DrPavel Kravchenko holds a PhD in technical sciences and is the creator of Distributed Lab.

Inthis viewpoint piece, Kravchenko discusses the ins and outs of cryptographic tokens, what kinds there are and how each kind is various.

Whatwe comprehend by the term “token” is really best specified as the balance of some sort of account.

But, possibly most notably, it’s a balance that can actually imply anything its creator desires it to imply. To date, tokens have actually been made to represent a user’s credibility within a system (augur), a deposit in United States dollars (tether), the amount of files that are conserved in it (filecoin) and the balance in some internal currency system (bitcoin).

Becauseof this, I in some cases argue that tokens do not even exist– primarily, since I wish to accentuate that they constantly have a really particular significance.

Ifwe desire an example, tokens can turn whatever that we’re utilized to seeing in paper kind– consisting of shares, and cash and promissory notes– digital. But the terms we will utilize for these things will stay the same (shares will still be shares). The truth that crypto assets are kept in a decentralized accounting system, or need digital signatures, does not alter their significance or worth.

Assuch, the issue that is emerging isn’t really with the real terms themselves, however that individuals have actually started to designate credit to tokens that they cannot potentially have.

Thereare individuals who declare that cryptocurrency tokens are something totally brand-new– which jobs that release tokens can end up being surprisingly changed.

Sadly, that’s not the truth.

Tokensand tokens

Incomputer system terms, the term “token” has actually long indicated one of 2 things: a gizmo that can license a user (such as a dongle or an unique thumb drive), or a set range of signs that recognize a user (such as an API secret).

Inboth scenarios, tokens can pass in between various owners. So, how are cryptocurrencies various from the tokens we understand?

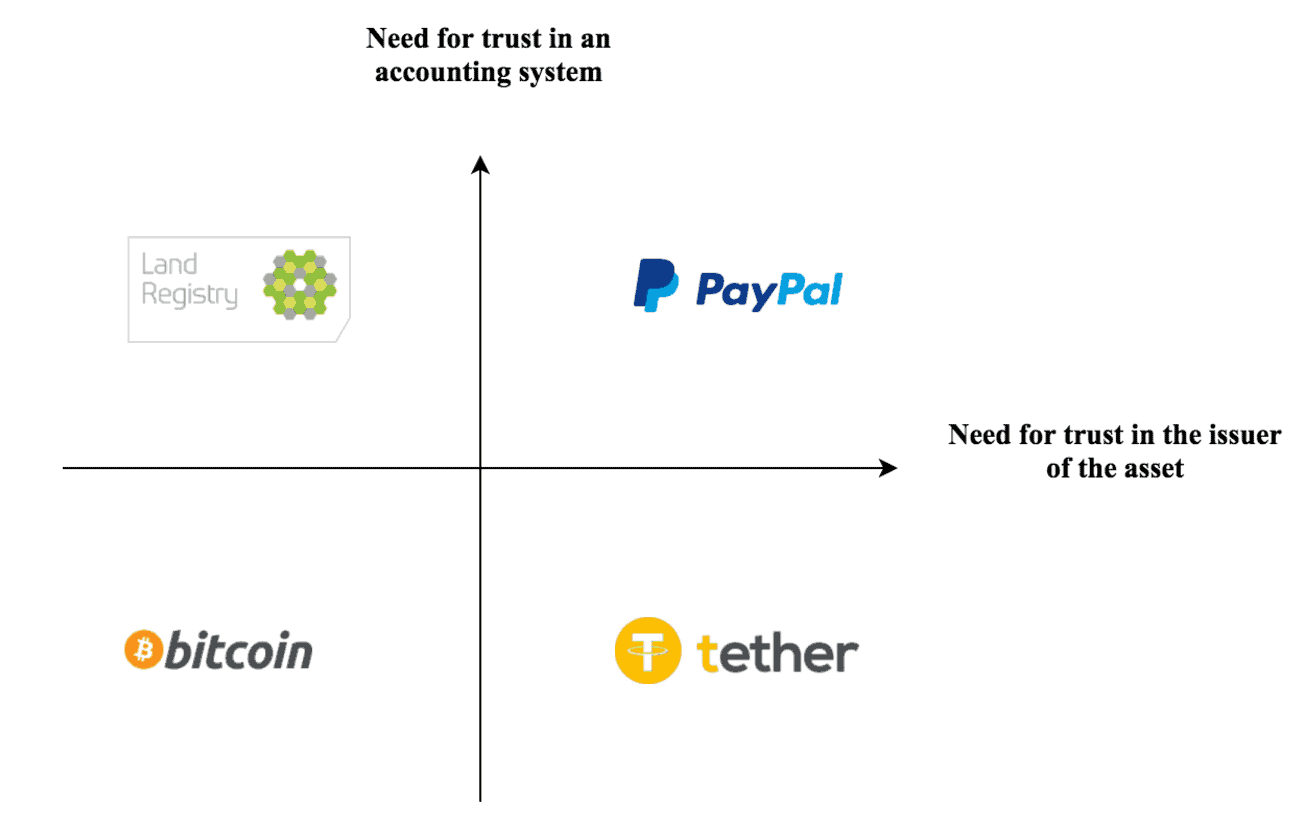

Generally, the term “crypto asset” suggests among 3 various things:

- A cryptocurrency with decentralized issuance and deals.

- A digital possession, provided into a decentralized system, and protected by either somebody or something. This variation can be divided into 2 more neighborhoods: either the accounting system isn’t really relied on; or the company isn’t really relied on.

- Somethingthat’s both provided and verified by the exact same company, yet not backed-up by anything.

Wecan summarize all the above possibilities in one easy diagram:

< img class =-LRB- *******) src =-LRB- ********) alt =-LRB- *********) width =-LRB- **********) height =-LRB- ***********)/ >

< img class =-LRB- *******) src =-LRB- ********) alt =-LRB- *********) width =-LRB- **********) height =-LRB- ***********)/ >

PayPalhandles digital balances and deal processing separately and non-transparently.(************************************************************************************ )indicates that its users should have implicit rely on PayPal, in order to have the ability to utilize its systems.

Bitcoinmanages processing and deal processing totally transparently, and in a totally decentralized method– since individuals would not rely on a confidential system under other scenarios whatsoever.

Tethermanages processing totally transparently (even much better than the bitcoin network), however users should rely on that it is consistently provided (each token is 100% supported by cash loan on a savings account).

Anycentralized land computer system registryrequires that its users trust it in elements of accuracy of accounting– yet there are no problems on the concern of problem (given that colony cannot be produced from thin air, and all land currently exists).

Typesof tokens

Sowhat sort of token exist? And how do they vary?

A token can satisfy either one, or numerous of the following functions:

- A currency, utilized as a payment system in between individuals.

- A digital possession (a digital right– to land ownership, or tomatoes in a storage facility, and comparable assets).

- A methods for accounting (variety of API-calls, volume of gush uploads).

- A share (stake) in a particular start-up.

- A method of gratifying primary gamers (the very best example is bitcoin).

- A method of avoiding attacks (such as commission within the bitcoin network).

- Paymentfor utilizing a system.

Yetsince there are many choices it might be tough to categorize any specific token; they are typically a cross in between shares, an internal currency and accounting systems.

Tokensthat are straight connected to shares in a business, for example, do not require more factor to consider; they are entirely similar to shares. More complex are so-called “utility tokens.”

Let’s keep in mind, this sort of token is utilized as method of making internal payments– yet their rate can increase due to restrictions in their problem, and due to increasing need. It’s specifically due to this double performance that it’s tough to specify precisely what they are. Sometimes they act on markets as though they are shares, yet regulators treat them as accounting systems.

Alongsidethis, individuals can in some cases utilize these to make payments to each other.

Thefinest meaning for “utility tokens” is the one advanced by Vladimir Dubinin (my company partner). He compared the pre-sale of tokens with the sale of federal government bonds in United States dollars. These bonds are denominated in the nationwide currency, and make money from them will be paid because currency too.

Thesebonds, it appears, will be cost a heavy discount rate, however if they work out, the currency rate may increase rapidly.

Inthis light, we should not forget that no country whatsoever is eager to see its currency ending up being too expensive since this results in a slow economy and has an unfavorable result on the balance of payments.

Questionsfor financiers

I ‘d state the primary concerns for financiers are these:

- Whatdoes this token represent?

- Isit a share, an internal currency or an accounting system?

- Whatwould trigger the worth of this token to increase?

- Isit restricted problem, or do you have to hold tokens to finish each deals when utilizing an item?

- What’s the capacity for development? Does this item have possible to be required by everybody in the world?

- Willthe item stay in need, state, if the token expenses $1,000? In other words, could not the item’s appeal become its own Achilles’ heel? For example, if a deal costs 1 token, at a rate of $1,000, then would that be a budget friendly and sensible rate for users?

- Couldthat exact same item continue to exist without the tokens for it? Bitcoin, for instance, could not operate without the bitcoin token, yet Ripple might quickly do so.

Inshort, it’s worth doing an analysis of this kind when taking a look at tokens as part of a long-lasting financial investment portfolio, instead of when purchasing with a view to hypothesizing.

Myown individual sensation is that the marketplace for crypto-assets stays rather overheated. It might be much better to hold back the minute for entering into this market.

Antique coinsimage through Shutterstock

Source link

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.