The delisting of privacy coins like monero, zcash, and dash is ending up being something of a pattern in Asia, and might quickly broaden somewhere else. In the wake of the intra-governmental Financial Action Task Force (FATF) providing brand-new worldwide requirements, Korean exchanges Okex and Upbit have actually revealed they will delist and put cautions on numerous privacy coins in the instant future, with Okex to axe the tokens in October. The progressive desertion of such coins in “crypto-friendly” Asia is a caution call to all privacy supporters: you can’t have your policies and privacy, too.

Also Read: European Countries Step Up Response to Facebook’s Libra

A Growing Trend

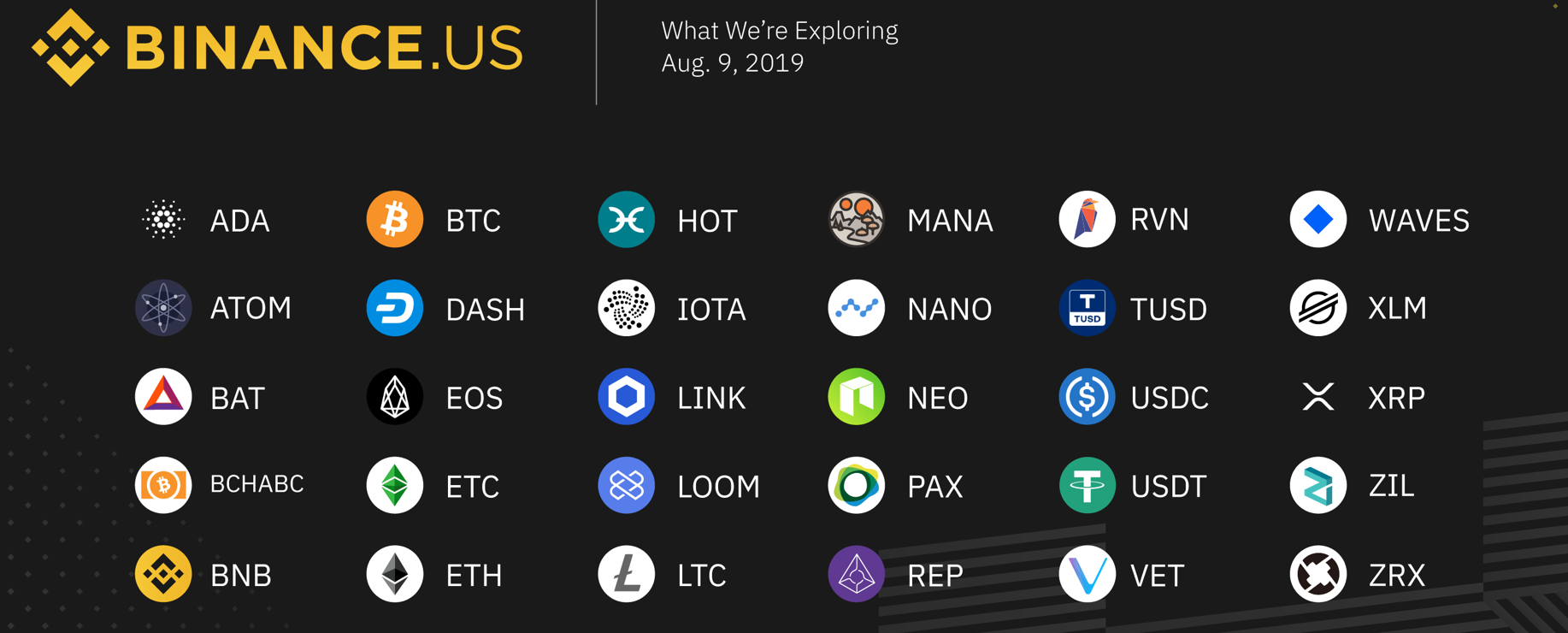

Prior to the issuance of FATF suggestions, one of Japan’s biggest exchanges had actually currently swung the axe. Coincheck delisted 4 significant privacy coins in 2018 thanks to push from the Japanese Financial Services Agency (FSA). An straight-out restriction on Japanese exchanges handling privacy coins followed right after. Further, extremely couple of privacy coins are set to be noted on Binance’s upcoming U.S.-compliant exchange, making the collective effort of regulators worldwide to put the brakes on privacy extremely clear.

According to a September 10 blog site post by Okex, the extensively utilized exchange will stop trading of XMR, DASH, ZEC, ZEN and SBTC for Korean consumers as of October 10, 2019 17: 00 KST. Users will have the ability to make withdrawals of the tokens up until December 10, 2019 17: 00 KST. The statement, equated from Korean, states in part:

According to the declaration representing FATF R.16 … We chose to take steps to end the trading assistance of stocks that are privacy-oriented cryptocurrency, aka dark coin.

The Okex blog site post particularly information the requirement of understanding both sender and recipient details according to the FATF standards, something privacy coins can make exceptionally challenging, if not difficult, for exchanges.

In comparable style, Korean exchange Upbit has actually now noted numerous privacy coins under an “financial investment caution” status, notifying traders that the tokens are under evaluation and might be eliminated if they are not discovered to fulfill FATF suggestions. A September 9 notification on their English site checks out: “The change to the FATF R.15 specifies business dealing with virtual possessions need to hold the basic comparable to that of banks and to register/report its legal service of operation. Particularly appropriate in R.16, it specifies that the collection and retention of details associated to the sender and the recipient of the virtual possession.” An upgrade is anticipated quickly regarding the last fate of the coins.

Binance’s U.S.-Compliant Exchange

The approaching U.S. legal certified version of trading leviathan Binance won’t be a sanctuary for privacy candidates, either, evaluating by the looks of things. With registration start on September 18, users will be welcomed with a trimmed variety of trading sets, and the possessions under factor to consider notably do not consist of regulator-shunned monero.

In choosing which possessions will be supported, Binance notes requirements for certification consisting of:

Whether trading the prospect possession will impact Binance.United States’s capability to adhere to appropriate legal requirements, consisting of, without restriction, United States AML/CFT and securities laws and their carrying out policies … Whether the prospect possession’s neighborhood has a record of reaching compromises and agreements to move the job forward.

The notification is authored by previous Ripple executive Catherine Coley, who is supervising the rollout of the platform as CEO of Bam trading services, the operator of the upcoming Binance U.S. exchange.

Privacy’s Not Dead

Compliance, delistings, and compromise are not precisely awesome potential customers for the Satoshi Nakamotos of the world who entered the crypto video game to reclaim monetary sovereignty. With privacy coins being gutted, it appears crypto may be losing itself in order to harmonize the huge young boys of tradition financing. Problem is, the entire concept of bitcoin was to offer the monetary bullies on Wall Street the middle finger, and not a goofy, submissive thumbs up. In spite of all the pressure, however, the embattled class of privacy coins is far from dead.

XMR ranks number 10 for market cap with a piece of $1.3 billion at press time. DASH remains in the 16 slot, and ZEC sits at 28. There is, moreover, the continued capability for different “basic coins” to carry out brand-new privacy procedures that make regulative pigeon-holing even harder. Litecoin, for instance, might support private deals (CT) in the future according to talk early in the year from Charlie Lee. Developments because arena appear to be moving forward, if gradually. In the BCH neighborhood, the privacy enhancing Cashshuffle procedure is being enhanced with a proposed anonymizing function called Cashfusion. The Github job spec states:

Cashfusion supplies high levels of privacy by means of a versatile plan that permits an approximate number of inputs and outputs of non-standard quantities. It supplies confidential, trustless coordination with typically zero-knowledge of linkages exposed to other gamers or the server.

Where some privacy coins have anonymizing functions baked right into the source code, a brand-new generation of procedures like Cashfusion and CT are emerging to manage even “basic” coins a kind of toggle switch permitting higher privacy. This method, both mainstream onboarding zealots and philosophically grounded privacy supporters might in theory support the very same possessions. The problem this may develop for the big-government-doting exchanges would be intriguing to see.

Cui Bono?

When it pertains to tokens being prohibited, blackballed, or delisted, it stands to ask who advantages. As news.Bitscoins.web has actually reported in previous posts, if the issue surrounding these possessions was genuinely about the avoidance of horror and criminal activity, the USD fiat plan ought to be priority top for overhaul, however it’s not. In a Reddit thread from August going over Coinbase’s delisting of zcash in the U.K., user sathound said sardonically:

Remember kids, tax avoidance and ethical personal bankruptcy is just for the abundant.

@zcash @ElectricCoinCo @coinbase what’s happening with Zcash in the UK? pic.twitter.com/6GWS9CuIoH

— Alex (@heskavich) August 8, 2019

Asia and Japan are typically hailed as crypto capitals thanks to adoption, policy, and active usage cases. Many in the area view this approval of crypto as an extremely bullish indication and an item of forward believing societies. To those old-fashioned curmudgeons still intently concentrated on “a simply peer-to-peer variation of electronic money that would permit online payments … without going through a banks,” all this talk can sound hollow, nevertheless. Of course, exchanges can do as they please, and time will inform which are going to kowtow to the FATF, and which DEXs, OTC platforms, and personal traders won’t.

What are your ideas on the delisting of privacy coins? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has thousands of individuals from all around the world trading BCH today. And if you require a bitcoin wallet to firmly save your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.