While American President Donald Trump earnings war with Iran, the U.S. Federal Reserve has actually continued to inject fresh capital into the hands of personal banks by providing $100 billion in over night and 14-day repos on Tuesday. The exact same day, Rabobank strategist Philip Marey forecasted the reserve bank will lower rate of interest to no in 2020. Additionally, previous Fed scientists think the reserve bank requires to produce a “standing repo center” so personal banks can transform securities into fresh fiat reserves whenever they please.

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

Federal Reserve Injects Another $100 Billion Into the Hands of Commercial Banks, While Analyst Believe Interest Rates Will Be Slashed to Zero

At the minute, the majority of the world is concentrated on the intensified stress in between America and Iran. Since the Iranian leader Qassem Soleimani was droned by American forces, safe-haven possessions – rare-earth elements like gold, oil, and cryptocurrencies have actually leapt in worth considerably. Following Soleimani’s funeral service, Iran released a couple of rockets which even more intensified stress in between the 2 nations. Meanwhile, as individuals focus on dry run, the U.S. Federal Reserve has actually been promoting a wide array of personal banks’ liquidity like there’s no tomorrow. Every time emergency situation repo operations occur, the New York Fed points out a substantial need for liquidity and a absence of cash reserves. Private banks and bond dealerships have actually continued to promise their treasuries as security for cash almost every couple of days for the last 4 months.

On January 7, the Fed pumped near to $100 billion into the hands of smaller sized banks by leveraging $63.9 billion in over night repos and $35 billion for 14-day repos. So far, because September 2019, the Fed has actually handled to promote personal banks with trillions by utilizing repo procedures and slashing rate of interest with a variety of financial reducing practices. The Fed is not the only reserve bank playing the fiat live roulette video game, as a bulk of international main coordinators are following the Fed’s patterns. Since the very first week of November 2019, more than 37 reserve banks around the world took part in stimulus and reducing plans. The Fed has actually cut rate of interest a couple of times because September, and now the entity acts as if it’s hesitant to cut rates once again. However, Rabobank executive Philip Marey thinks the Fed will drop the rates of interest hammer to no by the year’s end. Moreover, members of the Fed think the regular monthly schedule of repos is insufficient to calm the failing U.S. economy.

Creating a Standing Repo Facility So Banks Can Convert Securities for Cash Any Time They Want

While other reserve banks talk about questionable reducing subjects like ‘helicopter cash,’ previous members of the Fed have various concepts. During the last quarter of 2019, it was rather visible that the Fed increased financial interventions a lot. During a conference hung on December 10 and 11, Fed authorities talked about the application of a standing repo center. The center would be another arm of the U.S. financial system by permitting banks and bond dealerships to switch securities for cash whenever they remain in requirement. “Among the subjects discussed was the prospective function of a standing repo center in an ample-reserves routine, the setting of administered rates, and the structure of the Federal Reserve’s holdings of Treasury securities over the longer run,” discusses the Federal Open Market Committee’s records. Because a standing repo center is non-existent, the Fed reveals repo offerings each month so dealerships can get advance notification.

Following the Fed conversation about a standing repo center, previous New York Fed chair William Dudley also discussed the topic in a viewpoint column. Dudley’s editorial essentially states the Fed requires to galvanize a financial reducing plan in the kind of a standing repo. The essay kept in mind that the fall rate spike “shows the problem in anticipating the need for reserves offered the modifications.” Dudley worried:

[The Fed] ought to produce a standing repo center that is open to a broad set of counterparties restricted to Treasury and firm mortgage-backed securities security. Such a center would efficiently top repo rates. It would also resolve the prospective issue of the Fed supplying liquidity to main dealerships however main dealerships not providing the funds to other market individuals that may require short-term repo funding.

The Everlasting Conundrum: Who Owns the Fed?

The standing repo center would let debtors transform securities rapidly and whenever they desire. Markets Insider writer Ben Winck keeps in mind that JP Morgan experts would enjoy to see this kind of center executed. For years now, the Federal Reserve board members have actually constantly declared that the Fed system is “not ‘owned’ by anybody.” However, the factor JP Morgan experts like the Fed’s financial reducing policy is since they manage the Fed to a degree. Stockholders have actually managed the consortium of modern-day main banking because its beginning throughout the 17th century. Despite what the NY Fed composes, the entity is owned and managed by the 12 Federal Reserve Banks that serve particular areas within the nation. The 12 banks based in San Francisco, Kansas City, Missouri, Richmond, Boston, New York, Philadelphia, Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, and Dallas offer shares to thrifts and industrial banks living in the district.

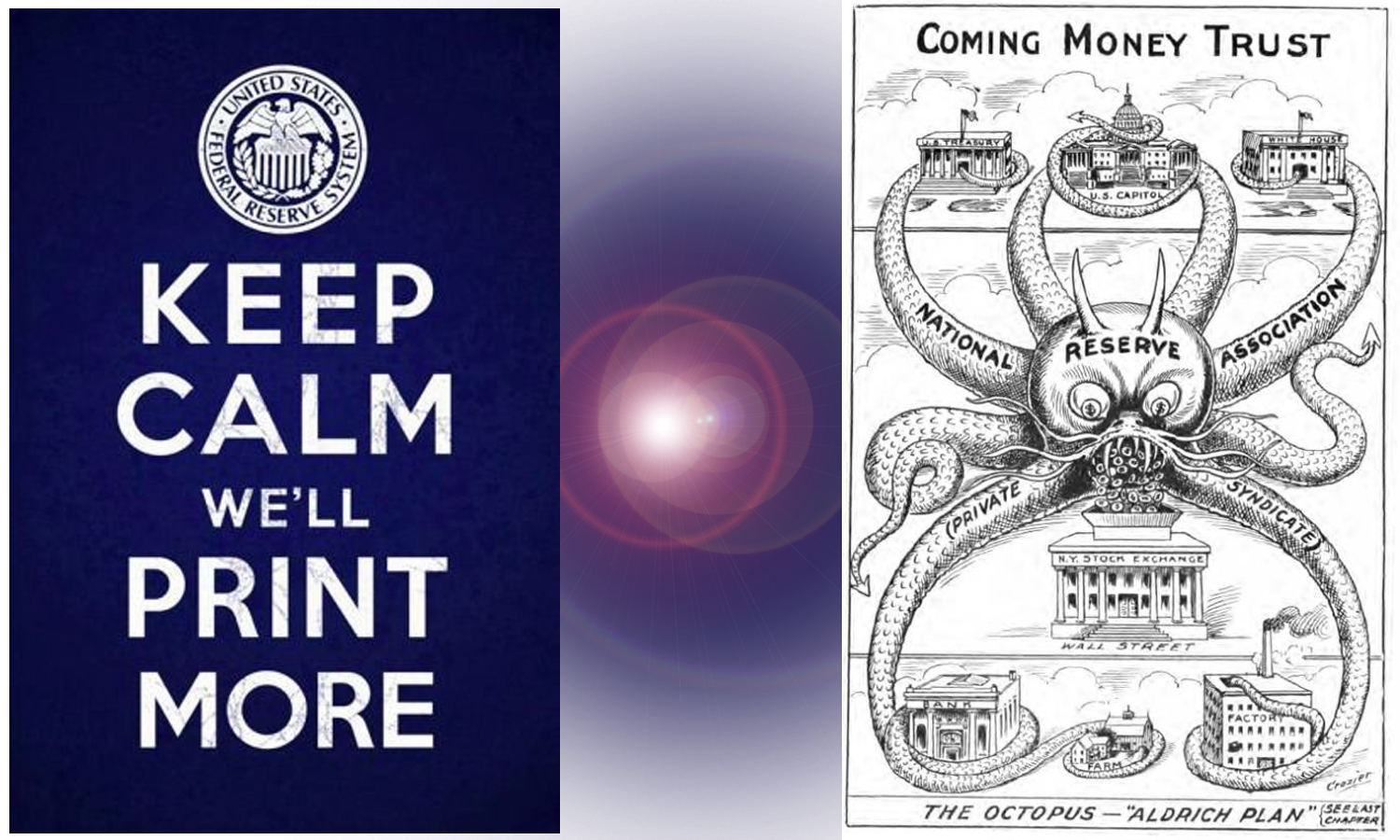

The exact same monetary households included with the ‘cash trust’ (House of Morgan) still control today’s most effective industrial banks. The exact same banking households utilize a part of command of each Fed branch also. For circumstances, in 1983 the NY Fed’s leading shareholders consisted of Citibank, Chase Manhattan, Morgan Guaranty Trust, and Bankers Trust Company. As of November 2019, the biggest shareowners (exact same households) of the NY Fed consist of JP Morgan Chase, Citigroup, Goldman Sachs, Morgan Stanley, and Bank of New York Mellon. Throughout other areas of the nation, industrial banks manage other Fed branches like Bank of America is a huge investor in Richmond, State Street has mega shares in Boston, and Wells Fargo runs the most significant video game with the Fed in San Francisco. It’s practically as if the 12 branches of the Fed are currently functioning as separate standing repo centers and the Fed wishes to divert attention in other places.

What are your ideas in concerns to the $100 billion injected into the hands of thrifts and industrial banks the other day while Donald Trump earnings war with Iran? What do you think of Rabobank Philip Marey’s forecast about rate of interest being cut to zero? What do you think of the idea of a standing repo center so banks can transform securities into cash whenever they please? Let us understand what you think of the reserve bank’s financial plans in the comments area below.

Image credits: Shutterstock, Pixabay, Wiki Commons, Fair Use, and Twitter.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The regional.Bitscoins.net market has countless individuals from all around the world trading BCH today. And if you require a bitcoin wallet to firmly save your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.