After years of offering important material and insights into Bitcoin investing, I’ve invested numerous hours evaluating information and evaluating charts to assist you construct a strong structure for your Bitcoin investment strategy. In this post, I’ll stroll you through my special technique to handling my own Bitcoin (BTC) financial investments, concentrating on a data-driven approach that makes sure impartial decision-making. Whether you’re a skilled financier or simply beginning, these insights can assist you browse the frequently unpredictable Bitcoin market.

Watch the complete video here to see the total breakdown of my Bitcoin investment strategy.

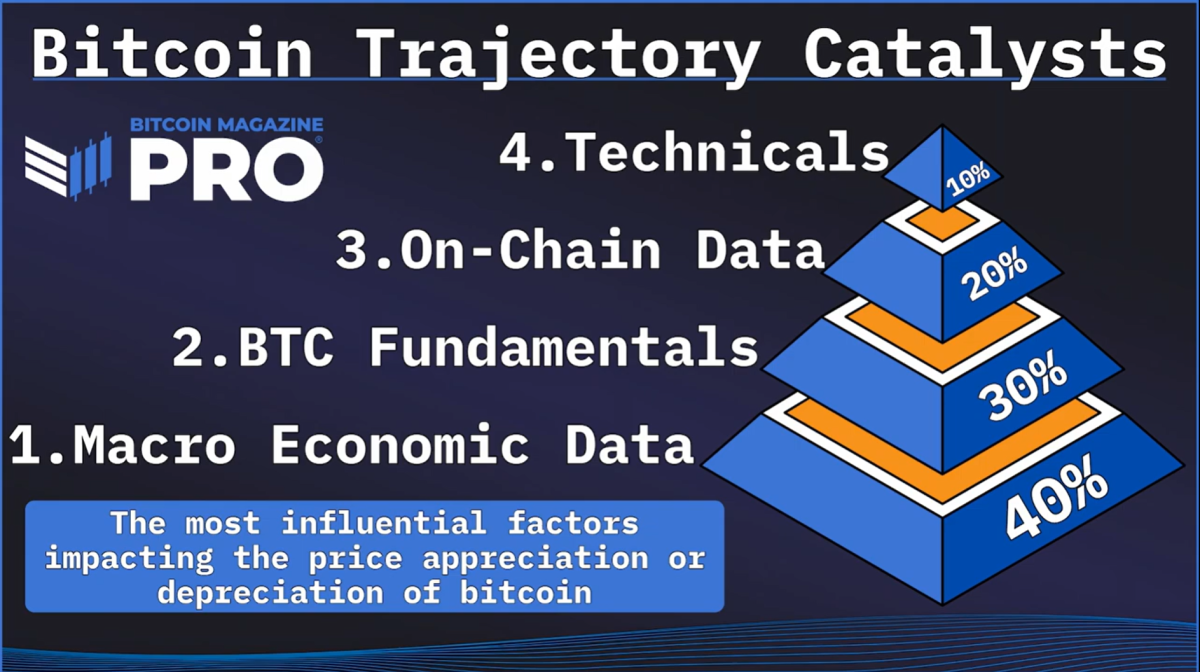

Understanding Bitcoin Trajectory Catalysts

To start with, it is necessary to acknowledge the essential aspects that drive Bitcoin’s rate motion, which I refer to as “Bitcoin Trajectory Catalysts” (BTCs). These drivers fall under 4 primary classifications:

1. Macroeconomic Data: This forms the essential basis for forecasting bullish or bearish patterns in Bitcoin’s rate. By tracking worldwide liquidity cycles, such as the M2 Money Supply, you can expect how modifications in the wider economy will affect Bitcoin.

2. Bitcoin Fundamentals: Key occasions and advancements such as the Bitcoin halving, ETF launches, and legal structures considerably effect Bitcoin’s supply-demand characteristics. Understanding these basics assists in determining long-lasting rate patterns.

3. On-Chain Data: Metrics like Coin Days Destroyed and the 1 year HODL wave offer insights into financier habits and the total health of the Bitcoin network. These indications are especially beneficial for comprehending when to build up or offer BTC based upon market belief.

4. Technical Analysis: Short-term market motions are best caught through technical analysis. Tools such as the golden ratio multiplier and the MVRV Z-score assistance determine overbought or oversold conditions, making them vital for timing trades.

The Power of Confluence in Investing

A crucial element of my strategy is discovering confluence amongst these various metrics. When several indications from various classifications line up, they offer a more powerful signal for making buy or offer choices. For example, when macroeconomic information recommends a beneficial environment for Bitcoin, and technical indications validate an uptrend, the likelihood of a effective trade boosts considerably.

To enhance this procedure, I utilize the Bitcoin Magazine Pro API, which provides sophisticated analytics and notifies. This tool permits me to keep an eye on the marketplace effectively without continuously viewing the charts, making it possible for data-driven choices that lower the threat of psychological trading.

Scaling In and Out of Bitcoin Positions

One of the most tough elements of Bitcoin investing is choosing when to go into or leave the marketplace. Rather than making all-or-nothing relocations, I advise scaling in and out of positions. For example, if technical indications indicate an overbought market, think about setting a routing stop loss instead of offering your whole position instantly. This technique permits you to capture extra gains if the rate continues to increase while safeguarding your earnings.

Similarly, when collecting Bitcoin throughout market slumps, set progressive buy levels to make the most of possible rate rebounds. This approach increases the probability of purchasing near the marketplace bottom and selling near the peak, enhancing your investment returns gradually.

The Importance of Patience and Discipline

Investing in Bitcoin needs a disciplined technique. Patience is essential, as the marketplace can be unpredictable and unforeseeable. By sticking to a distinct, data-driven strategy, you can prevent the risks of psychological decision-making and enhance your possibilities of long-lasting success. Whether you trade often or choose a more passive investment technique, it’s important to customize your strategy to your private objectives and run the risk of tolerance.

Conclusion

By integrating a variety of metrics into your Bitcoin investment strategy, you can get a more extensive understanding of the marketplace and make notified choices. Remember, the objective is to produce a strategy that works for you, whether that suggests concentrating on macroeconomic information, on-chain metrics, or technical analysis.

For more thorough material like this, subscribe to our YouTube channel where I routinely share analysis, insights, and methods for Bitcoin investing. Don’t forget to turn on alerts so you never ever miss out on an upgrade!

Additionally, if you’re major about enhancing your Bitcoin investment strategy, go to BitcoinMagazinePro.com for gain access to to over 150 live charts, customized indications, thorough market reports, and more. With a membership, you can cut through the sound and make data-driven choices with self-confidence.

By following these methods, you’ll be much better geared up to browse the intricacies of Bitcoin investing with a well-rounded, data-driven technique. Remember, the secret to success in this unpredictable market is not simply understanding however also the discipline to use that understanding regularly.

So, take the next action in your investing journey:

- Watch the complete video to get a comprehensive breakdown of these methods.

- Subscribe to the YouTube channel for routine updates and skilled insights.

- Explore Bitcoin Magazine Pro to gain access to effective tools and analytics that can assist you remain ahead of the curve.

Invest sensibly, remain notified, and let information drive your choices. Thank you for reading, and here’s to your future success in the Bitcoin market!

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.