Decentralized financing otherwise referred to as defi has actually climbed up considerably in worth this year, as the overall worth locked (TVL) in defi today is over $14 billion. Meanwhile, many defi platforms are getting assaulted with flash loans and there are a lot of brand-new defi jobs, it’s hard to track them all. Moreover, while lots of defi fans declare these platforms provide higher personal privacy, examples now reveal that a lot of whatever can be seen onchain linking ethereum addresses to identities and business.

Exploits and Flash Loans Are Becoming Commonplace in the Land of Decentralized Finance

In 2020, defi took off and there’s billions of dollars being in a myriad of platforms and applications today using a brand-new kind of financing. The development defi has actually seen is unusual and looks like the preliminary coin offering (ICO) days back in 2017. One of the greatest distinctions, nevertheless, is lots of defi jobs are more than just a white paper and token, as many applications like Maker, Uniswap, Aave, and others have actually provided different degrees of energy.

On November 22, 2020, data reveal that the defi TVL has actually exceeded the $14 billion deal with. At the end of August, the defi community’s aggregate TVL was just $7 billion, which indicates the defi economy doubled in a simple 3 months. The huge development is not without issues and even outright defi frauds. It appears a myriad of defi jobs are getting drained pipes by knowledgeable ethereum users, liquidating capital by means of intricate flash loans.

when next defi make use of?

— i.am.nomad (@IamNomad) November 21, 2020

This week alone, news.Bitscoins.internet reported on 2 significant flash loans, after reporting on these attacks on several celebrations ahead of time also. Five days back the Value Defi task saw a flash loan attack that siphoned $6 million in DAI. This wanted the group tweeted that the task had “flash-loan attack avoidance” and consequently erased the tweet. Flash loans and defi exploits have actually been occurring a lot, it’s end up being a routine activity.

On November 21, 2020, the popular Twitter account “I am wanderer” asked his 65,000 fans when the next defi make use of would remain in a study with 3 options. The 3 options consisted of “today,” “tomorrow,” and “within 7 days.” Well not too long after the tweet, The Block’s director of research study, Larry Cermak responded to the tweet.

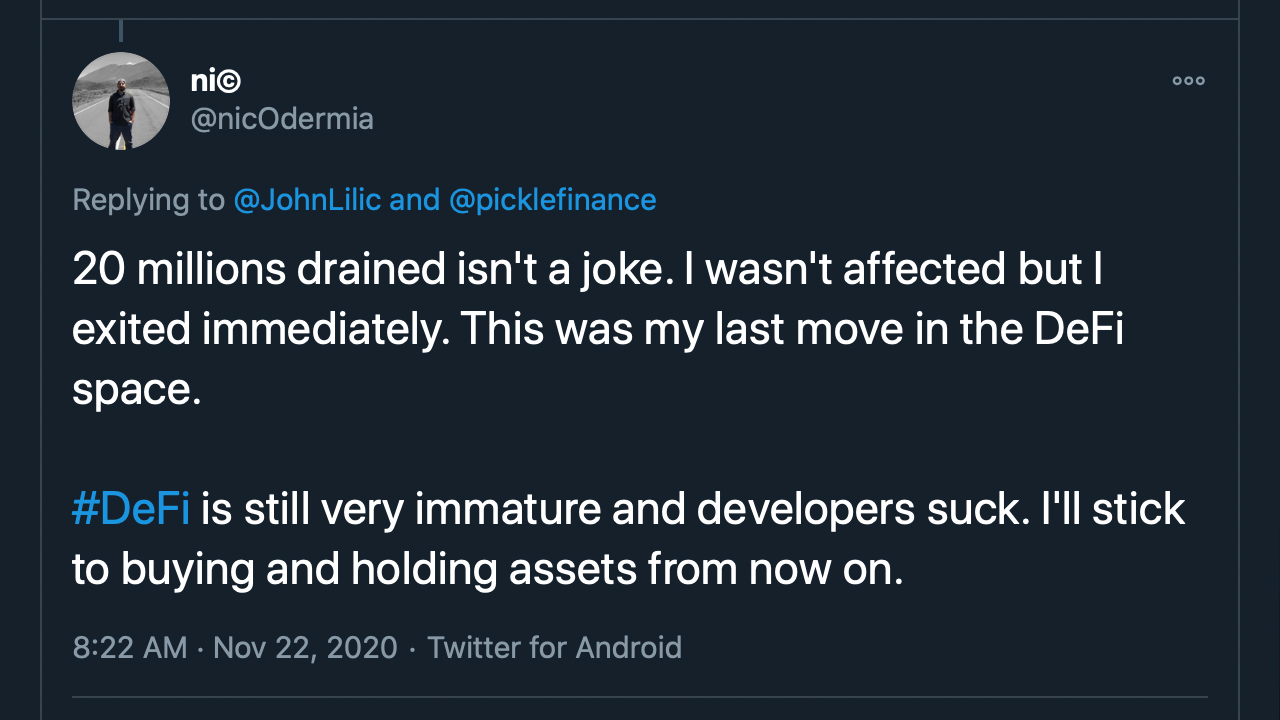

“It fasted,” Cermak responded, sharing a post about the defi platform Pickle Finance getting made use of for near $20 million.

The Lidless Eye and Onchain Transactions

Moreover, a couple of days ahead of time, the Twitter deal with @n2ckchong (Nick C) shared an intriguing viewpoint of just how much of the defi world can be seen onchain.

“What’s stunning (and sort of frightening) about defi is that we can see whatever that occurs on-chain and link addresses to identities and companies,” Nick C tweeted on Wednesday. In the Twitter thread, Nick C reveals a breakdown of ether addresses originating from Three Arrows Capital (3AC), Jump Trading, and Polychain Capital.

The first tweet alleges that 3AC is among “the greatest Compound providers” and also keeps in mind 3AC has $100M in WBTC, $50M in ETH, and $6M in the stablecoin DAI. “3AC is also providing 275 YFI and $13M in LINK to Aave and is farming SUSHI with 1.5M recently-acquired SUSHI,” Nick C stated. “3AC [also] obtained 351k LINK throughout [the] current dip,” he included. In another tweet, Nick C breaks down some apparent price quotes from Polychain Capital’s defi action.

“Polychain Capital has actually been the greatest YFI purchaser over the previous couple of weeks,” he even more composed. “They’ve gotten 570 YFI (~2% overall supply) over the previous 5 weeks at an approximated expense basis of $12~14k. They also own 48,000 ETH and 1,315 MKR on this address,” Nick C in-depth. The Twitter thread also offers a breakdown of Jump Trading’s defi action in addition to Nick C keeps in mind that Jump Trading is “a huge prop trading company based in Chicago.” The scientist continued by including:

[Jump Trading] are huge financiers in Ethereum tokens also.

Nick C’s insights made him a variety of Twitter fans after he shared his ideas about the 3 companies and the defi action. After publishing the thread, Nick C got a couple of thousand fans and he said he “would continue publishing high-signal material when I have the time.”

The viewpoint Nick C shared on Wednesday demonstrates how the defi economy shows extremely noticeable material onchain, and it’s a lot less private than the majority of people think.

What do you consider all the defi exploits nowadays and the presence of million-dollar onchain deals and trades? Let us understand what you consider this topic in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.