Despite what gold bug Peter Schiff states, economic experts doubt that gold will shine during the present coronavirus crisis. While gold and other rare-earth elements have actually seen good gains in the last couple of weeks, a couple of investors are terrified that reserve banks will utilize their flight-to-safety properties in order to conserve their economies. Data reveals that the U.S. owns the greatest stockpile of gold reserves and the Federal Reserve might extremely well dump the bullion in times of severe monetary tension.

Central Banks Might Need to Sell Gold, Which Could Crush the Price Long-Term

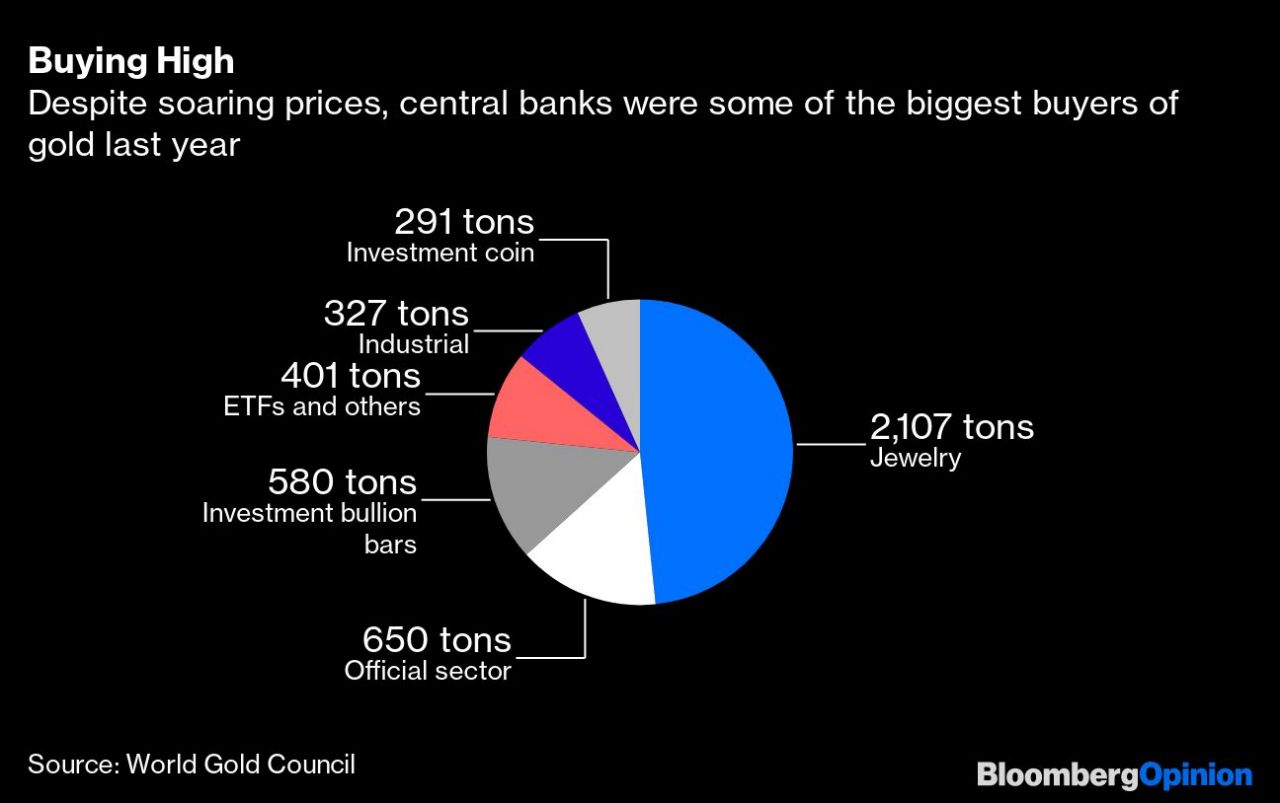

Just like digital properties like bitcoin, investors wonder about gold and whether the metal will increase much greater during the monetary disaster. For over a centuries, gold has actually been thought about a safe-haven possession and the yellow metal is much more limited than the endless fiat reserve banks produce frequently. Despite the deficiency, economic experts comprehend that reserve banks are the biggest holders of gold and there’s a fantastic possibility they might dump on the market at any time. In 2019, reserve banks around the world acquired the most tonnage of gold in more than 50 years.

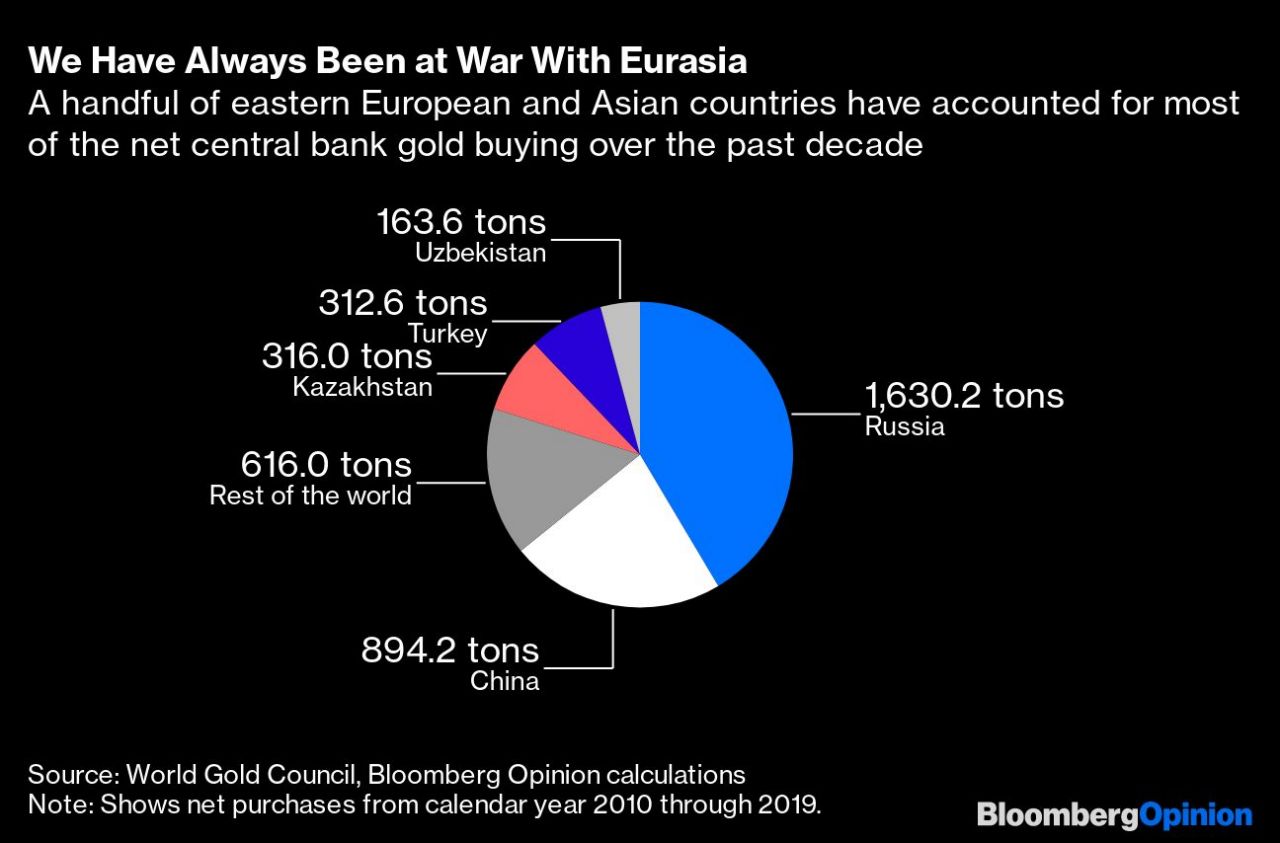

Interestingly, in the middle of the coronavirus break out, Russia’s reserve bank remarkably stopped purchasing gold and offered no main factor. Russia was not the just nation to suppress gold acquiring as Kazakhstan, and Uzbekistan brought gold purchases to a grinding stop. Speculators presume reserve banks are merely utilizing gold for its flight-to-safety function and they will need to offer the bullion when economies get squashed.

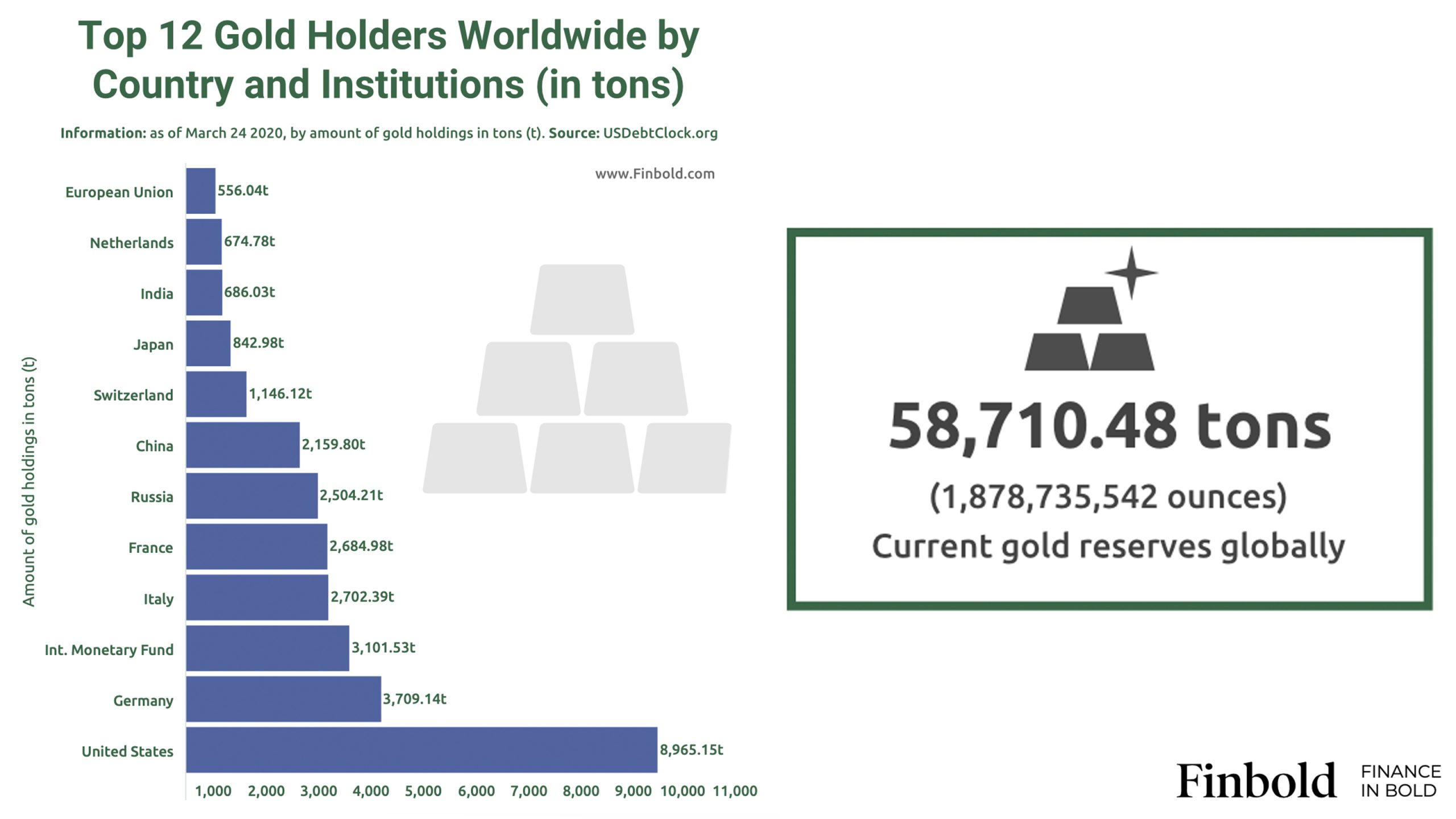

Statistics reveal that the U.S. is the biggest holder of gold reserves with 8,965 loads to-date. This is followed by Germany (3,709t), the International Monetary Fund (3,101t), Italy (2,702t), France (2,684t), Russia (2,504t), China (2,159t), Switzerland (1,146t), Japan (842t), India (686t), Netherlands (674t), and the European Union (556t).

Financial writer David Fickling describes in a current editorial that investors must not “anticipate a crisis to be helpful for gold.” “It might be argued that the present crisis is exactly the sort of emergency situation that shows the long-lasting worth of gold for a reserve bank, as a possession without any counterparty danger that can be offered in an exchange for any currency if things get tight,” Fickling composed on April 1. Fickling continued:

It’s worth showing that the surging cost of gold is increasing the share of bullion in many reserve banks’ reserves today, sometimes to the point where they require to think of selling.

Retail Investors Forced to Pay Higher Premiums for Small Bars and Coins

Further, although investors might wish to get some gold to keep as a safe house possession, monetary news outlets are reporting on gold dealerships discussing there are “huge lacks of little bars and coins.” Small bars and coins are popular amongst retail customers and individuals aiming to get some are paying “well above the per-ounce rates being priced estimate on monetary markets.”

“People wish to purchase, not to offer gold,” detailed Mark O’Byrne, the creator of the company Goldcore. “We have a purchasers’ waiting list and we emailed our customers seeing who wanted to offer their gold. At this time there are approximately just one or more sellers for every single 99 purchasers,” O’Byrne included.

In reality, retail premiums for gold “have actually taken off,” mentioned Markus Krall, CEO of Degussa, a German-based rare-earth elements dealership for retail investors. Krall stated that the cost of bullion at particular stores can be 10-15% above area rates. Furthermore, Ronan Manly, an expert at Singapore dealership Bullionstar informed the press that Kilobars dispersed by Argor-Heraeus SA are costing 6% above area. Even though there’s a scarcity of little bars and coins, gold bugs like Peter Schiff still believe that the yellow metal will undoubtedly increase in the future. Thanks to the stimulus prepares throughout the world, gold supporters have actually constantly stated that gold will be the finest shop of worth. Many other gold supporters concur with Schiff and Bob Haberkorn, senior products broker with RJO Futures feels the very same method.

“With all of the stimulus cash, rates of interest at absolutely no, loss of tasks and several fights on the economic front, I can’t see how gold is not greater next week,” Haberkorn informed Kitco on Thursday.

The Benefits of Bitcoin: Portable, Harder to Confiscate, and a Superior Rate of Issuance

While experts and wealth supervisors contemplate if gold will be a safe house possession during the present crisis numerous think digital properties like bitcoin will be king. There are different reasons bitcoiners believe crypto is much better than gold and among the greatest is the reality that bitcoin is much more difficult to take. Gold investors are frequently advised of when the U.S. took everybody’s gold in the 1930s, back when President Franklin D. Roosevelt (FDR) forbidden the yellow metal. Bitcoin is much more portable than gold, as taking a trip with the metal might weigh numerous pounds, which frequently causes saving it with a 3rd party.

Additionally, bitcoiners are more positive in the BTC supply and there’s no reserve banks to dump on the market. Moreover, BTC’s rate of issuance continues to beat gold as 3,300 lots of brand-new gold or $200 billion is mined every year. There’s a myriad of reasons bitcoin and cryptocurrency properties are developed for economic catastrophes such as the one we are experiencing today. If you have an interest in discovering more about bitcoin then have a look at our guides and instructional resources today.

What do you think of gold during the recession? Let us understand in the comments below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.