Grayscale Investments has actually gone beyond the turning point of $30 billion in net crypto assets under management (AUM). The business states the significant development is because of institutional financiers, especially hedge funds.

- Grayscale exposed Friday that its net overall crypto assets under management now stands at $30.4 billion. In the lead is Grayscale Bitcoin Trust, which presently has more than $24 billion in AUM, followed by the Ethereum trust with more than $5 billion in AUM.

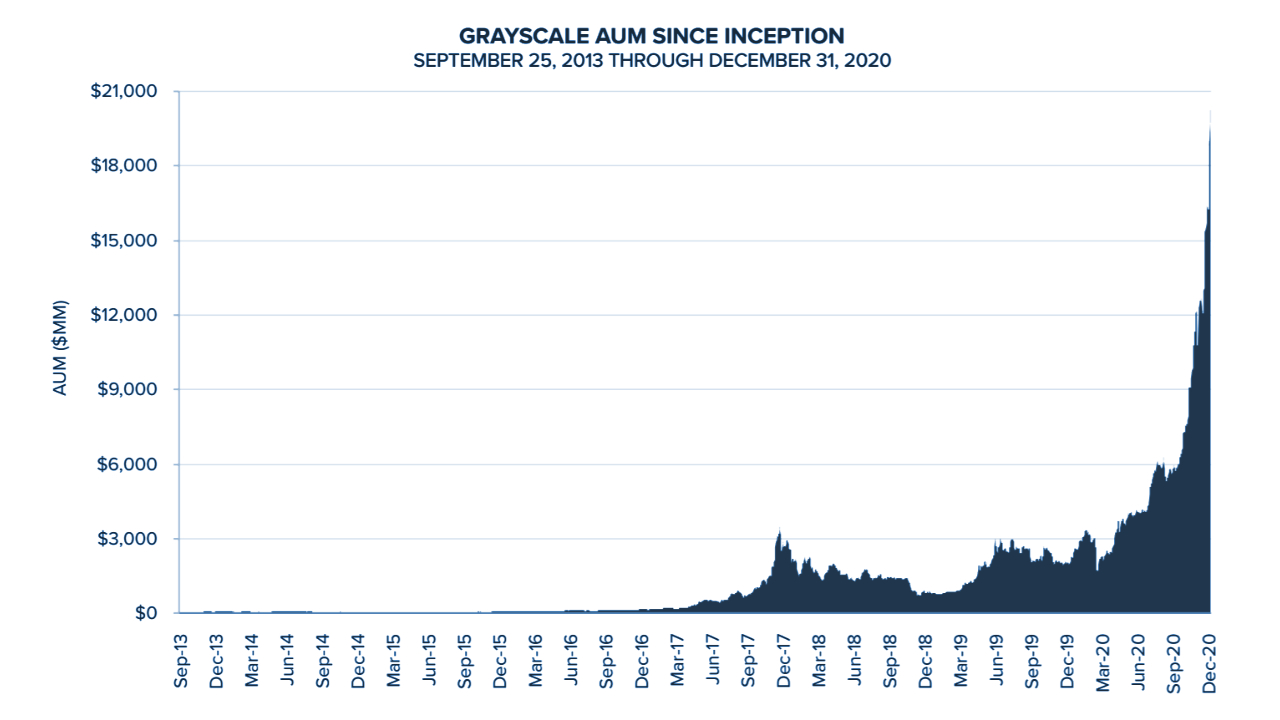

- Last year, Grayscale began with simply $2 billion in assets under management and ended the year with more than $20 billion, representing a 900% boost.

- Grayscale associated the enormous development to financial investments from institutional financiers, especially hedge funds. CEO Michael Sonnenshein states: “There’s no longer expert threat of buying the digital currency property class — there’s most likely more profession threat in not taking notice of it.”

- In its Q4 2020 report, the business composed that “Institutions are here,” including that in the 4th quarter organizations represented 93% of all the capital inflows throughout the duration, or around $3 billion. “The typical dedication amongst organizations is also growing at a substantial rate,” Grayscale comprehensive, keeping in mind that “The typical dedication from organizations was $6.8 million, up from approximately $2.9 million in 3Q20.”

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

- Grayscale now uses 9 various cryptocurrency financial investment items after stopping its XRP trust. The staying items are Grayscale’s Bitcoin Trust, Bitcoin Cash Trust, Ethereum Trust, Ethereum Classic Trust, Horizen Trust, Litecoin Trust, Stellar Lumens Trust, Zcash Trust, and the digital large-cap fund.

- Out of all the crypto items provided, just 3 are not openly traded on OTC markets: the Horizen Trust, Stellar Lumens Trust, and Zcash Trust. Shares of the staying trusts and the large-cap fund are now unlimited and offered through any brokerage account.

What do you think of Grayscale’s development? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.