Bitcoin’s cost cycles have actually regularly mesmerized the attention of financiers and experts. By juxtaposing existing patterns with historic cycles, there exists a chance to obtain prospective cost motions. As Bitcoin seems nearing the conclusion of its debt consolidation stage, numerous market gamers are hypothesizing about the possibility of an upcoming upward trajectory.

Comparative Analysis of Bitcoin Cycles

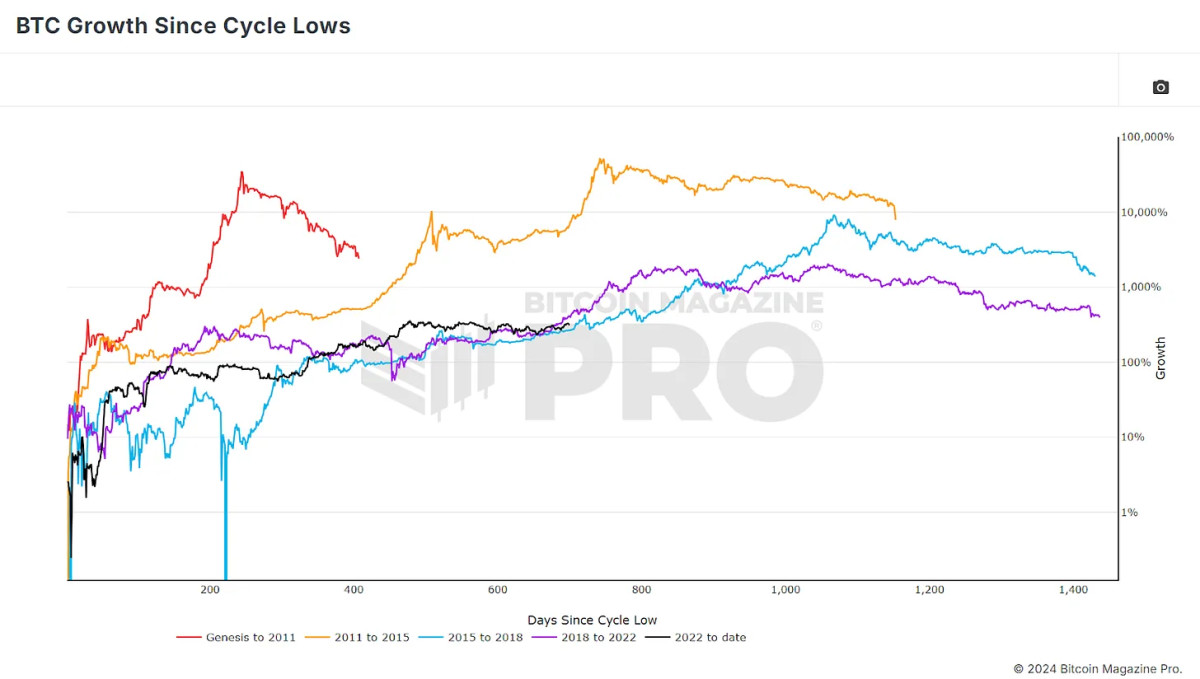

To successfully evaluate existing market conditions, it is important to assess Bitcoin’s efficiency considering that it reached its current cycle low. An analysis of the information exposes a noteworthy connection: the existing cost action (represented by the black line) echoes patterns observed in previous bull cycles. Although the debt consolidation stage has actually been marked by noteworthy volatility and relative stagnancy, there are considerable resemblances when comparing this cycle to those of 2015-2018 (portrayed by the purple line) and 2018-2022 (shown in blue).

The existing position in regards to portion gains mirrors those of both the 2018 and 2015 cycles. However, this observation just scratches the surface area of the story. An analysis of cost action alone is inadequate; a much deeper assessment of financier habits and other pertinent metrics is essential to completely understand the characteristics within the Bitcoin market.

Insights into Investor Behavior

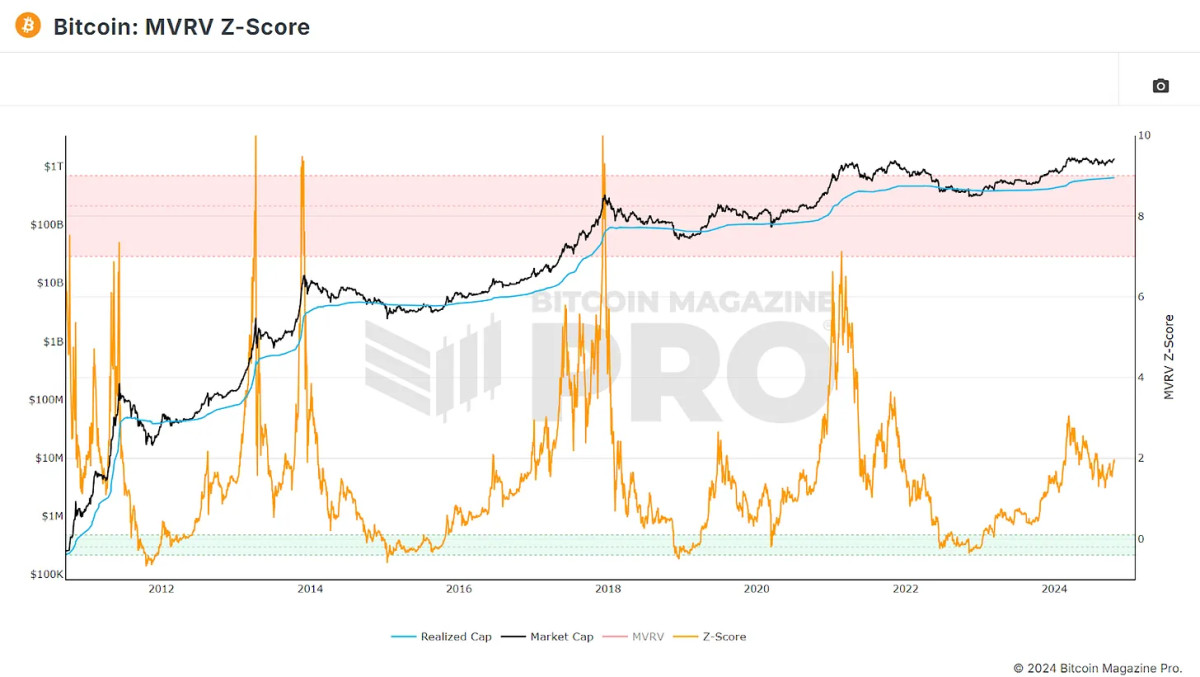

A critical metric adding to the understanding of financier habits is the MVRV Z-Score. This ratio compares Bitcoin’s dominating market value versus its “realized price” (or cost basis), which shows the typical cost at which all Bitcoin on the network was obtained. The Z-Score serves to stabilize the underlying MVRV information for Bitcoin’s volatility, successfully omitting severe outliers.

By thinking about metrics similar to the MVRV Z-Score instead of exclusively focusing on cost motions, experts can recognize patterns and parallels in between the existing cycle and its predecessors, incorporating not just cost patterns however also shifts in financier belief and habits.

Correlating Price Movements

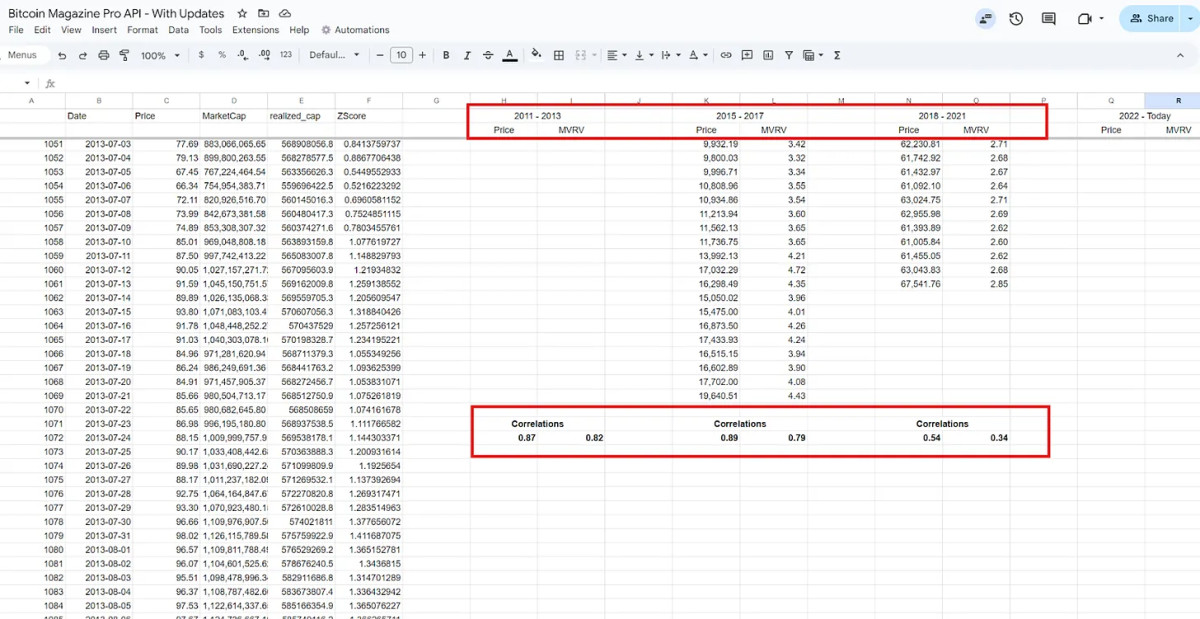

For a more thorough understanding of how the existing cycle lines up with historic patterns, information from Bitcoin Magazine Pro works as an important resource, using comprehensive insights by means of its API. By omitting the Genesis cycle—due to an absence of connection and separating the cost and MVRV information from Bitcoin’s least expensive closing rates to its acmes throughout the existing and 3 previous cycles—the analysis exposes unique connections.

The cycle covering 2011 to 2013 is especially defined by a double peak, with a robust 87% connection with the existing cost action. Furthermore, the MVRV ratio shows a considerable 82% connection, suggesting that Bitcoin’s cost patterns are mirrored by corresponding shifts in financier habits in regards to trading.

In contrast, the 2015 to 2017 cycle displays the greatest connection in cost action, reaching a remarkable 89%. However, the MVRV ratio is rather lower, recommending subtle distinctions in financier habits in spite of comparable cost trajectories.

The current cycle from 2018 to 2021 has the weakest connection with modern patterns, hinting that the marketplace characteristics might not imitate those of simply a couple of years back.

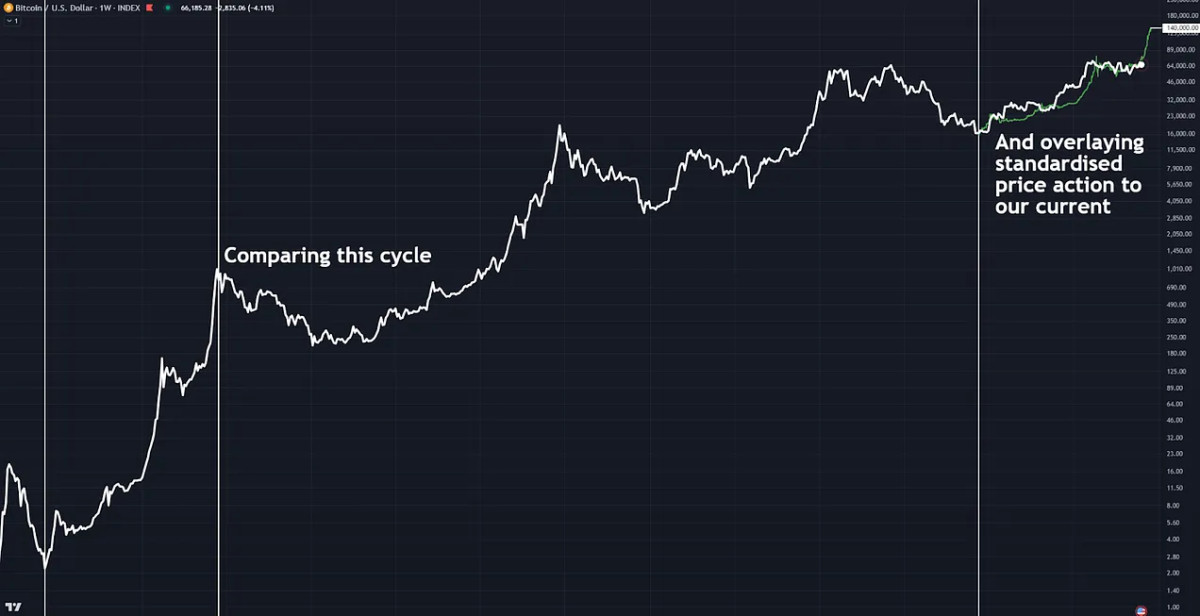

Prospects for a Double Peak

The substantial connection with the 2011-2013 cycle warrants attention, especially thinking about that Bitcoin experienced a double peak throughout this timeframe. Such a pattern, defined by 2 rises to brand-new all-time highs followed by a lengthy bearish market, might suggest that Bitcoin is on the precipice of notable cost motions in the near term. Overlaying the cost action fractal from the 2011-2013 cycle onto the existing trajectory exposes striking resemblances.

In both circumstances, Bitcoin experienced a speedy climb to a brand-new high, been successful by an extended and rough debt consolidation stage. Should history repeat itself, a considerable cost rally might be expected, possibly reaching around $140,000 by the year’s end, especially when thinking about lessening returns.

Patterns in Investor Behavior

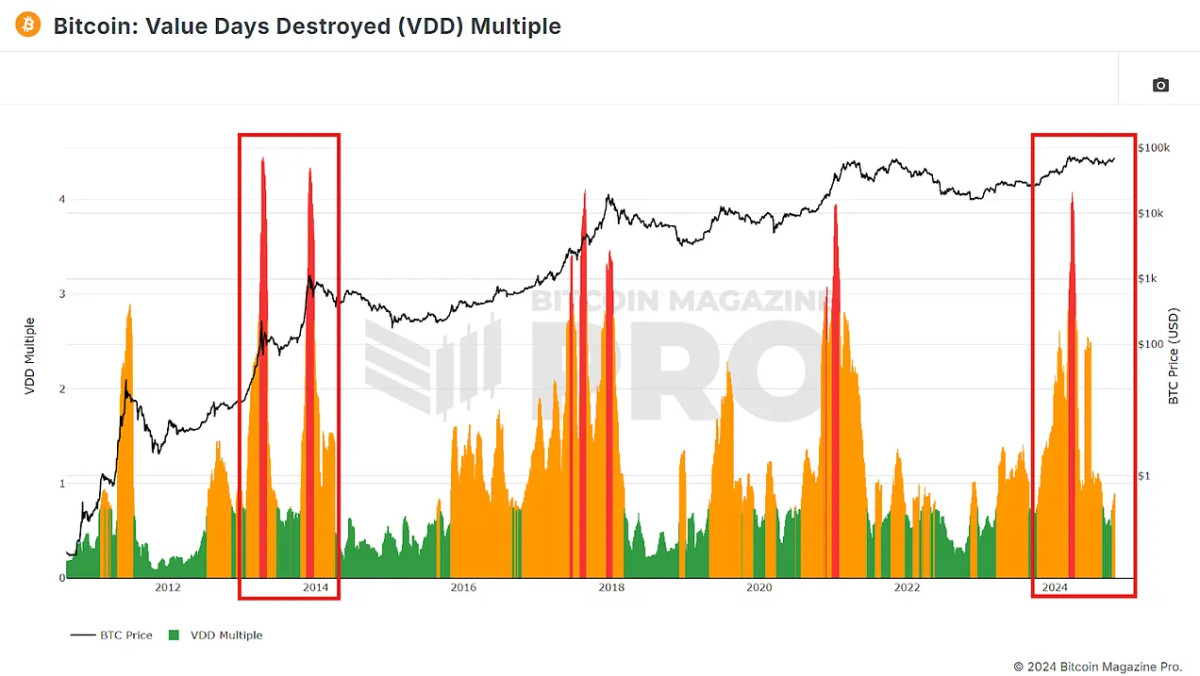

Another substantial metric to assess is the Value Days Destroyed (VDD), which measures Bitcoin motions by considering both the quantity negotiated and the time expired considering that the last transfer, consequently increasing this figure by the fundamental cost to obtain insights into the habits of long-lasting financiers, especially concerning profit-taking.

In the continuous cycle, VDD has actually shown a preliminary climb similar to the red spikes observed throughout the 2013 double peak. This pattern, following Bitcoin’s rise to a brand-new all-time high previously in the year, might recommend that we are poised for extra gains if the double peak cycle pattern continues.

A More Pragmatic Outlook

As Bitcoin has actually progressed as a possession, there has actually been a discernable shift towards extended cycles and lessening returns, especially in the 2 latest cycles in contrast to the preliminary 2. Thus, it stands to factor that Bitcoin might be most likely to mirror the cycle showing the greatest connection in cost action.

Figure 6: Overlaying a fractal of the 2017 cycle on existing cost action.

If Bitcoin were to abide by the pattern developed in between 2015 and 2017, brand-new all-time highs might still be possible before the conclusion of 2024; nevertheless, such a rally would likely unfold at a more progressive and sustainable speed. This circumstance recommends a rate target of around $90,000 to $100,000 by early 2025, followed by relentless development throughout the year, with a possible market peak in late 2025. While predicting a pinnacle of $1.2 million under this structure might be extremely positive, it stays a prospective result.

Conclusion

Historical information shows that a turning point is approaching. Whether Bitcoin reproduces the remarkable double-peak cycle of 2011-2013 or the steadier climb experienced in between 2015-2017, the general outlook stays bullish. By tracking crucial metrics such as the MVRV ratio and Value Days Destroyed, market individuals are much better geared up to recognize future trajectories. Additionally, evaluating connections with historic cycles offers important insights into upcoming advancements.

With Bitcoin on the edge of a prospective breakout—whether within the impending weeks or encompassing 2025—financiers must stay alert. If Bitcoin lines up, even partly, with any of its previous trajectories, considerable cost activity and the possibility of brand-new all-time highs might be seen quicker than expected.

For a more thorough expedition of this topic, audiences are motivated to see a current YouTube video entitled: Comparing Bitcoin Bull Runs: Which Cycle Are We Following.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.