Over the last 2 years, the Kenyan federal government and reserve bank have actually been talking about how to control bitcoin and other digital currencies. In March 2018, the Central Bank of Kenya cautioned the public about cryptocurrency financial investments. After those warnings, the area’s Capital Markets Authority (CMA) warned the general public once again after examining a task called kenicoin. Even though monetary regulators are dressing down digital currencies, Kenyan merchants and traders in the area are still gathering towards the crypto possession economy.

Kenyan Crypto Trade Volumes Show Increased Demand for Digital Assets

The federal government in Kenya and the monetary regulators have actually been hesitant towards managing bitcoin and other digital currencies. The reserve bank mulled over regulative standards in the summertime of 2018, while last month Kenya’s Capital Markets Authority (CMA) cautioned the general public about trading digital currencies since of a preliminary coin offering (ICO) called kenicoin. The task supposedly offered 10 million tokens and assured 10 percent regular monthly returns after the preliminary purchase. However, despite the fact that Kenya’s monetary guard dogs are warning versus investing and trading cryptocurrencies, they have actually been helpless to stop the consistent pattern of cryptocurrency approval and increasing trade volumes within the nation.

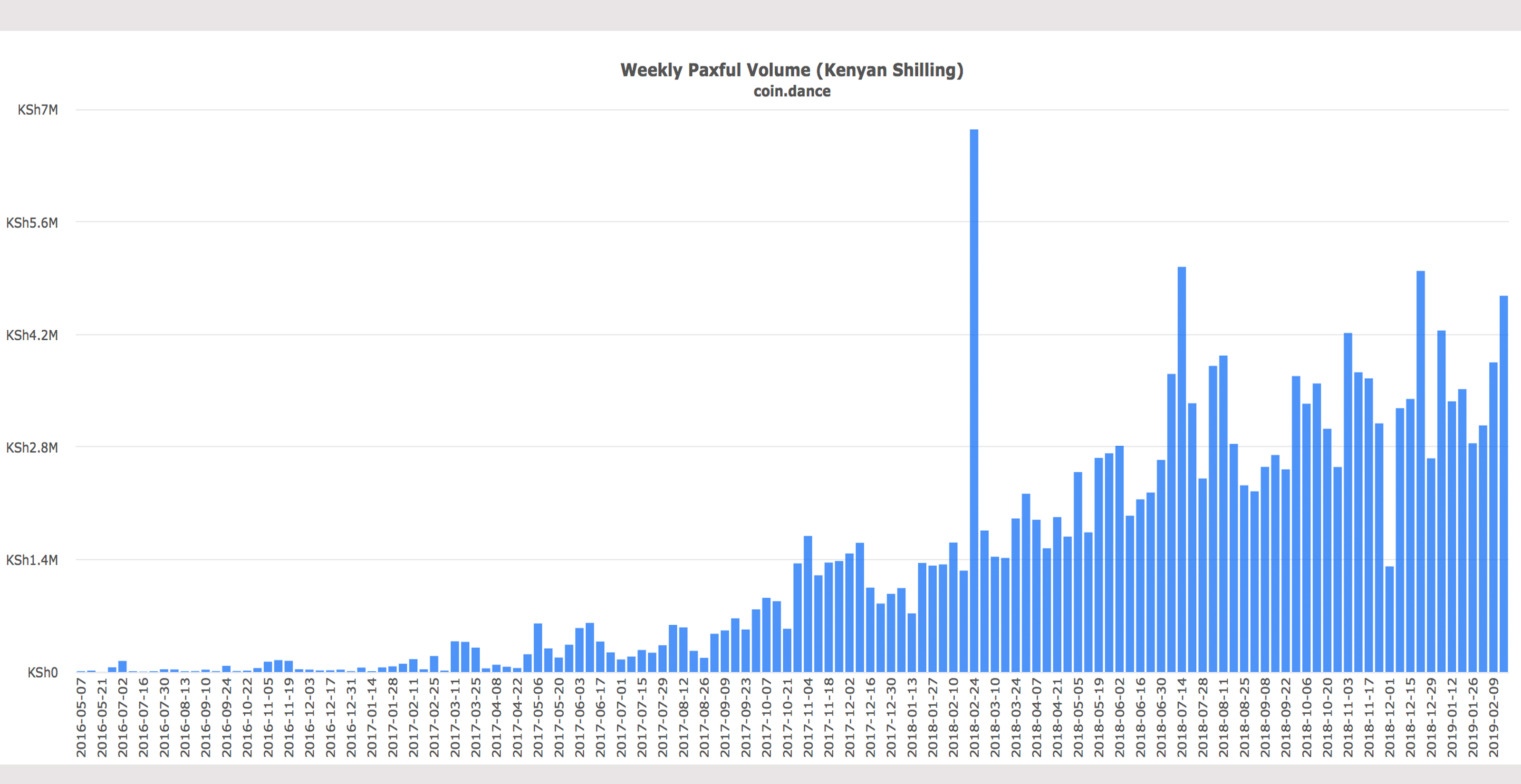

Kenyans have a wide array of exchange opportunities to select from if they wish to acquire cryptocurrencies like bitcoin. This consists of popular trading platforms like Remitano, Bitpesa, Coindirect, Paxful, Localbitcoins, and Belfrics. Localbitcoins volumes in Kenya have actually been regularly strong. At the time of composing, BTC trade volumes for Feb. 16, 2019 show 29,701,339 Kenya shillings ($297,000) traded on Localbitcoins in Kenya over the last 2 weeks. Paxful trade volumes in Kenya shillings (KES) are also considerably greater than normal with 4,679,664 KES ($48,000) traded over the last 2 weeks on the peer-to-peer exchange. According to Crypto Compare’s BTC sets analysis, bitcoin core (BTC) purchases represent $3,418 (KES 341,876) in day-to-day trades stemming from Stocksexchange.

Merchant approval is still growing in Kenya too according to a report from the BBC news outlet released on Feb. 22. The Blockchain Association of Kenya (BAK) discussed in an interview that digital currency awareness has actually increased, despite regulators in the area cautioning about trading them. BAK information that Kenyans are utilizing bitcoin and other digital possessions to spend for education in Kenya and Nigeria and to acquire items in China and bitcoin is also empowering numerous Kenyan freelancers. The not-for-profit company thinks blockchain-based currencies can lower deal expenses and increase regional remittances.

Last December, news.Bitscoins.web reported on the Healthland Spa in Nairobi which began accepting BTC for payments for products and services. This year Tony Mwongera, Healthland Spa’s president, discussed he utilizes the virtual currency primarily to prevent theft however business also delights in the benefit.

”I chose to embrace using cryptocurrencies since there was a lot theft in my company,” Mwongera informed press reporters on Friday. The medical spa owner continued:

So I stated, let me utilize a manner in which can be safe, safe and I can also welcome innovation.

Kenya’s Capital Markets Authority Thinks Blockchain Firms Are Okay as Long as ‘They Don’t Deal With Cryptocurrencies’

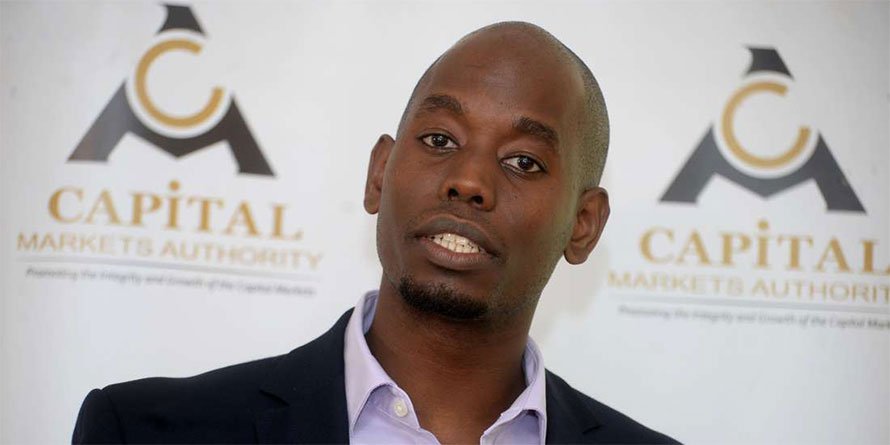

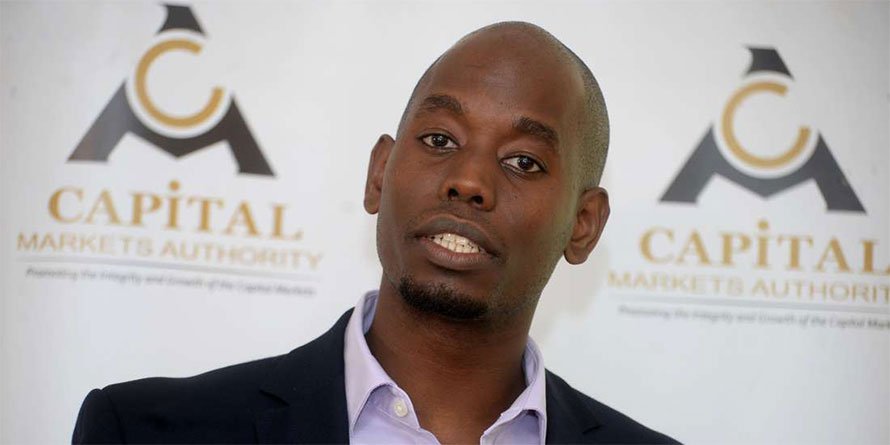

Kenya’s BAK is also hosting a World Blockchain Summit in Nairobi on March 20 in order to reinforce cryptocurrency options and blockchain innovation in the nation. However, Kenya’s CMA is also arranging a monetary innovation incubation platform set to release this May, however cryptocurrency tasks and designers are disallowed from going to the sandbox. The CMA ceo Paul Muthaura specified last Thursday that the firm would examine dispersed ledger tasks under particular conditions.

“In the validation, we have 70 companies, some from outside Kenya. Blockchain firms will be considered so long as they are not dealing with cryptocurrencies since the CMA’s mandate does not extend to currency,” Muthaura stated.

Muthaura more restated what the CMA and Kenyan reserve bank highlighted in the past: that cryptocurrencies have no oversight and regulators might not assist retail financiers with monetary losses. On Thursday the CME executive stated he thinks digital possessions bring brand-new dangers to the world of financing that can destabilize standard markets and perhaps harm retail financiers a lot. Despite the warnings, stats and tales of merchant adoption show that Kenyan crypto traders and bitcoin volumes continue to prosper in 2019.

What do you consider cryptocurrency trade volumes in Kenya increasing despite the warnings from the reserve bank and CMA? Let us understand what you consider this topic in the comments area below.

Image credits: Shutterstock, Pixabay, Twitter, and Coin Dance.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.