After reaching brand-new all-time highs previously this year, Bitcoin has actually gone into a multi-month duration of choppy cost action, leading numerous to question if the bull cycle is over. In this short article, we dive deep into essential metrics and patterns to comprehend if the market is simply cooling down or if we have actually currently seen the peak for this cycle.

Fundamentally Overvalued?

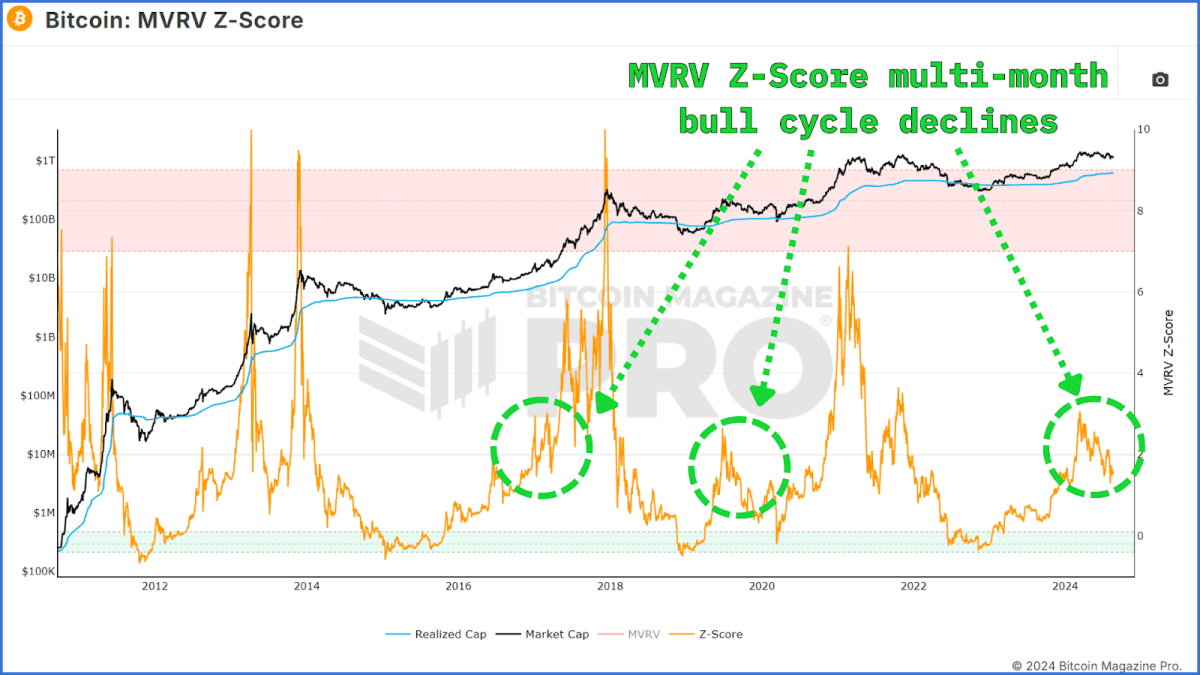

One of the most dependable tools for determining Bitcoin’s market cycles is the MVRV Z-Score. This metric procedures the distinction in between Bitcoin’s market cap and its understood cap, or cost-basis for all distributing BTC, assisting financiers figure out whether Bitcoin is over or underestimated according to this ‘fundamental’ expense of BTC.

Recent information reveals that the MVRV Z-Score has actually shown a continual down motion, which may recommend that Bitcoin’s up trajectory has actually ended. However, a historic analysis informs a various story. During previous bull cycles, consisting of those in 2016-2017 and 2019-2020, comparable decreases in the MVRV Z-Score were observed. These drawdown durations were followed by considerable rallies, resulting in brand-new all-time highs. Thus, while the present sag might appear worrying, it’s not always a sign of the bull cycle being over.

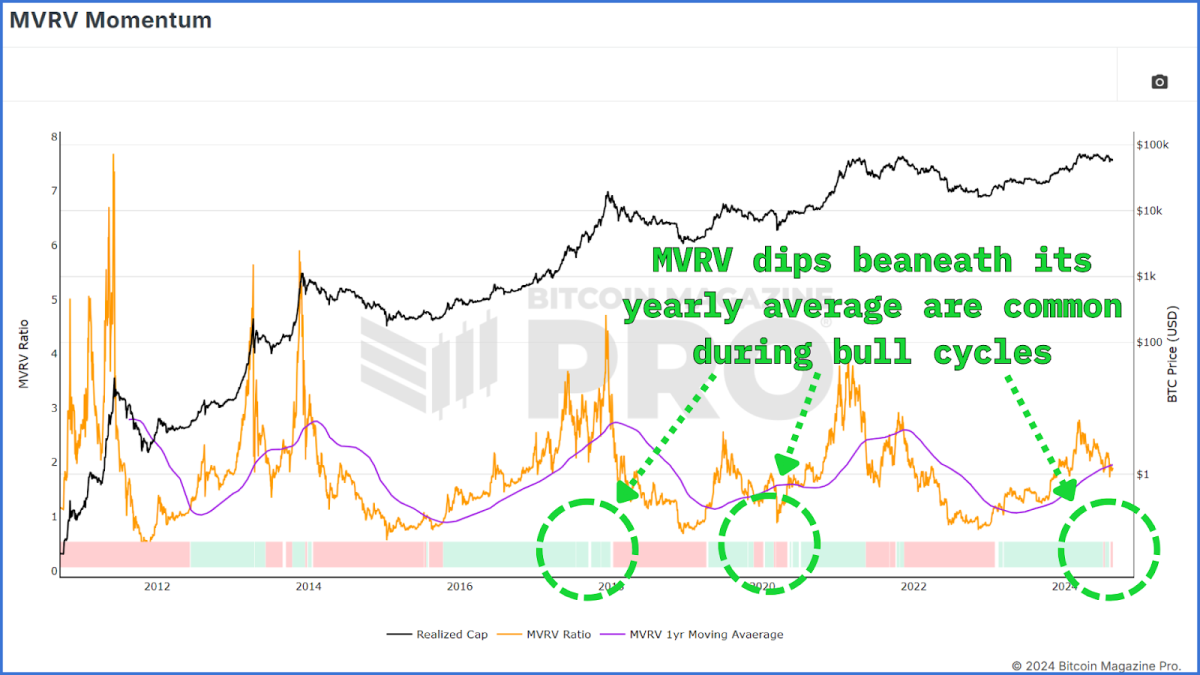

The MVRV Momentum Indicator assists compare bull and bear cycles by using a moving average to the raw MVRV information. It just recently dipped below its moving average and reddened, which might indicate the start of a bear cycle. However, historic information reveals that comparable dips have actually happened without resulting in an extended bearish market.

Struggling Beneath Resistance?

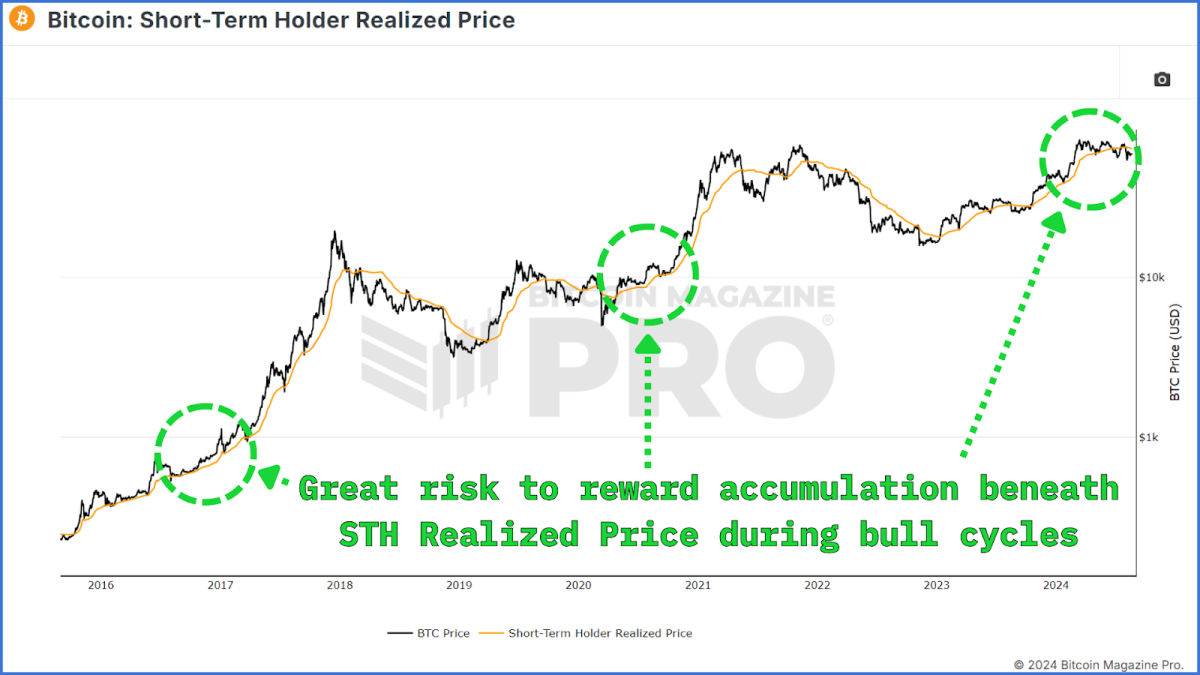

Another vital metric to think about is the Short-Term Holder (STH) Realized Price, which represents the typical cost at which current market individuals got their Bitcoin. Currently, the STH Realized Price is around $63,000, somewhat above the present market value. This indicates that numerous brand-new financiers are holding Bitcoin at a loss.

However, throughout previous bull cycles, Bitcoin’s cost dipped below the STH Realized Price several times without signaling the end of the booming market. These dips frequently provided chances for financiers to build up Bitcoin at affordable costs before the next upper hand.

Investor Capitulation?

The Spent Output Profit Ratio (SOPR) evaluates whether Bitcoin holders are costing a revenue or a loss. When the SOPR is below 0, it recommends that more holders are costing a loss, which can indicate market capitulation. However, current SOPR information reveals just a few circumstances of costing a loss, which have actually been quick. This suggests that there is no extensive panic amongst Bitcoin holders, normally seen throughout a bearishness’s early phases.

In the previous, quick durations of costing a loss throughout a bull cycle have actually been followed by considerable cost boosts, as seen in the 2020-2021 run-up. Therefore, the absence of continual losses and capitulation in the SOPR information assistances the see that the bull cycle is still undamaged.

Diminishing Returns?

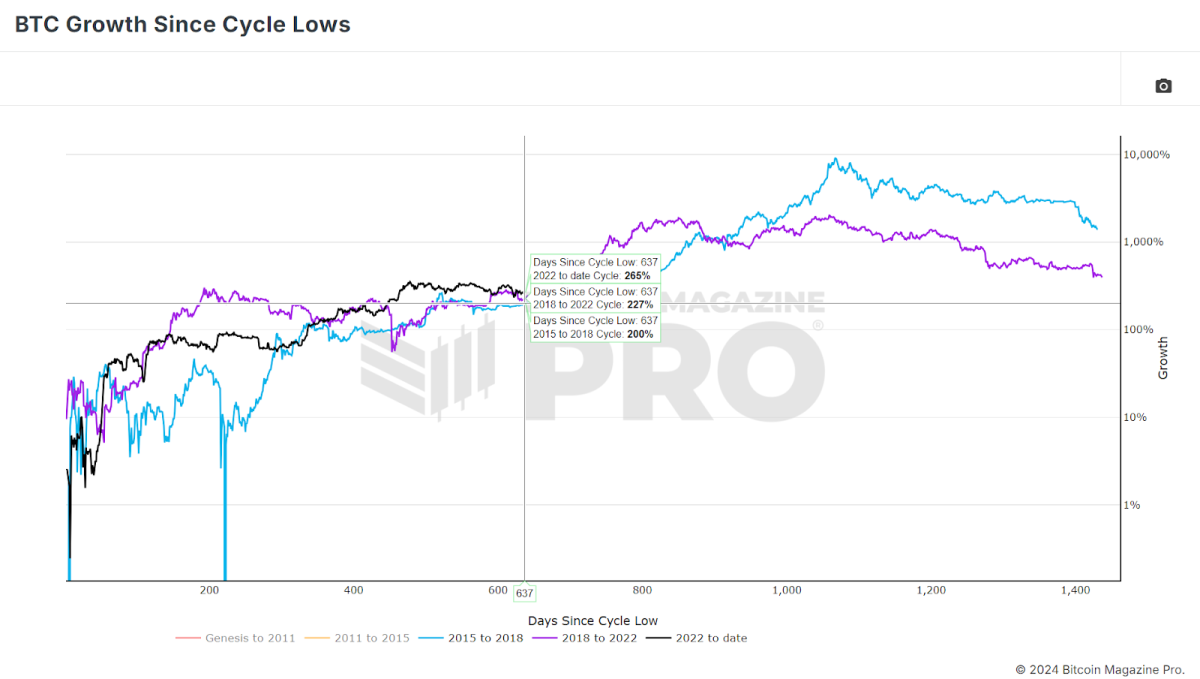

There’s a theory that each Bitcoin cycle has decreasing returns, with lower portion gains than the previous cycle. If we compare the present cycle to previous ones, it’s clear that Bitcoin has actually currently outshined both the 2015-2018 and 2018-2022 cycles concerning portion gains. This outperformance may recommend that Bitcoin has actually gotten ahead of itself, demanding a cooling-off duration.

However, it’s also essential to bear in mind that this cooling-off duration does not indicate the end of the booming market. Historically, Bitcoin has actually experienced comparable stops briefly before resuming its upward trajectory. Thus, while we may see more sideways and even down cost action in the short-term, this does not always suggest that the booming market is over.

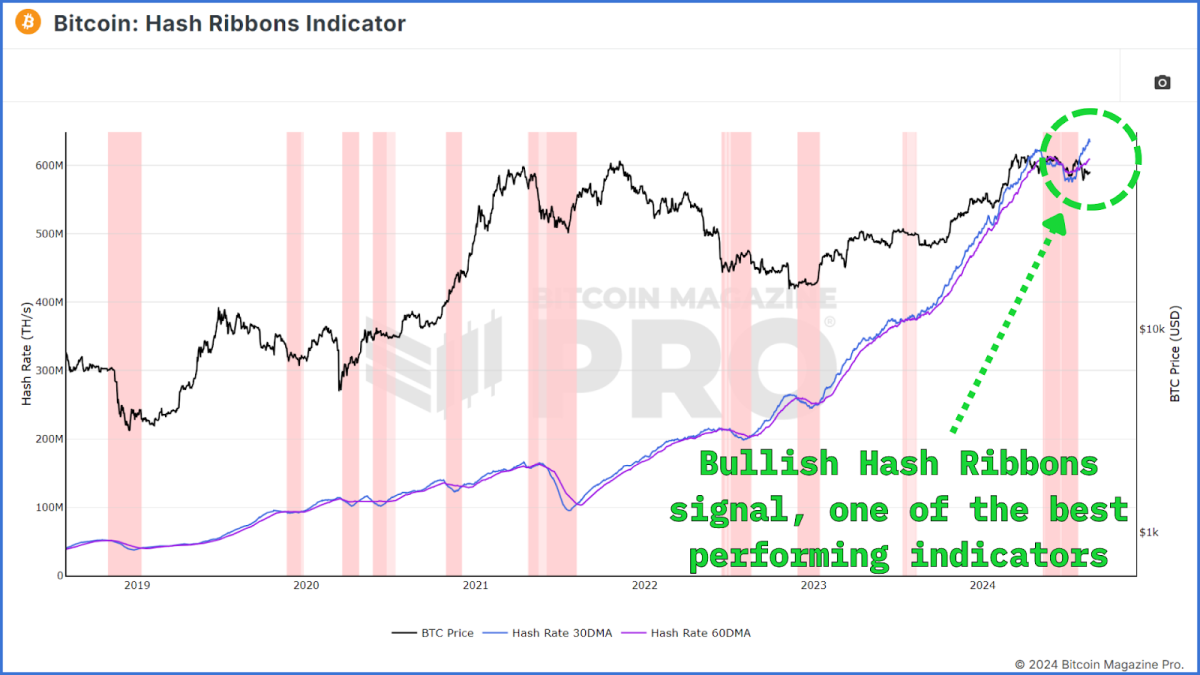

The Hash Ribbons Buy Signal

One of the most appealing indications for Bitcoin’s future cost action is the Hash Ribbons Buy Signal. This signal happens when the 30-day moving average of Bitcoin’s hash rate crosses above the 60-day moving average, showing that miners are recuperating after a duration of capitulation. The Hash Ribbons Buy Signal has actually traditionally been a dependable indication of bullish cost action in the months that follow.

Recently, Bitcoin has actually revealed this buy signal for the very first time considering that the cutting in half occasion previously this year, recommending that Bitcoin might see favorable cost action in the coming weeks and months.

Conclusion

In summary, while there are indications of weak point in the Bitcoin market, such as the dip in the MVRV Z-Score and the STH Realized Price, these metrics have actually revealed comparable habits in previous bull cycles without signaling the end of the market. The absence of extensive capitulation, as shown by the SOPR and the current Hash Ribbons Buy Signal, offers more self-confidence that the bull cycle is still undamaged.

For a more thorough check out this subject, take a look at a current YouTube video here:

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.