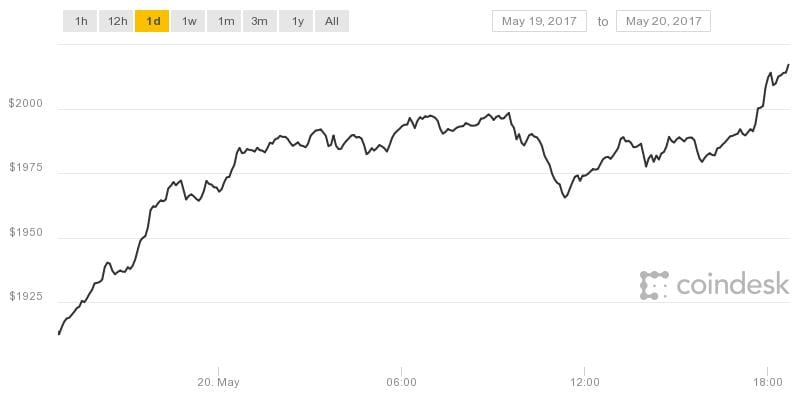

The value of bitcoin surpassed $2,000 for the primary time in historical past immediately, pushing the cryptocurrency to a contemporary, new file amid rising dealer curiosity.

The currency’s value rose as a lot as 2.62% through the session, in accordance to CoinDesk’s Bitcoin Price Index (BPI) to hit a press time excessive of $2,zero19. By rising above $2,000, bitcoin’s value has surged greater than 100% this 12 months and practically 125% since hitting an annual low of $891.51 in late March.

Now that the the digital currency has surpassed this key, psychological degree of $2,000, it may expertise some vital tailwinds, in accordance to a number of analysts who spoke with CoinDesk.

High hopes

Arthur Hayes, co-founder and CEO of leveraged digital currency platform BitMEX, advised CoinDesk that ought to bitcoin costs “convincingly” surpass $2,000, “the rate of price appreciation will accelerate dramatically”.

Charles Hayter, co-founder and CEO of CryptoCompare, additionally weighed in on the significance of this value degree, stating:

“As a psychological level, bitcoin hitting $2,000 is an important milestone and will generate further interest that could boost the price further.”

Speaking of curiosity, analysts usually agreed that bitcoin’s rise above $2,000 may spur vital consideration from the media. Hayes supplied comparable sentiment, stating sustained rise above $2,000 would immediate each main monetary media outlet to cowl bitcoin.

In spite of all this visibility, Hayter cautioned that generally, the “lack of sophistication” that goes together with mainstream media protection “can be dangerous as it snowballs momentum.”

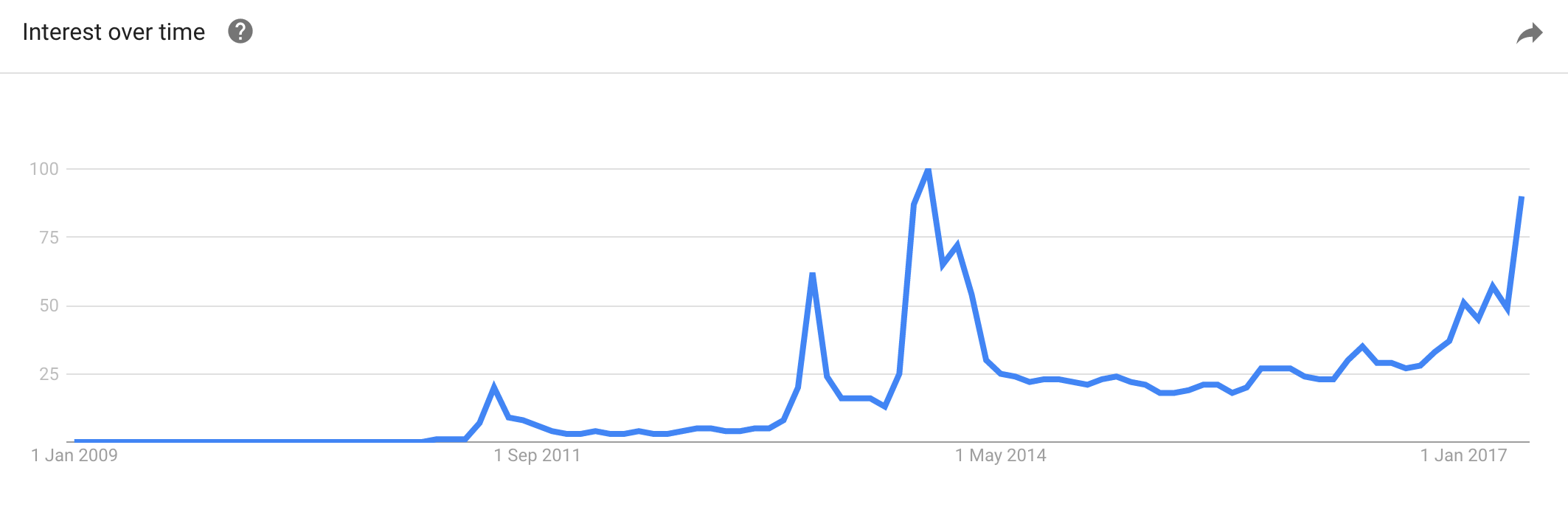

Interestingly sufficient, Google Trends knowledge has so far proven that on-line searches for the phrase “bitcoin” have nonetheless not recovered to the all-time excessive they set in December 2013, however they’re getting nearer. While a determine of 100 represents the best level for these searches, the metric stood at 85 on the time of report.

While many agreed that bitcoin’s rise above $2,000 would spur larger media protection, the elements that drove the currency’s value above this degree appeared a bit extra advanced.

Growing dealer curiosity

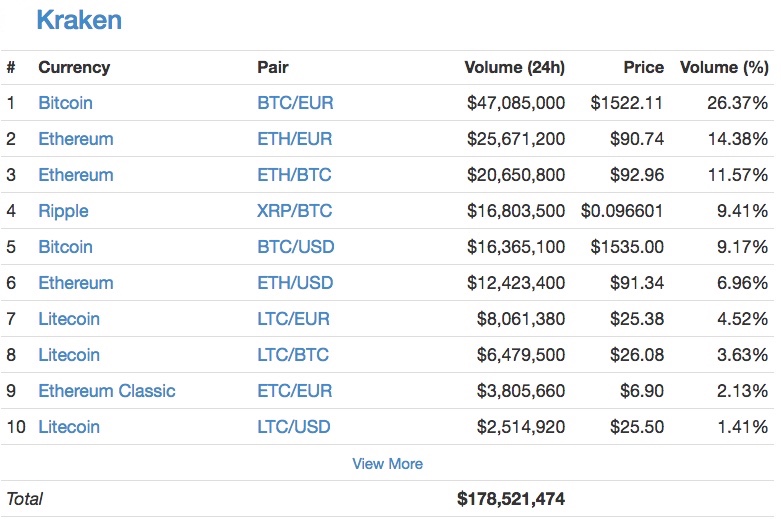

One growth that has coincided with bitcoin’s sharp value positive aspects over the past a number of months is the rising curiosity of merchants, as measured by buying and selling quantity at main exchanges. Earlier this month, each Kraken and Poloniex introduced that they have been experiencing surging transaction exercise.

Kraken indicated that on fifth May, buying and selling quantity throughout all digital belongings surpassed $178m, setting an all-time excessive and beating the prior file by 25%.

Poloniex expressed comparable sentiment, saying in an announcement that:

“We have never seen such enthusiasm for trading blockchain tokens as we have in the past few months. Since January, we’ve seen an increase of more than 600% active traders online and regularly process 640% more transactions than we did merely [four] months ago.”

Another issue that has helped drive bitcoin costs is the rising affect of Japan within the bitcoin markets, the place the expertise is now regulated. The Japanese yen is the only largest currency being exchanged for bitcoin, accounting for greater than 45% of the cash circulate into bitcoin on the time of report, in accordance to CryptoCompare knowledge.

The US greenback got here in a comparatively distant second, making up roughly 30% of the cash flowing into bitcoin, in accordance to further CryptoCompare figures.

This enhance in the usage of the Japanese yen comes after Japan moved to formally acknowledge bitcoin as a authorized technique of fee beginning 1st April. The nation’s lawmakers enacted laws that each categorized the cryptocurrency as a kind of pay as you go fee instrument and likewise precipitated it to fall beneath anti-money laundering and know-your-customer guidelines.

Scaling dilemma fades

Bitcoin costs have even been rising sharply regardless of the cryptocurrency’s ongoing scaling dilemma, an ongoing difficulty with its transaction capability that members of the bitcoin group have been making an attempt to resolve.

Developers may handle this drawback by rising block measurement, rising the variety of transactions that may match into a person block by Segregated Witness, or each. Thus far, the bitcoin community has failed to rally the assist wanted to result in any such adjustments.

Still, bitcoin markets appear unhindered by the scaling dilemma, and Hayes spoke to this growth:

“It appears the scaling issue is forgotten. The positive momentum and publicity continues to attract new capital into bitcoin.”

Rocket icon through Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.