IDEX, the supposedly decentralized change, plans to begin blocking merchants who reside within the state of New York. The choice units an alarming precedent for decentralized exchanges (DEX), which have historically given brief shrift to regional laws of their pursuit of censorship-resistance.

World’s Largest Censorship-Resistant

DEX Starts Censoring

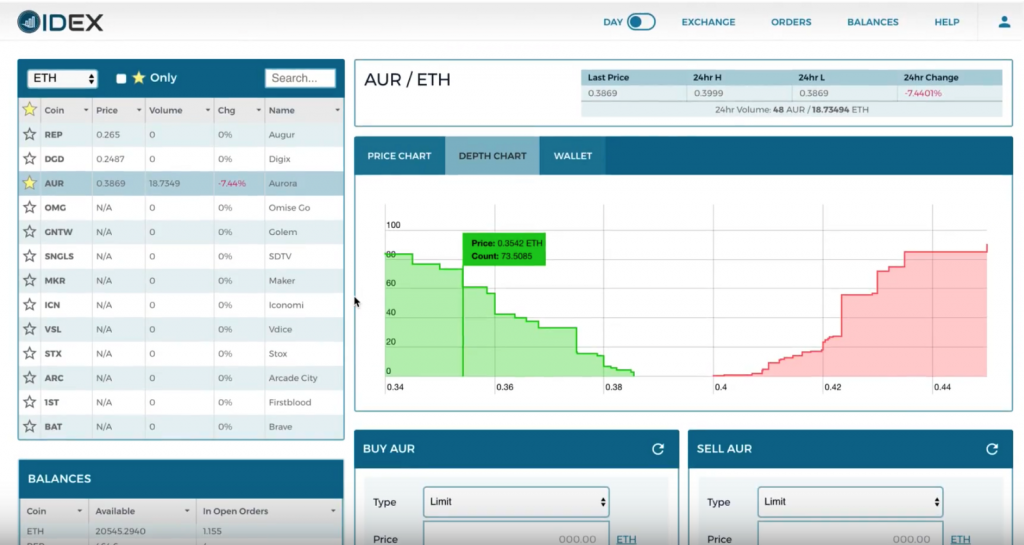

With 24-hour buying and selling quantity of 5,000 ETH, IDEX is seven instances bigger than its closest competitor, Forkdelta. The change does a regular commerce in ERC20 tokens, with quant (QNT) and midas protocol (MAS) forming its two pairs over the past 24 hours. However, as of tomorrow (Oct. 25), New Yorkers won’t be able to entry these or any of the a number of hundred different tokens listed on the platform.

***Notice: #IDEX will start blocking new orders from customers with New York State IP addresses on Thursday, October 25th (6pm UTC). Cancels and withdrawals will stay lively.

— Aurora (IDEX) *Not Giving Away ETH* (@Aurora_dao) October 24, 2018

The choice to dam merchants within the state has sparked protests all through the cryptocurrency neighborhood. It is customary for centralized exchanges to dam residents of sure areas, with New York the state mostly blacklisted on account of its terribly restrictive cryptocurrency laws. For a decentralized change to pay such shut consideration to the whims of New York lawmakers is stunning, nevertheless, particularly since IDEX incorporates no fiat currency pairs, safety tokens, or different devices that may be of curiosity to regulators.

Decentralization’s Death by 1,000 Cuts

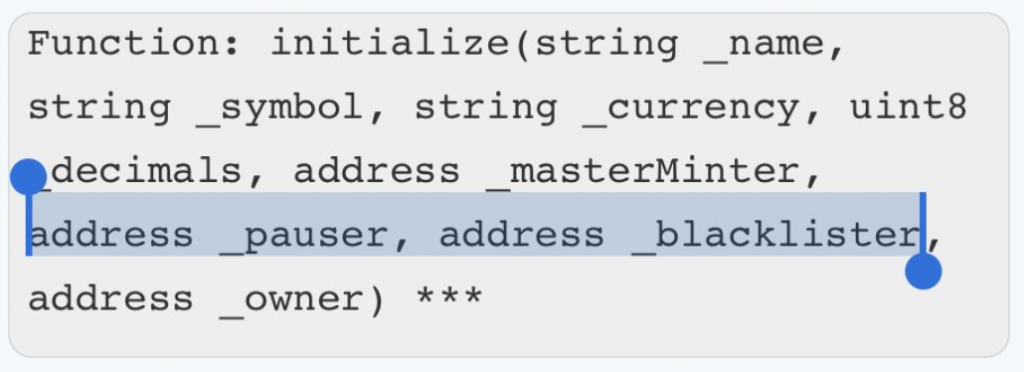

To proponents of decentralized currencies and the monetary freedom they bring about, IDEX’s choice to begin blacklisting is merely the most recent signal of the foundations of cryptocurrency being steadily eroded. Cryptocurrency exchanges blocking deposits which have handed by means of coin mixers. Japanese platforms refusing to record privateness cash. Binance hiring legislation enforcement’s favourite blockchain forensics agency, Chainalysis. Centralized Coinbase itemizing a centralized stablecoin (USDC) that incorporates a backdoor enabling account balances to be frozen at any time.

New York’s notoriously restrictive Bitlicense, which was liable for choking innovation within the cryptocurrency house in 2014, has been used as a cudgel to beat small gamers into submission. The Coinbases of the world, who will pay to play, have the capital to foyer lawmakers and appease officers from the U.S. Securities and Exchange Commission, whereas the remainder of the pack should both enlist a military of legal professionals or reduce their losses and keep away from the state of New York on ache of prosecution. The hatred many throughout the house really feel in the direction of the Bitlicense solely intensified when its chief architect, Benjamin Lawsky, joined the board of Ripple in 2017.

It’s unclear whether or not IDEX was pressured into excluding New York merchants, or whether or not the platform’s operators elected to blacklist them out of warning. What is evident is that when a trustless, Panama-based change is pandering to the whims of New York lawmakers, there’s something sorely flawed with the decentralized dream that cryptocurrency customers have been offered.

What are your ideas on IDEX banning New York residents? Let us know within the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.