The newly launched Enterprise Ethereum Alliance (EEA) may not be as aligned as its title suggests.

Launched in February, the group of ethereum startups and enterprise establishments goals to leverage giant company funding in the private ethereum blockchain in a approach that additionally strengthens the general public blockchain. To share extra concerning the present state of EEA, in addition to its course going ahead, a number of members of the group gathered on the the Rise fintech accelerator in New York.

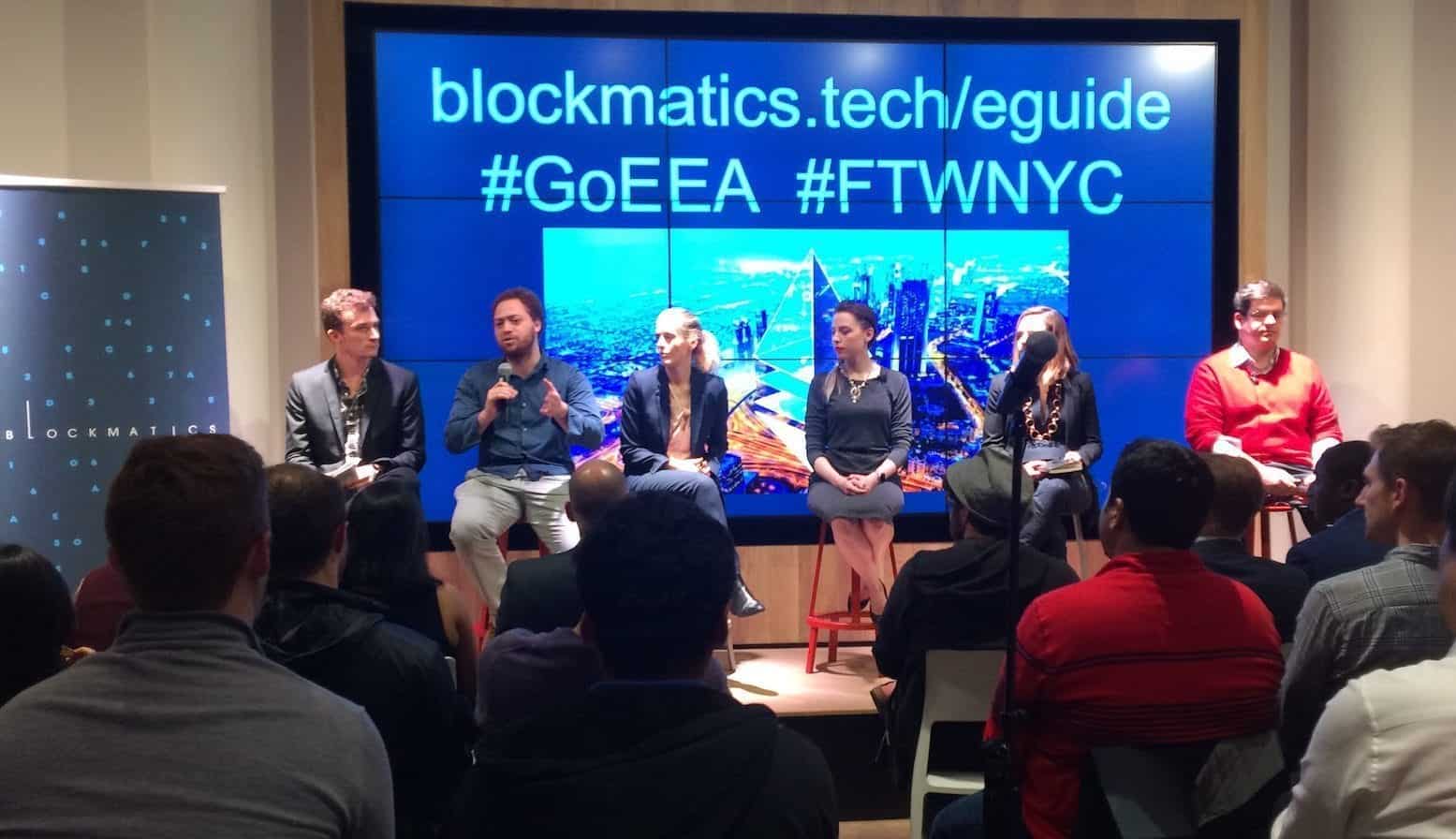

At the occasion, hosted by New York analysis and training agency Blockmatics, a panel consisting of representatives from JP Morgan, BNY Mellon, ConsensSys, Monax and BlockApps offered perception into the complexities of forming consensus with so many disparate pursuits.

The most heated a part of the night concerned dialogue of funding by way of cryptographic token gross sales, often known as ‘initial coin offerings’ (ICOs).

In response to a query from the viewers about the best way to conduct an ICO in a reliable approach, Monax COO and basic council Preston Byrne doubled-down on his well-known critical stance of the mannequin, whereas one other panelist defended it and one even did the blockchain equal of pleading the Fifth.

‘Dumb cash’

Though it appears potential to craft crypto tokens in a approach that may stop them from being categorized as securities (and therefore coming beneath extra stringent controls), the top result’s related in that they let companies increase cash for initiatives by means of buyers.

Byrne’s problem with the ICO mannequin is that it’s regularly utilized by teams who’ve little greater than a white paper to point out the potential buyers, and who hardly ever have confirmed market demand for his or her product.

Byrne stated:

“They take a startup’s incentives as a model and turn it on its head. Which is, they’re supposed to produce some product, they’re supposed to build a business.”

Instead, he argued, those that use ICOs to boost cash are “exploitative, abusive” in turning to what was referred to as “dumb money” a number of occasions all through the evening – a reference to individuals who do not absolutely perceive what they’re investing in.

“[T]hey have no redeeming characteristics whatsoever,” Byrne stated, describing the dangers of taking part in an ICO, warning:

“May god have mercy on the souls of those who invest in them.”

Global motion?

On the opposite facet of the talk, ConsenSys govt director of enterprise and social affect, Vanessa Grellet, heralded ICOs as a progressive departure from extra conventional enterprise capital constructions.

Though ConsenSys – a startup constructing decentralized purposes on ethereum – itself isn’t straight funded by an ICO, it has benefited from ethereum’s unique token sale, which might be thought of the success story and progenitor of the idea.

Grellet cited the controversial ICO of the ConsenSys ‘spoke’ Gnosis, in which a $12m increase gave the agency a valuation of about $300m primarily based on unsold tokens, for example of a “very successful” implementation of the funding automobile.

Stating that she believes regulation round token gross sales will “relax itself” to bear in mind the brand new funding mannequin, Grellet added:

“It will grow. It’s a global movement, it’s not going to stop and it’s a wonderful way to get your startup going.”

Nothing to see right here

Perhaps indicative of the totally different methods employed by the startups and the enterprises concerned with the EEA, each panelists representing enterprise banks – Amber Baldet, JP Morgan’s blockchain program lead, and Allison Paz, a fintech senior analyst at BNY Mellon – remained silent on the difficulty.

Similarly, Kieren James-Lubin, founding father of BlockApps (one other ConsenSys spoke), merely stated: “I’m not saying anything.”

While the temper in the room was often heated, the group exited stage left in what appeared like good spirits.

Before leaving, Byrne jokingly referred to as himself the “problem child” of the EEA, and additional described a collection of different inside debates surrounding the mechanism by which consensus must be achieved and extra.

He additional defined that the discussions had been all a part of the conventional rising pains of such a gaggle and would possible be resolved over time.

He concluded:

“It’s a question of everyone getting to know each other.”

Image by way of Michael del Castillo for CoinDesk

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.