A bond buying and selling platform constructed on high of Hyperledger’s Sawtooth Lake distributed ledger was made open supply this week, alongside a launch of a demo of the expertise.

The challenge, first introduced in September 2016, was designed to exhibit how bond buying and selling and settlement will be streamlined utilizing distributed ledgers. Created in partnership with the R3 consortium and eight taking part banks, the working proof-of-concept has now additionally been displayed as a public demo on Sawtooth’s web site.

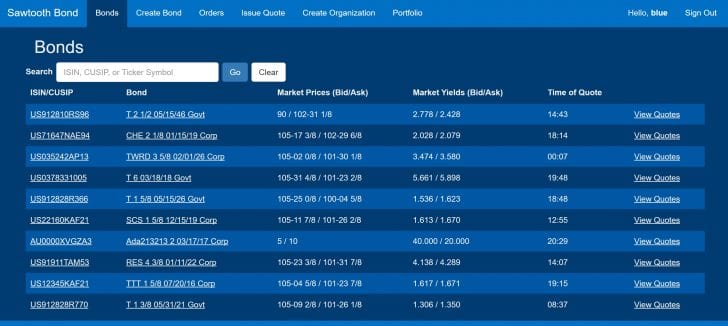

The no-frills platform makes use of a blockchain to trace and categorize transactions together with holdings, receipts and settlements.

Also featured is a portfolio-tracking part that lists the title, coupon charge and principal values of bonds held on a person’s particular person account, and a search permitting customers to search for bonds by CUSIP code, yield and worth.

The open-source code for the proof of idea can also be now listed on GitHub for anybody to make use of. However, the web page states that the platform wants additional funding earlier than it may be taken into manufacturing.

Trading chart picture through Shuttertsock; demo photos through Sawtooth/Intel

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.

1 thought on “Hyperledger Bond Trading Platform Goes Open Source”

Thanks for sharing your thoughts on hyperledger. Regards

Join to get latest updates on Bitcoins