This article highlights findings from CoinDesk Research‘s new Q1 2017 State of Blockchain report, increasing on ICO and VC funding in Q2.

Click here to view the slides in your browser.

Click here to download the slides as a PDF.

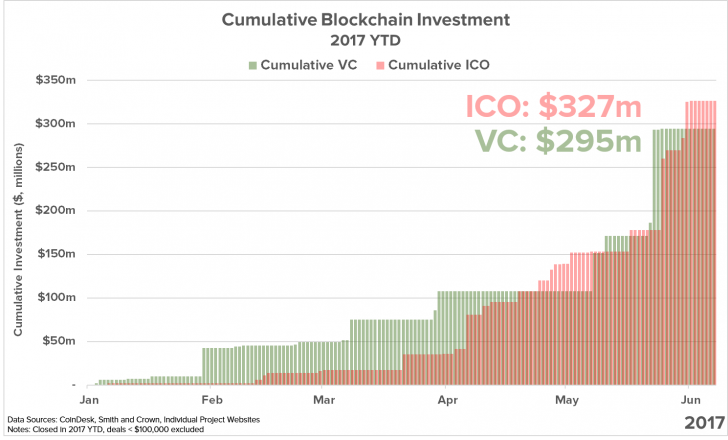

For the primary time in the know-how’s quick historical past, blockchain entrepreneurs are actually elevating more cash by preliminary coin choices (ICOs) than conventional enterprise capital investments.

So far in 2017, blockchain entrepreneurs have raised $327m by ICO choices, a determine that now exceeds the $295m raised by VC funding, in response to CoinDesk information.

Analysis exhibits the event was spurred by huge positive aspects in Q2, as entrepreneurs raised $291m by ICOs, in comparison with simply $187m in conventional funding over the identical interval.

Overall, the totals are a far cry from 2016, when the nascent funding mechanism accounted for lower than half of the practically $500m of venture capital invested into startups. In the first quarter of 2017, for instance, ICOs raised to slightly below a third of entities searching for VC funding.

In the months since, nonetheless, this pattern has reversed with ICO funding totals rising over 800% and hovering previous enterprise capital funding.

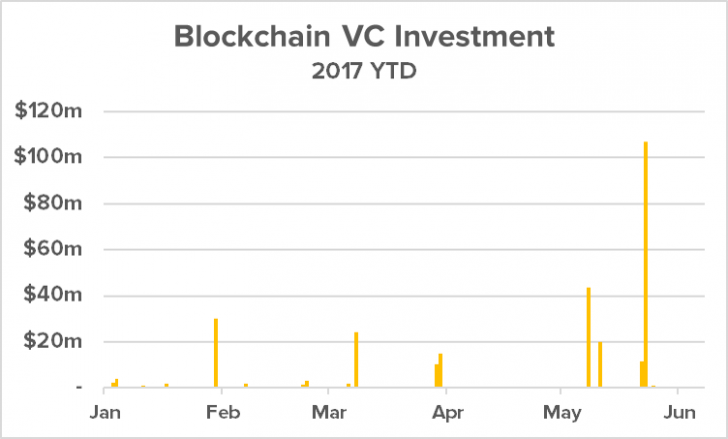

The second quarter has seen lower than 10 enterprise capital offers up to now.

More than 80% of that funding was contributed by two offers: bitcoin mining chip maker Canaan ($43.6m) and distributed ledger consortium R3 ($107m).

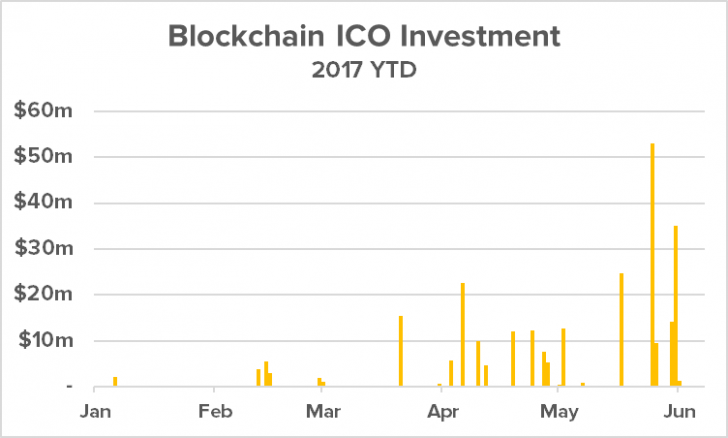

By comparability, greater than 20 ICOs have closed up to now in the second quarter, with over 10 exceeding $10m (and quite a few promoting out in simply seconds or with massive valuations.)

ICO funding into early-stage blockchain tasks has now totaled greater than enterprise capital, the first funding supply for the business in yearly prior.

The takeaway

Making sense of the info and its influence, although, could be tougher.

While they’re usually in contrast, it might not be the case that gross sales of blockchain-based tokens – which in a way monetize a startups community effort (and distribute possession and affect to the widest viewers doable) – will change conventional enterprise capital, designed to allow buyers to purchase a share of an organization’s fairness (with no actual draw back to a restricted group of holders).

Already rising are plenty of startups (Brave, Civic, Kik) which have each conventional VC funding and have issued a type of token, although its not clear that this hybrid mannequin will show in the end impactful.

Whether it’s by token gross sales and tasks supported largely by the retail public from the beginning, institutional buyers who start to dominate ICO rounds or some hybrid structure, the area is large open for innovation and evolution.

Further, the proliferation of latest decentralization software platforms and impartial blockchains has added further issue to surveying the universe of tokens, as buyers should not solely analyze the applying or system (like augur or golem), but in addition the bottom protocol or infrastructure layer (like ethereum, waves or lisk) in quite a few circumstances.

Still, with confirmed demand and curiosity from each entrepreneurial and investor audiences and restricted regulatory steering, ICOs may proceed to achieve steam as a fundraising mechanism.

How the constructions, valuations and legalities evolve is a a lot bigger query, however undoubtedly the continued and rising wave of token gross sales will focus the highlight on every of those questions and extra.

View CoinDesk Research for the complete Q1 2017 State of Blockchain and ICO Spotlight Study.

Disclosure: CoinDesk is a subsidiary of DCG, which has an possession stake in Civic and Brave.

Horse race picture through Shutterstock

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.