Over the previous years, Coinbase has actually reached countless cryptocurrency traders and broadened to end up being the biggest crypto exchange in the United States. Despite its strong credibility, Coinbase did not prevent examination and uncertainty. It has actually magnified in the previous 2 years, driven by the sharp upswing and plunge in crypto rates in a brief duration. But what has actually ended up being the hot subject was the abrupt collapse of FTX, the previous biggest crypto exchange worldwide.

Nonetheless, it stays a prominent figure in the marketplace. True followers concern cryptocurrencies in spite of not being a sure inflation hedge. Bitcoin’s inverted connection with inflation demonstrated how much macroeconomic signs might impact crypto rates. Traders continue to profit from crypto volatility to create enormous gains.

Given this, Coinbase delights in high crypto balances. This powerful crypto exchange giant leverages the weak point of its smaller sized peers. Inflows and outflows might in some cases be frustrating, however its liquidity guarantees it can sustain its operations. Hence, this post will describe why Coinbase is a safe cryptocurrency exchange.

What Makes Coinbase a Safe and Liquid Cryptocurrency Exchange

As a crypto trading rookie, one frequently searches for those exchanges with low deal charges and safe and secure user privacy. But a more crucial factor to consider is whether it can sustain company operations with enormous deals.

Being in business for over a years, we might not need to ask ourselves, “Is Coinbase safe?” It has actually gone through enormous ups and downs, such as the crypto bubble burst in 2017-2018 and the FTX fallout in 2022. Its liquidity and smart token allowance make it among the most long lasting crypto exchanges. These are some factors Coinbase is a safe crypto exchange.

Stable month-to-month market share

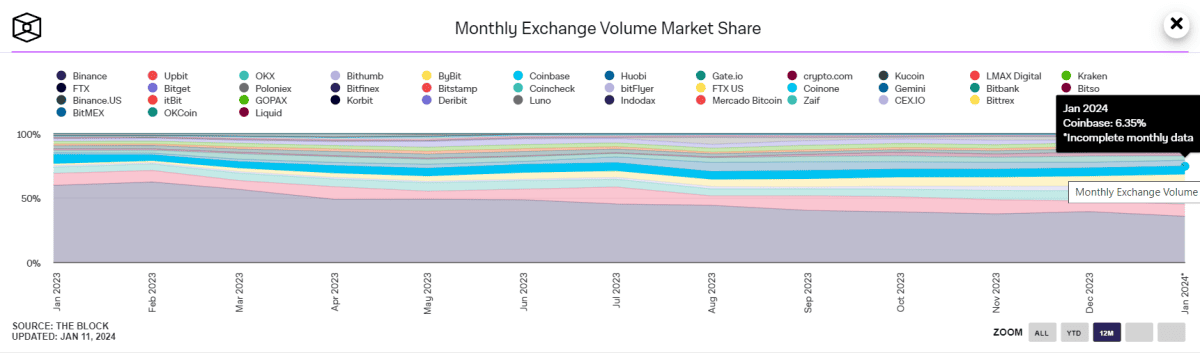

Since the FTX collapse, we have actually seen how Binance has actually quickly taken control of the marketplace. It dismissed Coinbase and kept a large margin from its peers for a long period of time.

Even so, Coinbase revealed it has not yet failed and would not be another FTX in spite of the substantial drop in traders’ self-confidence. Binance might be the giant now, however Coinbase is among the initial crypto exchanges. It has actually stood the test of time, dealing with enormous crypto market shocks in the last few years.

But what makes it a remarkable crypto exchange competitor is its steady market share. In January 2023, its market share was 6.97%. It plunged to 4.58% in just a month, the most affordable market share in several years.

It rebounded in the following months however remained within a 5-6% variety. But considering that the 2nd half of 2023, we can see a continual boost in its market share before reaching 6.2%. There have actually been some ups and downs, however they were a lot more workable than in 2022.

At completion of the year, the marketplace share increased once again to 6.34%. As these days, it is taped at 6.35%. It might be lower year-over-year however better than in the previous months. The continual rebound reveals it can stand up to difficulties and gain back momentum amidst tight competitors. It is undoubtedly a durable crypto exchange.

And if we compare it to other exchanges, Coinbase had among the most steady market share modifications in the previous year. Take Binance as an example. It stays the biggest exchange however has actually currently lost about 25% of its market share after falling from 59% in January 2023 to 35% today.

We can associate it to the current debate where it confessed its fault for breaking the United States Anti-Money Laundering Act. Hence, its close rivals, such as Coinbase, OKX, and Upbeat, profit from it to create more traders.

High cryptocurrency balance

Another aspect to think about is the liquidity and accessibility of digital properties. Given its sufficient balance of main cryptocurrencies, Coinbase stays a big cryptocurrency exchange. These consist of Bitcoin (BTC) and Ethereum (ETH).

Coinbase is the second-largest cryptocurrency exchange in the overall Bitcoin balance. As of this writing, it has 411,762.68 Bitcoins or 2.2% of the overall flowing supply in the market. It also has a narrow space with Binance, the leading Bitcoin holder, with 554,836.88 or 2.8% of the overall market volume.

Bitfinex comes as a close 3rd with 388,742.04 or 2.0% of the overall market supply. The leading 3 Bitcoin exchanges have a large margin from the 4th second, OKX, with simply 132,678.97 or 0.7%.

With regard to Ethereum, the overall balance in Coinbase is 2,185,579.12, or 1.8% of the overall flowing supply. It ranks 3rd after Binance and Bitfinex with 3,770,920.82 or 3.1% and 2,349,649.56 or 2.0%, respectively. Kraken remains in 4th location with 1,691,412.27, or 1.4% of the overall flowing coins. These 4 biggest Ethereum holders are far bigger than OKX, the 5th second with 945,955.80 or 0.8%.

Even in other cryptocurrencies, Coinbase also has among the biggest reserves. It ranks 2nd in USDC with 516,852,821.09, although it is far lower than Binance with 1,454,578,122.56. It has a large distinction from OKX, the 3rd second, with 157,577,919.60. The staying exchanges with USDC have less than a 100,000,000 balance.

For smaller sized cryptocurrencies, Coinbase stays popular as it is among the leading 10 holders of their reserves. Several examples consist of DAI (5th- 2,848,007.58), USDT (ninth- 35,157,653.02), SKL (seventh- 7,393,205.74), and USDP (4th- 482,327.81).

Given this, Coinbase appears to have sufficient liquidity levels, enabling it to sustain high-volume deals. This is a vital element to think about in an extremely unstable market.

Prudent Token Allocation

Traders ought to also think about the level of dependence on a particular token or coin. The previous biggest crypto exchange, FTX, might have overlooked this important element. Its dependence by itself tokens resulted in its unanticipated failure in 2022. This resulted in capital outflows in numerous other exchanges, and Coinbase was no exception.

On a lighter note, Coinbase does not seem another FTX in the making, provided its high balance of numerous cryptocurrencies. It is not greatly dependent on a single cryptocurrency. It holds numerous cryptocurrencies and belongs to the leading 10 exchanges in numerous cryptocurrencies it holds.

Like most crypto exchanges, Bitcoin stays its most plentiful reserve. It is a vital token considering that numerous organizations worldwide commonly accept it. Ethereum comes 2nd, also utilized for company and federal government deals. Many federal government firms are taking Ethereum agreements for their services.

These 2 cryptocurrencies are necessary in numerous states, particularly Texas, which has the ninth-largest economy internationally. That is why following the requirements and procedures of forming an LLC in Texas is simpler with crypto payments.

As such, Coinbase can stand up to an enormous outflow of a single cryptocurrency. Thankfully, its high liquidity will assist it cover the inevitable capital while refocusing on other reserves.

Key Takeaways

Coinbase has actually been through crests and troughs considering that its creation a years back. Although it has a long method to precede it goes head-to-head with Binance, it has a big capacity to outshine the 3rd and 2nd placers. Its presence for over 10 years states a lot about its durability and vigilance. Hence, this crypto exchange guarantees security to cryptocurrency traders.

This is a visitor post by Ivan Serrano. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.