This is a viewpoint editorial by Logan Chipkin, an expert author who produces instructional material about Bitcoin and other subjects.

In “The Fiat Standard,” financial expert Saifedean Ammous argues at length that the United States federal government has actually been propagandizing the masses into picking “cheap industrial substitutes” and “massively reducing (its) meat consumption” considering that a minimum of 1916.

As Ammous composed:

“…the ADA (American Dietetics Association) is responsible for formulating the dietary guidelines taught at most nutrition and medical schools worldwide, meaning it has for a century shaped the way nutritionists and doctors (mis)understand nutrition. The astonishing consequence is that the vast majority of people, nutritionists, and doctors today think that animal fat is harmful, while grains are healthy, necessary, and safe!”

In other words, despite the fact that a meat-centered diet plan transcends to a grain-centered one, the federal government and its quasi-private partners prospered in encouraging countless individuals into selecting the latter.

Ammous raises the subject of dietary standards as simply one example of how a fiat basic misshapes a market, however there’s another lesson in this story that Bitcoiners need to come to grips with:

Even if your item is the very best on the marketplace, federal governments (and other entities) can spreading out stories that encourage residents to select an inferior option.

If it occurred with food, it might occur with cash.

A CBDC Punch-Counterpunch

On July 10, 2023, Karin Strohecker released a post in Reuters entitled, “Twenty-Four Central Banks Will Have Digital Currencies By 2030, Survey Shows.” Apparently, a couple lots reserve banks have actually been making “great” development in their advancement of reserve bank digital currencies (CBDCs). Strohecker composed that these reserve banks have actually been “working on digital versions of their currencies for retail use to avoid leaving digital payments to the private sector (emphasis added) amid an accelerating decline of cash.”

This supposed inspiration behind CBDCs has actually been brewing for a while — in August 2022, the European Central Bank (ECB) launched a report called “Towards The Holy Grail Of Cross-Border Payments.” In it, the authors compared the benefits and demerits of numerous technological executions of a cross-border payment service that may be “immediate, cheap, universal and settled in a secure settlement medium.” Of the prospects they thought about, they concluded that “Bitcoin is least credible” which “the interlinking of domestic instant payment systems and future CBDCs, both with a competitive FX conversion layer” are the 2 most trustworthy services.

While the ECB excluded any remark about the threats that CBDCs position to residents’ personal privacy and sovereignty, River Financial reacted with a report of its own. Spearheaded by River’s Sam Wouters, this report does describe the open hole in the ECB’s argument for CBDCs, in addition to the technological barriers that Bitcoin should get rid of if it’s going to be embraced worldwide.

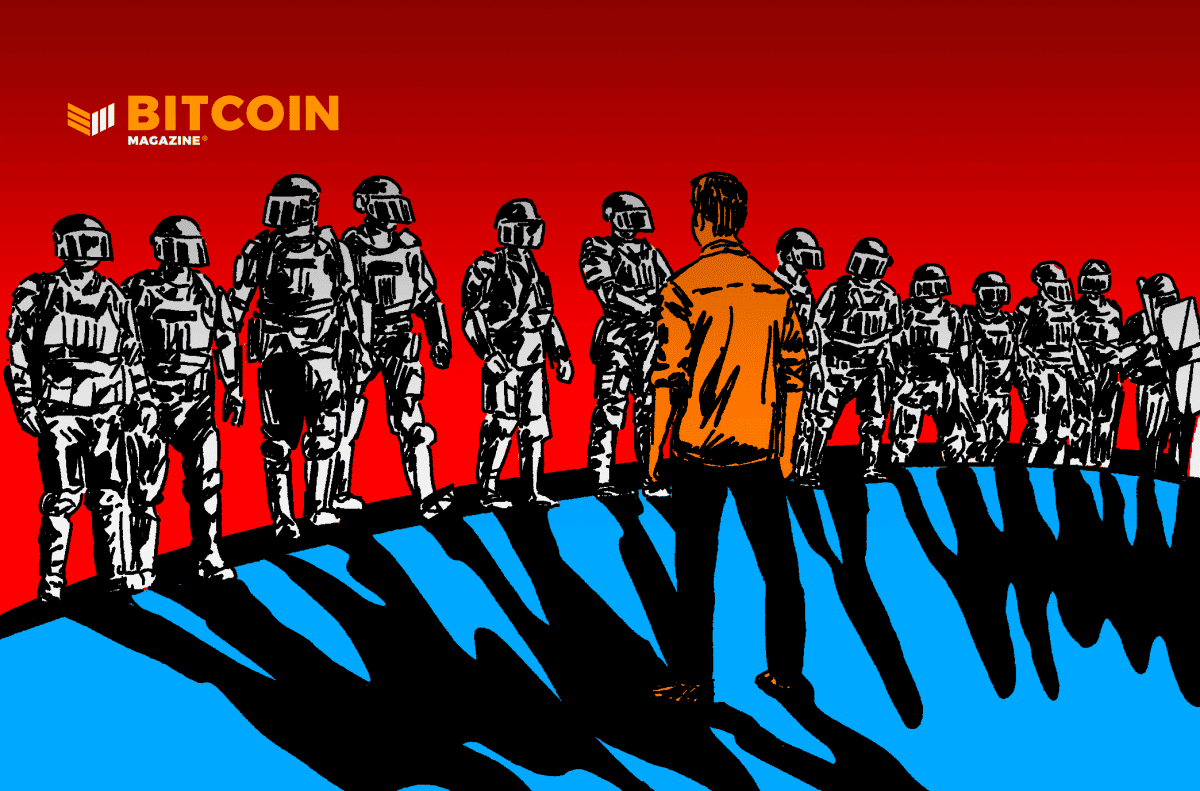

Readers can evaluate the technical and quantitative arguments of both ECB and River Financial on their own — my function in raising this punch-counterpunch is that the fight in between freedom-money and tyranny-money is not one that we will win by default, which it’s as much a fight for hearts and minds as it is for item supremacy. Much like the propaganda project that encouraged individuals to change from much healthier diet plans to those that the federal government chosen, reserve banks are imposing their finest words, videos and other marketing methods to persuade individuals that CBDCs transcend to Bitcoin.

And, in the end, their success is possible.

Understanding The Education Process

We understand that Bitcoin resolves mankind’s lots of financial issues far much better than CBDCs do. We acknowledge the havoc that widespread inflation wreaks on countries. We comprehend that doing not have a shop of worth is the reason for many anti-civilizational habits. But that’s inadequate. If others don’t comprehend the fiat origins of these issues, they don’t stand an opportunity of valuing Bitcoin as their service. Whether or not reserve banks acknowledge the value of this understanding in the fight over the future of cash, they’re definitely taking every chance they can to spread out concepts that press Bitcoin to the borders and make CBDCs extensive reputation.

“Bitcoin bad, CBDCs good,” individuals believe. And that’s all reserve banks require, the inability of their item be damned.

As Wouters appropriately mentioned in his report:

“Great strides have been made in education, but if Bitcoiners who are less experienced in education want to accelerate adoption, they would benefit from gaining a deeper understanding of the education process to take ownership of it and become more effective. This starts by understanding the gap between their perspective and knowledge and that of the recipient… (S)ome people inside the Bitcoin space are not aware enough of how difficult it is for the average person to go through this journey.”

As much as Wouters heroically discusses the “how,” “what,” and “why” of the technological enhancements that will assist Bitcoin accomplish extensive adoption, none of these compares individuals’s concepts about cash. Even if Bitcoin ultimately ends up being as simple to utilize as charge card or money, the masses might still decline it in favor of CBDCs for purely-ideological factors. Grain will have beat meat as soon as again.

This is no factor to anguish. Bitcoin isn’t unavoidable, no. But success is possible, and its fate is mostly figured out on the ideological battleground. The space in between our inmost description of financial economics and many people’s views on the topic is large. The exact same opts for the issues that fiat cash continues to trigger, the risks of CBDCs, and how and why Bitcoin is a remedy for the majority of our cash issues.

The instructional effort prior to us is huge, however, in the face of the opponent’s propaganda, needed. And it’s thrilling — billions of individuals will find out about the best civilizational fight they hadn’t even understood was taking place right under their noses.

Our war is an ideological one. Bitcoin doesn’t need to suffer the exact same fate as meat — and the commercial sludge that is CBDCs can die in the sewage systems of history. We have encouraging to do.

This is a visitor post by Logan Chipkin. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.