In a brand-new report by the International Monetary Fund (IMF) entitled “Global Financial Stability Report: Lower for Longer,” the group offers an introduction of the existing debt-ridden and precarious state of affairs in global economics. Not lost on some financial experts, nevertheless, is the paradox that these modern-day truths are the direct outcome of policies traditionally supported by the IMF itself.

Also Read: IMF Has Another Trick Up Its Sleeve When Fiat Fails – Its Own Coin SDR

Flip-Flopping

The six-chapter, 109-page report breaks down the threatening state of global financing and “recognizes the existing essential vulnerabilities in the global monetary system as the increase in business financial obligation problems, increasing holdings of riskier and more illiquid possessions by institutional financiers, and growing dependence on external loaning by emerging and frontier market economies.” The evaluations are not incorrect, however stop working to turn the lens back on the source, and the extremely causal aspects adding to these truths.

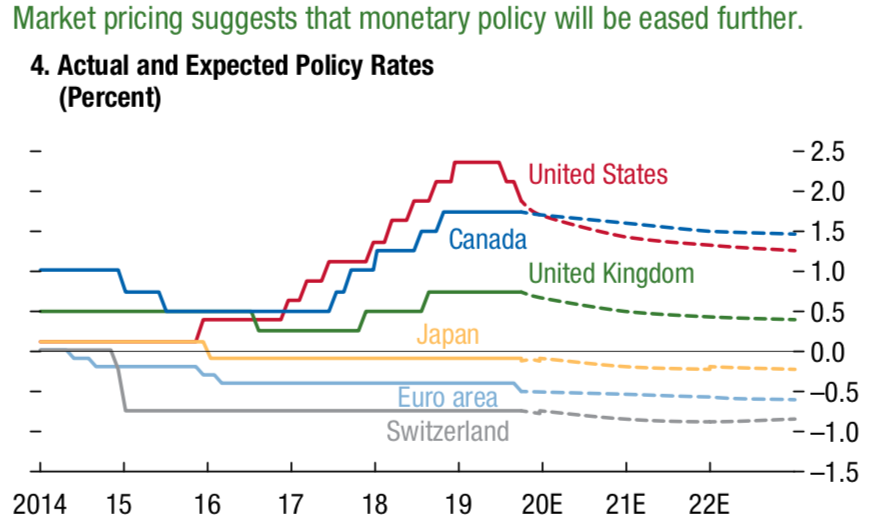

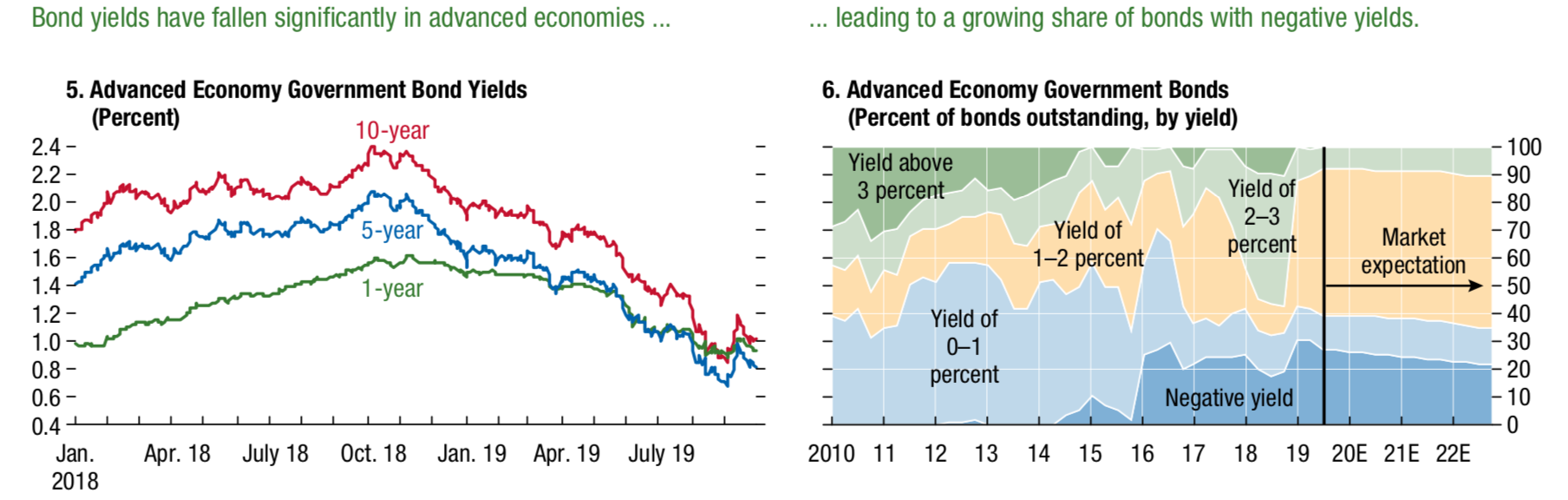

Citing continued relieving and precipitously falling bond yields, the IMF requires more conservative methods to the management of financial issues, mentioning:

To decrease the danger that extra relieving might have the unexpected effect of causing an additional accumulation of monetary system vulnerabilities, macroprudential policies must be tightened up, as required.

The IMF is all of a sudden extremely thinking about vigilance, and the management of systemic danger, motivating making use of recommended tools for reducing depressing results of extended unfavorable interest, QE and simple credit, and the resultant motion of financiers into riskier, more illiquid possessions. The report preserves that “Low rate of interest have actually lowered financial obligation service expenses and might have added to a boost in sovereign financial obligation. This has actually made some federal governments more prone to an abrupt and sharp tightening up in monetary conditions.”

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.