The U.S. Internal Revenue Service (IRS) has actually completed and put in usage a brand-new tax return that requires crypto owners to state whether they got, purchased, offered, exchanged, or obtained any cryptocurrencies in 2019. Tax professionals are annoyed at the uncertainty of the tax firm, with some questioning whether the responses would increase the opportunities of being investigated by the IRS.

New Tax Form With Crypto Question

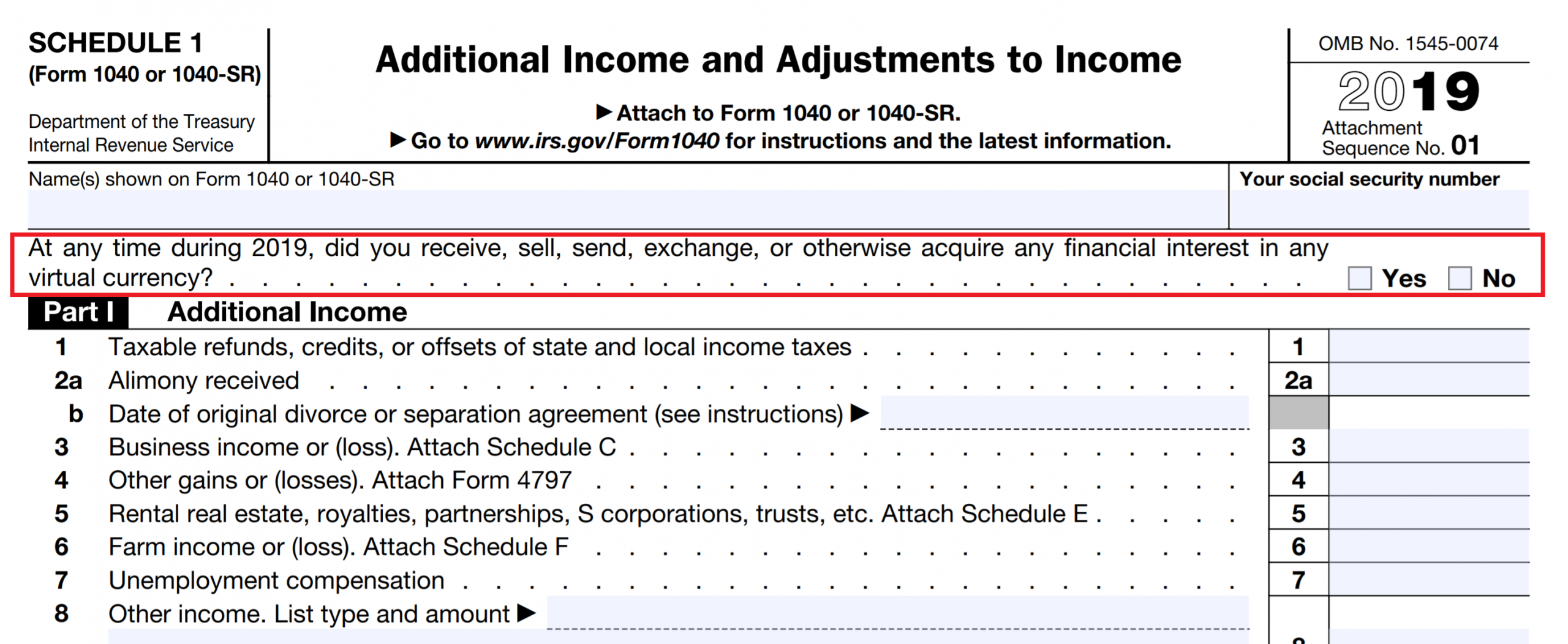

The IRS released a brand-new tax return including a concern about cryptocurrency on Thursday. The Schedule 1 kind belongs to the 1040 tax return for U.S. taxpayers to state “Additional Income and Adjustments to Income.” The IRS very first revealed the draft of this kind in October, as news.Bitscoins.net formerly reported. The kind is now completed and published on the IRS site for usage in filing 2019 income tax return. Form 1040 is utilized by over 152 million U.S. tax filers. The very first concern on the brand-new Schedule 1 checks out:

At whenever throughout 2019, did you get, offer, send out, exchange, or otherwise get any monetary interest in any virtual currency?

What Will the IRS Do?

The crypto concern at the start of the brand-new tax return has the crypto neighborhood thinking the IRS’ intent, what it will finish with the info, and just what requires to be stated. A tax specialist informed CNBC that “The questions itself is an unclear one.”

Sarah-Jane Morin, a partner at Morgan Lewis in San Francisco, informed the publication, “As a taxpayer myself, I discover this concern really discouraging since it isn’t clear.” She explained that moving one’s own cryptocurrency from one wallet to another might be thought about “sending out.” Morin concluded that “The most conservative method that a taxpayer can take is to think about any interaction you’ve had with virtual currency and whether there’s any method this can fall under this really broad list of what you might’ve participated in throughout 2019.”

Jeffrey Levine, a Certified Public Accountant and director of monetary preparation at Blueprint Wealth Alliance in New York, was estimated by the news outlet as stating:

The most significant thing is that the IRS is asking this for a factor, and my concern is just how much have you increased your audit threat by inspecting ‘Yes’ in reaction?

The IRS has a history of being unclear when it comes to taxing crypto deals. The firm launched brand-new tax standards in October to supplement its previous assistance released in 2014. However, while the brand-new assistance addresses some concerns, it also raises numerous more, specifically relating to how tough forks and airdrops are taxed. In November, 2 lawyers in the IRS Office of Associate Chief Counsel (Income Tax and Accounting) tried to address some concerns relating to tough forks and like-kind exchanges.

IRS Increases Focus on Crypto

The IRS has actually been increasing its efforts to discover and tax crypto owners. The firm’s Criminal Investigation Annual Report 2019 launched recently details its efforts and development in finding and founding guilty crypto tax evaders. The IRS composed:

Cryptocurrencies are weakening the monetary and tax system.

“Companies pay workers in cryptocurrency or get crypto for items/services,” the tax firm continued. “They do not pay taxes and entities shift earnings to overseas exchanges without any reporting requirements, using exchanges with little to no AML practices.” The IRS included, “Understanding the improvements in this location and remaining on top of the criminal approaches is our support.”

While confessing that its resources are restricted, the IRS thinks that it has the tools and capability to discover crypto tax evaders. Cyber bad guys “now handle cryptocurrency, once again believing this will make them confidential, however our representatives have as soon as again showed that there is no place to conceal. We will not drop in our pursuit,” the report checks out. In July, the tax firm sent out more than 10,000 letters to crypto users advising them of their tax commitments.

The IRS’ report also highlights the accomplishments of its partnership with worldwide partners, the Joint Chiefs of Global Tax Enforcement or J5. The group consists of the IRS Criminal Investigation and its equivalents in the U.K., Australia, Canada, and the Netherlands. The J5 concentrates on worldwide tax evasion consisting of using cryptocurrency to avert worldwide tax commitments. The IRS additional composed:

In simply 18-months, we are currently seeing the advantages to this group both in the advancement of brand-new tools and in the numbering of genuine cases. We anticipate our very first functional arise from this group in FY20.

What do you think about the IRS asking all tax filers about their crypto activities? What do you believe it will finish with the info acquired? Let us understand in the comments area below.

Did you understand you can purchase and offer BCH independently utilizing our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The regional.Bitscoins.net market has countless individuals from all around the world trading BCH today. And if you require a bitcoin wallet to firmly keep your coins, you can download one from us here.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.