2019 saw considerable bitcoin derivatives action from companies like CME Group and Bakkt. This year, demand for CME’s bitcoin futures stays strong and the company’s choices items might be offered today. Additionally, Bakkt’s physically-delivered bitcoin futures have actually regularly seen development in day-to-day volumes and open interest in 2020. Despite the development, institutional futures have a long method to go to capture up to the trade volumes retail bitcoin derivatives platforms have actually seen.

Also Read: Mining Report Highlights China’s ASIC Manufacturing Improvements and Dominance

Regulated Bitcoin Futures Products See Increased Demand Into 2020

The international markets business Chicago Mercantile Exchange (CME) has actually been offering cash-settled bitcoin futures agreements now for more than 2 years. A variety of individuals think mainstream and institutional financiers ended up being mindful of cryptocurrency markets in 2017, since interest was mainly driven by bitcoin futures items introduced by CME and the Chicago Board Options Exchange (CBOE). Since then, CBOE stopped providing bitcoin derivatives items, however CME Group has actually seen constant demand. In addition to CME’s cash-settled crypto offering, Bakkt began offering physically provided bitcoin futures agreements in September 2019. Despite the sluggish start, Bakkt’s futures have actually broken brand-new records as far as open interest and day-to-day volumes are worried. Both Bakkt and CME Group’s numbers reveal that financiers are really thinking about these offerings and derivatives cash from bitcoin continues to circulation into the very first month of the year.

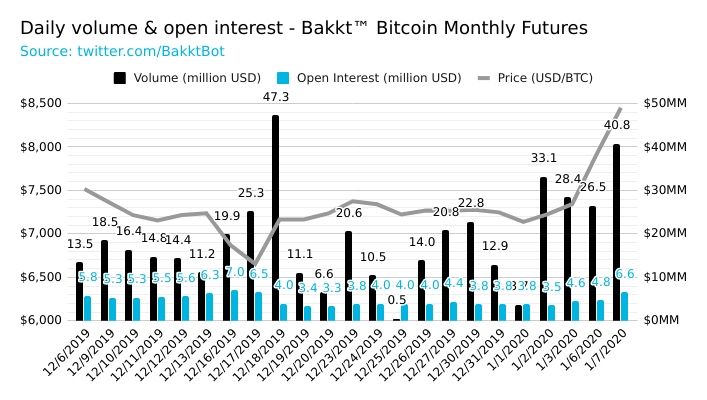

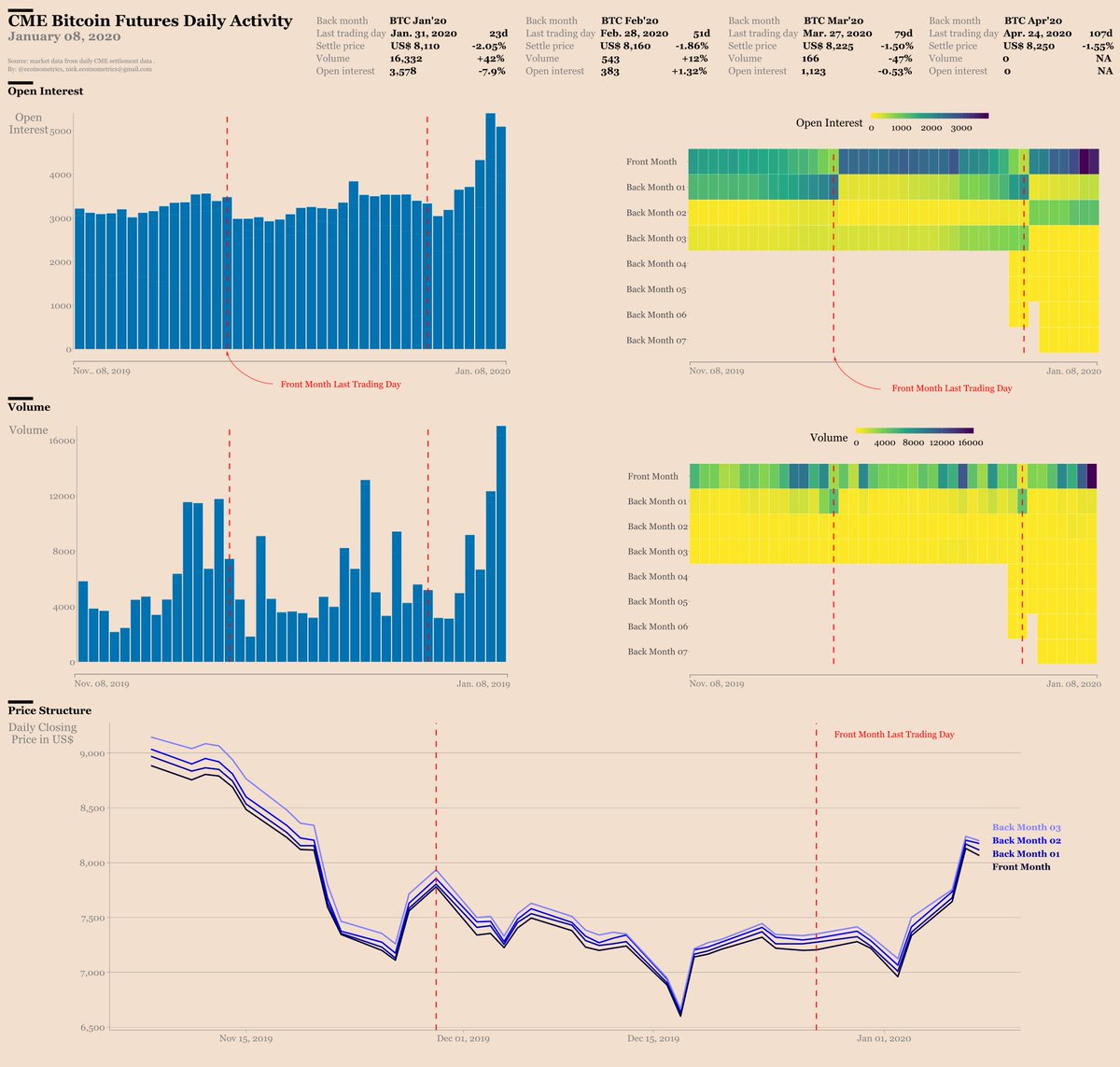

For circumstances, Bakkt’s BTC futures volumes touched an all-time high (ATH) on December 18, 2019, and came extremely close to the ATH on January 7. That day in mid-December, there were 6,601 traded agreements and on Tuesday, January 7, Bakkt saw 4,823 ($40.75 million) traded agreements. CME volumes and open interest have actually seen constant demand also, as the Twitter account @ecoinometrics noted today. The list below day after Bakkt’s $40 million in trades, Ecoinometrics explained in its “CME Bitcoin Futures Activity Report” it’s observed that “strong trade volume and open interest are remaining above typical compared to the previous couple of months.” Additionally, news.Bitscoins.internet reported on CME revealing that it would quickly provide choices on its bitcoin futures items and choices trading may start today. CME discussed that “increased demand” made them file to twofold the 30-day employment opportunities limit to 10,000 BTC.

JP Morgan Executives Anticipate CME’s Bitcoin Options Launch, While Retail Crypto Derivatives Volumes Outpace Regulated Products by a Long Shot

Financial writer Joanna Ossinger kept in mind that if CME’s choices items are authorized by regulators, trading might start as early as January 12 through 14. Ossinger’s report also declared that “institutional interest in bitcoin-associated agreements appears to be developing” according to JP Morgan Chase & Co. Nikolaos Panigirtzoglou, a strategist for JP Morgan, composed in a note on Friday that CME’s bitcoin futures have actually seen more interest.

“There has actually been an action boost in the activity of the underlying CME futures agreement over the previous couple of days,” Panigirtzoglou discussed. “This uncommonly strong activity over the previous couple of days most likely shows the high anticipation amongst market individuals of the alternative agreement,” the expert included. Panigirtzoglou’s report also stated that BTC’s “intrinsic worth has actually been increasing” however at the minute it “remains below the marketplace rate following a substantial divergence in the middle of in 2015.” Panigirtzoglou concluded:

The market value has actually decreased by almost 40% from its peak while the intrinsic worth has actually increased by around 10%, [but] the space has not yet totally closed, recommending some drawback threat stays.

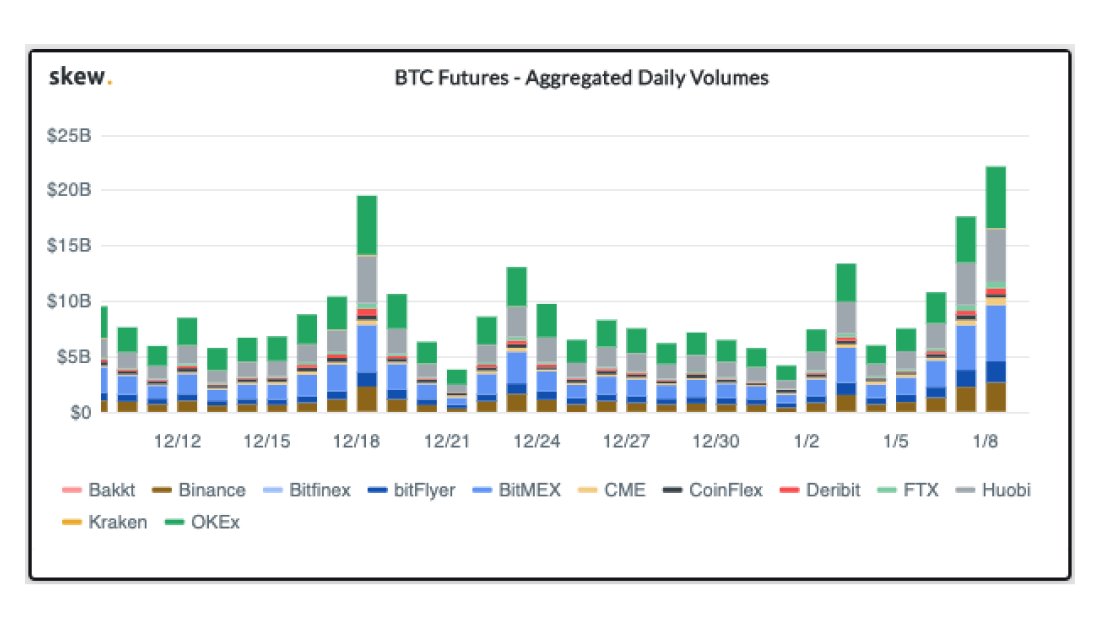

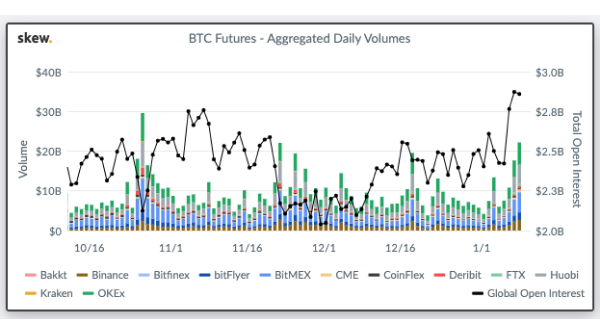

Institutional derivatives trading still fades in contrast to the trades happening on Bitmex, Bitfinex, Okex, Coinflex, Binance, and Huobi. The scientists from @skewdotcom experienced “major bitcoin futures volumes” when on Thursday more than $20 billion in BTC-based derivatives were switched. A chart proving aggregated open interest suggests open interest in crypto-based derivatives from 12 various exchanges is on the increase. Bitmex, Huobi, and Okex continue to control the BTC futures landscape and as far as volume is worried, CME and Bakkt have an incredibly long method to go to capture up to the cash being switched on those exchanges.

What do you consider CME Group introducing bitcoin choices items in the future? What do you consider the volumes of other exchanges compared to the institutional BTC derivatives offerings from CME and Bakkt?

Image credits: Shutterstock, @Bakktbot, @skewdotcom, @ecoinometrics, Fair Use, Wiki Commons, CME Group, Bakkt, and Pixabay.

Did you understand you can make BTC and BCH through Bitcoin Mining? If you currently own hardware, link it to our effective Bitcoin mining swimming pool. If not, you can quickly start through among our versatile Bitcoin cloud mining agreements.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.