The overall assets under management throughout all crypto exchange-traded items (ETPs) worldwide have actually increased 50% this month to almost $44 billion. Among noted items, Grayscale’s bitcoin trust tops the list with the most assets under management while Bitwise’s fund was the very best carrying out bitcoin item by market value over the last 1 month.

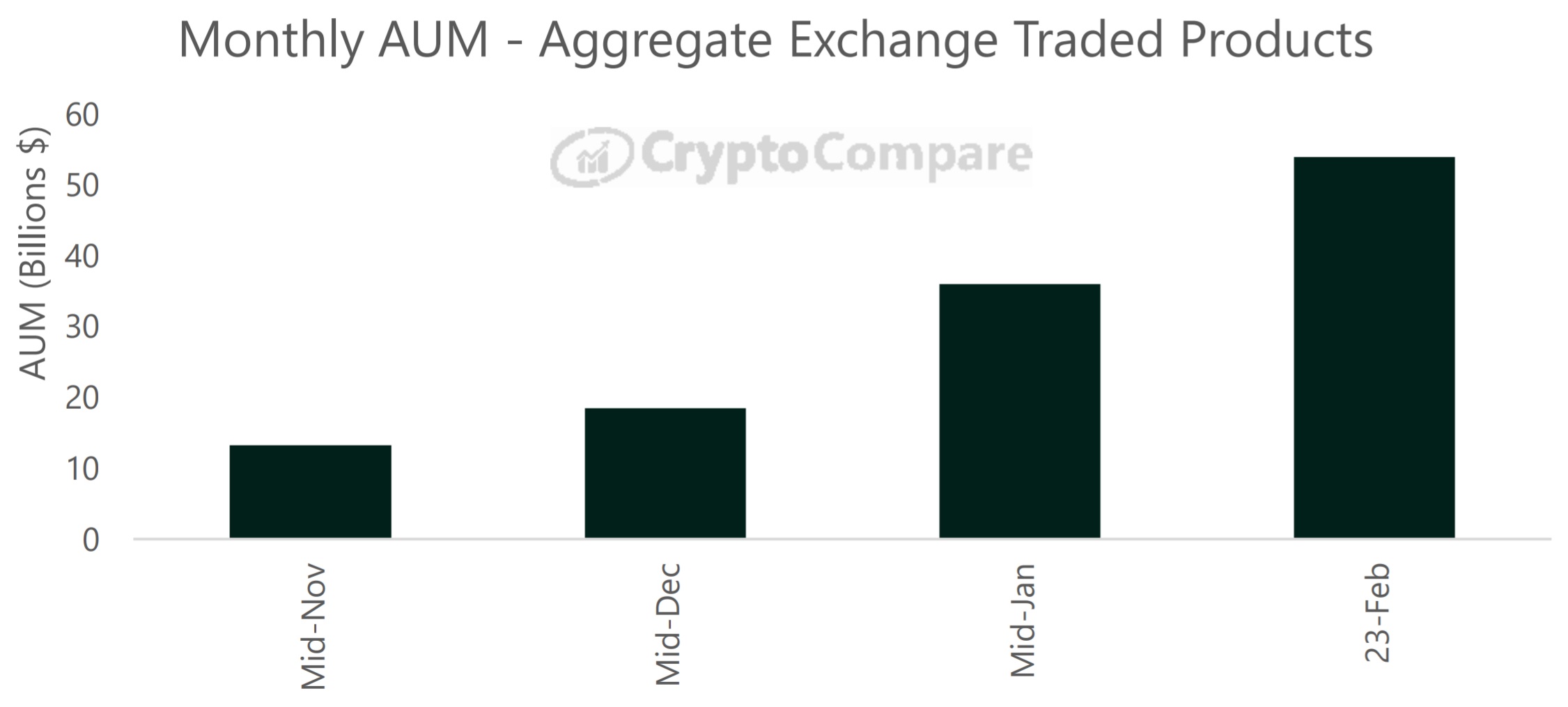

- Cryptocompare released its “Digital Asset Management Review” for the month of February on Friday. The report mentions that the overall assets under management (AUM) throughout all exchange-traded items (ETPs) increased 50% to $43.9 billion from mid-January to Feb. 23.

- The rate of bitcoin was above $50K on Feb. 23. It has actually considering that fallen to $46,876 at the time of composing, based upon information from markets.Bitscoins.internet.

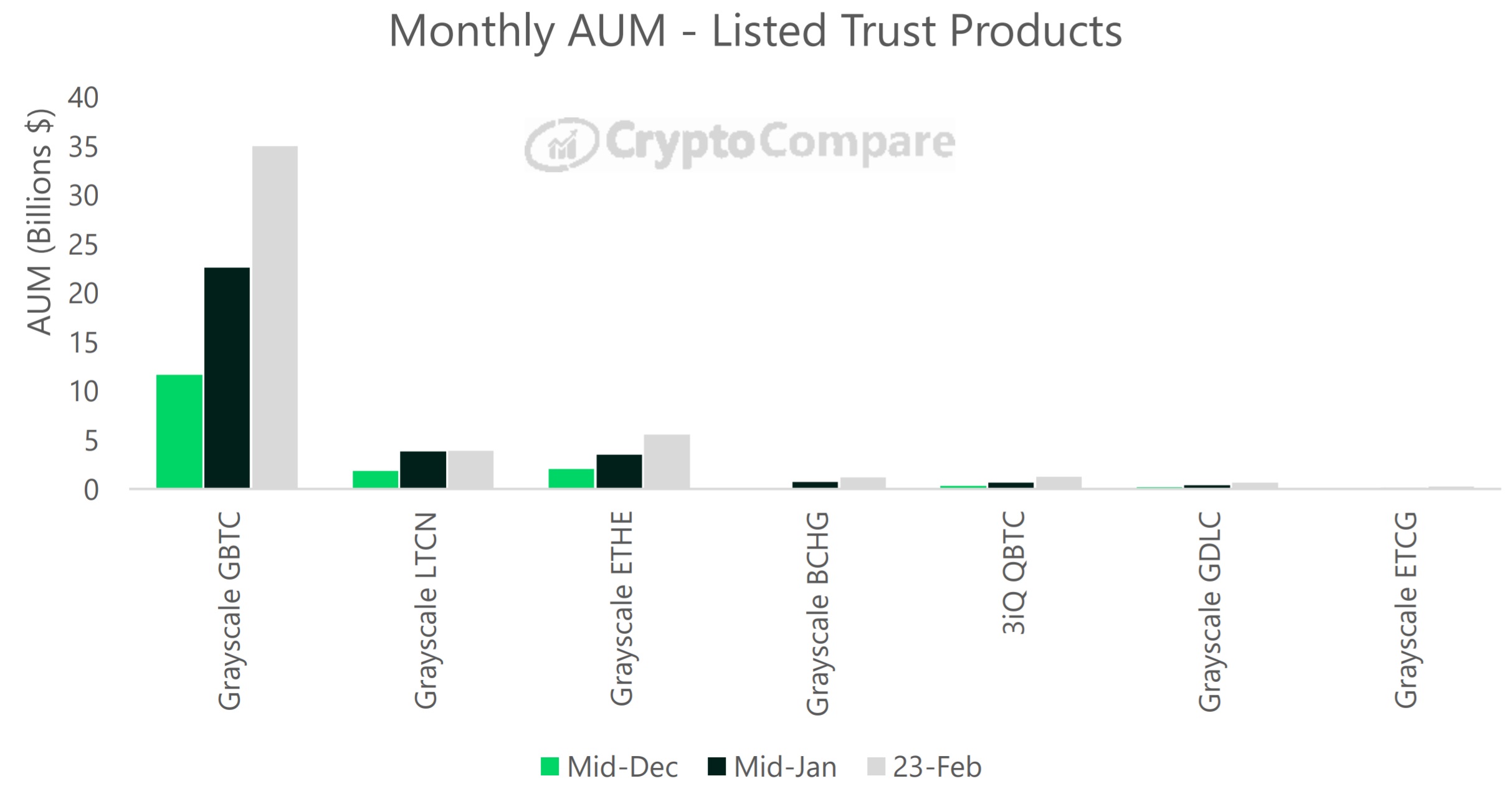

- The crypto exchange-traded item with the most AUM was Grayscale Bitcoin Trust (GBTC) with $35 billion in assets under management, according to the report. As of Feb. 26, GBTC’s AUM has actually dropped to $30.72 billion due to the lower BTC rate. Other noted crypto items with the most AUM consist of Grayscale’s Ethereum Trust, Litecoin Trust, and Bitcoin Cash Trust. The bitcoin fund by 3iq (QBTC) also made the leading 5 list with $1.27 billion under management.

- Most of the financial investments into crypto exchange items are made by institutional investors, especially hedge funds. In its Q4 2020 report, Grayscale composed that “Institutions are here,” keeping in mind that organizations represented 93% of all its capital inflows throughout the duration.

if (!window.GrowJs) { (function () { var s = document.createElement(‘script’); s.async = real; s.type=”text/javascript”; s.src=”https://bitcoinads.growadvertising.com/adserve/app”; var n = document.getElementsByTagName(“script”)[0]; n.parentNode.insertBefore(s, n); }()); } var GrowJs = GrowJs || {}; GrowJs.ads = GrowJs.ads || []; GrowJs.ads.push({ node: document.currentScript.parentElement, handler: function (node) { var banner = GrowJs.createBanner(node, 31, [300, 250], null, []); GrowJs.showBanner(banner.index); } });

- As for exchange-traded notes (ETNs), ETC Group’s BTCE has the biggest AUM with $1.01 billion. Wisdomtree’s BTCW came 2nd with $314.8 million and 21shares’ ABTC with $257.8 million.

- The report also ranks exchange-traded certificates. XBT Provider by Coinshares’ Bitcoin Tracker Euro holds the greatest AUM with $1.72 billion, followed by Bitcoin Tracker One with $1.06 billion.

- The finest carrying out bitcoin exchange-traded item by market value over the last 1 month was Bitwise 10 Crypto Index Fund (BITW) with 156%, the report notes. Its efficiency surpassed both Cryptocompare’s CCCAGG BTC/USD Index efficiency (64%) and MVIS’ MVDA Index efficiency (48.9%).

- Furthermore, North America now has 2 bitcoin exchange-traded funds (ETF): Purpose Bitcoin ETF and Evolve Bitcoin ETF. The previous built up $165 million on its very first day of trading.

What do you think of purchasing crypto exchange-traded items? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.