Bitcoin Magazine

FPPS Is Not A Free Lunch For Bitcoin Miners

Bitcoin mining provides considerable obstacles. In contrast to the mining of standard products, such as gold, copper, or oil—where prospecting and initial evaluation are vital for making sure that capital expense are warranted—the special security procedure of Bitcoin avoids miners from participating in any such insight. Mining for Bitcoin is a probabilistic undertaking, as the discovery of a block is figured out by random possibility. With just 144 blocks readily available for discovery every day, miners deal with considerable unpredictability relating to the timing and consistency of their benefits unless they command a significant share of the network’s hash rate. To attain trusted payments and lower earnings irregularity, a miner needs around 1.2% of the overall hash rate—comparable to around 10 exahashes per 2nd at the time of composing. Attaining this level demands capital investment in the numerous countless dollars, a limit that is usually overwhelming for smaller sized operations.

To alleviate these obstacles, swimming pool mining has actually become a practical service. Consider a miner with a modest operation, having 1/52560th of the whole network hash rate. Statistically, this miner would be anticipated to find one block throughout a year. However, provided the frequency with which functional expenses accumulate—regular monthly electrical energy expenses, for example—waiting a whole year for earnings might cause monetary destroy. To address this, the miner looks for 499 others with comparable operations and proposes a collective technique to mining. By pooling their resources and sharing the mining rewards based upon private contributions whenever a block is discovered, the group substantially increases the frequency of payments. Collectively, the 500 miners are anticipated to find around 2 blocks weekly, making sure that each individual can handle their costs more dependably and prevent insolvency. Still, the payments within the swimming pool still experience variations.

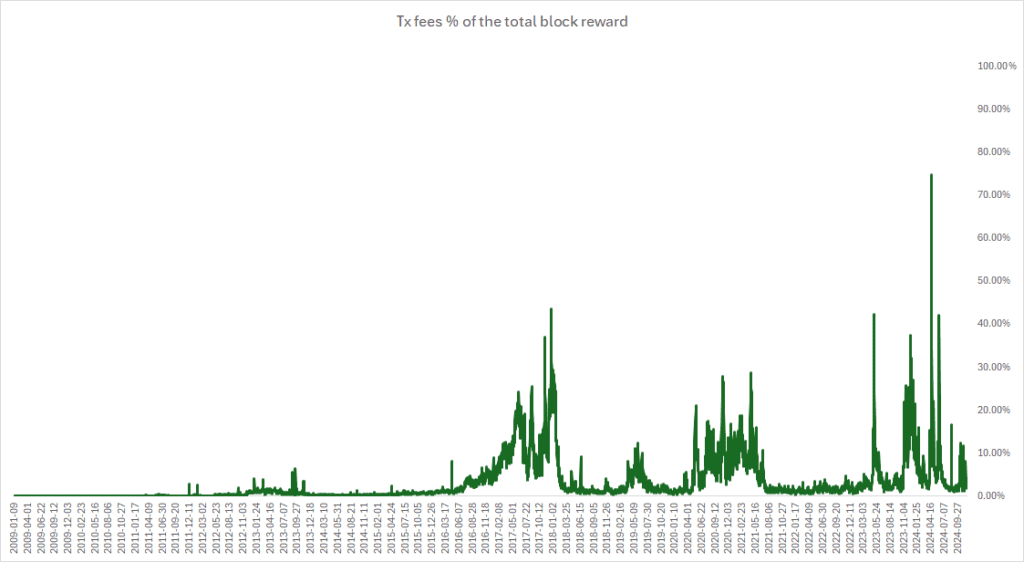

While swimming pool mining provides more regular payments compared to solo efforts, it does not remove the unpredictability related to payments proportional to each miner’s hash power. This phenomenon is typically described as the “pool’s luck risk.” Returning to the earlier example, although the cumulative of 500 miners must statistically mine around 500 blocks each year, they might in fact mine 480, 497, or perhaps 520—we cannot ensure accurate results. Pool luck is examined by dividing the real blocks mined by the anticipated overall according to the swimming pool’s hash rate. If a swimming pool finds 480 blocks when 500 were prepared for, the swimming pool’s luck is successfully 95%. Such luck can cause considerable variations in miner profits over brief durations, although it usually levels out in time, lining up payments with expectations based upon the swimming pool’s hash rate. Two extra aspects add to payment difference for miners: deal charges, which have actually changed considerably over the last few years, and the time in between block discoveries. Blocks discovered in fast succession usually yield less deals in the mempool, causing reduce charges, while extended periods permit for more deals and consequently greater charges.

Uncertainty is a considerable issue, especially when significant capital is included. Consequently, numerous miners focus on foreseeable, steady, and less unstable payments to recover their financial investments. In this context, the Full Pay Per Share (FPPS) payment design ends up being pertinent. FPPS functions comparable to a standard insurance coverage item, where miners are compensated based upon the prepared for worth of their hash power, no matter the variety of blocks mined or the matching deal charges. The swimming pool presumes the involved threats, providing unequaled predictability to miners. Notably, FPPS has actually ended up being the fundamental requirement in swimming pool payments; nevertheless, it requires significant expenses.

It is important to acknowledge that FPPS is not a safe choice. To hold up against prospective durations of underperformance and the intrinsic threats of the FPPS structure, mining swimming pools should keep considerable capital reserves. These monetary requirements are not unimportant, and as such, greater swimming pool charges are demanded, borne by the miners using the services. Additionally, FPPS runs like an insurance plan, which hinges upon the dependability of counterparties. Trusting that a swimming pool will satisfy its commitments to miners presents a component of threat, especially highlighted by historic precedents such as the 2008 monetary crisis. While bigger swimming pools might have lowered threat, the essential concept of Bitcoin intends to lessen trust and counterparty threat—a worth that seems on the subside in the swimming pool mining community.

Moreover, miners getting FPPS benefits should give up prospective incomes stemmed from deals throughout cost spikes. The FPPS payment design computes miner benefits based upon deal charges from a series of preceding blocks, causing settlement that shows previous conditions instead of present spikes. Thus, miners lose out on compensation throughout rising cost durations, which swimming pools cannot virtually integrate into payment computations without risking their monetary practicality.

The Unsustainability of the FPPS Payout Scheme

An extensive evaluation of the FPPS payment design exposes a structural unsustainability similar to numerous contemporary pension systems. As the characteristics of deal charges progress to represent a significantly bigger section of miner payments, along with their intrinsic irregularity, the resulting boost in payment difference will drive insurance coverage expenses for FPPS swimming pools to unmatched levels. As the Coinbase benefit continues to cut in half, the threat related to supplying this repaired settlement will also intensify demanding greater premiums that swimming pools will require to charge for their insurance coverage items. The ramifications for swimming pool charges are severe, with the requirement for considerable boosts in charges ending up being basic to keep FPPS services. The precise level of this boost stays speculative and will need actuarial analysis; nevertheless, it appears that sustaining FPPS will not come cheap, as present expenses are currently considerable.

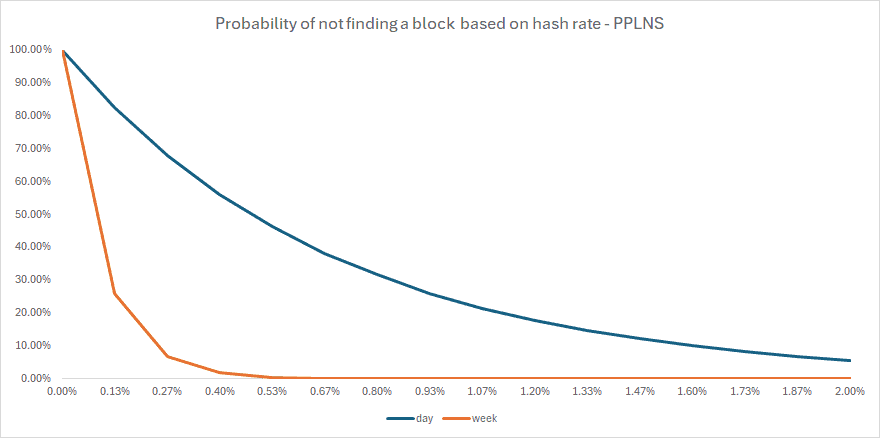

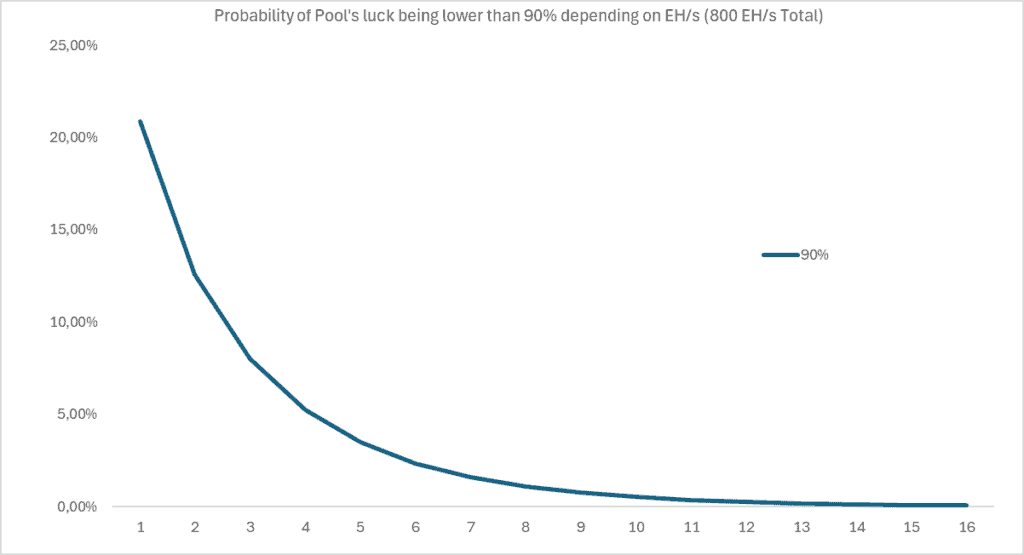

The prospective increase in swimming pool charges for the stability provided by FPPS might drive miners to look for alternative designs, such as Pay Per Last N Shares (PPLNS), which rewards miners upon the discovery of blocks proportional to their contributions over the last N blocks. Although this technique does bring threats related to swimming pool luck—a situation where the swimming pool stops working to find blocks within a provided duration—data recommend that such threats are very little for swimming pools with even modest hash rate shares. For circumstances, a swimming pool with simply 1% of the hash rate has a 0.0042% likelihood of not mining a block over one week, and the probability of the swimming pool’s luck falling below 90% within a year is around 1.09%.

The future of FPPS swimming pool services stays unpredictable. The market characteristics might render FPPS services excessively costly for miners provided the considerable earnings they would need to surrender. As the mining market develops—with brand-new entrants such as energy business—there might also be increased accessibility of ingenious threat management tools customized to these obstacles. New payment structures that attend to continuous threats might become the landscape modifications.

Ultimately, the earnings and success of miners will be greatly affected by the characteristics articulated in this discourse. Miners crazy about optimizing their success should check out alternative swimming pool payment structures and run the risk of management methods. While FPPS might still use some energy, its sustainability in the long term is progressively skeptical.

This post is a visitor post by Francisco Quadrio Monteiro. The views revealed are entirely those of the author and do not always show the viewpoints of BTC Inc or Bitcoin Magazine.

This post, “FPPS Is Not A Free Lunch For Bitcoin Miners,” initially appeared in Bitcoin Magazine and was authored by Francisco Quadrio Monteiro.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.