The largest financial institution within the United States, JP Morgan Chase, discovered itself the topic of a federal class motion lawsuit this week. The grievance alleges that after hindering clients from shopping for cryptocurrencies, the financial institution charged fans further charges and better rates of interest.

JP Morgan Chase Subject of Million Dollar Class Action

Brady Tucker et al v Chase Bank USA, filed in U.S. District Court, Southern District of New York, 18-3155, Manhattan, was initiated by San Diego-based legislation agency, Finkelstein & Krinsk LLP, a category motion specialist. Mr. Tucker of Idaho, plaintiff, claims he incurred $143.30 in charges, and $20.61 in sudden curiosity fees over 5 crypto transactions throughout late January and early February. And whereas by itself it’d seem trivial, magnified by untold hundreds of consumers, and the numbers start to get substantial. Mr. Tucker also claims “upon purchasing a cryptocurrency from Coinbase.com or another online crypto merchant,” he was saddled with money advance charges in violation of his unique phrases and situations.

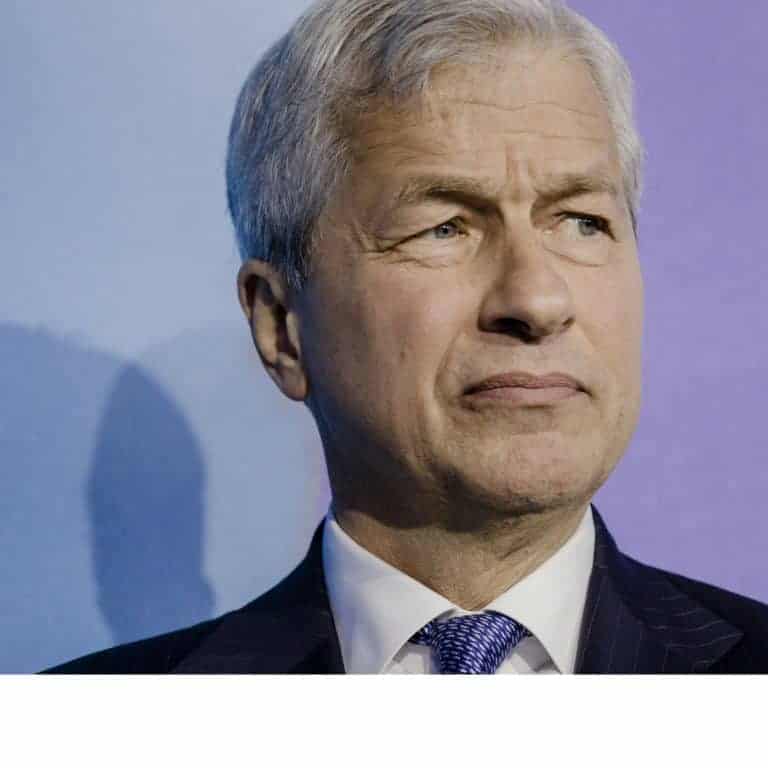

JP Morgan has been significantly aggressive in relation to cryptocurrency, particularly bitcoin. Its, at instances, curmudgeonly CEO, Jamie Dimon, has waged a quotable conflict for years, referring to cryptos as a fraud, tulip bulbs, and even calling fans silly, insisting he’d instantly fireplace an worker if he discovered them dabbling in crypto. He’d later try and stroll again a few of his harsher statements. At one level it even appeared he may dabble in bitcoin futures. In any occasion, it’s not past the scope of issues to imagine JP Morgan would have a specific, separate coverage for crypto fans.

JP Morgan has been significantly aggressive in relation to cryptocurrency, particularly bitcoin. Its, at instances, curmudgeonly CEO, Jamie Dimon, has waged a quotable conflict for years, referring to cryptos as a fraud, tulip bulbs, and even calling fans silly, insisting he’d instantly fireplace an worker if he discovered them dabbling in crypto. He’d later try and stroll again a few of his harsher statements. At one level it even appeared he may dabble in bitcoin futures. In any occasion, it’s not past the scope of issues to imagine JP Morgan would have a specific, separate coverage for crypto fans.

Indeed, Mr. Tucker tried to dispute fees however JP Morgan outright refused any consideration, he insisted. According to Reuters, with out warning the financial institution “stuck the plaintiff with the bill, after the fact of his transactions, and insisted that he pay it,” the lawsuit is quoted. The go well with was filed in federal courtroom, and accuses the financial institution of “charging surprise fees when it stopped letting customers buy cryptocurrency with credit cards in late January and began treating the purchases as cash advances.”

Stupid Employees, Stupid Customers

It seems the financial institution charged further charges and better curiosity on money advances, and refused refunds as soon as clients introduced it to their consideration. Mary Jane Rogers of JP Morgan wouldn’t touch upon the case’s claims, however she did say the financial institution halted crypto purchases due to the related dangers. She mentioned clients have been free to make use of debit playing cards with out incurring such premiums.

“Chase silently smacked them with instant-cash-advance fees, plus much higher interest rates than normal, and left them without any recourse,” Mr. Tucker is quoted within the grievance. Furthermore, the lawsuit alleges JP Morgan Chase to have flagrantly usurped the Truth in Lending Act, laws requiring buyer discover when substantial adjustments are made to an account’s phrases. “The lawsuit is asking for actual damages and statutory damages of $1 million,” Reuters reported.

“Chase silently smacked them with instant-cash-advance fees, plus much higher interest rates than normal, and left them without any recourse,” Mr. Tucker is quoted within the grievance. Furthermore, the lawsuit alleges JP Morgan Chase to have flagrantly usurped the Truth in Lending Act, laws requiring buyer discover when substantial adjustments are made to an account’s phrases. “The lawsuit is asking for actual damages and statutory damages of $1 million,” Reuters reported.

According to the grievance, “The full lack of truthful discover to Chase’s cardholders triggered them to unknowingly incur hundreds of thousands of {dollars} in money advance charges and sky-high curiosity fees on each crypto buy.” Mr. Tucker continued, “It appears that in addition to firing its ‘stupid’ employees, Chase elected to start fining its ‘stupid’ customers: unilaterally.”

Has a financial institution overcharged you when dealing in crypto? Let us know within the comments part below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.