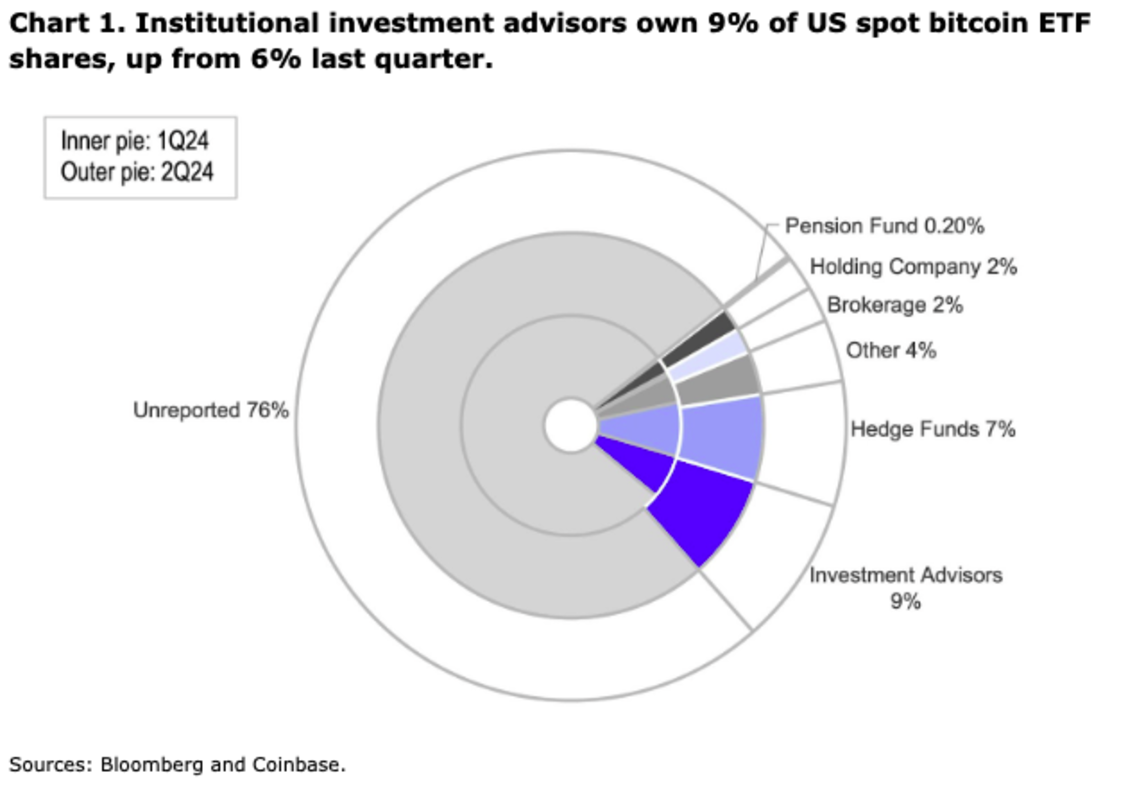

Coinbase has actually reported that upgraded 2Q 2024 13-F filings show a noteworthy boost in institutional inflows into U.S. area Bitcoin ETFs, which the business deems a “promising indicator” for the Bitcoin market. The 13-F filings, launched on August 14, expose that institutional ownership of these ETFs grew from 21.4% to 24.0% in between Q1 and Q2 of 2024.

Significantly, the percentage of ETF shares held by the “investment advisor” classification increased from 29.8% to 36.6%, signaling increased interest from wealth management companies. Notable brand-new holders consist of Goldman Sachs and Morgan Stanley, who included $412 million and $188 million worth of shares, respectively. Despite Bitcoin’s rate drop throughout the quarter, net inflows into area Bitcoin ETFs reached $2.4 billion.

“The ETF complex saw net inflows of $2.4B during this period, although the total AUM of spot bitcoin ETFs dropped from $59.3B to $51.8B (due to BTC dropping from $70,700 to $60,300),” Coinbase reported. “We think that the continued ETF inflows during bitcoin’s underperformance may be a promising indicator of sustained interest in crypto from the new pools of capital that the ETFs give access to.”

Coinbase And Bloomberg

Coinbase anticipates this development to continue as more brokerage homes finish their due diligence on Bitcoin ETFs, especially amongst authorized financial investment consultants. However, the report also keeps in mind that short-term inflows might be tempered by seasonal aspects and existing market volatility.

“In our view, it’s likely that we will see the proportion of investment advisor holdings continue to increase as more brokerage houses complete their due diligence on these funds,” the report specified. “We may not immediately see large inflows emerge in the short-term, as soliciting clients may be harder to do during the summer, when more people are on vacation, liquidity tends to be thinner and the price action might be choppy.”

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.