Indian crypto exchanges are innovating, introducing brand-new items and enhancing services for their users, regardless of the nation’s regulative unpredictability and unsolved banking limitations. Meanwhile, the Indian crypto neighborhood continues its efforts to persuade the federal government that the draft costs to prohibit cryptocurrencies is flawed, calling for positive regulation rather.

Better Trading Environment

Undeterred by regulative unpredictability and a difficult banking restriction, 5 crypto exchanges in India exposed their brand-new jobs recently. Crypto exchange Coindcx has actually shown news.Bitscoins.web that it has actually partnered with Australia-based crypto trading platform Koinfox. CEO Sumit Gupta discussed that the cooperation offers Koinfox’s users access to his exchange’s liquidity aggregated from significant international exchanges. Meanwhile, users of his exchange will have access to Koinfox’s advanced trading tools, consisting of algorithmic trading and threat management methods. The combination will be live by mid-September, he validated.

Besides an exchange service and a P2P platform, Coindcx also uses margin trading in over 200 markets as well as crypto financing. The financing program presently supports 9 cryptocurrencies: BTC, USDT, BNB, XRP, ETH, TUSD, TRX, BTT, and LTC. Users can make regular monthly interest of approximately 1.5% depending upon the coins provided. Further, they will quickly have the ability to sell crypto derivatives, Gupta exposed.

Two other cryptocurrency exchanges, Bitbns and Okex, also revealed their collaboration recently to much better serve the Indian market, however have actually not revealed any particular information of the cooperation. Meanwhile, cryptocurrency exchanges in India have actually been suffocating from the banking limitations enforced by the Reserve Bank of India (RBI). The reserve bank released a circular in April in 2015, prohibiting managed banks from supplying services to crypto organisations. The restriction entered into result 90 days later on. It has actually been thoroughly challenged in the supreme court, which is set up to review the case on Sept. 25.

Smart Token Fund

Another Indian cryptocurrency exchange is introducing a brand-new item. Wazirx revealed recently its Smart Token Fund (STF) program, which it explained as “a streamlined community-driven effort where cryptocurrency lovers can discover wise traders, and let them grow their cryptocurrency portfolio.” The exchange declares to currently have “an existing neighborhood of professional traders who can trade with the funds of brand-new entrants and in return, make a particular portion of the revenues they make,” elaborating:

STF’s goal is to democratise cryptocurrency trading proficiency for everybody. You can select the ideal STF trader for yourself based upon the tokens they trade, their trading history, efficiency, and more.

Wazirx CEO Nischal Shetty shared that numerous users on his exchange do not comprehend how to trade cryptocurrencies and have actually asked him for assistance. He stressed that the most significant issue in crypto for brand-new entrants is not understanding which tokens to purchase. “There’s a remarkably a great deal of individuals out there who put on’t have time to trade, put on’t understand which token to trade or how to trade. These barriers are holding them back from buying cryptos, and in turn avoiding them from taking part in this remarkable transformation,” he believed.

The STF program allows traders “to trade and handle several individuals’s portfolio — all on a single user interface,” and keep a portion of the revenues they make for financiers, the CEO discussed. Investors can select to invest with the traders based upon aspects such as their efficiency, the tokens they trade, or their trading history. They can go into and leave at any time without any locked-in duration. The exchange is presently providing early access to “selective specialist traders.”

How Wealthy Indians Plan to Invest in Crypto

The Indian federal government is presently pondering on a draft costs to prohibit cryptocurrencies, prepared by an interministerial committee (IMC) headed by previous Secretary of the Department of Economic Affairs Subhash Chandra Garg, who was consequently reassigned to the Power Ministry. The federal government has actually shown to the supreme court that this costs may be presented in the next parliament session.

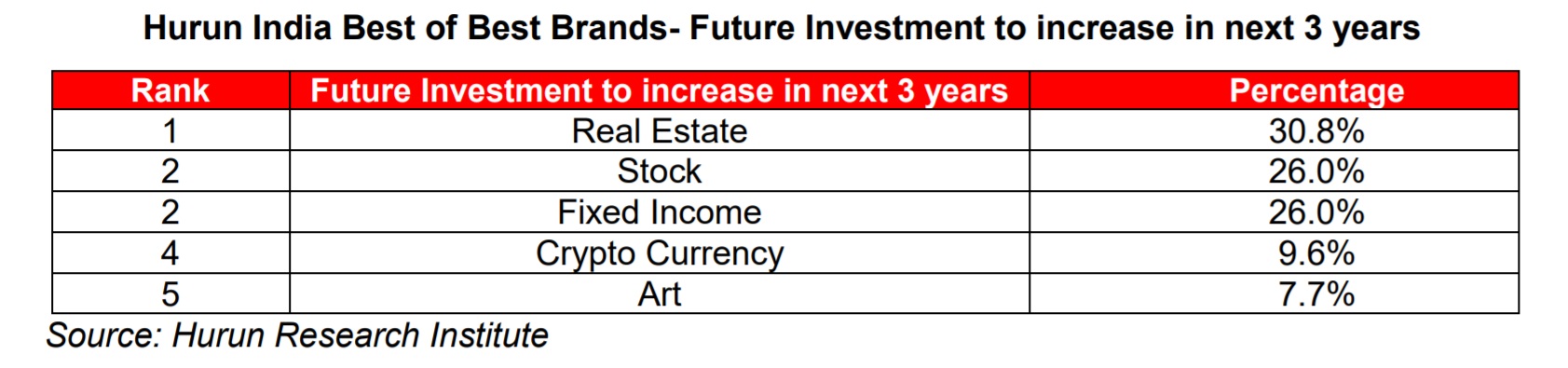

Despite the nation’s unsure policies on crypto properties, some rich Indians are preparing to purchase cryptocurrencies, according to the very first “Hurun Indian Luxury Consumer Survey 2019.” Released Friday by The Hurun Research Institute, the study exposes “the modifications and choices of way of life, usage routines and brand name cognition of high-net-worth people in India,” the institute explained. Respondents consist of 831 wealthiest Indians on the Hurun India Rich List.

According to the outcomes, 9.6% of participants stated that their financial investment in cryptocurrency would increase over the next 3 years. However, almost half of the study individuals stated they did not understand much about cryptocurrency. Among those who did, 29.15% stated they chose bitcoin, 8.74% favored ethereum, 6.8% chosen ripple, and 5.83% chosen other coins.

Calls for Positive Regulation Escalate

Since the IMC report and draft costs were revealed on July 22, the Indian crypto neighborhood has actually been attempting to persuade the federal government to reconsider the draft costs. Many think that the costs is flawed in numerous locations, from the meaning of cryptocurrency to the restriction suggestions. The neighborhood has actually acquired assistance from a variety of leading market groups, such as The National Association of Software and Services Companies (Nasscom) and the Internet & Mobile Association of India (IAMAI) which also think that prohibiting is not the option.

The “India Wants Crypto” project, which gets in touch with the federal government to present positive crypto regulation, has actually entered its 306th day and has actually just recently crossed its turning point of more than 50,000 tweets and retweets.

“The whole 5 million Indian crypto youth wish to take part in attaining [the] target of growing Indian economy to $5 trillion,” Shetty tweeted to his nation’s prime minister and financing minister. His determination is beginning to settle, as a minimum of one parliament member, Rajeev Chandrasekhar, wants to hear more. The Wazirx executive even more discussed that numerous in the crypto sector are quickly innovating, however they drag other nations due to regulative unpredictability and banking limitations. He thinks that accepting crypto will cause more tasks and financial investments, to name a few advantages, which he just recently showed news.Bitscoins.web.

What do you think about Indian exchanges’ brand-new services? Do you believe the Indian federal government will present positive crypto regulation rather of prohibiting crypto? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The Local.Bitscoins.net market has countless individuals from all around the world trading BCH today. And if you require a bitcoin wallet to safely keep your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.