This short article is included in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this short article.

Ordinals have actually been a polarizing phenomenon for the majority of every subcommunity in Bitcoin — other than for miners.

The meteoric increase of the brand-new Bitcoin-native NFT requirement controlled discourse for months as Ordinals flooded blockspace and buoyed deal costs to multiyear highs. According to critics, these deals are, at worst, an attack on Bitcoin that polluted the sanctity of limited blockspace; at best, they are shitcoins, the play-things of bettors that belong on gambling establishment chains like Ethereum.

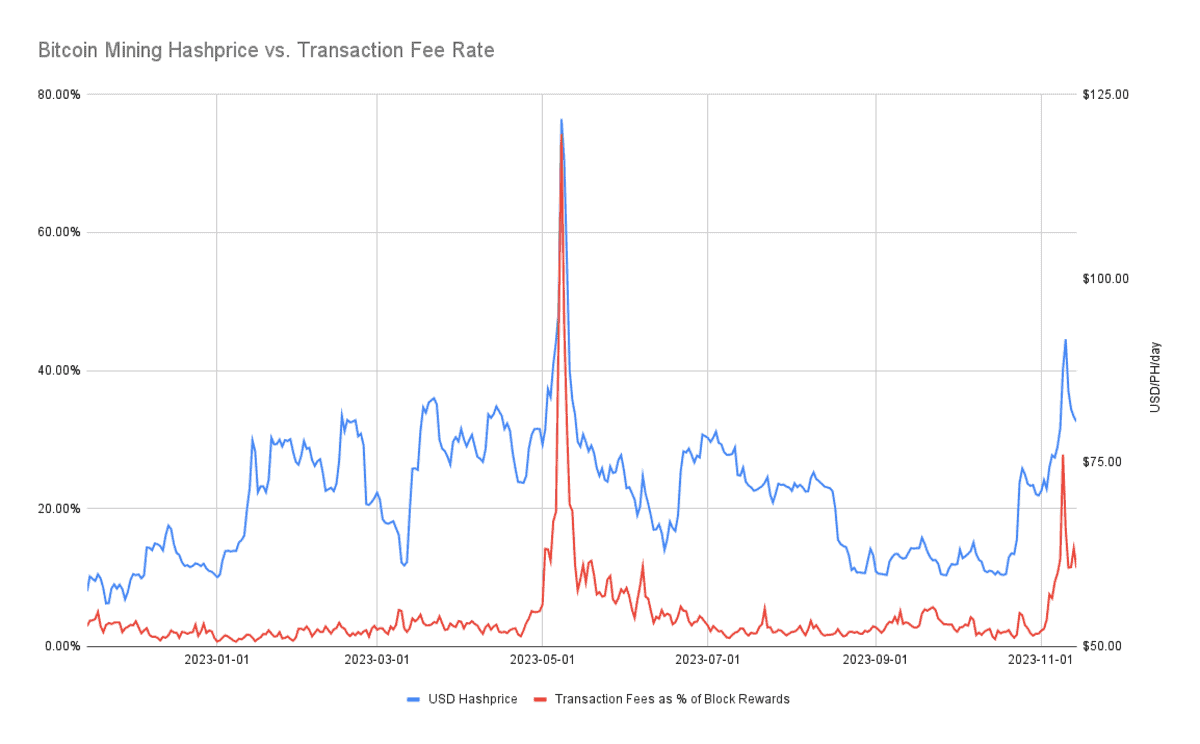

Well, miners don’t offer a shit if they’re shitcoins. They offer a shit about earning money, and Ordinals provided an earnings increase at a time when mining earnings was at among its floors ever. So lots of miners have actually accepted — or at the least, are ambivalent about — Ordinals/engravings, given that they got a much-needed increase to Bitcoin mining success when lots of miners were almost breakeven or unprofitable.

Hashprice is a procedure of the USD (or BTC) quantity miners can anticipate to make from a unit of hashrate (for instance, at $80/PH/day, a miner with 1 petahash of mining rigs — approximately 10 new-gen ASICs like the S19j Pro, for instance — can make $80 daily).

Given their favorable effect on hashprice, Ordinals, a darkhorse technical improvement that couple of might have anticipated in 2015, have actually discovered themselves at the center of conversations relating to Bitcoin mining economics, conversations that are more germane with each block that pulls us closer to Bitcoin’s 4th block aid halving.

I’m not composing this to proselytize anybody into ending up being an Ordinals enjoooyer. I, for one, don’t truly comprehend the appeal. But I do believe that they’re important in the context of Bitcoin’s ever-dwindling block aid, so they’re worth studying to comprehend how they impact blockspace and mining economics — and what advancements like them may indicate in a future where miners survive entirely on deal costs.

WTF is an Ordinal, Anyway?

In NFT parlance, folks utilize Ordinal and engraving interchangeably, however the private terms refer to 2 various elements of the NFT requirement.

An engraving is an art piece or digital media, while an Ordinal is technically the number recommended to an engraving to mark its location in the grand plan of all other engravings. Another method to see it is that the engraving itself is the NFT, while the Ordinal is the number utilized to recognize a specific engraving.

The information for each engraving resides in the Segregated Witness area of a deal. As such, unlike other NFT requirements, the real art, digital media, or information is published straight to Bitcoin’s blockchain. Since the engravings are completely on-chain, you might argue that they are the purest type of NFT offered as they gain from the blockchain’s immutability.

Not All Inscriptions Are Created Equal

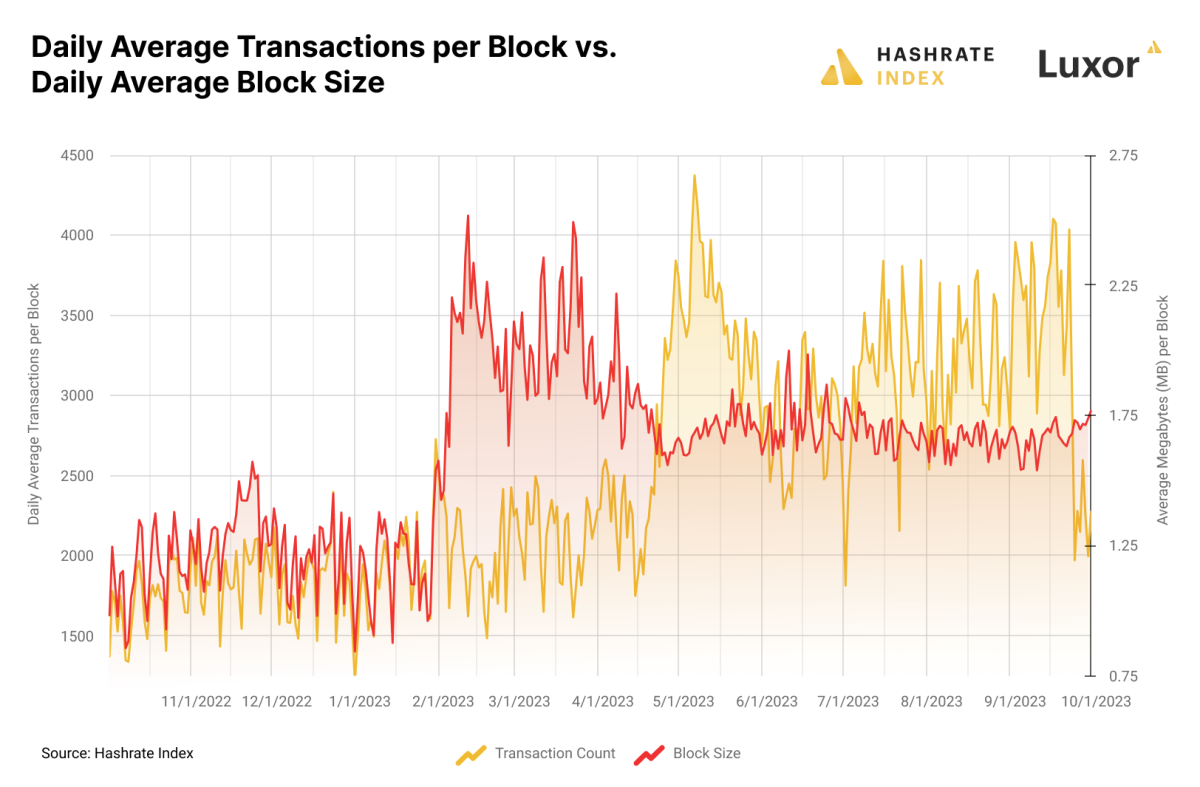

When you comprehend that engravings are real on-chain information, you can value a few of the reviews and issues from critics; if a lot of NFT degens are engraving monkey JPEGs and dickbutts and God-knows-what-else on-chain, then this crowds out financial (and possibly required) deals.

This issue was exacerbated by the reality that the approximate information for each engraving gain from a deal cost discount rate. As a scalability procedure, Bitcoin’s Segregated Witness upgrade customized the deal structure so that the witness information for a personal crucial signature and public secret was moved from the deal hash field to another part of the block. Bitcoin discount rates SegWit information, so it needs less satoshis per byte in deal costs to negotiate. The approximate information for an engraving resides in the SegWit field of a deal, so it’s entitled to the SegWit discount rate. Cue the pitchforks.

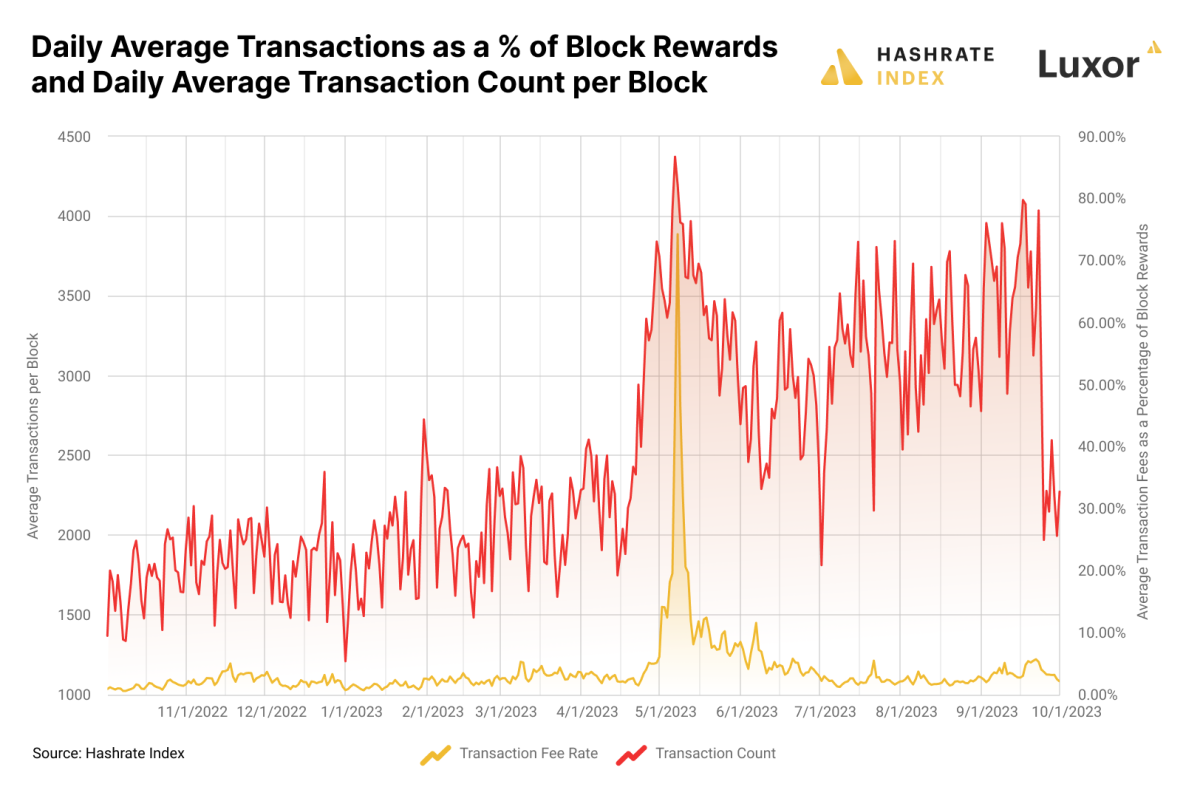

This discount rate is why, in spite of the very first wave of image-based engravings obstructing block area in February/March/April, deal costs did not meaningfully increase; block sizes swelled when trendsetting inscribers flushed the blockchain with countless JPEGs for the very first engravings collections, however these all gained from SegWit’s 4-to-1 information discount rate versus typical deals. Perhaps intuitively, it wasn’t up until less data-heavy, text-based engravings from BRC-20 tokens ended up being the most popular engraving type that deal costs skyrocketed.

So-called BRC-20s (a nod to Ethereum’s own ERC-20 token requirement) are a loose type of token. I state loose due to the fact that they are truly simply Ordinals in a series specified by Bitcoin’s OP_CODE function, where each “token” is itself an OP_CODE deal that specifies the token’s location in the particular BRC-20 series. It goes like this: Someone (God just understands who) releases an OP_CODE deal that specifies the token series’ max supply, ticker, and the minting limitation per deal. Once advertised, anybody with the technical knowledge can mint tokens in the series.

These OP_CODE deals do not gain from SegWit’s information discount rate, so they cost a quite cent more than image-based engravings. But they also have a function that image engravings don’t: the minting function, which brings Ethereum NFT-esque rewards to gathering these engravings. Ethereum NFT series usually have minting agreements where anybody can develop brand-new NFTs in the series by connecting with the agreement. This becomes part of — if not the whole — appeal. Minting an NFT resembles opening a digital pack of Pokémon/baseball/Magic: The Gathering cards — perhaps there’s an uncommon card in this next one!

And while there isn’t always the chance to mint an uncommon BRC-20 (due to the fact that they are all the exact same), there’s the opportunity to mint a lot of NFTs in a hot brand-new series. Why anybody appreciates having ORDI/CUMY/RATS #1 or #100 or whatever, I don’t understand. Perhaps it’s the biggest expression of the higher fool theory yet in Bitcoin. But the reality is, they do, and the minting rewards for BRC-20s precipitated the biggest wave of Bitcoin deal activity ever.

Through a mix of cost wars and the reality that these NFTs don’t gain from the SegWit discount rate, BRC-20s have actually catered a genuine cost banquet for Bitcoin miners, however not precisely in the method you may believe.

Quantifying Transaction Fee Collateral Damage

The bulk of deal cost increases in 2023 has actually not come straight from costs connected with Ordinals; it has actually originated from indirect cost pressure on other deals.

Per information from independent expert Data Always’ Dune control panel, since November 12, 2023, miners have actually generated $70.3 million costs from Ordinals. Seems bigly, however it’s just 19.4% of the $368.2 million in deal costs that miners have actually made in overall given that engravings debuted on December 14, 2022. To put this into additional point of view, there have actually been 40.2 million engraving deals, which relates to 30% of all deal volume given that December 14. So engravings have actually represented one-third of deal volume over the in 2015 however just one-fifth of all costs.

As for the other costs, much of them are the outcome of indirect cost pressure from engravings — that is, costs that do not come straight from engravings themselves, however from the pressure that engravings put in on the typical deal cost required to clear a Bitcoin deal in a sensible amount of time.

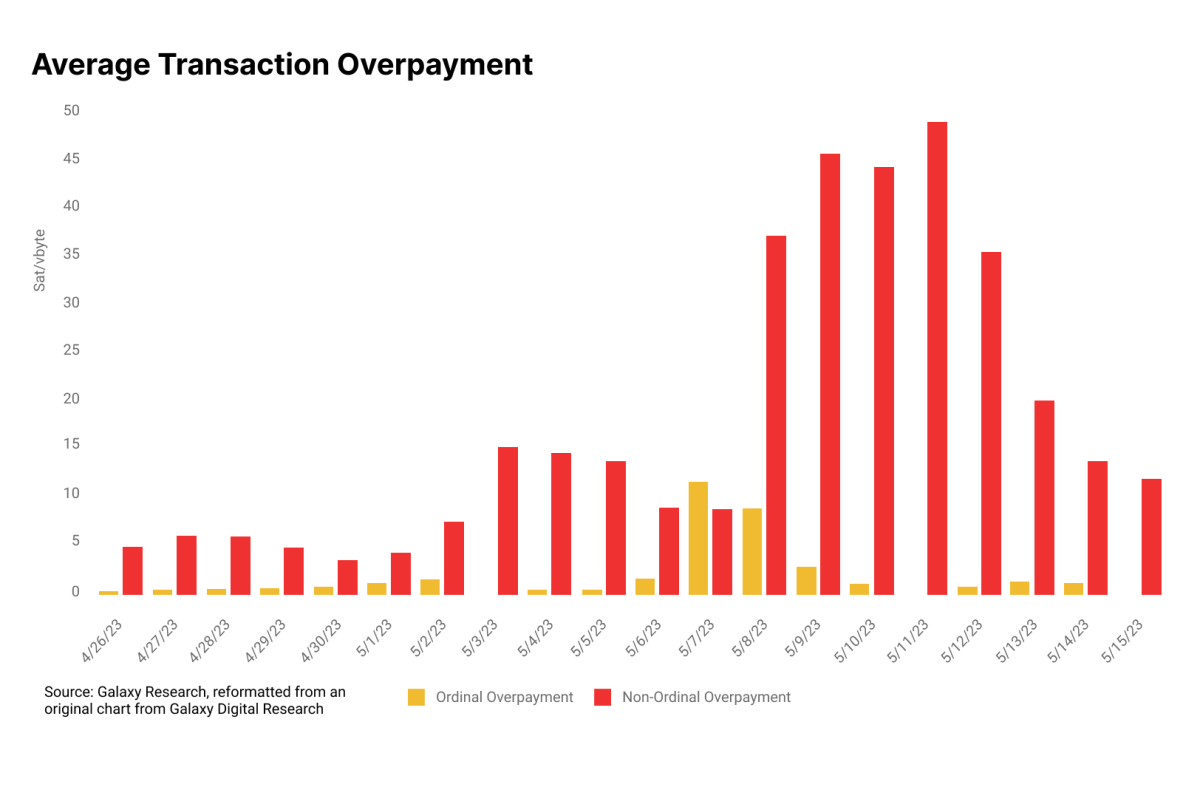

Galaxy Digital Research analyzes this vibrant in a report entitled “Bitcoin Inscriptions & Ordinals: A Maturing Ecosystem”. Rampant engraving activity congests the mempool. This is especially real throughout BRC-20 minting occasions, as the first-come-first-mint incentivizes bidding wars as inscribers weapon to be the initially to mint a series. This raises the flooring for typical deal costs and, as Galaxy Digital Research mentions, speeds up deal cost “overpayment” from numerous transactors. They specify overpayment as any cost in a block that is higher than that block’s mean deal cost. For typical deals, this overpayment might originate from deal cost estimators in wallets or on exchanges or from basic user lack of knowledge relating to deal cost structure and characteristics. Some users might also requirement to speed up deals for any variety of factors, leading to overpayment. For engraving deals, Galaxy Digital Research states that “voluntary overpayment” was prevalent throughout times of high activity and popular engraving mints.

This chart measures overpayment for engraving deals and all other deals to show the characteristics Galaxy Digital Research describes in their report. When Bitcoin’s mempool ended up being backlogged in April and May — the most popular amount of time for engraving activity up until now — a bulk of the deal costs throughout this time in fact originated from user overpayment for monetary deals, not engravings themselves. These users might most likely make it much easier on themselves by not utilizing integrated deal cost estimators with their wallets and exchanges.

Blessing and a Curse

Inscriptions are a true blessing and a curse. They’re a blessing for miners, however they can be a discomfort in the ass for other Bitcoiners, especially those who have to send out deals on the network every day.

That stated, blockspace is a free market. So I don’t have to like Ordinals to acknowledge that it’s not my location to cops somebody else’s costs. Nor is it my location to censor a deal that spends for blockspace on the f(r)ee market. That’s part of the point of a permissionless blockchain, after all: to make deals other individuals don’t desire you to make.

This short article is included in Bitcoin Magazine’s “The Inscription Issue”. Click here to get your Annual Bitcoin Magazine Subscription.

Click here to download a PDF of this short article.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.