Latin Americans have actually welcomed cryptocurrency as a shop of worth while their fiat currencies diminish, a brand-new report programs. Bitcoin adoption in the area is more driven by the absence of banking gain access to and remittance requirements.

Latin American Bitcoin Adoption

Blockchain information analytics company Chainalysis launched a brand-new research study of cryptocurrency use in Latin American nations based upon on-chain information and interviews with specialists in the area recently. The research study belongs to the company’s Geography of Cryptocurrency Report, due to be launched this month. Cryptocurrency adoption in Latin America is driven by elements such as an absence of banking gain access to, remittance requirements, and the decline of local fiat currencies.

Sebastian Villanueva, who handles the Chile operations of crypto exchange Satoshitango, described that the absence of banking gain access to for people and services is a significant drive for cryptocurrency adoption in Latin America. “Lots of individuals here have unequal earnings due to the fact that they do gig work for Uber or locations like that, that makes it difficult for them to get a savings account,” he stated, asserting:

Without simple banking gain access to, numerous youths in Latin America turn to cryptocurrency as a way of keeping worth.

Many Latin Americans utilize stablecoins like DAI and USDC to lock in their cost savings, Villanueva kept in mind. Chainalysis described that a considerable share of the stablecoin transfer volume in the area is from traders utilizing fiat to buy bitcoin or stablecoins, like tether, from local exchanges or P2P exchanges, and after that utilize those funds to trade on bigger exchanges like Binance that offers more trading sets and higher liquidity. “This is a typical pattern not simply in Latin America, however in other establishing areas as well,” the company kept in mind.

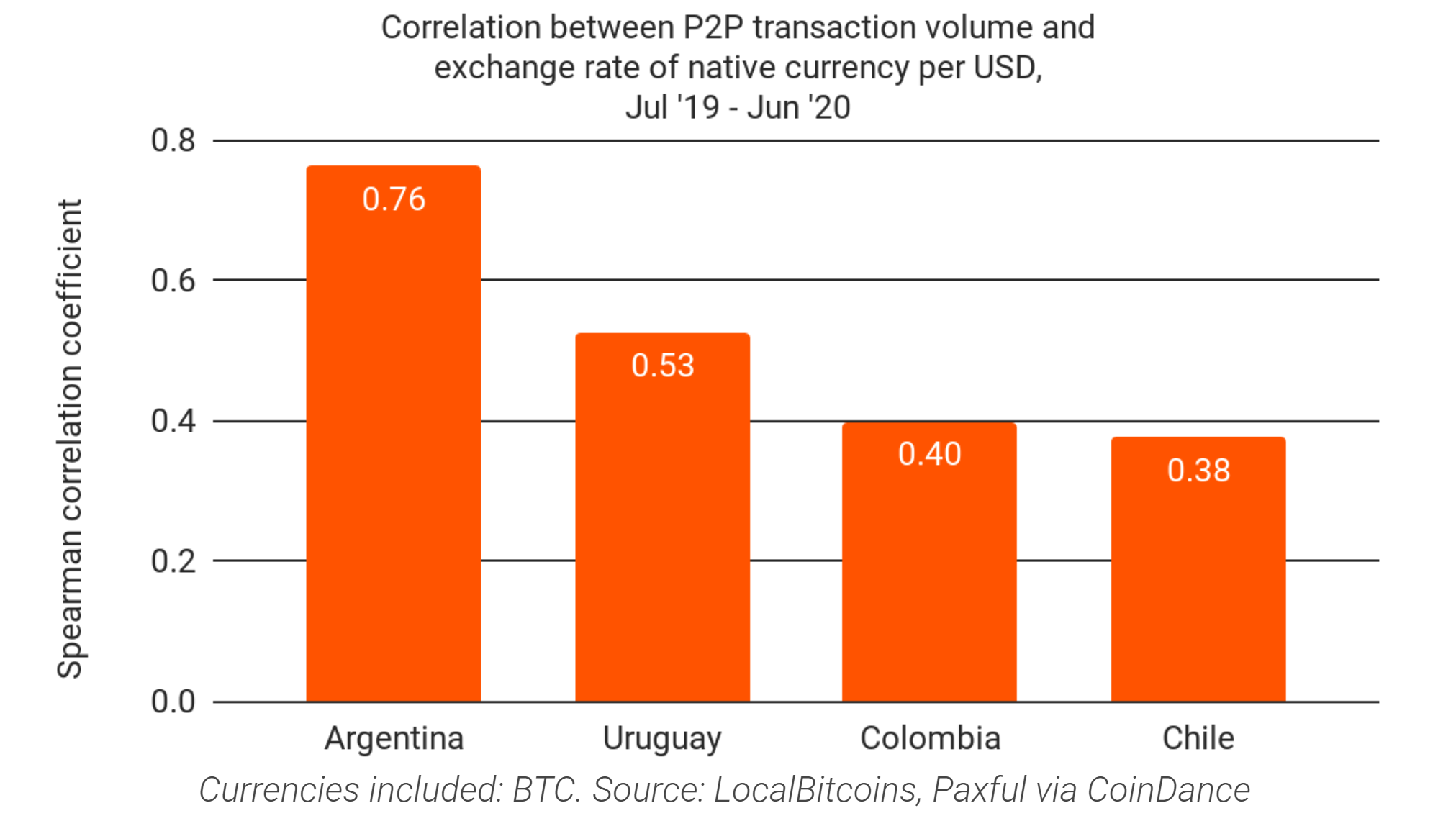

“Currency instability is another aspect driving cryptocurrency adoption in Latin America,” Chainalysis claims, keeping in mind that “the quantity of P2P trading volume in numerous Latin American nations increases as native currency diminishes.” The company elaborated:

The connections, each of which is statistically considerable, recommend that cryptocurrency users in Argentina, Uruguay, Colombia, and Chile in specific are turning to cryptocurrency as a way to shop worth when their native fiat currencies are declining.

“Venezuela and Argentina particularly are printing cash like insane, so their fiat currencies are declining. That drives a great deal of cryptocurrency adoption,” Villanueva continued. “Some nations, like Argentina, restrict the quantity of U.S. dollars residents can purchase each month, which even more restricts their alternatives for protected cost savings and increases the requirement for cryptocurrency.”

Reiterating that intensifying financial conditions and associated civil discontent are driving cryptocurrency adoption in Latin American nations, Villanueva even more kept in mind:

Last October in Chile, there were mass demonstrations over education, health care, and general financial conditions. Fiat pay platforms saw big declines in activity throughout that time, however we grew by about 35% … People simply desire a safe method to shop cash, and there are no gatekeepers in crypto.

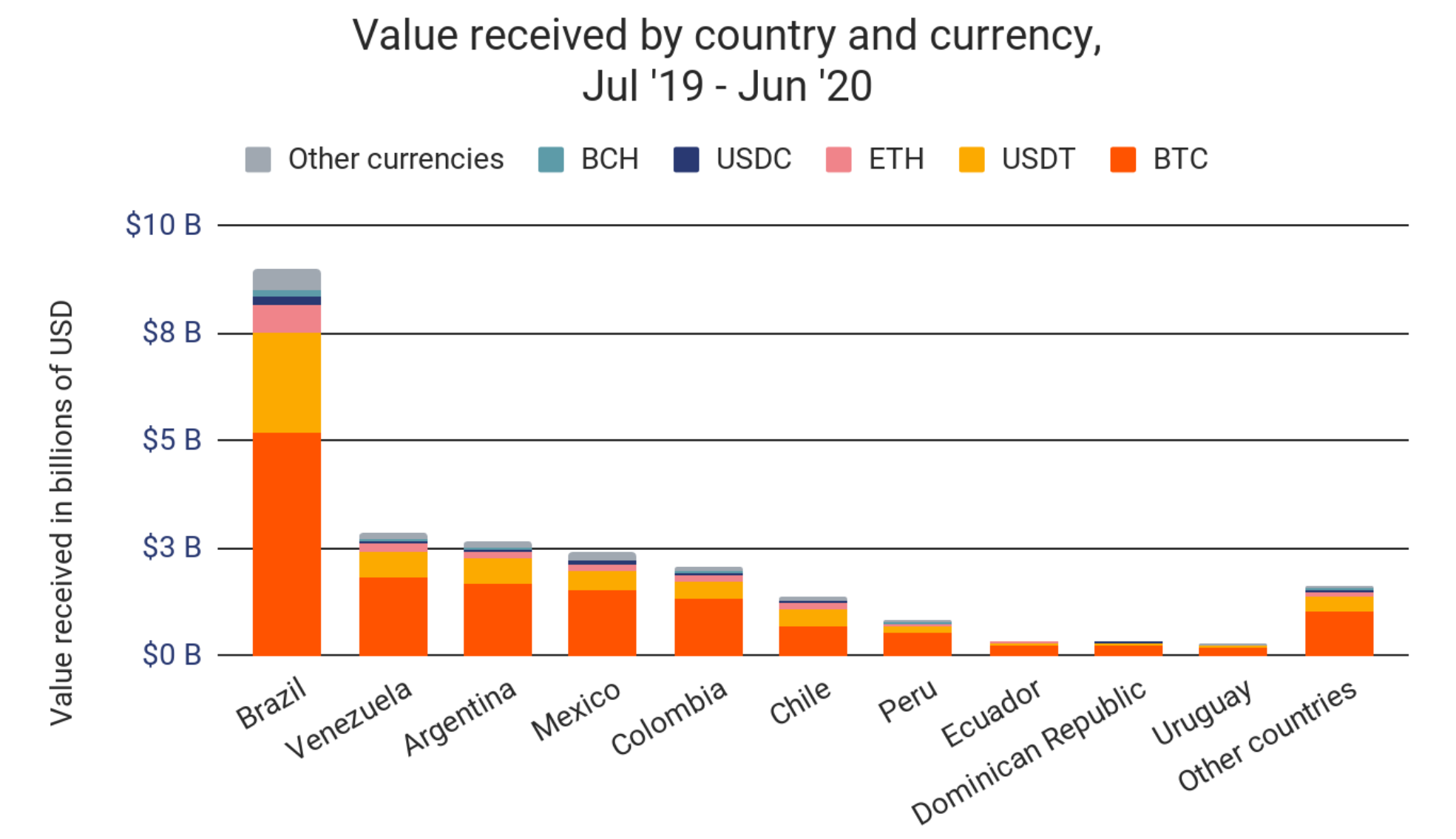

Latin America also has a robust crypto trading scene, with Brazil in the lead in regards to the most cryptocurrency use by on-chain volume. Venezuela is a remote 2nd, however the nation represent the third-highest variety of transfers on Localbitcoins and Paxful, 2 of the most popular around the world P2P exchanges, as news.Bitscoins.web just recently reported.

The area has the second-highest share of retail crypto activity, specified as transfers of less than $10,000 worth of cryptocurrency. However, expert traders still represent approximately 80% of all volume moved in an offered month; they choose utilizing big worldwide exchanges like Binance instead of local exchanges to gain access to more trading sets and higher liquidity. Overall, Latin American nations sent out $25 billion worth of cryptocurrency and got $24 billion worth in the previous year, representing in between 5% and 9% of all cryptocurrency activity in any provided month, Chainalysis detailed.

Representatives from Brazil-headquartered crypto hedge fund Hashdex informed Chainalysis that “a desire for prospective high yield properties with uncorrelated returns is driving cryptocurrency adoption among expert financiers, such as those representing pension funds and household workplaces.”

What do you consider bitcoin adoption in Latin America? Let us understand in the comments area below.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.