The Director of Global Macro at Fidelity Investments, Jurrien Timmer, regularly provides important structures for comprehending the valuation and development of Bitcoin. In a current upgrade, he supplied insights into Bitcoin’s adoption and worth trajectories, supported by in-depth charts that display both historic patterns and theoretical situations.

Timmer’s analytical models are developed to debunk the complex characteristics surrounding Bitcoin’s development, successfully bridging the space in between network adoption and valuation. He highlighted that, “While the supply is known, the demand is not,” highlighting the necessary impact of adoption curves and macroeconomic aspects, consisting of genuine rates and financial policy.

Adoption Curves: Slowing however Consistent Growth

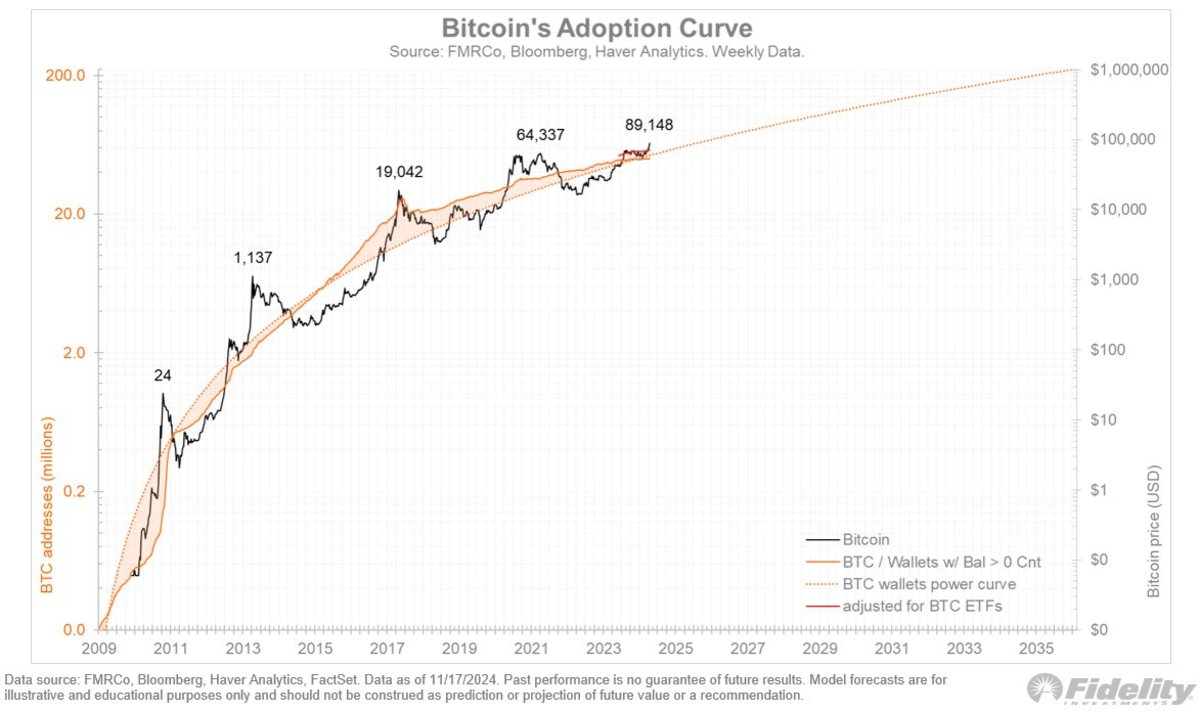

Despite observing a downturn in Bitcoin’s network development—defined by the variety of wallets holding a non-zero balance—Timmer mentioned that this pattern stays constant with the high power curve portrayed in his upgraded adoption chart. While the adoption curve of the web displays a gentler slope, Bitcoin’s trajectory continues to show a steeper climb, suggesting fast however growing development.

A substantial point made by Timmer worries the restrictions in determining wallet development: the real count of wallets or addresses might be downplayed due to Bitcoin ETFs, which combine holdings into less wallets. He suggested, “It’s very likely that the wallet/address count is understated,” keeping in mind that ETFs can obscure the wider circulation of Bitcoin adoption.

Monetary Policy Meets Adoption Dynamics

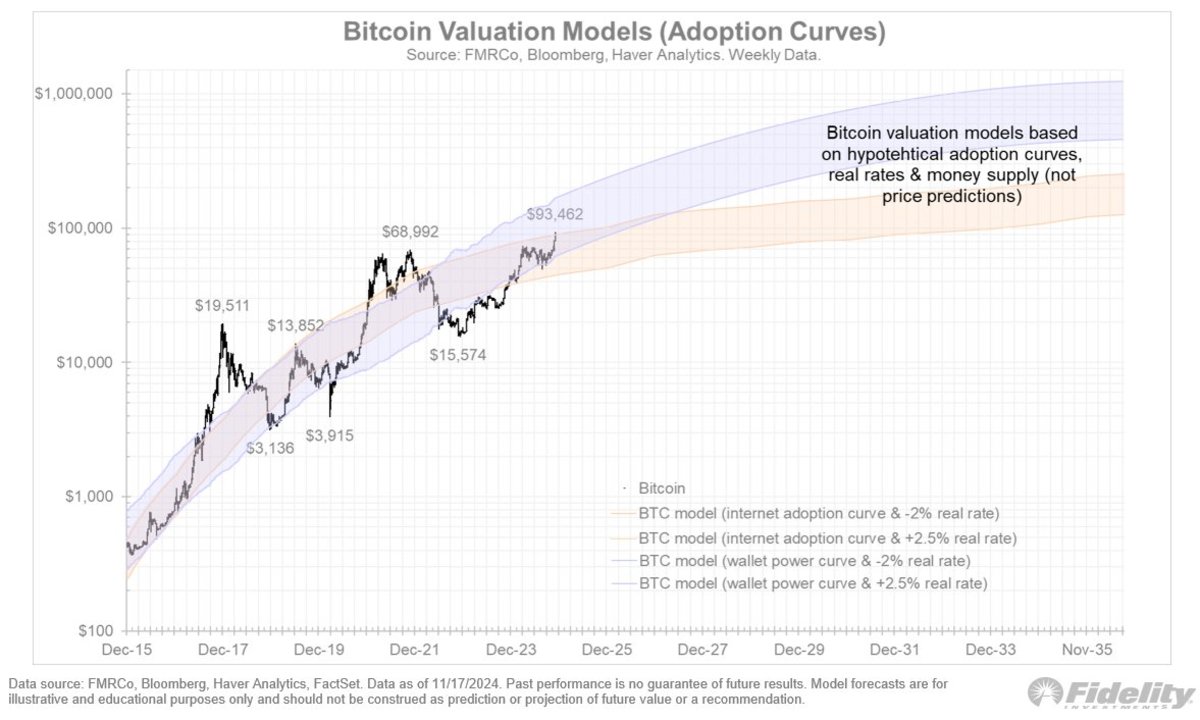

Extending his previous models, Timmer presented an extra measurement to his valuation structure by including cash supply development in combination with genuine rates of interest. His upgraded charts present 2 theoretical paths for Bitcoin’s valuation: one driven by adoption curves and genuine rates, the other factoring in financial inflation.

Timmer clarified, “Again, these are not predictions, but merely attempts at visualizing the use case on the basis of adoption, real rates, and monetary inflation.” This complex technique stresses how external macroeconomic forces, such as financial policy, might affect Bitcoin’s adoption and valuation.

Why This Matters

Timmer’s modified models verify Bitcoin’s growing status as a genuine monetary property. By incorporating historic S-curves, Metcalfe’s Law, and macroeconomic variables, he provides a holistic view of Bitcoin’s unique mix of network energy and financial functions. His findings highlight the vital function of adoption in driving Bitcoin’s worth while also highlighting how real-world financial conditions can form its trajectory.

For both supporters and critics of Bitcoin, Timmer’s insights offer a substantial structure for comprehending the property’s double qualities as both a network and a financial kind. The factor to consider of financial inflation within his models even more highlights Bitcoin’s capacity as a hedge versus the debasement of fiat currencies.

The Road Ahead

As Bitcoin continues to establish, Timmer’s models work as an important lens for monitoring its development. Whether examining the flattening of the adoption curve or the interaction in between financial policy and valuation, his analysis highlights the property’s increasing intricacy and withstanding significance in the monetary landscape.

For financiers, experts, and lovers, these insights brighten Bitcoin’s transformative capacity, even as its development curve develops.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.