Bitcoin Magazine

How Expanding Global Liquidity Could Drive Bitcoin Price to New All-Time Highs

The cost trajectory of Bitcoin is as soon as again making headings, mainly due to emerging global liquidity patterns that are changing financier belief. In a current in-depth analysis, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, provides engaging proof connecting the bullish momentum of the digital possession to the broadening global M2 cash supply. His insights not just brighten the possible future of Bitcoin’s cost however also highlight its macroeconomic significance within a more comprehensive monetary structure.

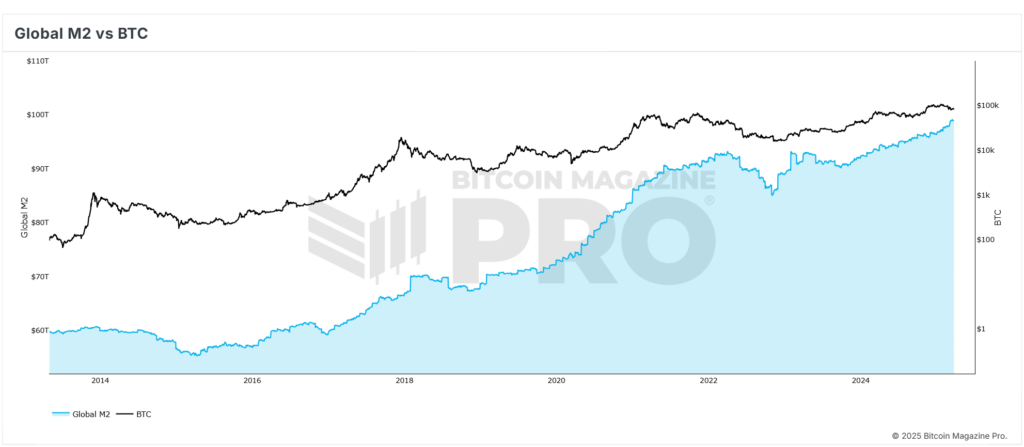

The Correlation Between Bitcoin Price and Global Liquidity

Crosby highlights a notable and constant connection—frequently surpassing 84%—in between Bitcoin’s cost and global M2 liquidity levels. As liquidity increases within the global economy, Bitcoin’s cost typically reacts with upward motion, albeit with a noticeable hold-up. Historical information supports a 56–60 day lag in between financial growth and Bitcoin cost boosts.

This insight has actually just recently manifested as Bitcoin’s cost rebounded from lows of $75,000 to above $85,000. This pattern carefully lines up with the expected healing that Crosby and his group detailed based upon macroeconomic signs, therefore verifying the effectiveness of the connection moving Bitcoin’s cost up.

Understanding the Two-Month Delay in Bitcoin Price Response

The observed two-month hold-up in market action is crucial for understanding Bitcoin’s cost motions. Crosby highlights that modifications in financial policy and liquidity injections do not immediately impact speculative properties such as Bitcoin. Instead, there exists an incubation duration—typically around 2 months—throughout which liquidity penetrates monetary systems and starts to impact Bitcoin’s cost.

Crosby has actually enhanced this connection through numerous backtests, changing timeframes and offsets. The findings suggest that a 60-day hold-up takes full advantage of predictive precision throughout both short-term (1-year) and extended (4-year) historic Bitcoin cost motions. This lag provides a tactical benefit to financiers who carefully keep track of macroeconomic patterns in anticipation of Bitcoin cost rises.

The Influence of the S&P 500 on Bitcoin Price Trends

Further corroborating his thesis, Crosby extends his analysis to conventional equity markets. The S&P 500 displays a robust all-time connection of roughly 92% with global liquidity. This connection boosts the assertion that financial growth substantially affects not just Bitcoin rates however also wider risk-on possession classes.

By juxtaposing liquidity patterns with numerous indices, Crosby shows that Bitcoin’s cost habits is not a separated phenomenon, however rather part of a thorough systemic pattern. When liquidity increases, both equities and digital properties tend to advantage, showing that M2 supply acts as an important indication for timing Bitcoin cost motions.

Projected Bitcoin Price Target of $108,000 by June 2025

To cultivate a positive viewpoint, Crosby makes use of historic fractals from previous booming market to design future Bitcoin cost trajectories. When these patterns are overlapped with existing macroeconomic information, the design recommends a situation where Bitcoin’s cost might retest and possibly surpass its previous all-time highs, targeting roughly $108,000 by June 2025.

This positive forecast for Bitcoin’s cost depend upon the property that global liquidity continues its ascension. Recent declarations from the Federal Reserve suggest that extra financial stimulus might be executed if market stability is threatened—more strengthening possible development for Bitcoin’s cost.

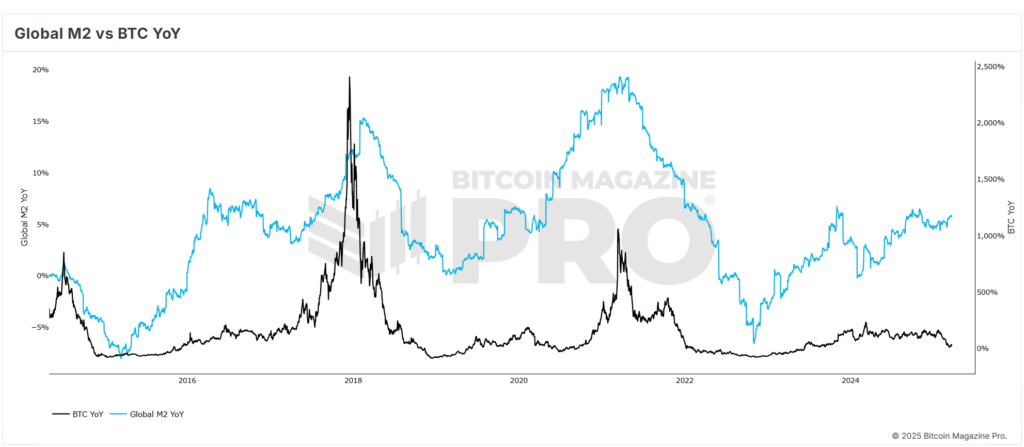

The Significance of the Rate of Liquidity Expansion on Bitcoin Price

While increasing liquidity levels are necessary, Crosby highlights the value of keeping track of the rate of liquidity growth to precisely anticipate Bitcoin cost patterns. The year-on-year M2 development rate supplies a more nuanced understanding of macroeconomic momentum. Although liquidity has actually typically increased, the rate of growth briefly slowed before resuming an upward pattern in current months.

This pattern mirrors conditions observed in early 2017, simply prior to Bitcoin’s entryway into a rapid development stage. The resemblances enhance Crosby’s bullish outlook on Bitcoin and highlight the requirement of vibrant macroeconomic analysis over fixed assessments.

Concluding Thoughts: Preparation for Bitcoin’s Next Price Phase

While possible dangers such as a global economic crisis or substantial corrections within equity markets stay, dominating macroeconomic signs recommend a beneficial environment for Bitcoin’s cost. Crosby’s data-driven approach supplies financiers with a tactical structure to analyze and browse the marketplace efficiently.

For those looking for to make notified choices in an unstable environment, these insights provide actionable intelligence grounded in financial principles, permitting financiers to profit from chances associated to Bitcoin’s cost motions.

For extensive research study, technical signs, real-time market informs, and gain access to to a blossoming neighborhood of experts, please go to BitcoinMagazinePro.com.

This analysis, “How Expanding Global Liquidity Could Drive Bitcoin Price to New All-Time Highs,” initially appeared in Bitcoin Magazine and was authored by Mark Mason.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.