As the U.S. governmental election techniques, it’s worth taking a look at how previous elections have actually affected Bitcoin’s cost. Historically, the U.S. stock exchange has actually revealed noteworthy patterns around election durations. Given Bitcoin’s connection with equities and, most significantly, the S&P 500, these patterns might provide insights into what may take place next.

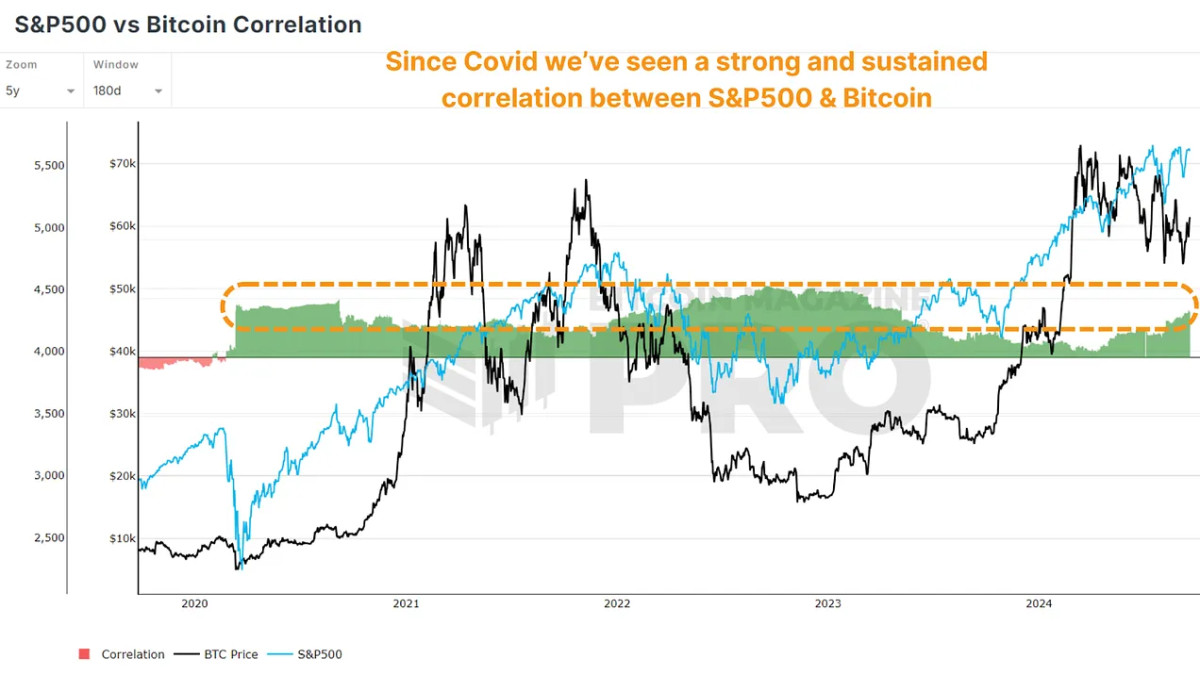

S&P 500 Correlation

Bitcoin and the S&P 500 have actually traditionally held a strong connection, especially throughout BTC’s bull cycles and durations of a risk-on belief throughout standard markets. This might phenomenon might possibly pertain to an end as Bitcoin develops and ‘decouples’ from equities and it’s narrative as a speculative possession. However there’s no proof yet that this holds true.

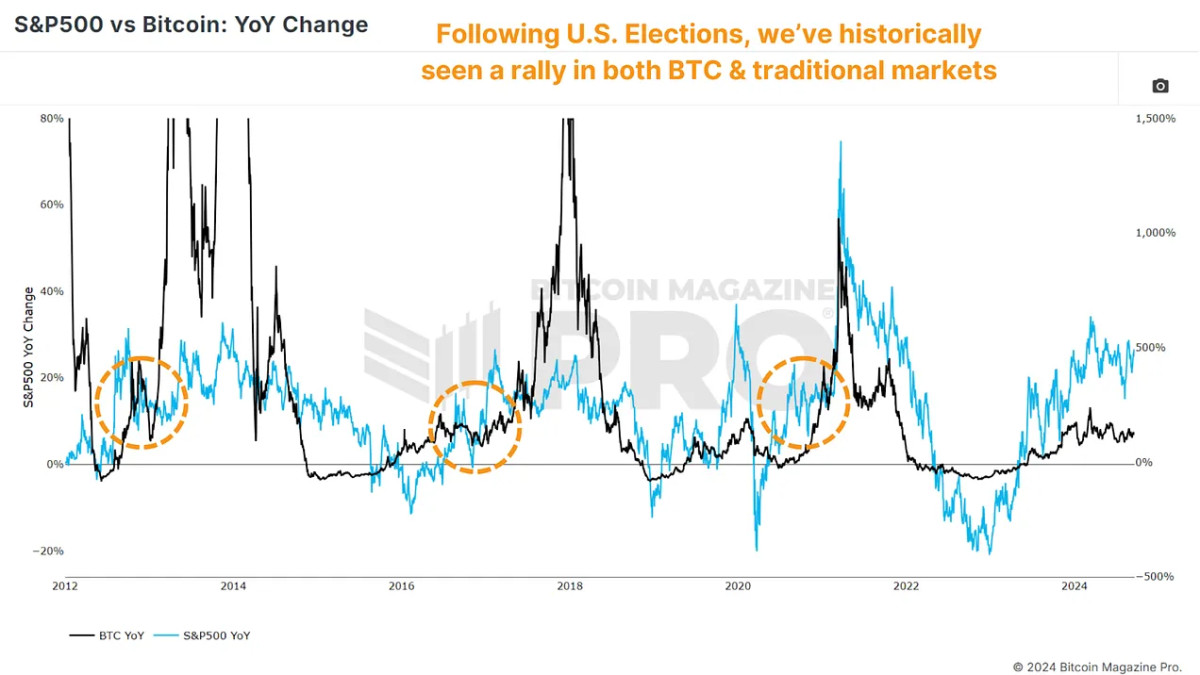

Post Election Outperformance

The S&P 500 has actually generally responded favorably following U.S. governmental elections. This pattern has actually corresponded over the previous couple of years, with the stock exchange typically experiencing considerable gains in the year following an election. In the S&P500 vs Bitcoin YoY Change chart we can see when elections happen (orange circles), and the cost action of BTC (black line) and the S&P 500 (blue line) in the months that follow.

2012 Election: In November 2012, the S&P 500 saw 11% year-on-year development. A year later on, this development rose to around 32%, showing a strong post-election market rally.

2016 Election: In November 2016, the S&P 500 was up by about 7% year-on-year. A year later on, it had actually increased by roughly 22%, once again revealing a considerable post-election increase.

2020 Election: The pattern continued in 2020. The S&P 500’s development was around 17-18% in November 2020; by the list below year, it had actually reached almost 29%.

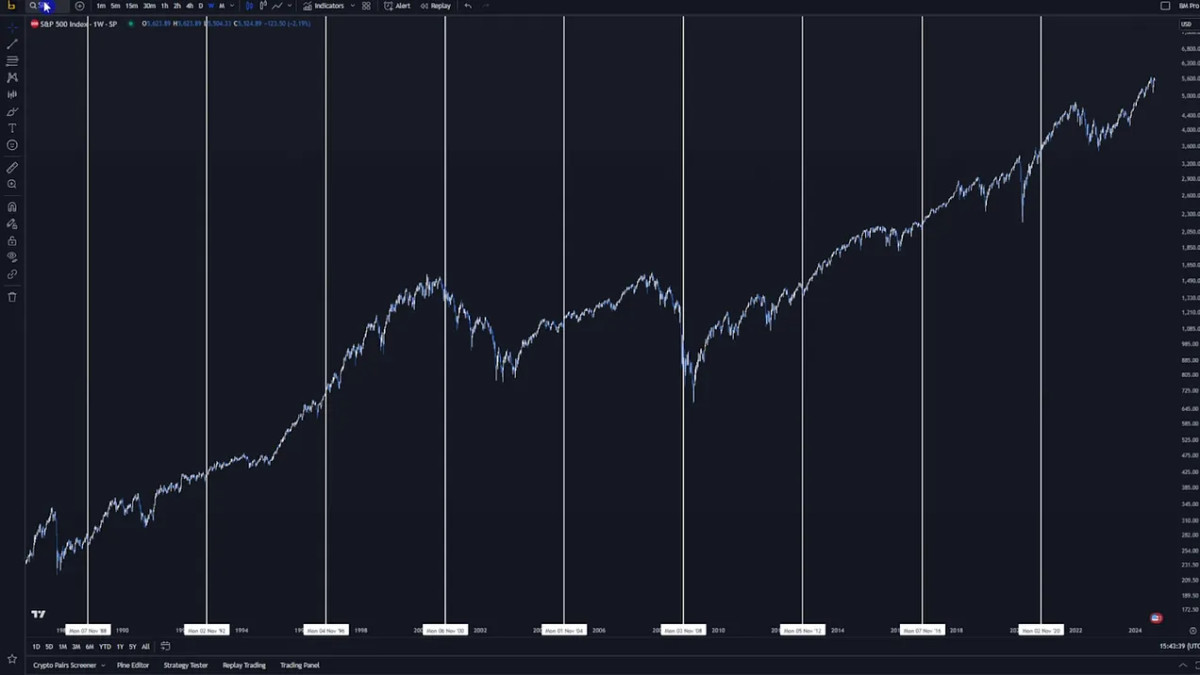

A Recent Phenomenon?

This isn’t restricted to the previous 3 elections while Bitcoin existed. To get a bigger information set, we can take a look at the previous 4 years, or 10 elections, of S&P 500 returns. Only one year had unfavorable returns twelve months following election day (2000, as the dot-com bubble burst).

Historical information recommends that whether Republican or Democrat, the winning celebration does not substantially effect these favorable market patterns. Instead, the upward momentum is more about dealing with unpredictability and increasing financier self-confidence.

How Will Bitcoin React This Time

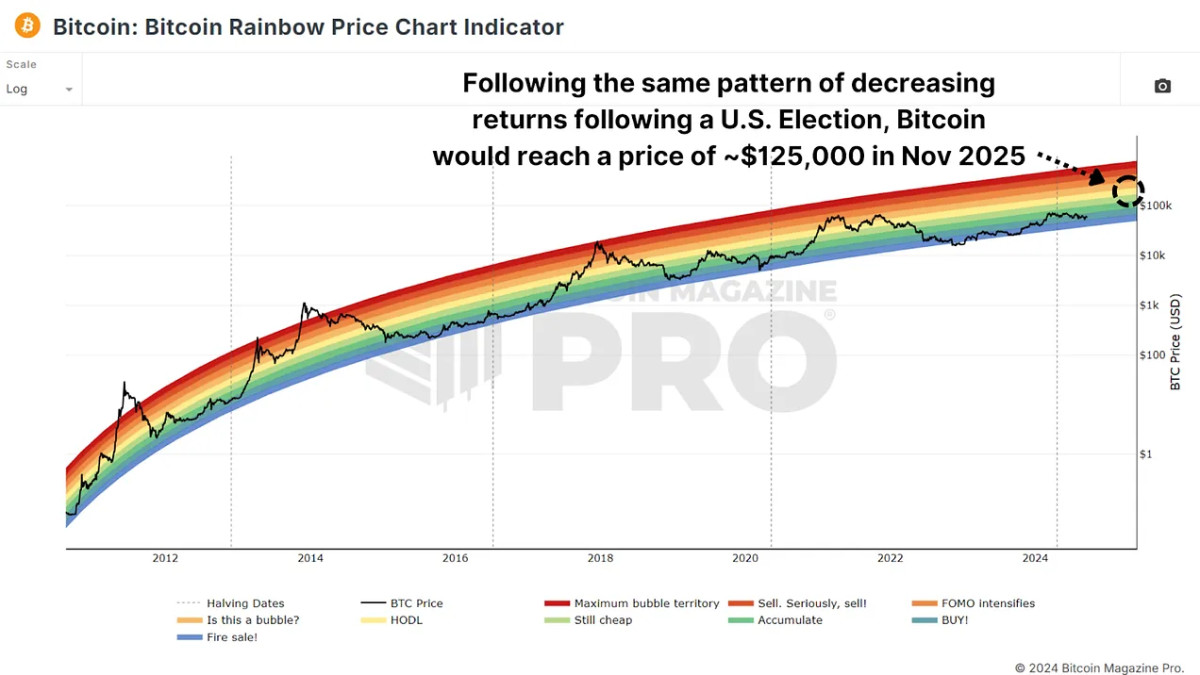

As we approach the 2024 U.S. governmental election, it’s appealing to hypothesize on Bitcoin’s prospective efficiency. If historic patterns hold, we might see considerable cost boosts. For example:

If we experience the exact same portion gains in the 365 days following the election as we performed in 2012, Bitcoin’s cost might increase to $1,000,000 or more. If we experience the like the 2016 election, we might reach around $500,000, and something comparable to 2020 might see a $250,000 BTC.

It’s fascinating to keep in mind that each event has actually led to returns reducing by about 50% each time, so perhaps $125,000 is a reasonable target for November 2025, specifically as that cost and information line up with the middle bands of the Rainbow Price Chart. It’s also worth keeping in mind that in all of those cycles, Bitcoin really went on to experience even greater cycle peak gains!

Conclusion

The information recommends that the duration after a U.S. governmental election is typically bullish for both the stock exchange and Bitcoin. With less than 2 months till the next election, Bitcoin financiers might have factor to be positive about the months ahead.

For a more thorough check out this subject, take a look at a current YouTube video here: Will The U.S. Election Be Bullish For Bitcoin?

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.