Ever because cryptocurrencies began getting worth, hackers have targeted exchanges that supply digital possession trading and harmful entities have siphoned billions of dollars worth of bitcoin because 2011. So far, over 1 countless the world’s BTC has actually been taken from exchanges and traders continue to leave large amounts of funds on central trading platforms.

Hackers Love to Profit from People Leaving Funds on Centralized Crypto Exchanges

Over the years, hackers have handled to make a profitable profession taking cryptocurrencies from exchanges. Exchanges have seen digital burglars loot wallets because 2010 and crypto trading platforms are still being jeopardized in 2019. Last year, according to Chainalysis information, hackers handled to produce over $1 billion in income from just robbing crypto exchanges. Moreover, Chainalysis described in January 2019 that just 2 significant hacking groups were the offenders to the majority of 2018’s exchange hacks. It’s uncertain precisely the number of bitcoins have been taken however over the last 10 years, it’s approximated that more than 1 million BTC, has actually been pilfered from exchanges.

The quantity of snatched coins is approximately around the very same variety of BTC that Satoshi Nakamoto might have and most likely a lot more. Moreover, 2 of the greatest hacks comprise the majority of the BTC taken over the last 8 years. Roughly 650,000 BTC was drawn from Mt. Gox back in 2014 and 120,000 BTC were taken from Bitfinex in 2016. This indicates that more than 770,000 of the looted BTC also provides the hackers 770,000 BCH too. Essentially, this indicates that there’s been more than $7.7 billion dollars worth of BTC taken at today’s currency exchange rate. All of those funds were taken prior to the BCH fork so after August 1, 2017, the hackers who took 770,000+ BTC handled to obtain $303 million in BCH too.

A Look at Some of the Biggest Crypto Exchange Heists Since 2011

Back in 2011, Mt. Gox lost bitcoins well prior to they lost a fantastic portion of the overall supply. On June 19, 2011, the exchange stated they had actually lost $8.7 million worth of BTC due to a “security breach.” At the time, in order to show the exchange was solvent, the company moved 424,242 BTC into freezer, which can be seen in block 132749. Then the exchange also lost around 2,609 BTC by sending them to an unspendable address. The now-defunct exchange is also well-known for losing 850,000 BTC in 2014 and presumably the trading platform’s CEO Mark Karpeles discovered 200,000 of the missing out on coins after the exchange went under. The staying 200,000 coins were to be distributed to all the account holders who lost loan, however the circulation procedure has actually been held up for many years.

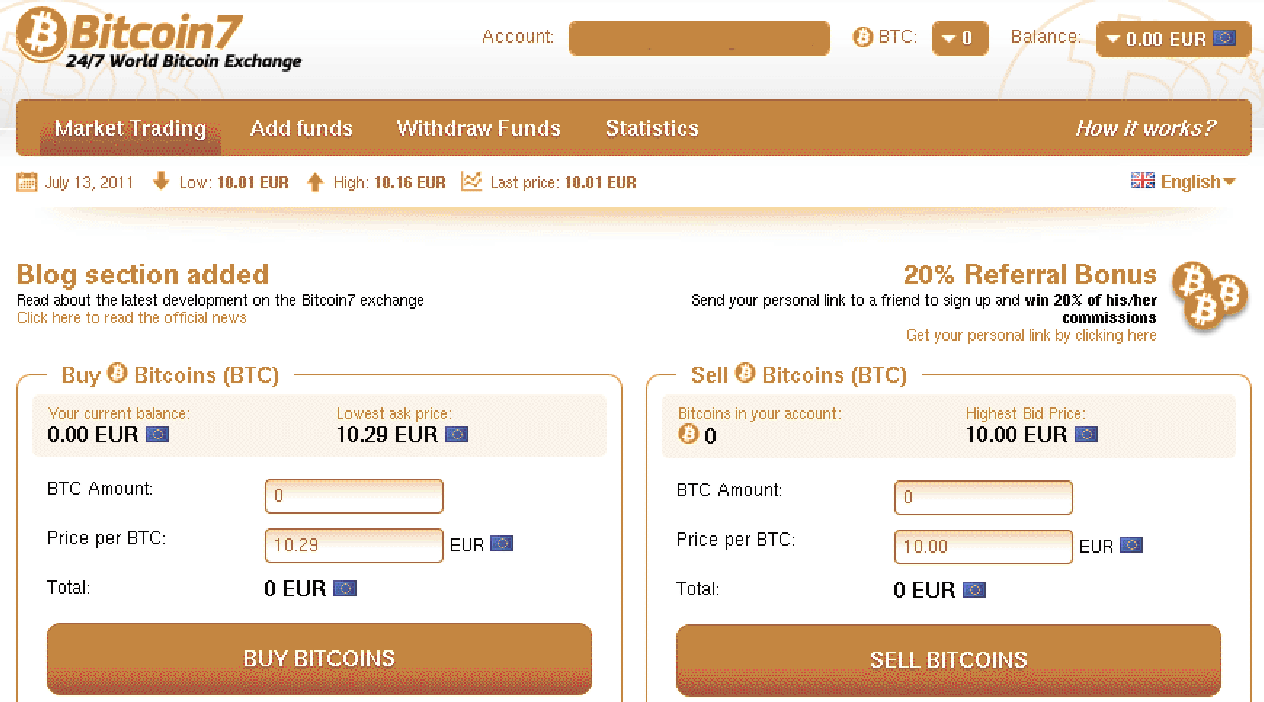

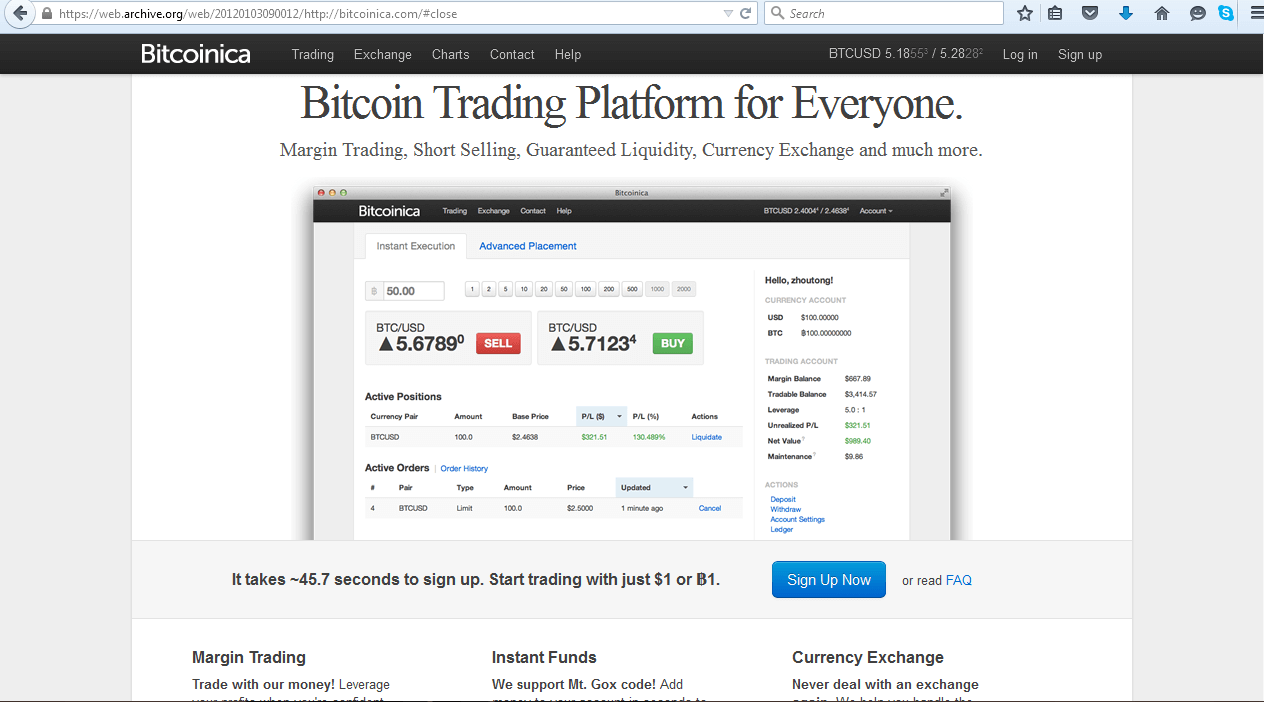

Most individuals put on’t keep in mind the trading platform Bitcoin7, however at one time the operation was the 3rd biggest exchange in 2011. Back on Oct. 5, 2011, the exchange stated they lost 5,000 BTC or $39 million at today’s currency exchange rate. The loss of 5,000 BTC was excessive for Bitcoin7 to manage and the exchange never ever re-opened. Even though the business had actually guaranteed to compensate users, the restitution procedure never ever concerned fulfillment and the site went dark. In 2012, throughout the Linode hack, crypto lovers saw an approximated overall of 46,653 BTC taken from an overall of 8 crypto-related organisations such as Tradehill and Bitcoinica. The very same year Bitcoinica was hacked two times losing 38,000 BTC in May and after that in July, the platform lost another 40,000 BTC. In September 2012, the trading platform Bitfloor lost 24,000 BTC throughout a security breach.

2013 saw a lot of bitcoins taken that year as the Vircurex Exchange Hack saw the loss of 1,666 BTC, and the platform Bitmarket.eu exit scammed with $400 million worth of BTC. In October of 2013, GBL Exchange also ran off with clients coins taking 9,640 BTC. The digital currency payment service provider BIPS had a security breach which saw the loss of 1,295 BTC. 2014 was no various as crypto supporters saw the significant Mt. Gox hack however also saw Cryptsy lose 13,000 BTC and Mintpal lost 3,894 BTC. Then in 2015, the Bitstamp hot wallet was siphoned for 19,000 BTC, 796 Exchange saw 1,000 BTC taken, and the Bitfinex hot wallet lost 1,500 BTC.

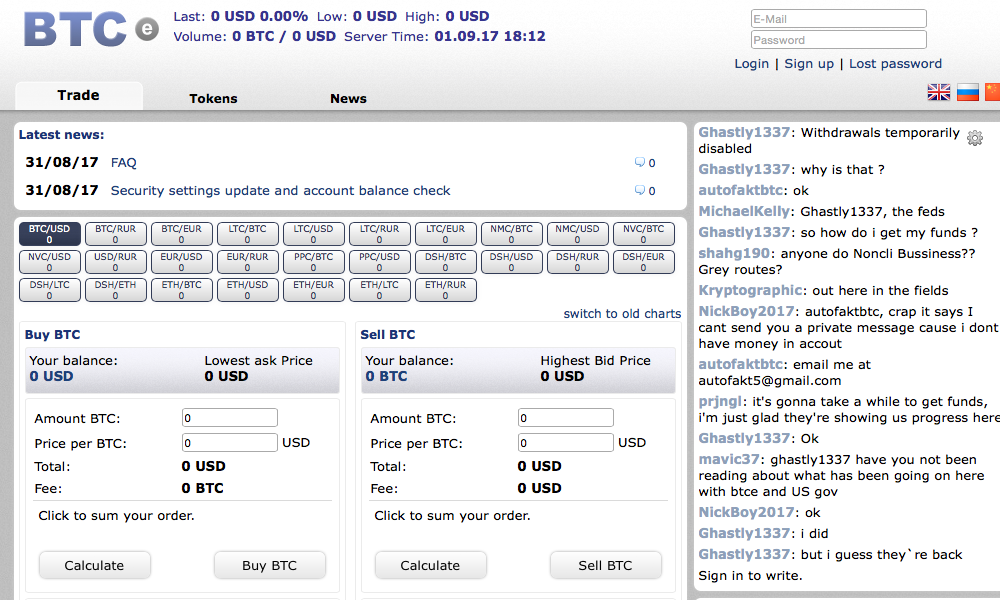

The extremely next year, Bitfinex saw an even larger loss when hackers took 119,756 BTC. A couple of months later on, Bitcurex lost 2,300 BTC. During the bull run in 2017, there were a lot of exchange losses when Yapizon lost 3,831 BTC, hackers took $31 million from Bithumb, and Btc-e left with 66,000 BTC. In 2018, BTC Global scammed individuals out of $50 million and Gainbitcoin ran away with $300 million. In April 2018, the Indian exchange Coinsecure lost 438 BTC and in September, the Japanese crypto exchange Zaif was hacked for 913 BTC. The following month Maplechange took client funds swiping 913 BTC. At completion of the year, Electroneum users saw 250 BTC taken from them.

More Than $8.2 Billion Worth of BTC Stolen Since 2011

2019 is not over however users are still losing funds left and right on central trading platforms. It’s approximated that around $140 to $200 million worth of crypto was lost throughout the Quadrigacx incident, and simply recently, Binance suffered a hack too when 7,000 BTC was taken. Out of all the exchanges and 3rd party company, discussed hackers handled to take 1,058,658 BTC ($8.2 billion) in overall which’s simply skimming the surface area of huge exchange hacks. The $8.2 billion also doesn’t represent the enormous variety of BCH connected to a minimum of 2/3 of the funds looted. The variety of coins swiped from exchanges far goes beyond Satoshi’s stash and individuals continue to leave their funds on central platforms. The 1 million coins out of 21 million in blood circulation that hackers have handled to rob is a fantastic pointer to why cryptocurrencies need to not be left on exchanges.

At Bitscoins.internet we understand individuals like to trade fiat for cryptos which’s why we developed Local.Bitscoins.internet, where user funds are never ever kept on our servers. Our peer-to-peer exchange will release on June 4, 2019, however you can develop an account today and even established a trade for when the platform goes live. The more peer-to-peer exchanges that help with sell a noncustodial style, the much better due to the fact that many crypto lovers are tired of becoming aware of trading platforms losing millions.

What do you consider the 1 million coins taken because 2011? Let us understand what you consider this topic in the comments below.

Image credits: Shutterstock, Pixabay, and Archive.org.

Did you understand you can confirm any unofficial Bitcoin deal with our Bitcoin Block Explorer tool? Simply total a Bitcoin address search to see it on the blockchain. Plus, go to our Bitcoin Charts to see what’s occurring in the market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.