketplace and to best serve our clients. As part of this restructure, we are making some staff changes and redundancies.”

Israeli Exchange Looks Abroad

According to Israeli media experiences, Tel Aviv-based alternate Bit2c is wanting to supply its services into overseas markets. The alternate has reportedly acquired a Gibraltar-based agency, Eyos, that’s mentioned to be in superior phases of receiving a distributed ledger expertise (DLT) license from the native regulatory authorities that can be utilized to settle for purchasers from throughout the EU.

According to Israeli media experiences, Tel Aviv-based alternate Bit2c is wanting to supply its services into overseas markets. The alternate has reportedly acquired a Gibraltar-based agency, Eyos, that’s mentioned to be in superior phases of receiving a distributed ledger expertise (DLT) license from the native regulatory authorities that can be utilized to settle for purchasers from throughout the EU.

“This is a significant breakthrough in making unique Israeli technology more accessible while providing a professional and experienced service to the whole of Europe, and all in the framework of a license that will enable a range of trading activities, payment options and cooperations with traditional financial institutions such as banks, credit companies and insurance companies,” Bit2c CEO Eli Bejerano mentioned. “We continue to examine other markets, and in the future we will act to get additional licenses around the world.”

Bequant Launches EUR Stablecoin

Bequant, a London-based international alternate, has introduced the launch of Stasis’ stablecoin EURS. The firm explains that the launch of the token, meant to be backed 1-for-1 by the euro, will permit protected investing for its European institutional traders in a dependable asset.

Bequant, a London-based international alternate, has introduced the launch of Stasis’ stablecoin EURS. The firm explains that the launch of the token, meant to be backed 1-for-1 by the euro, will permit protected investing for its European institutional traders in a dependable asset.

“The cryptocurrency sector is constantly striving for ways to encourage transparency, reliability and trust from investors — both institutional and individuals. Doing so not only builds trust within the industry, but also establishes clear regulation and controls that make crypto-assets a desirable choice for any investor’s portfolio. Stablecoins hold huge advantages in making this goal possible, tying themselves to a more traditional asset,” mentioned CEO George Zarya.

“STASIS EUR’s work in creating a more reliable asset will help build the credibility of cryptocurrency in the wider financial market through its improved processes aimed at providing a more secure asset for investment. Its listing on BeQuant presents a huge opportunity for investors to get involved with a currency that is already giving previously cautious investors access to the world of crypto.”

Should we anticipate extra exchanges to minimize employees as buying and selling volumes drop? Share your ideas within the comments part below.

Verify and monitor bitcoin money transactions on our BCH Block Explorer, the perfect of its sort anyplace on the earth. Also, sustain together with your holdings, BCH and different cash, on our market charts at Satoshi’s Pulse, one other authentic and free service from Bitscoins.internet.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.