This is a viewpoint editorial by Kudzai Kutukwa, a monetary addition supporter and Mandela Washington fellow.

“When use of strong cryptography becomes popular, it’s harder for the government to criminalize it. Therefore, using PGP is good for preserving democracy. If privacy is outlawed, only outlaws will have privacy… PGP empowers people to take their privacy into their own hands. There has been a growing social need for it. That’s why I wrote it.”

–Phil Zimmerman, “Why I Wrote PGP”

The case of Roman Sterlingov, who stands implicated of running the custodial Bitcoin mixer, “Bitcoin Fog,” is a sign of the numerous scenarios in which people are targeted by police for securing their monetary privacy.

As laid out in “What Bitcoin Did,” the U.S. Department of Justice depended on Chainalysis’ Reactor software application to trace the purchase of the Bitcoin Fog domain back to an address connected to Sterlingov’s Mt. Gox account, developing him as its operator. Reactor was created to connect cryptocurrency addresses with real-world identities. Despite the different abnormalities present in this ongoing case, one might draw the conclusion that it sends out a clear message of “thou shalt not have financial privacy.”

Introducing Ark

Given this growing hostility towards monetary privacy for Bitcoin deals, there is a pushing requirement for the advancement of exceptional tools. At the just recently concluded Bitcoin 2023 conference, a possibly game-changing tool, called the Ark Protocol, was presented.

Announced throughout among the keynote sessions on the open-source phase by designer Burak, Ark is a Layer 2 scaling solution that makes it possible for low-cost, confidential and off-chain Bitcoin deals. The procedure also has a very little on-chain footprint, which even more safeguards user privacy while keeping deal expenses low. In what can be referred to as an “accidental invention” that happened when Burak was attempting to establish a Lightning wallet, Ark is an unique procedure that might possibly scale non-custodial bitcoin usage.

Burak called the procedure “Ark” in recommendation to Noah’s Ark, which functions as a lifeboat that offers haven from predatory blockchain monitoring companies and custodians.

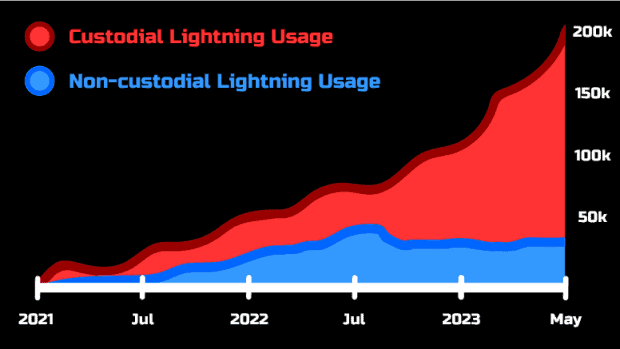

During his discussion, Burak highlighted among the most worrying patterns with the Lightning Network today, which is that there are presently more custodial users of Lightning than there are non-custodial ones. This is primarily due to the liquidity restrictions on Lightning that need non-custodial users to very first get liquidity from another person’s node prior to they can get funds. Custodial wallets like Wallet Of Satoshi abstract this issue far from the user however at the cost of the user not being 100% in control of their funds, in addition to their monetary privacy.

An Alternative Layer 2 Protocol

I spoke with Burak to get a much deeper understanding of Ark and the motivation behind its advancement. When I quizzed him on what led him to establish an alternative Layer 2 procedure, he stated:

“I have always been a critic of Lightning mainly because of inbound liquidity issues, async receiving as well as its on-chain footprint. Inbound liquidity always felt like a bug to me, which made the user experience anything but pleasant. In addition to that, it would take more than a century to onboard the entire global population in a non-custodial fashion onto the Lightning Network, assuming each person has four channels that each consume a few hundred vbytes.”

As he set out to attend to these and other concerns, his Lightning wallet concept ultimately changed into Ark.

“Ark can be best defined as trustless e-cash or a liquidity network similar to the Lightning Network but with a UTXO set that lives entirely off-chain and it’s neither a statechain nor a rollup,” Burak stated. “These UTXOs are called ‘virtual UTXOs’ or ‘vTXOs,’ which have a ‘lifespan’ of four weeks. The core of Ark’s anonymous off-chain payments is driven by the vTXOs.”

Throughout the discussion, Burak continued to highlight his fascination with a smooth experience for completion user, his view being that sending out sats need to be as simple as pressing a button. This is among the reasons that Ark users do not require to have channels or liquidity, as this is handed over to a network of untrusted intermediaries referred to as Ark company (ASPs). These are always-on servers that offer liquidity to the network, likewise to how Lightning company run, however with an included advantage: ASPs are not able to connect senders with receivers, which includes another layer of privacy for users.

This is enabled by the reality that every payment on Ark occurs within a CoinJoin round which obfuscates the connection in between sender and receiver. The highlight about this is that the CoinJoin takes place completely off-chain while settling payments every 5 seconds, which not just significantly minimizes on-chain footprints however also strengthens the users’ privacy. The privacy set is every celebration associated with a deal and, in theory, this develops a higher degree of privacy than what’s possible on the Lightning Network. Furthermore, Ark imitates on-chain user experiences because users have a devoted address for sending out and getting payments, however the distinction is that it’s a multiple-use address that doesn’t jeopardize the user’s privacy, enabled in a manner that’s similar to how quiet payments work.

Trade-Offs

However, like any other system, Ark does have its own compromises. Although it might not use immediate settlements as quickly as Lightning does, it offers instant ease of access to funds without needing to await verifications in what Burak referred to as “immediate availability with delayed finality.”

For suppliers, Lightning is still the much better alternative when it pertains to getting payments. Additionally, liquidity service providers are needed, however based upon the presumption that people will be inspired to use liquidity to make yield in bitcoin, Burak also believes this difficulty can be quickly gotten rid of in the long term. This unique proposal addresses specific drawbacks in Lightning, yet also includes its own set of difficulties.

The Road Ahead

In summary, the Ark procedure is a unique, second-layer scaling solution with unilateral exit ability that makes it possible for smooth deals without enforcing any liquidity restrictions or interactivity, nor demanding a direct connection in between sender and receiver. Therefore, receivers can quickly get payments without the inconvenience of any onboarding setup, preserving a constant server existence or jeopardizing their privacy to 3rd parties. Designed to be a scalable, non-custodial solution, Ark permits users finish control over their funds and provides everybody the alternative to self custody their cash.

Ark is interoperable with Lightning, however also acts as an enhance to it. However, due to the complex procedure of self-custodial Lightning and differing levels of privacy for senders and receivers, together with the impending threat positioned by blockchain monitoring companies, scaling services that focus on privacy, like Ark, have actually ended up being important. The different efforts to attack Bitcoin through destructive prosecution, like when it comes to Sterlingov, and predatory legislation such as the EU’s MiCA, show the requirement for scalable, effective, privacy-preserving tools in order to avoid future concerns.

It’s versus this background that I believe Ark is a fascinating idea worth watching on as advancement of the procedure unfolds. Of course, without code to evaluate at the minute or a battle-tested, working model, it’s still a long roadway ahead. Despite the unpredicted difficulties ahead, Burak is positive about Ark’s capacity and is encouraged that it’s a development that strikes the balance in between personal Bitcoin deals and scalability, in a user-friendly way. A belief that I also share, offered the crucial requirement for non-custodial, privacy-preserving tools.

This is a visitor post by Kudzai Kutukwa. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.